Canada’s major pension funds are dragging their heels on climate change, according to a new report from Shift Action for Pension Wealth and Planet Health.

Shift Action is a charitable initiative that seeks to protect pensions and the climate by tracking pension fund investments and comparing them with climate policies.

The second edition of their Canadian Pension Climate Report Card notes that while some pensions made very modest improvements over the previous year, on the whole, Canadian pensions continue to act as if the climate crisis isn’t happening, and as though their considerable investments in the fossil fuel sector weren’t exacerbating the crisis.

The report notes that even though 2023 was the hottest year on record, Canadian pension managers have not responded appropriately. By not aligning investments with “safe emissions pathways and implementing credible climate plans,” pensions are failing at their fiduciary duties to protect their plan members, especially the youngest cohort of contributors.

“The risks of a warming world are considerable,” Adam Scott, Shift Action’s executive director, said in an interview with DeSmog. “Failing to have a credible and ambitious climate plan is a recipe for underperformance in the years to come.”

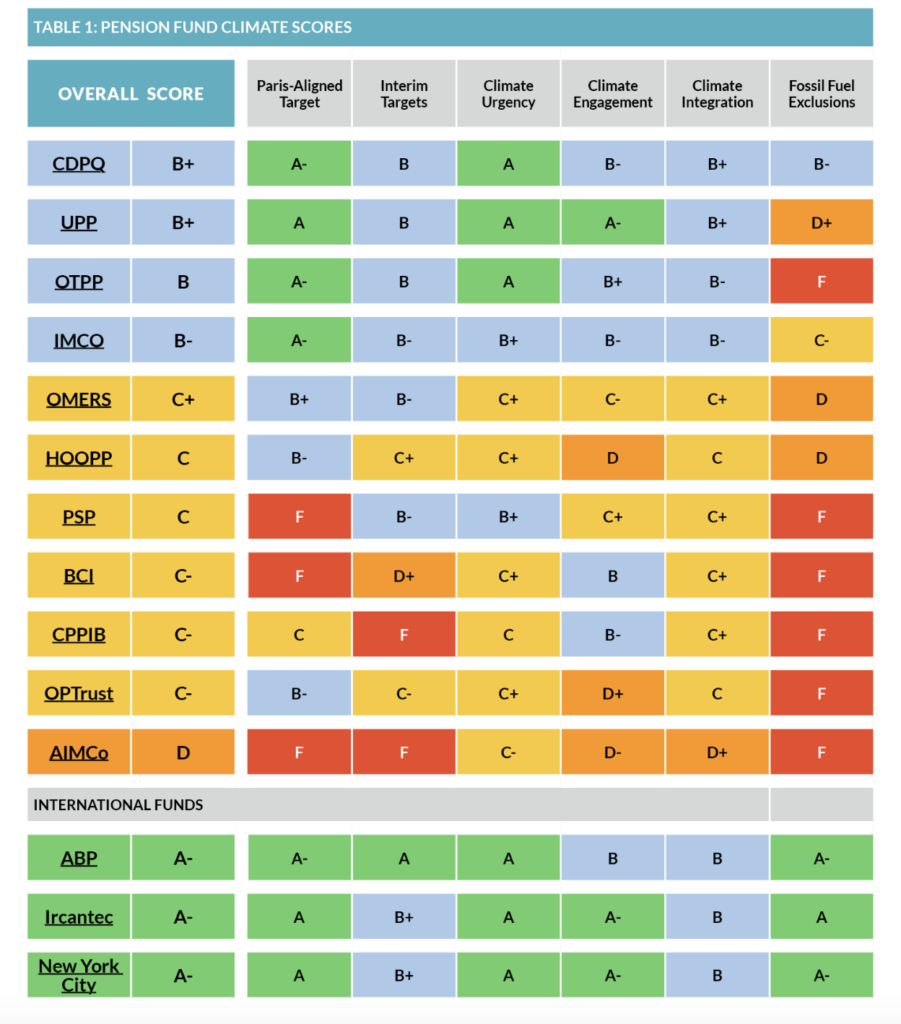

The report found Canadian pension funds are lagging far behind their international peers, and pension executives are ignoring the considerable risk posed by stranded assets.

“For the majority of Canadian pensions, there is a mismatch between the incremental pace of climate progress and the need for urgent action to prevent irreversible climate breakdown,” said Laura McGrath, pension engagement manager with Shift Action.

The report card is an independent analysis of the climate policies for 11 of Canada’s largest pension managers. The report assesses the credibility, depth, and quality of the pensions’ climate policies, and is intended to raise awareness of the crucial role pension funds play in addressing interrelated environmental and economic issues.

Of the 11 pension funds investigated, Shift Action found that four still do not have emissions reductions targets, either for 2030 or 2050. Three of the pensions have no commitment to net-zero emissions, including one of Canada’s largest (the Public Sector Pension Investment Board), and the provincial institutional investors for the provinces of Alberta and British Columbia. Alberta’s institutional investor, AIMCo, still hasn’t come up with a climate plan meeting Shift Action’s criteria.

Shift Action argues this is unacceptable, and that action is urgently needed, not only for the benefit of the pension plans, but to protect the economy at large from the adverse effects of climate change.

“Canadian pensions are huge, and them choosing to transition their investments away from fossil fuels and towards renewables could be massively impactful,” said Julie Segal, senior manager of climate finance with Environmental Defence, in an interview with DeSmog. “It’s a self-fulfilling prophecy — the investment decisions of Canada’s major pension funds today define what our economy and infrastructure will look like tomorrow.”

Segal said there are three distinct areas of concern related to Canadian pension funds and the climate crisis: one for the funds, one for pension members, and one for the government.

“Canadian pensions hold significant amounts of money, but they’re not building an economy that’s resilient to climate change, and this creates more risk,” said Segal. “On the other hand, people don’t want to worry about their pensions, and they shouldn’t have to worry about whether their pensions are invested in fossil fuels or whether they’ll get paid when they retire.”

Segal points to a similar disinterest on the part of the federal government when it comes to steering pension funds towards clean and green investments. “There are rules to guide finance, but when it comes to finance and climate the Government of Canada is lagging. New rules for climate-aligned finance are important, because it is the government’s responsibility to keep pensions and the planet safe.”

Segal told DeSmog that, according to surveys conducted by Environmental Defence, roughly two-thirds of Canadians support new sustainable finance regulations in general, a figure that rises to more than three quarters when it’s specifically framed as countering industry-led greenwashing efforts.

Shift Action’s report also notes that getting a clear picture of just how risky Canada’s pension plan fossil fuel investments truly are is difficult, given pension funds’ lack of transparency. In addition, some funds were found to obfuscate green assets and transition assets, and are susceptible to greenwashing. The report further notes that the Canada Pension Plan Investment Board (CPPIB) — the crown corporation that oversees and manages the Canada Pension Plan — continues to make questionable investments in fossil fuels. Shift Action found a considerable disconnect between statements made by CPPIB executives about the urgency to act on climate change, and the fund’s continued support of the fossil fuel sector. The CPPIB has also repeated industry talking points, such as “Canada has a reputation for responsibly-produced energy” despite considerable evidence to the contrary.

Close relationships between pension fund managers and the fossil fuel sector are also a cause for concern.“We see directors of pensions also sitting on the boards of fossil fuel companies, creating an unacceptable risk for conflicts of interest,” said Scott.

Institutional momentum may also be a problem contributing to the lethargy of Canadian pension funds when it comes to addressing their role in the climate crisis.

Scott argues newer funds have been quicker to react to climate change than their larger legacy peers, but across the financial sector a general lack of climate literacy is a considerable barrier drafting and executing effective climate plans.

How far Canadian pensions are lagging behind both their international peers and the apparent goals of various governments in Canada is considerable.

Only three of the 11 pension funds studied by Shift Action have joined credible and reputable international investor groups aligned to Paris Agreement targets, meaning most pension funds are lacking in international accountability. None of the pension funds explicitly include scope 3 emissions in their net zero commitments, except for the CPPIB. However, the latter has indicated that only 6-7 percent of their reported scope 3 emissions are being reported directly by portfolio companies. Additionally, none of the pension funds have adopted portfolio-wide absolute emissions reduction targets.

This lagging response goes hand in hand with a general disinterest in committing the incredible capital held by Canadian pension funds to accelerating the energy transition, said Scott.

“Canada’s slow renewable energy deployment has, to date, largely been a result of regulatory failures and lack of market access, not a lack of capital,” he said. “In recent years, the pace and scale of investment in climate solutions has increased exponentially globally, but not in Canada. We have thankfully seen significant investment from Canadian pensions in renewable energy in recent years, but largely outside the country.”

Scott said shifting “tens of billions” of capital into renewables will help Canada meet climate and investment targets. “The full-scale electrification of our economy — through investments in heat pumps, energy storage, electric transportation of all types, energy efficiency upgrades, and decarbonizing industry — is a massive opportunity for low-risk economic growth that will support pension obligations in the long-term.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts