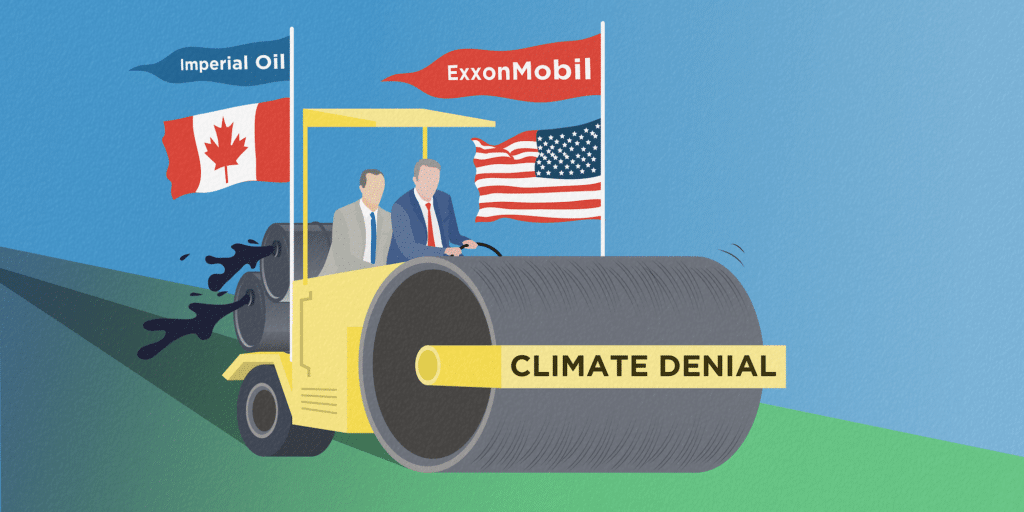

Exxon figured out a solution that could have helped achieve “stabilization” of the climate emergency back in the early 1990s, and then came up with a communication strategy to make sure that solution wouldn’t happen.

That’s according to a newly reviewed 1993 document labeled “proprietary” that was written by the company’s Canadian subsidiary Imperial Oil, one of the top producers in a heavily polluting oil deposit known as the Alberta tar sands.

The document directed leaders at the company to stress the “many uncertainties” of implementing a national tax on greenhouse gas emissions when talking with journalists and politicians, even though Imperial Oil had privately studied the policy and learned that it could cause national emissions to plateau and then shrink without doing significant damage to the economy.

If Exxon had back then used its vast political and financial power to aggressively push for a national carbon tax to be adopted in major economies around the world, global emissions might have already peaked by now. “We’d be headed down the backside,” environmental writer and 350.org founder Bill McKibben argues in my new book entitled The Petroleum Papers: Inside the Far-Right Conspiracy To Cover Up Climate Change.

Enrique Rosero, a scientist who spent 10 years working for Exxon before being pushed out for questioning its opposition to climate solutions, agrees his former employer could have made a huge early impact in the climate fight by pushing for a carbon tax.

“That would have significantly changed incentives for everything,” he says in The Petroleum Papers. “It would have been so much easier to address the crisis if we’d started then.”

The main problem with a carbon tax from Imperial Oil’s perspective was that it would drastically harm the company’s sizable investments in Canada’s massive oil patch. “Imposition of increased taxes to dampen demand and influence supply mix could increase the relative supply costs of energy intensive/higher carbon content fossil fuels such as oil sands,” the 1993 document says.

This could potentially “result in a 12% reduction in downstream revenue” for Imperial Oil, the document warned, equivalent to losses of 940 million Canadian dollars.

For that reason the company came up with a list of talking points targeted to “government, thought leaders and media” that would make carbon taxes look economically reckless. This “Basic Strategy/Action Plan” also was apparently shared with leaders at “Exxon’s Environment and Safety and Corporate Planning networks.”

Step one in the plan was to warn people in power that climate policies such as a carbon tax would hurt a “precarious economy and international competitiveness” while achieving only “uncertainty in environmental benefits.”

Leaders at Imperial Oil and Exxon should argue publicly that it “makes little sense to act unilaterally to respond to a global issue” and that responding to global warming “doesn’t warrant drastic steps at this time,” according to Imperial Oil’s communication plan.

This position was a misrepresentation of Imperial’s own research on climate solutions, which was contained in a 1991 report presented to the oil and gas company by an economics consulting firm known as DRI/McGraw-Hill.

Read a Q&A with Geoff Dembicki, author of the book The Petroleum Papers

That report showed that if a major greenhouse gas emitter like Canada forced polluters to pay a tax of CA$55 for each ton of carbon dioxide released into the atmosphere, it would result in policymakers and executives closing down oil refineries and coal power plants, building renewable energy sources, phasing out diesel locomotives, making car engines less polluting, and reducing emissions from buildings.

All this would have the potential to stop the climate emergency in its tracks, resulting in “approximate stabilization of Canada’s CO2 emissions,” the 1991 report read. This is exactly what would be needed in order for a global economic power like Canada to do its part to halt climate change.

Imperial calculated there would be up-front costs associated with this policy shift. But those costs would be primarily felt by the fossil fuel industry. “The Canadian oil and gas industry, which is heavily concentrated in Alberta, would be harshly penalized,” the report warned.

Overall the country’s economy would be fine, however. The reason for that is “government would have enormous amounts of additional revenue once carbon taxes are imposed,” the report explains, potentially allowing for a massive green build-out effort. “The surge in capital spending mitigates the impact on the economy after the year 2000,” Imperial learned.

Armed with this knowledge, Imperial then created a “well developed and broadly communicated position aimed at limiting non market-driven response steps” to climate change. That is the strategy laid out in the “proprietary” 1993 document.

Thus, at a crucial early moment when the world could have gotten the climate emergency under control, Exxon and its Canadian subsidiary chose to sabotage what they knew to be the most effective solution, McKibben argues.

“I think that’s the part that’s sometimes hard for people to understand,” he said. During the early 1990s when this research was being conducted, “we had a variety of options that were fairly modest.” But with each wasted year since then, he explains, the climate emergency, and the solutions at hand to fix it, have become more and more dire.

Editor’s note: Learn more about these issues by checking out Dembicki’s book and diving into the Imperial Oil Files.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts