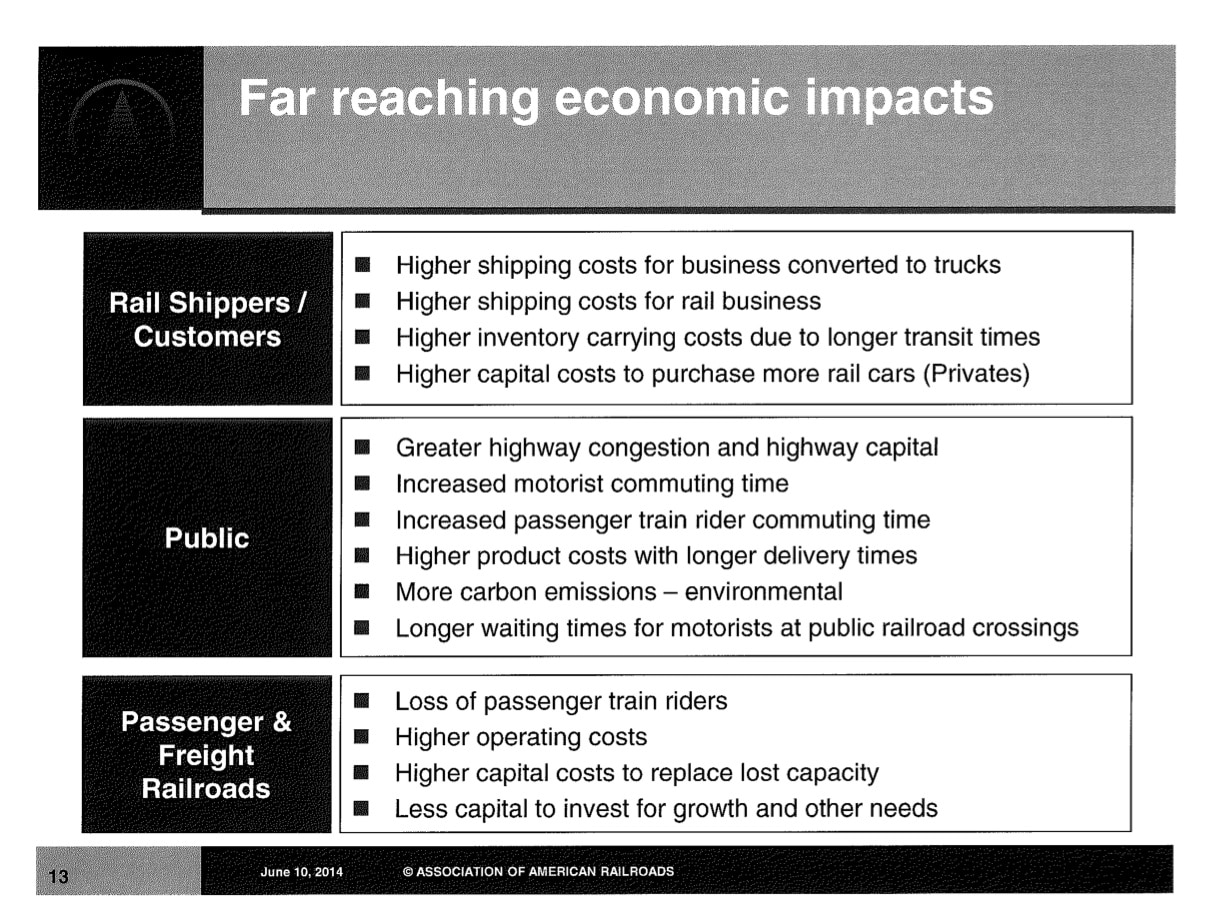

In June of 2014, a representative of oil-by-rail giant Burlington Northern Santa Fe (BNSF) attended a meeting with regulators where the American Association of Railroads (AAR) lobbied against any speed limits for oil trains. One of the slides from that presentation – titled “Far Reaching Economic Impacts” (image below) — predicted dire consequences to the American economy if speed limits were put in place.

There was no mention of the safety benefits of such a speed limit in the presentation.

And now BNSF is back at it, informing regulators that if a congressionally mandated requirement from 2008 that requires all railroads to implement positive train control (PTC) by the end of 2015 isn’t extended, they may just shut down BNSF.

No trains will run. Because BNSF apparently is so concerned about safety that the company would rather not operate if it can’t do it in the safest manner possible.

Aside from those speed limits it is against. And the modern braking systems it opposes. And its efforts to move to a single person crew for oil trains.

The rail industry is great at publicity stunts. Earlier this year, Hunter Harrison, CEO of Canadian Pacific Railway (CP) also threatened to get out of the oil-by-rail business citing safety risks to “the public.” Meanwhile, as noted on DeSmog, two days after that threat, CP’s vice president of safety was in D.C. lobbying against modern braking systems for oil trains.

And BNSF has pulled off some good public relations stunts in its efforts to shape the narrative on oil-by-rail safety. In early 2014, after a string of oil-by-rail accidents, BNSF announced that it would not wait for regulators and would be investing in 5,000 new rail tank cars that exceeded all existing safety requirements.

As documented by DeSmog, these cars never existed anywhere other than on a press release.

So what happened at BNSF? How can the leading rail company have arrived at a place where lack of planning and investment has the company facing a shutdown, as Reuters reports, based on a letter from company president Carl Ice? Were no plans in place to implement PTC? Did Carl Ice forget what he said in 2008?

“BNSF has had a plan in place for implementation of PTC over many of the routes specified in the legislation,” says Carl Ice, BNSF‘s executive vice president and chief operations officer. “We will be able to accelerate that plan to meet the statutory deadline and, if financing is available, may be able to implement PTC sooner in specific parts of our system, such as those where rail commuter service operates.”

Which Carl Ice should we believe? The one from 2008 or 2015?

Perhaps this isn’t about safety and is rather about an industry that has consistently lobbied against any safety regulations that might cut into profits. A 2012 RailwayAge article about BNSF CEO Matthew Rose notes that BNSF is investing in PTC, but that Rose “doesn’t like the mandate” requiring PTC to be implemented by 2015.

At this year’s Energy Information Administration annual conference, Matthew Rose gave a presentation about BNSF and if he thought the company was facing a potential crisis over PTC, that information certainly didn’t make it into his presentation.

It looks like Rose has found a way around the mandate — ignore it and create a perceived crisis, giving politicians cover to extend the deadline for PTC another three years, or perhaps five years.

Seeing as PTC was first recommended by the National Transportation Safety Board in 1970, any length of an extension is absurdly plausible.

Obviously BNSF has known about this mandate all along and is looking to force an extension. In March of this year, DeSmog noted that in a congressional hearing on rail safety the head of the American Association of Railroads “told Congress that PTC wouldn’t be implemented for at least another five years.”

He did not mention that this might require the railroads to shut down.

The issue of PTC has come up in multiple rail safety hearings in congress over the past two years and not once has anyone suggested any outcome other than congress extending the deadline.

However, it is hard to make it through a congressional hearing on any topic related to the oil and rail industries without some representative talking about the efficiency of free markets while decrying any sort of safety regulations. So, what do the markets think about the threat to shut down BNSF for safety reasons?

BNSF is owned by Berkshire Hathaway. Upon the publication of an article stating BNSF may choose a “service shutdown” if the requirement for PTC is still in place at the end of the year, Berkshire Hathaway’s (NYSE: BRKA.A) stock price went up.

Apparently the markets are betting that BNSF is bluffing. And since the result most likely will be delayed safety requirements resulting in higher profits, the market likes what it sees.

Blog image credit: emattil / Shutterstock.com“>emattil via Shutterstock.com

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts