On January 23, Bloomberg News reported Warren Buffett’s Burlington Northern Santa Fe Railway (BNSF), owned by his lucrative holding company Berkshire Hathaway, stands to benefit greatly from President Barack Obama’s recent cancellation of the Keystone XL pipeline.

If built, TransCanada’s Keystone XL (KXL) pipeline would carry tar sands crude, or bitumen (“dilbit”) from Alberta, B.C. down to Port Arthur, Texas, where it would be sold on the global export market.

If not built, as revealed recently by DeSmogBlog, the grass is not necessarily greener on the other side, and could include increased levels of ecologically hazardous gas flaring in the Bakken Shale, or else many other pipeline routes moving the prized dilbit to crucial global markets.

Rail is among the most important infrastructure options for ensuring tar sands crude still moves to key global markets, and the industry is pursuing rail actively. But transporting tar sands crude via rail is in many ways a dirtier alternative to the KXL pipeline. “Railroads too present environmental issues. Moving crude on trains produces more global warming gases than a pipeline,” explained Bloomberg.

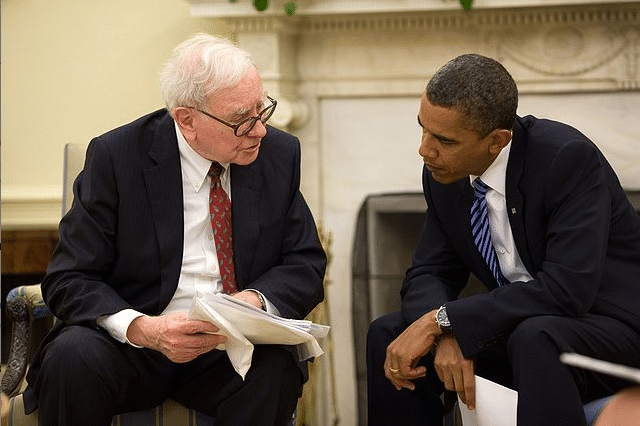

A key mover and shaker behind the push for more rail shipments is Warren Buffett, known by some as the “Oracle of Omaha” – of “Buffett Tax” fame – and the third richest man in the world, with a net worth of $39 billion. With or without Keystone XL, Warren Buffett stands to profit enormously from multiple aspects of the Alberta Tar Sands project. He also, importantly, maintains close ties with President Barack Obama.

Buffett, Berkshire Hathaway, BNSF and the Tar Sands

Many eyebrows were raised in August 2008, when two of the richest men on the planet, Warren Buffett and Bill Gates, sojourned to Alberta’s tar sands patch. The Calgary Herald wrote “they took in the oilsands, apparently with awe.” According to a reliable but confidential source quoted in the story, the two men “visited the booming hub to satisfy ‘their own curiosity’ but also ‘with investment in mind.’”

And while he told the media he wasn’t interested in doing so at the time of the trip, Buffett soon became a major investor in tar sands related assets. A year after his visit to the oil sands, in November 2009, Buffett’s Berkshire Hathaway purchased BNSF Railway as a wholly owned subsidiary.

BNSF Railway is the second largest freight railroad network in North America. BNSF “plans $3.9 billion in capital spending this year, an increase of 11 percent from 2011,” according to a recent article by Bloomberg.

BNSF serves as a vital cog in the oil sands procurement process. In the November/December 2008 edition of BNSF’s employee magazine, “Railway,” BNSF produced a piece titled, “Alberta oil Sands: No sour deal.”

The article reveals the exact role BNSF plays in the oil sands procurement process:

Before bitumen can move through a pipeline to its destination, it must be blended with diluents (diluting agents) such as natural gasoline (not natural gas, which is a gaseous fuel) or butane, which are composed of lighter weight hydrocarbons.

For the last two years, BNSF has been moving single carloads of diluents from U.S.refineries to the Canadian border (at Superior,Wis., Noyes, N.D., Sweetgrass, Mont., and New West minster, B.C.). The inbounds are then interchanged with Canadian railroads, then moved to Edmonton, with the final move to the oil sands’ processing center via pipeline.

Last year, BNSF moved about 9,000 carloads of diluents for the project, with the majority of loads originating from the Gulf Coast,California and Kansas. This year, about 12,000 carloads are anticipated to move.

(Snip)

In addition to moving the diluents, BNSF has also transported turbines, other large machinery and pipes for use at the drilling sites.

Not only does BNSF haul diluent materials in its freight trains bound for Alberta for tar sands oil procurement, but it also hauls pipes and pipeline materials.

Does this include materials for the KXL Pipeline? As the prospective pipeline is not yet officially dead, this is a key question to ask.

Look no further than to BNSF’s involvement in hauling the pipeline materials for the original TransCanada Keystone pipeline for crucial evidence.

BNSF Railway and the Original Keystone Pipeline

A South Dakota state government document shows that BNSF and TransCanada Keystone Pipeline, LP entered into a Pipeline License Agreement on August 1, 2008. The Agreement called for BNSF to carry pipeline materials from South Dakota up to the Alberta tar sands.

The Keystone Pipeline was the first TransCanada pipeline carrying tar sands crude down from Alberta to Cushing, Oklahoma.

BNSF Railway, the KXL Pipeline, and Railway Alternative

BNSF’s ties to TransCanada are not limited to the Keystone Pipeline – they are also on the State Department’s “Distribution List” section of the Environmental Impact Statement report released in August 2011 on TransCanada’s KXL pipeline proposal.

In its final Environmental Impact Statement (EIS), the State Department acknowledged that railway is both a key alternative to the Keystone XL and capable of hauling dilbit around North America to vital markets through 2030, stating,

Even in a situation where there was a total freeze in pipeline capacity for 20 years, it appears that there is sufficient capacity on existing rail tracks to accommodate shipping…through at least 2030…[S]tatistics from the Department of Transportation,…conservatively estimated that the existing cross-border rail lines from Canada to the U.S. could accommodate crude oil train shipments of over 1,000,000 bpd (barrels per day).

Keystone XL, if built, is expected to ship 700,000 bpd of tar sands crude to Port Arthur, Texas, according to Bloomberg. Furthermore, the State Department notes that rail transport is also a dirtier alternative than a pipeline, due to the diesel cumbustion inherent in such a scheme.

In addition, there would be an increase in the emission of combustion products due to the use of diesel engines which could have an adverse impact on air quality along the route selected. As compared to the proposed Project (Keystone XL), this alternative would have substantially greater GHG (greenhouse gas) emissions during operation due to the combustion of diesel fuel.

BNSF is eager to haul anything and everything it can. “Whatever people bring to us, we’re ready to haul [and if KXL] doesn’t happen, we’re here to haul.” Krista York-Wooley, a spokeswoman for BNSF said in an interview with Bloomberg.

Buffett’s financial interests in the tar sands, though, go far beyond the Keystone XL saga, and into the development of the tar sands more generally, through Berkshire Hathaway’s extensive stock holdings in ConocoPhillips, ExxonMobil, and General Electric. All three corporations are big league financial players in this game.

Berkshire Hathaway, ConocoPhillips, ExxonMobil and General Electric

An August 2011 Fox Business story revealed Buffett owns 29.1 million shares of stock in ConocoPhillips, 421,800 shares of stock in ExxonMobil, and 7.777 million shares of stock in General Electric. All three of these corporations are deeply tied to the Alberta tar sands.

As of the Jan. 24 closing stock prices for the three corporations, this amounts to $1.73 billion worth of stock owned by Berkshire in these three Alberta oil sands profiteers.

ConocoPhillips’ website notes that it runs the Surmont oil sands project in Alberta. That project produces some 110,000 barrels of tar sands crude per day and is expected to run through 2015, according to Reuters.

ExxonMobil also has a massive stake in the Alberta Tar Sands through its Canadian subsidiary, Imperial Oil. As reported by Agence France-Presse in May 2009, ExxonMobil has plans, through its Kearl oil sands project, to begin producing 110,000 barrels of tar sands crude per day in 2012. ExxonMobil has future plans to produce over 300,000 barrels per day of dirty tar sands crude via the Kearl oil sands.

ExxonMobil is also deeply invested in oil sands pipelines, exposed in July 2011 for carrying oil sands crude down from Alberta through Montana in one of its pipelines. The pipeline ruptured, spilling 1,000 barrels of oil into the Yellowstone River.

Lastly, General Electric (GE), via its GE Water & Process Technologies and GE Canada subsidiaries, also has much to gain from tar sands oil development, particularly in the area of water holding and usage, once water has been contaminated during the procurement process.

A September 2010 press release reads,

“In 2007, GE entered into a $15-million technology development program with the Alberta Water Research Institute and its research funding partners. The program aims to develop technology to improve water reuse and management in in-situ oil sands operations. GE is also actively involved in developing and proving effective technologies for treating tailings water for industrial reuse, in order to help operators improve the efficiency of their operations.”

In addition to its tight-knit financial and research relationship with the Alberta Water Research Institute, GE also owns a water treatment facility in the tar sands patch through its wholly owned subsidiary, Zenon Environmental Inc., which it purchased for $760 million in 2006. Furthermore, in September 2011, Grizzly Oil Sands ULC announced that it had chosen GE’s water technology for its Algar Lake oil sands project in Alberta.

Buffett Raises Big Bucks for Barack

Buffett hosted an Obama fundraiser in August 2007, well before the 2008 Democratic Party presidential primaries. The minimum donation was $500 to attend and many gave up to $2,300.

“About 35 people who gave the higher amount or helped raise money from others met first with Buffett and Obama in a smaller room,” wrote the Los Angeles Times.

Buffett did not limit his fundraising help in the Democratic primary process to Obama exclusively. He also hosted two multi-million dollar fundraising events for Hillary Clinton’s presidential bid in 2007, one in June in New York City and another in December in San Francisco.

“Guests at a high-dollar fundraiser for Hillary Rodham Clinton on Tuesday were treated to cocktails, dinner and an hour-long business tutorial from billionaire Warren Buffett……[T]he fundraiser…brought in at least $1 million for Clinton…,” wrote the Associated Press of the June New York City fundraiser.

The San Francisco event, on the other hand, drew “about 1,200 people,” with tickets costing “between $100 and $2,300.” The event raised over $1 million for the Clinton for President campaign.

Once Obama won the Democratic Party nomination in May 2008, not long thereafter, Buffett endorsed Obama for President. A couple months later, in July, Buffett hosted a fundraiser for Obama with a required commitment of the individual maximum $28,500 per attendee, according to the New York Times.

Buffett has maintained tight ties with President Obama since his November 2008 victory, and has met with Obama to discuss economic issues on multiple occasions. Additionally, in February 2011, Obama honored Buffett with a Presidential Medal of Freedom.

At the awards ceremony Obama ironically scoffed, “Buffett doesn’t wear ‘fancy ties’ or drive ‘fancy cars.’ Instead, ‘you see him devoting the vast majority of his wealth to those around the world who are suffering, or sick, or in need of help,’” wrote Bloomberg on the scene of the the medal ceremony.

Most recently, Buffett has hosted Obama campaign fundraisers on September 30 in New York and October 27 in Chicago. Of the New York City Buffett fundraiser, CNN Money wrote, “The event will bring in a pretty penny for the campaign. The base price is $10,000, while a $35,800 donation will buy a VIP reception with Buffett, according to the schedule.”

The Chicago Buffett fundraiser was similar in its extravagance, “with a ticket price of $35,800 per person,” according to Bloomberg, or nearly $10,000 more than the 2010 median American income of $26,364.

Buffett also gave a $30,800 donation to the Democratic National Committee in October 2011, according to the Center for Responsive Politics.

From TransCanada Corruption to BNSF Corruption

While DeSmogBlog and many others thoroughly uncovered the corrupt ties between the Obama White House and State Department and the tar sands lobby, the additional Obama-Buffett-industry ties have gotten little play in the media until now.

Image credit: Pete Souza, Executive Office of the President

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts