Former Chesapeake Energy CEO and Founder Aubrey McClendon is back in the hydraulic fracturing (“fracking”) game in Ohio’s Utica Shale in a big way, receiving a permit to frack five wells from the Ohio Department of Natural Resources on November 26.

“The Ohio Department of Natural Resources awarded McClendon’s new company, American Energy Utica LLC, five horizontal well permits Nov. 26 that allows oil and gas exploration on the Jones property in Nottingham Township, Harrison County,” a December 6 article appearing in The Business Journal explained. “In October, American Energy Utica announced it has raised $1.7 billion in capital to secure new leases in the Utica shale play.”

McClendon is the former CEO of fracking giant Chesapeake Energy and now the owner of American Energy Partners, whose office is located less than a mile away from Chesapeake’s corporate headquarters.

The $1.7 billion McClendon has received in capital investments for the purchase of 110,000 acres worth of Utica Shale land came from the Energy & Minerals Group, First Reserve Corporation, BlackRock Inc. and Magnetar Capital.

McClendon — a central figure in Gregory Zuckerman’s recent book “The Frackers” — is currently under investigation by the U.S. Securities and Exchange Commission. He left Chesapeake in January 2013 following a shareholder revolt over his controversial business practices.

In departing, he was given a $35 million severance package, access to the company’s private jets through 2016 and a 2.5% stake in every well Chesapeake fracks through June 2014 as part of the Founder’s Well Participation Program.

Little discussed beyond the business press, McClendon has teamed up with a prominent business partner for his new start-up: former ExxonMobil CEO Lee Raymond.

Power Mapping McClendon’s New Venture

“[Lee] Raymond has emerged as a director alongside Mr. McClendon in American Energy Ohio Holdings LLC… according to [an SEC] regulatory filing,” The Wall Street Journal reported in October.

The former Exxon CEO‘s son John Raymond is the Managing Partner, Chief Financial Officer, and Chief Executive Officer of Minerals & Energy Group, currently the largest capital investor in McClendon’s start-up venture. He is also a partner McClendon’s new venture. Ryan Turner, Chesapeake’s Stock Plan Manager has also joined the team as a partner.

“Jefferies Group LLC gave financial advice to American Energy” for the deal, according to Bloomberg — and is listed as such on American Energy Ohio Holdings LLC‘s SEC Form D.

Ralph Eads III — McClendon’s fraternity brother at Duke University — serves as Global Head of Energy Investment Banking at Jefferies Group, Inc.

Photo Credit: YouTube Screenshot

“Mr. Eads…is a prince of this world,” the New York Times reported in October 2012. “His financial innovations helped feed the gas drilling boom, and he has participated in $159 billion worth of oil and gas deals since 2007.”

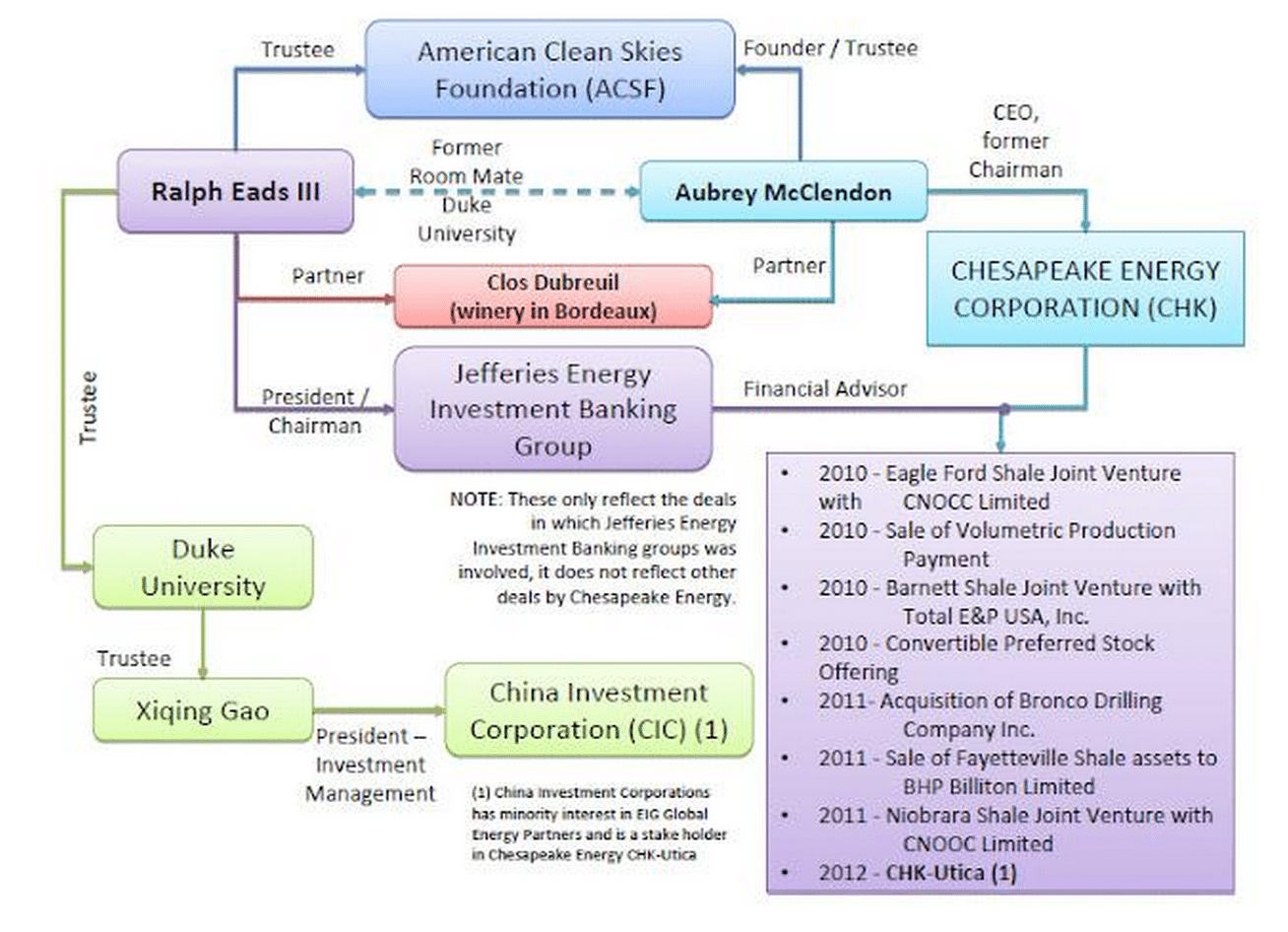

Eads maintained tight financial ties with McClendon when he was at the helm of Chesapeake Energy. The flow chart below depicts the financial and career ties binding Eads and McClendon.

Flowchart Credit: Dory Hippauf, Raging Chicken Press

High Stakes Game

In teaming up with Lee Raymond, the former CEO of ExxonMobil — notorious for its role in funding climate change denial — and his brother John, McClendon has shown he is back in Ohio ready to play ball.

But a recent Environmental Integrity Project report indicates the life-cycle climate change impacts of fracking are more severe than previously thought.

With the U.S. Navy predicting an ice-free Arctic summer by 2016 due to climate change, it’s a ball game with undeniably high stakes.

Photo Credit: Cleveland Museum of Natural History

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts