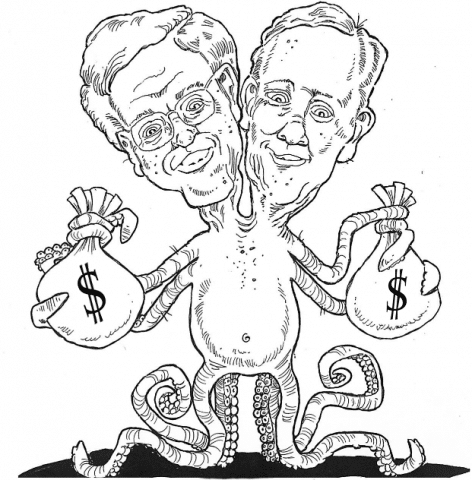

On the heels of a 21-page investigative article by Bloomberg Magazine, which covered the high crimes and misdemeanors of the Koch Brothers, Koch Industries, and its numerous subsidiaries over the past several decades, more damning news arrives about their dirty deeds in Canada.

Today, InsideClimate News reported in a story titled “Koch Subsidiary Told Regulators It Has ‘Direct and Substantial Interest’ in Keystone XL”, that contrary to the narrative the Kochs have been dishing out to the U.S. government, Koch Industries has a huge fiscal stake in both the Keystone XL Pipeline and in Tar Sands production more generally.

Inside Climate reports:

In 2009, Flint Hills Resources Canada LP, an Alberta-based subsidiary of Koch Industries, applied for—and won— ‘intervenor status’ in the National Energy Board hearings that led to Canada’s 2010 approval of its 327-mile portion of the pipeline. The controversial project would carry heavy crude 1,700 miles from Alberta to the Texas Gulf Coast.

In the form it submitted to the Energy Board, Flint Hills wrote that it “is among Canada’s largest crude oil purchasers, shippers and exporters. Consequently, Flint Hills has a direct and substantial interest in the application” for the pipeline under consideration.

To be approved as an intervenor, Flint Hills had to have some degree of “business interest” in Keystone XL, Carole Léger-Kubeczek, a National Energy Board spokeswoman, told InsideClimate News. Intervenors are granted the highest level of access in hearings, with the option to ask questions. The Energy Board approved Canada’s segment of the pipeline with little opposition, and Flint Hills did not exercise its right to speak.

Inside Climate also explains:

The company’s Flint Hills subsidiary already has an oil terminal in Hardisty, Alberta, the starting point of the Keystone XL. It sends about 250,000 barrels of diluted bitumen a day to a heavy oil refinery it owns near St. Paul, Minn., making that refinery ‘among the top processors of Canadian crude in the United States,’ the company website says.

This is, of course, all contrary to the claims that a Koch Industries spokesman gave to the United States’ House of Representatives Energy and Commerce Committee at a May hearing, when the spokesman said, Koch Industries has “no financial interest in the pipeline.”

But like many powerful players in this game, including the latest revelations coming out of the State Department via two recent rounds of FOIA requests revealed by Friends of the Earth that portray a hand-in-glove relationship between State and TransCanada, Koch Industries certainly has a massive financial stake in the Keystone XL Pipeline going through.

This will only add fuel to the fire that is building more and more each day to stop the Keystone XL pipeline in its tracks.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts