In April, the Center for Global Energy Policy (CGEP) at Columbia University released a report concluding that, without major new subsidies from the American public, technologies for capturing heat-trapping carbon dioxide from coal and natural gas-fired power plants will remain uneconomical.

However, CGEP, which has a history of strongly supporting the interests of the fossil fuel industry, concludes in this report that the government should implement new publicly financed policies in order to ensure investors are willing to take the risk of investing in carbon capture — and use the public to backstop that risk so those investors make money.

The report, Capturing Investment: Policy Design to Finance CCUS Projects in the U.S. Power Sector, goes into great detail about the various approaches that might be required to support carbon capture for both coal and gas-fired power plants, depending on the multiple financial operating models for those plants. It also analyzes the impacts of the existing tax policy, known as 45Q, that supports carbon capture, use, and storage, or CCUS.

The authors of the report set out to answer the following question: “What are the specific U.S. policy design parameters that could provide investors and lenders with net cash flows that are both high enough and certain enough to attract private capital to CCUS projects?”

Or to put it another way, how much money will the public have to subsidize coal and natural gas plants to implement CCUS so that investors can be assured of a profit?

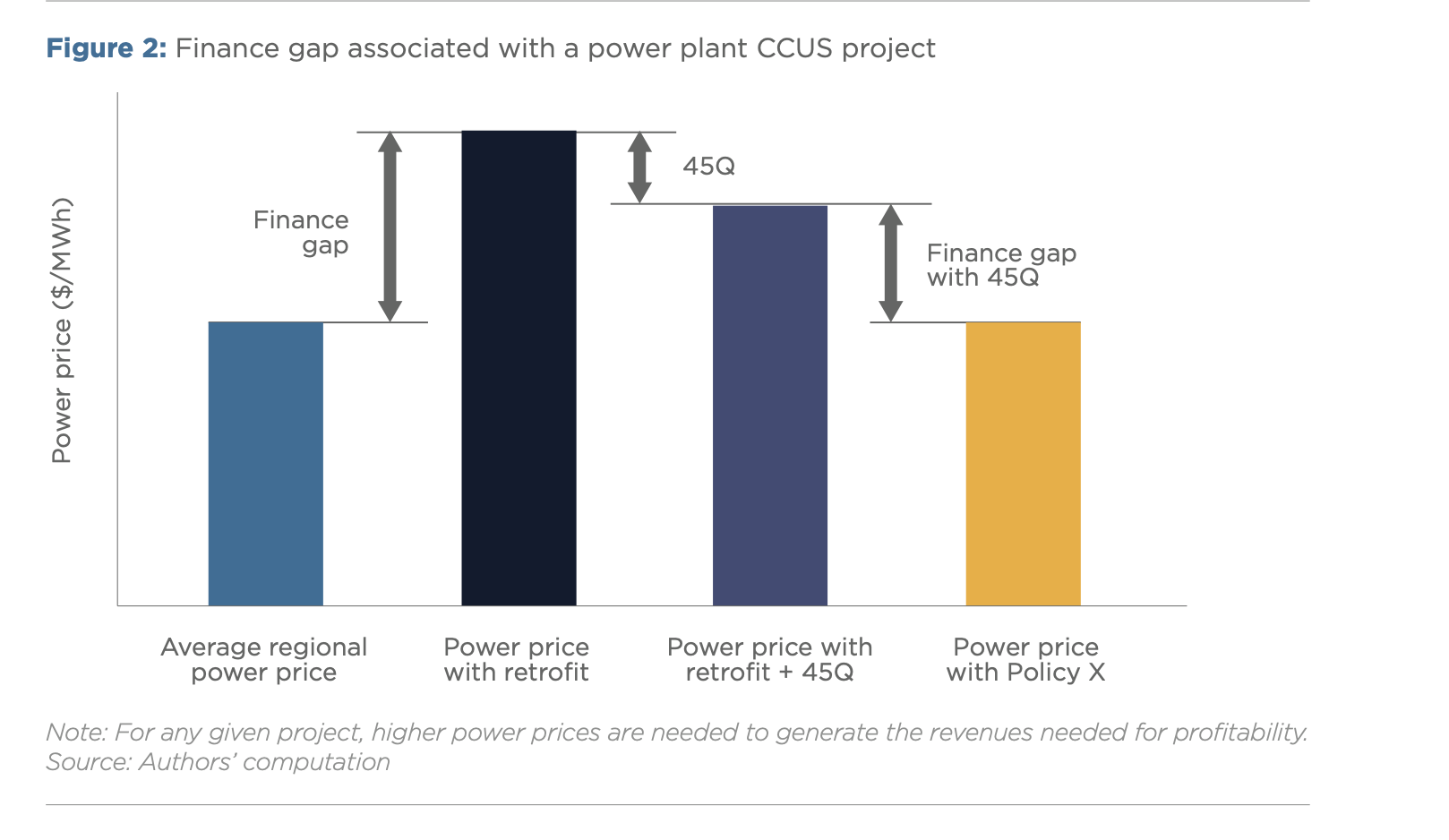

As the following graphic from the report notes, with any CCUS project for gas or coal plants, there is a finance gap that must be filled in order for investors to achieve profitability. Of course, one way to do that is raise the prices charged to customers. The report is clear that “higher power prices are needed to generate the revenue needed for profitability.”

Graph of prices need to support CCUS. Credit: Capturing Investment: Policy Design to Finance CCUS Projects in the US Power Sector

While prices for renewable energy continue to fall, this report is suggesting that prices for gas and coal-fired power will have to increase if CCUS is implemented.

The report also leaves no doubt that this will require significant policy changes and subsidies, concluding that “additional incentives are needed to stimulate private investment in CCUS projects and to scale deployment.”

Carbon capture is currently a favored approach for the fossil fuel industry because it is premised on long-term use of fossil fuels. One reason investors are hesitant to put their money into risky carbon capture projects is the fact that renewable power generation offers a better investment opportunity — while also being carbon free.

And even if CCUS technology could remove all carbon dioxide from natural gas power generation and that carbon could be safely sequestered somewhere without producing more fossil fuels in the process, it still would do nothing about the growing problem of methane emissions from natural gas, oil, and coal production.

Despite decades of subsidies, there is not one single unsubsidized coal #CCS project in the world.

Not one. https://t.co/bfvIYuidT8

— IEEFA.org (@ieefa_institute) May 20, 2020

Renewables Are a Better Investment

The timing of this report coincides with the current U.S. trend of closing coal and gas power plants and replacing them with renewable energy projects. At the same time, the United Kingdom recently went a whole month without using any coal-fired power, and 2020 represents the first year that renewables are expected to produce more power than coal in the U.S.

In CGEP‘s report, the trio of energy researchers analyzed prices for both coal and natural gas combined-cycle power plants.

However, the coal industry is widely acknowledged to be dying, and experts are saying it will not recover from the current coronavirus crisis. With this context, a better focus would have been concentrated on the potential of CCUS for natural gas alone. The oil and gas industry itself has been trying to sell natural gas with carbon capture as a climate solution in order to compete with renewable energy.

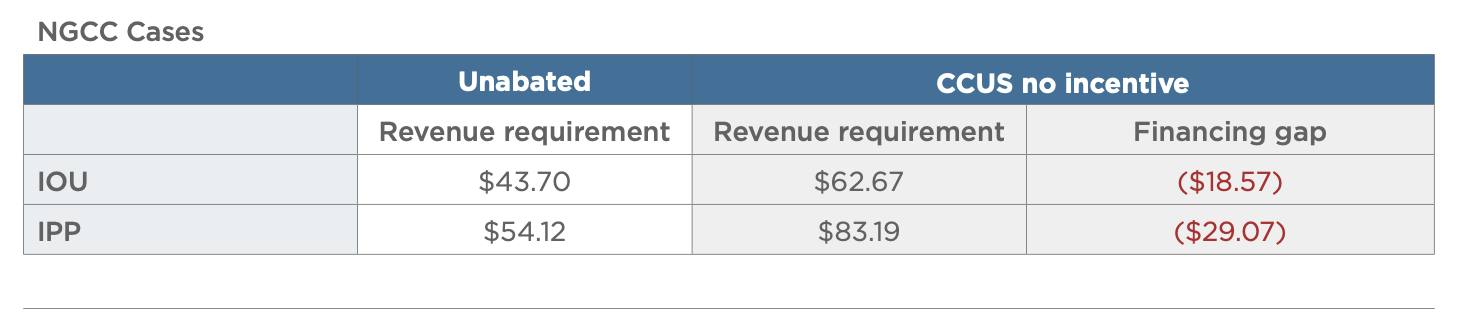

The CGEP report reviews the economics of CCUS for the two main types of financial ownership used for natural gas power plants in the U.S.: investor owned utilities (IOUs) and privately owned independent power producers (IPPs).

The following table summarizes the reports’ estimates for what it would cost for investors to get a satisfactory return on investment for a current natural gas combined-cycle (NGCC) power plant, both with and without carbon capture technology for each ownership approach. The prices are per megawatt-hour of power produced.

Revenue requirements for natural gas power generation Source: Capturing Investment: Policy Design to Finance CCUS Projects in the US Power Sector

The addition of CCUS to a natural gas-fired power plant would add between $18.57 and $29.07 to the cost per megawatt-hour (MWh) of power produced, on top of the existing costs to generate that power without CCUS.

For comparison, according to a new analysis done by Bloomberg New Energy Finance (BNEF) and reported by a writer on Forbes, “the global benchmark levelized cost of electricity for onshore wind and utility-scale [solar] PV has fallen 9 percent and 4 percent respectively since the second half of 2019 — to $44/MWh and $50/MWh, respectively.”

However, onshore wind power projects in the U.S. now report costs as low as $26/MWh, excluding subsidies or tax credits. And wind and solar prices continue to fall.

As the CGEP report points out, adding carbon capture to coal and natural gas plants will require a massive subsidy by the public — either via direct subsidies or higher power prices. Meanwhile, renewables offer a more effective long-term method of decarbonizing power while also costing less.

The facts are that carbon capture & storage has proved to be far more costly than thought a decade ago and renewables vastly less costly. So the clean/cheap energy answer is renewables + storage. Apart from v niche appl’ns CCS is just another coal de sac https://t.co/QroNiFaGfq

— Malcolm Turnbull (@TurnbullMalcolm) May 20, 2020

Tifenn Brandily, the lead author of BNEF’s new report, highlighted the speed at which the economics of renewables has changed:

“On current trends, the [levelized cost of electricity] of best-in-class solar and wind projects will be pushing below $20/MWh this side of 2030. A decade ago, solar generation costs were well above $300, while onshore wind power hovered above $100/MWh.”

This is the energy market in which CGEP is making the argument for large financial support of CCUS for fossil fuel power plants. These researchers’ own rigorous analysis of the economics of fossil fuel power production using carbon capture has actually made a very convincing argument about why that is a path not worth pursuing.

Another Strike Against Carbon Capture for Fossil Fuels

Yet another challenge of adding carbon capture technology to coal-fired power plants is water consumption, reports a team of researchers from the University of California, Berkeley.

The research, published in May in the journal Nature Sustainability, found that 43 percent of locations for global coal-fired power plant capacity “experiences water scarcity for at least one month per year and 32 percent experiences scarcity for five or more months per year.”

While retrofitting facilities with CCUS “would not greatly exacerbate water scarcity,” the UC-Berkeley team concluded that for areas already feeling pinched by water supplies, the addition of water-intensive carbon capture technologies would further contribute to that scarcity. In addition, the process itself requires power, which means running the power plants longer and using more water.

DeSmog has previously reported on the advantages of renewable energy consuming and using much less water than fossil fuel-powered plants. Producing electricity via fossil fuels actually requires large amounts of freshwater, primarily for cooling.

Climate change is already causing water scarcity issues. The most recent update of the World Resources Institute Global Water Risk Atlas notes that 17 countries are facing “extremely high” water stress in the next two decades.

Study of southwestern North America shows that 2000 to 2018 was the driest 19-year span since the late 1500s and the second driest since 800 CE and appears to be the beginning of a trend toward a “megadrought”. #GlobalWarming #ClimateChange https://t.co/GM6CGX1ki9 pic.twitter.com/MhLaRlTopR

— MIT Alumni for Climate Action (@MITAlum4Climate) May 20, 2020

With the western U.S. facing the worst megadrought in 1,200 years, a state which may last for 100 years, water use is going to become an increasingly important factor in policy decisions. Adding water-intensive carbon capture technology to already water-hungry coal power plants seems extremely shortsighted given other options.

Subsidizing Carbon Capture: Another Fossil Fuel Industry Bailout

All over North America, evidence abounds that the oil and gas industries can’t survive without help from taxpayers.

Since the COVID-19 pandemic began, the U.S. oil and gas industry has been receiving a number of bailouts, including royalty relief and lease suspensions for federal lands, while the Trump administration has suddenly asked for big retroactive rent bills from wind and solar companies.

Using the coronavirus crisis as justification, the current administration in Mexico, which owns a number of aging fossil fuel plants, has made several recent moves that may serve as stumbling blocks for renewables investments. And Canada, long a supporter of Alberta’s tar sands, is continuing to bail out the oil industry.

Using more public money to support uneconomical carbon capture technologies represents yet another potential subsidy for the same industries that are causing the climate crisis.

Just one example of the Big Oil Bailout:

Diamond Offshore Drilling Inc used the bailout to get a $9.7 million refund.

It then declared bankruptcy and gave its executives $9.7 million in bonuses. https://t.co/4VP71fed1M

— Jamie Henn (@jamieclimate) May 15, 2020

Meanwhile, if the energy markets were allowed to function as free markets without politicians fighting the adoptions of renewable energy, there is little doubt that no one would be investing in carbon capture for natural gas plants — and coal plants would likely just close down.

Carbon capture is just one more attempt by the coal, oil, and gas industries to convince the public that fossil fuels can be part of a climate solution — something the oil and gas industry has been pushing since at least 2006. But when looking at the numbers, fossil fuels, a major cause of climate change, don’t add up to a solution.

Main image: Haynes Generating Station, a natural gas power plant in Seal Beach, California. Credit: Jon Sullivan, CC BY–NC 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts