Copenhagen Consensus Center

Background

The Copenhagen Consensus Center is a think tank registered in Arlington, Virginia, near Washington DC. The CCC says its role is to publicize “the best ways for governments and philanthropists to spend aid and development money.”

High-profile Danish economist and author Bjørn Lomborg is the Copenhagen Consensus Center’s president, founder and key spokesperson and is a popular speaker at conferences and in the media, where he regularly writes columns in mainstream newspapers.

Lomborg argues that human-caused climate change is a problem, but says the immediate economic impacts will not be great. He says carbon pricing laws are expensive, the United Nations negotiations on climate change have achieved nothing and that the “smart” way to tackle the issue is to invest massively in research and technology to make “green technologies cheaper.”

John Mashey describes the Copenhagen Consensus Center’s policies, and notes a pattern of “profit-protective priorities, which might be cast as: kill mosquitoes and viruses, but burn coal, eat sugar, and thank you for smoking.”

In a December 2013 op-ed in the New York Times titled “The Poor Need Cheap Fossil Fuels,” Lomborg stated that Western nations “should not stand in the way of poorer nations as they turn to coal and other fossil fuels.”1Bjorn Lomborg. “The Poor Need Cheap Fossil Fuels,” The New York Times, December 3, 2013.

Stance on Climate Change

The Copenhagen Consensus Center (CCC) does not challenge the scientific consensus that human emissions of greenhouse gases cause climate change. However, reports from the CCC do not advocate for sharp reductions in emissions and conclude there are many other global issues which should be tackled first.

A research report/book from the Copenhagen Consensus Center, titled “How Much Have Global Problems Cost the World: A Scorecard from 1900 to 2050” published in 2013 and edited by Bjorn Lomborg, concluded:2“Outcome,” Score Card For Humanity (Copenhagenconsensus.com). Archived July 21, 2015.

“Global warming is surprising, because the impact now is positive. The increased level of CO₂ has boosted agriculture because it works as a fertilizer. At the same time, the number of people dying from heat waves are more that outweighed by fewer people dying from fewer cold waves. In all, global warming benefits have increased from 1900 to almost 1.5% of GDP by now, but by 2025, they will peak and begin a rapid decline, leading to a net negative towards the end of the century.”

In a speech given to Australia’s National Press Club in December 2013, CCC president Lomborg said that his center’s study titled “How Much Have Global Problems Cost the World?” had found that “until about 2070 global warming is a net benefit to the world,” Graham Readfearn reported in The Guardian.3Graham Readfearn. “Is Bjorn Lomborg right to say fossil fuels are what poor countries need?“ The Guardian, December 6, 2013. Archived July 21, 2015.

The CCC has hosted three conferences where “the world’s leading economists” are asked to prioritise global spending. On each occasion measures to lower greenhouse gas emissions are ranked at the bottom, or close to the bottom, of the list.

Funding

Bjorn Lomborg’s Compensation

The CCC’s Vice President Roland Mathiasson told DeSmog:

Some donors stipulate that we are not allowed to advertise the name of the foundation or donor. Donors routinely decide to be anonymous, for a variety of reasons. Given how some parts of the blogosphere vilify Dr. Lomborg and certain research from the Center, it is something donors can understandably live without.

We work with more than a hundred of the world’s top economists and 7 Nobel Laureates. It is the work of these people that assure the public of the quality of the output of the Copenhagen Consensus.

We do not take funding from fossil fuel industry and we are explicit that no funding will have any influence on our research. This statement should be on our website – we’ll add this to the new website.

DeSmog has done several investigations on the Copenhagen Consenses Center:

(1) The Millions Behind Bjorn Lomborg’s Copenhagen Consensus Center US Think Tank.

Readfearn’s DeSmog investigation in June 2014 of the Copenhagen Consensus Center’s tax records finds a rapid rise in revenue for the center since it registered operations in the United States in 2008.

More than $4 million in grants and donations flooded in between 2008 and 2014, three quarters of which came in 2011 and 2012. In one year alone, the Copenhagen Consensus Center paid Lomborg $775,000.

The CCC’s public tax records show contributions received by the think tank but account for only about $500,000 of the center’s total $4.3 million income between 2008 and 2012.

Below is a summary of Readfern’s initial findings:

- In 2008 (990 form), the think tank’s first year of operation, it received $120,000. Tax records of the New York-based conservative Randolph Foundation show it gave $120,000 to Lomborg’s project that year. The Randolph Foundation gave CCC a further $50,000 grant in 2012.

- In 2009 (990 form), the CCC received $300,000. The tax records of the Sevenbar Foundation shows it gave CCC a $50,000 grant in 2009. The foundation has a focus on raising funds from lingerie shows which it then passes on to women entrepreneurs in developing countries through micro-financing.

- In 2010 (990 form) CCC accepted $750,000.

- In 2011 (990 form), the CCC received $1,064,685 in contributions and donations. $71,211 was allocated for support and promotion of the “Cool It” global warming denial documentary, with funds also going to “reimbursement to principals involved in speaking about the film in print, electronic, and online media.” The tax records of the Kansas-based Ewing Marion Kauffman Foundation, which holds about $2 billion in assets, indicate it gave CCC a $150,000 grant in 2011 and another in 2012. The foundation is the legacy of pharmaceutical entrepreneur Ewing Kauffman.

- In 2012 (990 form), the tax records show that CCC paid Bjorn Lomborg $775,000 that year for a declared 40-hour week. In previous years of its US operation, the CCC declared Lomborg was working only one hour per week for the center.

- In 2013 (990 form), CCC reported $645,057 in total revenue with $200,484 of that value going to Bjorn Lomborg in compensation.

- In 2013/2014 (990 – PF Form) , the CCC’s income included a $50,000 donation from the Modzelewski Charitable Trust (MCT). The MCT is trust of Stephen Modzelweski, who is a trustee at the Reason Foundation and a board member at Institute for Justice.4“Stephen Modzelewski,” Sourcewatch. Archive.is URL: https://archive.is/Em77q

This 2014 Investigation looks at funding by New York-based hedge fund manager Paul Singer’s charitable foundation, which gave $200,000 to Lomborg’s Copenhagen Consensus Center (CCC) in 2013.

The grant to Lomborg’s think tank is revealed in the tax form of the Paul E. Singer Foundation covering that foundation’s activities between December 2012 and November 2013.

(3) Bjorn Lomborg’s Copenhagen Consensus Center – Real Charity Or “Foreign Conduit”?

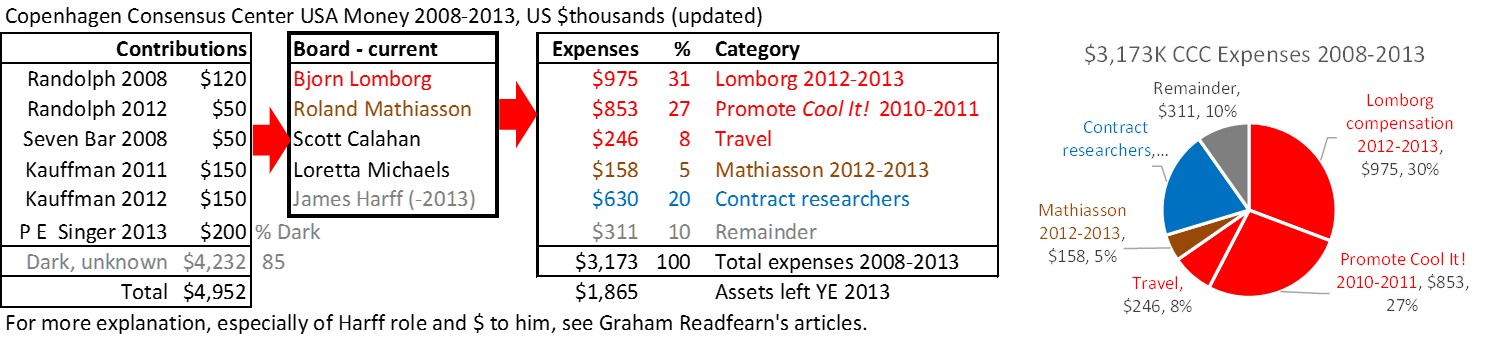

An updated April, 2015 investigation by John Mashey delves even deeper into the Copenhagen Consensus Center’s funding (see .xls spreadsheet for full details). According to Mashey’s report, more than 60% of the CCC’s funding when directly to Lomborg, and $853,000 went to the production of his movie (Cool It) which grossed $63,000.

Mashey breaks down the CCC’s money flows as follows:

Mashey describes the CCC as a “foreign conduit” and “shell charity”:

“A foreign group’s creation of a US ‘shell’ charity to gather US funds and funnel them abroad is the most obvious of ‘foreign conduits’ in IRS parlance, #1 on its list of no-no’s. IRS revocation of 501(c)(3) status not only eliminates tax breaks for ordinary donors, but eliminates entirely crucial major gifts from private foundations like the Randolph Foundation, Ewing Marion Kauffman Foundation and the Paul E. Singer Foundation.

CCC seems to break many rules. Foreign citizen Lomborg is simultaneously CCC founder, president, and highest-paid employee. Most people are a little more subtle when trying to create conduits, as in this example, where the IRS determined someone was not eligible for 501(c)(3) status, despite various stratagems to obscure the relationships.”

Other Funding

According to Conservative Transparency, the Copenhagen Consensus Center (US) received $170,000 from The Randolph Foundation between 2008 and 2012.5“Copenhagen Consensus Center US,” Conservative Transparency. Accessed July 5, 2016.

990 Forms

Location

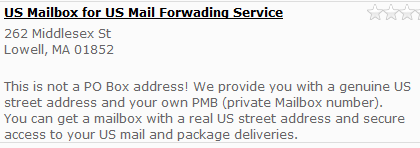

According to its IRS 990 filings and its website contact page, the Copenhagen Consensus Center lists its primary business address and contact address as:6“Press Contact,” Copenhagen Consensus Centre. Archived July 21, 2015.

Copenhagen Consensus Center

262 Middlesex St PMB SE-132

Lowell, MA 01852This is what that address looks like on Google street view:

The description of the business at this address on Google is:

Key People

As of July 2015:7“Board & Directors,” Copenhagen Consensus Center. Archived July 22, 2015.

Board & Directors

- Bjørn Lomborg – President and Founder

- Roland Mathiasson – Executive Vice President, Secretary, and Assistant Treasurer

- Scott Calahan – Treasurer, Member of Compensation Committee, and Independent Director

- Loretta Michaels – Member of Compensation Committee and Independent Director

Advisory Panel

- , Copenhagen Business School

- , Washington University in St. Louis

- Professor Martin Paldam, COMMA

Actions

July–October, 2015

Bjorn Lomborg and the Copenhagen Consensus Center secured $4.4m in federal funding to establish the “Australian Consensus Center” (australiaconsensus.com). The contract would require Bjorn Lomborg to conduct seminars across the country titled “The Australian Rational Conversation.”8Lenore Taylor. “Bjørn Lomborg university funding tied to ‘rational conversation’ lectures,” The Guardian, June 25, 2015. Archived July 22, 2015.

While the University of Western Australia’s Business school initially picked up the project, a backlash when Guardian Australia revealed the federal grant in April9Lenore Taylor. “Abbott government gives m to help climate contrarian set up Australian centre,” The Guardian, April 16, 2015. Archived June 7, 2015. caused UWA to later turn it down.10Bjorn Lomborg. “The Honor of Being Mugged by Climate Censors,” The Wall Street Journal, May 13, 2015. Archived July 22, 2015.

As reported in The Guardian, since UWA pulled out of the deal, the Department of Education told universities to speak directly with Lomborg:11Lenore Taylor. “Universities told to speak to Bjørn Lomborg if they want m in funding,” The Guardian. June 3, 2015. Archived July 22, 2015.

They “had some informal approaches from universities who might be interested and suggested to them and Dr Lomborg they might want to talk.”

The department had spoken to Lomborg last July and he advised them “he was in discussion with a number of universities.” Lomborg had been advised to “speak to vice chancellors directly” to find a host institution for the $4m centre.

**Update: As of October, 2015 the federal government had withdrawn funding offered to Bjørn Lomborg for the creation of the Australia Consensus centre in any university.12Graham Readfearn. “Australian Government Withdraws Million Grant For Climate Contrarian Bjorn Lomborg’s Consensus Project,” DeSmog, October 23, 2015. 13Shalailah Medhora and Daniel Hurst. “Government withdraws funding offer for Bjørn Lomborg centre“ The Guardian, October 20, 2015. Archived October 24, 2015. Archive URL: https://archive.ph/wFGZI

July 29, 2014

Bjorn Lomborg of the Copenhagen Consensus Center testified in front of the U.S. Senate Committee on Environment & Public Works, Subcommittee on Clean Air and Nuclear Safety in a hearing titled, “Examining the Threats Posed by Climate Change: The Effects of Unchecked Climate Change on Communities and the Economy.”14Examining the Threats Posed by Climate Change: The Effects of Unchecked Climate Change on Communities and the Economy” (PDF), The Senate EPW Committee, Subcommittee on Clean Air and Nuclear Safety, July 29, 2015.

Lomborg’s testimony is summarized as follows:

“Global warming is real, but a problem, not the end of the world. Claims of ‘catastrophic’ costs are ill founded. For instance, even assuming increasing hurricane damage from global warming, the relative impact on society will decrease.

Inaction has costs, but so does action. It is likely that climate action will lead to higher total costs in this century.

Climate action through increased energy costs will likely harm the poor most, both in rich and poor countries..”

October 2013

The CCC published a book “How Much Have Global Problems Cost the World?” with a chapter edited by economist Professor Richard Tol. Tol’s chapter concluded:15“Research,” Score Card For Humanity (Copenhagenconsensus.com). Archived July 21, 2015.

“After year 2070, global warming will become a net cost to the world, justifying cost-effective climate action.”

The book also concludes that “climate change from 1900 to 2025 has mostly been a net benefit” because CO2″ works as a fertilizer.” These arguments have been thoroughly debunked by SkepticalScience.

October 7, 2013

As reported by ThinkProgress, the Copenhagen Consensus Center launched the American Prosperity Consensus project in partnership with Slate. Lomborg is quoted with this explanation of the project:

“The American Prosperity Consensus is designed as a competition of sorts. After we determine the most pressing issues according to reader input, we will ask economists and academics to propose policy solutions that best address these challenges while enabling America’s prosperity to continue and expand. With your help and with the guidance of Nobel laureates, we will create a list of top proposals. A final ranking will emerge from ongoing online debates and from the American Prosperity Summit, to be held in May 2014.”16Joe Romm. “Clean Slate? Asking Bjorn Lomborg to Help Figure Out ‘The Most Pressing Issue Facing’ America is Like…,” ThinkProgress, October 7, 2013. Archived July 22, 2015.

May 2012

The Copenhagen Consensus Center (CCC) published an assessment of of global challenges with a list prioritizing action.

The “Copenhagen Consensus 2012” findings suggested funding on climate change should be restricted to improving yields from crops and, down the list, investing in projects to artificially engineer the world’s climate.17“Outcome,” Score Card For Humanity (Copenhagenconsensus.com). Archived July 21, 2015.

February 2012

In an interview with Ecologist, Copenhagen Consensus Center (CCC) president Bjorn Lomborg discussed how his organization’s annual funding from the Danish Government had been withdrawn.18Richard Orange. “Bjørn Lomborg: ‘Five inches…? I can’t even remember that figure’,“ Ecologist. February 3, 2012. Archived July 22, 2015.

This had resulted in the CCC losing 90 per cent of its £1.5 million (about $2.4 million) annual budget.

August 2009

The Copenhagen Consensus Center (CCC) launched a new project on global warming (Copenhagen Consensus on Climate/www.FixTheClimate.com). They “commissioned new research on the economics and feasibility of different responses to global warming, and then used Nobel Laureate economists to evaluate that research and identify the best and worst ways to counter this global challenge.” ) The “economists” mentioned were in fact climate change skeptic Richard Tol.)19“Results,” Fix the Climate (Copenhagen Consensus on Climate). Archived July 22, 2015.

The resulting document, titled “Fix The Climate: Advice for Policymakers,” speaks of solutions of “solar radiation management technology,” “carbon storage technology,” and a “technology-led policy response.” These would, in effect, be artificial engineering to counter climate change as opposed to implementing policies to prevent it in the first place.20“Fix The Climate: Advice for Policymakers,” Copenhagen Consensus Centre. Archived July 22, 2015.

View the paper here (PDF). Authors included:

- Bjorn Lomborg

- Christopher Green

- Isabel Galiana

- J. Eric Bickel

- Lee Lane

- Valentina Bosetti

Video below:

February 5, 2008

The Fraser Institute hosted Bjorn Lomborg, author of The Skeptical Environmentalist and president of the Copenhagen Consensus Center, on a cross-country speaking tour.21“Up Front: A skeptic’s view on climate change,” Fraser Institute. Archived July 22, 2015.

May, 2004

The first Copenhagen Consensus project generates a list of priorities for world spending. In a list of 17 proposed “projects” the three related to climate change are placed 15th, 16th and 17th.22“Copenhagen Consensus 2004,” Copenhagen Consensus Center. Archived June 5, 2004.

The Kyoto Protocol and two types of carbon tax were all categorized as “bad projects.” At the time, the project’s founder Bjorn Lomborg was director of the Environmental Assessment Institute established as an independent authority by the Danish government.

September, 2003

The Institute of Public Affairs, an Australian free market think-tank, hosted Bjorn Lomborg for the HV McKay Lecture on how the world should prioritize funds in tackling major issues.23“Bjørn Storm:Lomborg replies to Critics at the Canberra Press Club” (PDF), In Touch, December 2003. Archived July 22, 2015.

During Lomborg’s visit, he also lectured at the National Press Club. The IPA produced an edited transcript of Lomborg’s speech.24Bjørn Lomborg. “How Do We Prioritize Our Resources” (PDF), Institute of Public Affairs. December, 2003. Archived July 22, 2015.

Related Organizations

- American Prosperity Consensus project

- Australia Consensus Center (The government-funded project was turned down by the University of Western Australia’s Business school, and is waiting on a new university to pick it up 25Lenore Taylor. “Bjørn Lomborg university funding tied to ‘rational conversation’ lectures,” The Guardian, June 25, 2015. Archived July 22, 2015. 26Bjorn Lomborg. “The Honor of Being Mugged by Climate Censors,” The Wall Street Journal, May 13, 2015. Archived July 22, 2015. 27Lenore Taylor. “Universities told to speak to Bjørn Lomborg if they want m in funding,” The Guardian. June 3, 2015. Archived July 22, 2015.

Social Media

- @Copenhagen_CC on Twitter.

- “Copenhagen Consensus Center” on Facebook.

- “Copenhagen Consensus Center” on LinkedIn.

Publications

Below is a complete bibliography of the Copenhagen Consensus Center’s published work as of July, 2015.28“Publications,” Copenhagen Consensus Centre. Archived July 22, 2015.

- The Nobel Laureates’ Guide To The Smartest Targets For The World — Copenhagen Consensus Center, 2015

- Prioritizing The World – Copenhagen Consensus Center, 2014

- How Much Have Global Problems Cost the World? – Cambridge University Press, 2013

- Global Problems, Smart Solutions – Costs and Benefits Cambridge University Press, 2013

- How to Spend $75 Billion to Make the World a Better Place – Copenhagen Consensus Center, 2012

- Rethink HIV – Cambridge University Press, 2012

- Smart Solutions to Climate Change – Cambridge University Press, 2010

- Cool it – Knopf Publishing Group, 2010

- Latin American Development Priorities: Costs and Benefits – Cambridge University Press, 2010

- Global Crises, Global Solutions – Cambridge University Press, 2009

- Solutions For The World’s Biggest Problems – Cambridge University Press, 2007

- How to Spend $50 Billion to Make the World a Better Place – Cambridge University Press, 2006

- Global Crises, Global Solutions – Cambridge University Press, 2004

- The Skeptical Environmentalist – Cambridge University Press, 2001

Other Resources

Resources

- 1Bjorn Lomborg. “The Poor Need Cheap Fossil Fuels,” The New York Times, December 3, 2013.

- 2“Outcome,” Score Card For Humanity (Copenhagenconsensus.com). Archived July 21, 2015.

- 3Graham Readfearn. “Is Bjorn Lomborg right to say fossil fuels are what poor countries need?“ The Guardian, December 6, 2013. Archived July 21, 2015.

- 4“Stephen Modzelewski,” Sourcewatch. Archive.is URL: https://archive.is/Em77q

- 5“Copenhagen Consensus Center US,” Conservative Transparency. Accessed July 5, 2016.

- 6“Press Contact,” Copenhagen Consensus Centre. Archived July 21, 2015.

- 7“Board & Directors,” Copenhagen Consensus Center. Archived July 22, 2015.

- 8Lenore Taylor. “Bjørn Lomborg university funding tied to ‘rational conversation’ lectures,” The Guardian, June 25, 2015. Archived July 22, 2015.

- 9Lenore Taylor. “Abbott government gives m to help climate contrarian set up Australian centre,” The Guardian, April 16, 2015. Archived June 7, 2015.

- 10Bjorn Lomborg. “The Honor of Being Mugged by Climate Censors,” The Wall Street Journal, May 13, 2015. Archived July 22, 2015.

- 11Lenore Taylor. “Universities told to speak to Bjørn Lomborg if they want m in funding,” The Guardian. June 3, 2015. Archived July 22, 2015.

- 12Graham Readfearn. “Australian Government Withdraws Million Grant For Climate Contrarian Bjorn Lomborg’s Consensus Project,” DeSmog, October 23, 2015.

- 13Shalailah Medhora and Daniel Hurst. “Government withdraws funding offer for Bjørn Lomborg centre“ The Guardian, October 20, 2015. Archived October 24, 2015. Archive URL: https://archive.ph/wFGZI

- 14Examining the Threats Posed by Climate Change: The Effects of Unchecked Climate Change on Communities and the Economy” (PDF), The Senate EPW Committee, Subcommittee on Clean Air and Nuclear Safety, July 29, 2015.

- 15

- 16Joe Romm. “Clean Slate? Asking Bjorn Lomborg to Help Figure Out ‘The Most Pressing Issue Facing’ America is Like…,” ThinkProgress, October 7, 2013. Archived July 22, 2015.

- 17“Outcome,” Score Card For Humanity (Copenhagenconsensus.com). Archived July 21, 2015.

- 18Richard Orange. “Bjørn Lomborg: ‘Five inches…? I can’t even remember that figure’,“ Ecologist. February 3, 2012. Archived July 22, 2015.

- 19“Results,” Fix the Climate (Copenhagen Consensus on Climate). Archived July 22, 2015.

- 20“Fix The Climate: Advice for Policymakers,” Copenhagen Consensus Centre. Archived July 22, 2015.

- 21“Up Front: A skeptic’s view on climate change,” Fraser Institute. Archived July 22, 2015.

- 22“Copenhagen Consensus 2004,” Copenhagen Consensus Center. Archived June 5, 2004.

- 23“Bjørn Storm:Lomborg replies to Critics at the Canberra Press Club” (PDF), In Touch, December 2003. Archived July 22, 2015.

- 24Bjørn Lomborg. “How Do We Prioritize Our Resources” (PDF), Institute of Public Affairs. December, 2003. Archived July 22, 2015.

- 25Lenore Taylor. “Bjørn Lomborg university funding tied to ‘rational conversation’ lectures,” The Guardian, June 25, 2015. Archived July 22, 2015.

- 26Bjorn Lomborg. “The Honor of Being Mugged by Climate Censors,” The Wall Street Journal, May 13, 2015. Archived July 22, 2015.

- 27Lenore Taylor. “Universities told to speak to Bjørn Lomborg if they want m in funding,” The Guardian. June 3, 2015. Archived July 22, 2015.

- 28“Publications,” Copenhagen Consensus Centre. Archived July 22, 2015.