This story is the sixth part of a DeSmog series on carbon capture and was developed with the support of Journalismfund Europe.

Norwegian state-owned oil and gas company Equinor, the North Sea’s largest fossil fuel producer, is positioning itself to play a key role in plans to turn Britain into a world leader in capturing carbon.

Earlier this month, the new Labour government pledged £21.7 billion over 25 years to finance carbon capture and storage (CCS) projects shortlisted by the previous Conservative administration. Equinor was among several companies awarded a total of £3.9 billion in subsidies from 2025 to 2026 under the scheme when Chancellor of the Exchequer Rachel Reeves delivered the Autumn Budget on Wednesday.

But a DeSmog analysis of the company’s plans points to a series of technical, environmental and economic risks that raise questions over whether the projects will succeed in reducing emissions — or make them worse.

The uncertainties centre on Equinor’s backing for new “net zero” gas-fired power plants fitted with technology to capture carbon dioxide (CO2) billowing from their smokestacks, and bury the gas in disused oil and gas fields under the North Sea.

Carbon capture has never been deployed on gas-fired power stations at such a scale before — and a senior Equinor executive has made frank admissions around the technical challenges such projects face. Even if they perform as hoped, the power plants would likely burn imported liquified natural gas (LNG) from the United States, Qatar, and other suppliers — a fuel source that emits high levels of climate-heating methane when it’s being extracted, transported and stored.

Climate advocates are also concerned about Equinor’s plans to develop a UK market for “blue hydrogen”. This clean-burning fuel is made from natural gas, with carbon capture technology used to trap emissions released during the process. Even if the majority of these emissions are stored, however, the problem of methane leaking from the natural gas supply chain remains.

“This is not a decarbonisation project, it’s a ‘recarbonisation project’,” said environmental consultant Andrew Boswell, who launched a legal challenge to one of the new gas-power projects backed by Equinor and British oil giant BP in July.

Lobbying Push

With oil and gas companies intensifying their lobbying of government ministers over carbon capture in recent years, Equinor, which supplies about 27 percent of the UK’s natural gas, has secured a prime seat at the table. Equinor executives attended 16 meetings with UK ministers from 2020 to 2023 to discuss CCS — more than any other company, and second only to the Carbon Capture and Storage Association lobby group, which held 20 meetings, according to transparency records [See related story].

Concerned about the fossil fuel industry’s role in shaping the UK’s carbon capture strategy, a group of scientists and campaigners wrote to Ed Miliband, Secretary of State for Energy and Net Zero, in September to urge him to reconsider the UK government’s support for the proposed gas-fired power and blue hydrogen projects.

“Putting the UK on the wrong pathway could be catastrophic,” wrote the authors, who included professors from 10 universities, including the University of Cambridge and the Massachusetts Institute of Technology. “Currently, this policy would lock the UK into using fossil fuel-based energy generation to well past 2050.”

Responding to the criticisms, Stuart Haszeldine, a geology professor at the University of Edinburgh and several other UK-based university professors, wrote their own letter to Miliband this month in support of CCS, and urged the government to disburse promised funding to avoid further delays.

“The fact remains that to achieve Net Zero in the UK by 2050 we need to deploy CCS at scale, and we need to deploy it well,” the authors wrote. “Not doing so could lead the UK to lose its status as a world leader in the space of tackling climate change, climate technology innovation, and a hub for investment for the energy transition.”

Technical Challenges

Equinor’s flagship carbon capture project in Britain is the estimated £1.5 billion Net Zero Teesside Power gas-fired power plant in the northeast of England, to be built in partnership with BP on the site of the demolished Teesside Steelworks.

Equinor and BP describe Net Zero Teesside Power as a “world-first gas-fired power station with carbon capture” and estimate that it will capture up to two million tonnes of CO2 per year by 2027, about 0.5 percent of the UK’s current yearly emissions.

Worldwide, attempts to make fossil fuel power plants cleaner through CCS have proved costly and challenging, however. So far, the approach has mostly only been used at power stations which burn coal — and even then the climate impact has been miniscule.

Only about 1.5 million tonnes of the world’s 37 billion tonnes of energy sector emissions each year, or 0.004 percent, were captured from power stations fitted with CCS in 2023, according to a DeSmog analysis of data from the Global CCS Institute, an industry group, and reporting from the SaskPower company in Canada.

And past attempts to build large gas-fired power stations with carbon capture in the UK, Norway, and Canada never made it past the planning stage.

That’s for both economic and technical reasons: It’s much harder and more expensive to capture the diffuse CO2 molecules emitted by burning natural gas than it is to mop up the denser CO2 concentrations spewed by natural gas processing facilities, the most common source of captured carbon worldwide.

‘Needle in a Haystack‘

Equinor encountered these challenges first-hand in 2006, when the company (then known as Statoil) began an estimated £650 million project to capture CO2 from its Mongstad gas-fired power station.

Then-prime minister of Norway Jens Stoltenberg called the project a “moon landing” for the climate, but project costs soon ballooned beyond earlier estimates, and the plan was abandoned in 2013. More recently, doubts about Equinor’s ability to capture CO2 from gas-fired power plants surfaced from within the company’s senior management.

Henrik Solgaard Andersen, then Equinor’s vice-president for low carbon technology, told Recharge News in 2021 that CCS at gas-fired power stations was “very difficult” and like “finding a needle in a haystack”.

Nevertheless, Equinor and BP told the UK government in their 2021 application for Net Zero Teesside Power that the companies could capture up to 95 percent of CO2 emissions at the gas-fired power plant. And the project’s website says the plant will capture “over 95% of emissions”.

That appeared to contradict Andersen’s 2021 comments to Recharge News, where he said a large gas-fired power station “will not be able to capture that amount of CO2” (90-plus percent).

“Nobody has run a dispatchable power plant with CCS before. Nobody knows really what the energy efficiency will be and the capture rate,” Andersen was quoted as saying.

When asked by DeSmog to clarify the apparent disparity between Andersen’s prior statements and company estimates for Net Zero Teesside Power, an Equinor spokesperson suggested referring all technical questions to BP, which will run operations at the power station.

“We believe that CCS could play a vital role in the UK’s transition to net zero by enabling industrial carbon capture, low-carbon hydrogen production, and power with carbon capture,” said the Equinor spokesperson.

BP did not respond to multiple requests for further information regarding CO2 capture estimates for Net Zero Teesside Power.

Equinor says its major investments in offshore wind and CCS will put the company on track to reach “net zero” carbon emissions by 2050 — and says it plans to store 30 to 50 million tonnes of CO2 a year by 2035 at various sites in Norway, the UK, Denmark and the United States, an over thirtyfold increase from the 0.8 million tonnes of CO2 it stored last year.

The company opened its new Northern Lights carbon transport and storage facility in Norway last month, a joint venture with Shell and TotalEnergies, but has yet to store large quantities of CO2 at the site.

‘Flawed’ Estimates

Even if Equinor and BP can achieve capture rates of 95 percent in Teesside, some researchers say that the project and others like it could still undermine Britain’s climate ambitions.

Lorenzo Sani, a power analyst from the London-based financial think tank Carbon Tracker, concluded in a June report that “flawed assumptions” and “underestimates” marred the government’s analysis of the Net Zero Teesside Power project’s potential emissions — which could make its climate impact up to four times higher than stated by BP and Equinor.

Sani argues that BP and Equinor have not taken adequate account of “upstream emissions” — methane and CO2 released during the production and transport of the natural gas burned in the power station.

As North Sea oil and gas production declines, the UK is increasingly importing gas in the form of liquefied natural gas (LNG), with the majority from the United States. This gas generally has a higher emissions footprint than UK or Norwegian gas due to the elevated amounts of methane and CO2 released during extraction, and the process of turning the gas into a liquid, and shipping it.

In Teesside, U.S.-based company WaveCrest Energy plans to build a new liquified natural gas import terminal to satisfy future gas demand in the region, which it advertises as “sustainable” and “low carbon” — despite its significant carbon footprint.

“Liquefied natural gas comes with a much heavier carbon intensity when combustion emissions are removed, because in the whole supply chain, there are higher energy losses and leaks,” Sani said. “So the carbon intensity of the gas that is delivered is at five or more times higher than natural gas from the North Sea.”

That critique was the basis of the case brought by Boswell, the environmental consultant, who argued that planning permission for Equinor and BP’s Net Zero Teesside Power plant failed to consider the full climate impact of the project.

In her July ruling in favour of the government, High Court Justice Nathalie Lieven, however, found that “no logical flaw” was made by ministers in granting planning permission for the project. Boswell has appealed the ruling, with a hearing due in March.

In response to detailed questions about the government’s CCS strategy submitted by DeSmog, a spokesman for the Department for Energy Security and Net Zero said that the Climate Change Committee, an independent government advisory body, had described carbon capture as “a necessity not an option for reaching our climate goals.”

“Carbon capture, usage and storage will play a vital role in a decarbonised power system,” the spokesperson said.

WaveCrest Energy did not respond to a request for comment.

‘Business as Usual’

Beyond concerns over the emissions footprint of the planned projects, it is also unclear how Equinor and other oil companies venturing into the UK’s nascent carbon capture market can expect to make such projects pay.

Carbon capture advocates often cite Equinor’s success at capturing CO2 from its Sleipner offshore gas field in the North Sea since 1996 as proof the technology can work.

But critics point out that the project did nothing to reduce consumption of fossil fuels.

Ada Nissen, a University of Oslo historian, argues that the Sleipner project allowed Equinor to continue “business as usual” — earning the company a rebate on a new Norwegian carbon tax, but doing nothing to curb further natural gas extraction or consumption.

What’s more, company figures for the amount of CO2 stored at Sleipner have not always proved reliable.

Equinor has admitted over-reporting the amount of CO2 captured at Sleipner during the period 2017-2021 due to an equipment malfunction, DeSmog reported this week, expanding on findings by Norwegian public broadcaster NRK Rogaland in 2022.

Elsewhere, in the 52 years since carbon capture was first deployed in a Texas oilfield, the fossil fuel industry has mostly used the technique to revive depleting oilfields by pumping CO2 back underground to force hard-to-reach oil to the surface. Selling that oil helped make the expensive business of capturing carbon economically viable — and generated more emissions when the oil was burned.

DeSmog revealed in March that the North Sea oil industry has long studied the possibility of using the technique — known as enhanced oil recovery — to reanimate declining offshore fields. Nevertheless, oil companies such as Shell and Equinor say they have no plans to do so.

That raises the question of how industry will finance the UK’s carbon capture plans.

The previous Conservative government set a target to capture 20 to 30 million tonnes of CO2 by 2030 — from none today. Such a build-out would mean constructing the equivalent of roughly half of the world’s total CCS capacity of about 50 million tonnes, which took half a century to develop, over the next five years. The new Labour government has not explicitly endorsed that target, though its carbon capture strategy is broadly in line with its predecessor’s.

In Britain, two decades of on-off attempts to introduce CCS have foundered due to the lack of a viable market to sell captured CO2, and wavering policy support.

“There’s been no monetary value placed on putting carbon back into the ground, and that’s why it doesn’t happen,” said Haszeldine, the geology professor at the University of Edinburgh.

Under the UK’s emissions trading scheme (ETS), companies must buy CO2 pollution allowances. In theory, rising prices for these permits could incentivise companies to capture carbon — instead of venting it into the atmosphere. Permits are trading at less than £40 per tonne, however, far below the estimated costs for capturing CO2 from a variety of sources. For example, the U.S.-based National Petroleum Council estimated in 2021 that it would cost an average of £90 per tonne to capture CO2 from a large gas-fired power plant.

In the absence of a reliable market signal, industry is clear that it will need significant subsidies.

Funding Concerns

The UK’s Carbon Capture Storage Association lobby group — which counts Equinor as a member — estimates that £2-3 billion in subsidies will be needed a year by 2028 to get a British CCS industry off the ground. That’s roughly in line with the government’s £3.9 billion in CCS subsidies for 2025-2026 announced on Wednesday, but higher than Labour’s pledge of £21.7 billion over 25 years — an average of less than £1 billion annually.

Despite past funding pledges, successive governments have come nowhere near to disbursing such funds. Since 2020, the government has granted £171 million for CCS and hydrogen projects as part of its 2021 UK Research and Innovation funding scheme. Equinor was the second largest recipient, with project grants amounting to more than £22 million, behind Italian oil company Eni with £30 million, according to a DeSmog review of the government’s subsidy database.

Companies are open about their worries over shortfalls.

In June last year, representatives of the Carbon Capture and Storage Association told Grant Shapps, then Secretary of State for Energy Security and Net Zero, that its members were concerned about delays and there was a “struggle to keep investors upbeat”, according to meeting notes obtained by DeSmog via a freedom of information request.

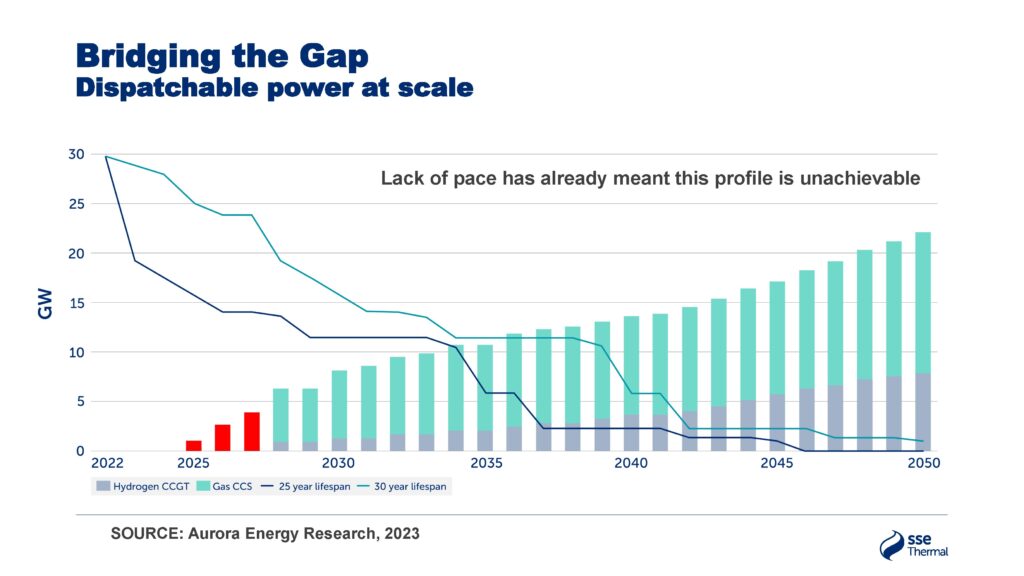

In a presentation given at a London CCS conference in October last year, Catherine Raw — then vice-president for Scottish utility SSE — stated that plans to scale up the UK’s gas-fired power CCS were beset by “lack of pace” which made them “unachievable.” If nothing happened soon, the then government’s plan to decarbonise electricity generation by 2035 — a target which Labour has since brought forward to 2030 — would force SSE to shut down much of its business. SSE did not respond to a request for comment.

To meet the net zero challenge, SSE is partnering with Equinor to build two gas-fired power plants with CCS priced at £2.2 billion each, in Peterhead, Scotland and Keadby in the east of England. Neither project has yet been selected for government funding, with priority given to Net Zero Teesside Power.

The Peterhead project has sparked opposition from climate groups including Friends of the Earth Scotland, which organised a protest in Edinburgh last month. “Projects like Peterhead carbon capture and Net Zero Teesside are wasting both time and money that should be spent on climate solutions that work from day one and will improve lives,” said Alex Lee, a campaigner for the group, responding to the CCS subsidy announcement in the Budget. “These greedy energy companies will do whatever it takes to keep the subsidies flowing, leaving the UK public to pick up the tab for its inevitable failure.”

In addition to Equinor and SSE, German energy company RWE plans to build CCS retrofits at three gas-fired power plants it operates in Pembroke, Wales, and Great Yarmouth and Staythorpe in eastern England, as well as a new-built gas power station with CCS at Stallingborough, also in eastern England. RWE estimates the projects could capture up to 11 million tonnes of CO2 emissions a year.

In February, Uniper — the German-state owned power utility and gas company — also announced plans to retrofit its Connah’s Quay gas-fired power station in Wales with CCS.

“Efficient gas-fired power stations fitted with carbon capture will support the transition to renewables by providing a firm and flexible power source, crucial for filling the gap when there is insufficient wind or solar energy to meet demand,” RWE said in a statement.

Uniper did not immediately respond to a request for comment.

Meanwhile, other carbon capture projects remain stalled. In June, Equinor delayed the potential start-date for a planned blue hydrogen plant near Hull on the east coast of England until 2027 at the earliest, citing funding concerns.

In September, Equinor cancelled plans to export blue hydrogen from Norway to Germany, citing lack of demand and economic challenges. And this month, ExxonMobil dropped plans to build a CO2 pipeline from its Fawley Refinery in southern England, linked to a proposed blue hydrogen plant at the site.

Budget Announcement

While the government’s carbon capture funding shortlist initially included eight projects, the Department for Energy Security and Net Zero said this month that the list would be cut to three.

The recipients are Net Zero Teesside Power; a blue hydrogen plant to be operated by EET Technologies — a subsidiary of Indian conglomerate and oil company Essar; and the Protos waste-to-energy power station with CCS, planned by waste and energy companies Biffa and Encyclis in Merseyside.

Left out of the funding round from the government’s initial shortlist were two blue hydrogen facilities planned in Teesside; a lime plant; a separate waste-to-power facility in Merseyside; and a project to capture CO2 at the Padeswood cement works in northern Wales.

In addition to the three selected carbon capture projects, the government plans to support Italian oil and gas company Eni’s CO2 transport and storage project in the Irish Sea as part of the HyNet Cluster in Merseyside, as well as the Northern Endurance Partnership CO2 transport and storage project in the North Sea, to be operated by Equinor, BP and TotalEnergies.

Eni says that its HyNet CO2 transport and storage network on land and in the Irish Sea could handle up to 4.5 million tonnes of CO2 per year, with plans to scale capacity to 10 million tonnes after 2030.

“The project will help preserve local jobs by supporting the decarbonisation of hard-to-abate industries, as well as attracting investment and creating new jobs,” said an Eni spokesperson.

David Parkin, chair of the HyNet Alliance, which includes Eni and EET Technologies, said that all blue hydrogen produced by EET Technologies will meet the UK’s “Low Carbon Hydrogen Standard” and estimates that more than 97 percent of CO2 will be captured from its blue hydrogen production plant.

“The low-carbon hydrogen can be stored in significant quantities to support the UK’s energy security and provide a reliable source of power for when the wind doesn’t blow and the sun doesn’t shine,” Parkin said.

The government’s decision to prioritise natural gas-based CCS projects such as new gas-fired power plants and blue hydrogen has alarmed some climate advocates, who recommend that the technology be used to clean up existing dirty industries, not build more fossil-based infrastructure.

Any investments in carbon capture “should be focusing on genuine ‘hard-to-abate’ applications like cement, fertiliser, and other chemicals processing/refining — not power generation and blue hydrogen,” said Arjun Flora, European director of the Institute for Energy Economics and Financial Analysis, a think tank, which analysed the UK’s carbon capture strategy last year.

“The most likely consequence is a waste of public money, at a time when budgets are constrained,” he added.

Record Profits

While Equinor, BP and other companies waited for subsidies from the UK government to develop carbon capture in recent years, skyrocketing energy prices earned them record profits from oil and gas. In 2022, Equinor recorded adjusted earnings of £61 billion, more than double its previous annual record.

With demand for Norwegian oil and gas remaining strong, Equinor’s chief executive Anders Opedal announced plans in August to invest between £4.3 and £5 billion a year to maintain production levels in the Norwegian sector of the North Sea until 2035.

The company and partner Ithaca Energy also plan to invest an initial £3.1 billion to drill the Rosebank oil field west of the Shetland Islands, the UK’s largest fossil fuel project in a decade.

Last year, DeSmog revealed that former Chancellor of the Exchequer Jeremy Hunt had reassured Equinor’s Opedal of the government’s support for the Rosebank project during a meeting in January 2023, and had appeared to suggest that low carbon investments could improve the company’s image.

Even if Equinor succeeds in transforming the North Sea into a vast CO2 capture and storage site, however, the company’s target to store 30 to 50 million tonnes of CO2 a year by 2035 would nowhere near offset the 262 million tonnes of CO2 emitted from its operations and burning its oil and gas last year, according to company data reviewed by DeSmog.

That’s more than 300 times the combined total of 0.8 million tonnes of CO2 emissions it captured and stored in 2023 at its carbon capture project at the Sleipner gas field, and a similar facility in the Barents Sea.

Carbon capture expert Stuart Haszeldine said that fossil fuel companies should be bound by a “carbon takeback obligation” — a legal mechanism aimed at forcing them to store an equivalent amount of CO2 to the quantity produced by burning their products.

By subsidising carbon capture without constraining fresh drilling, governments are allowing fossil fuel companies to “have their cake and eat it too,” he said.

Additional reporting by TJ Jordan and Michael Buchsbaum

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts