A new report from Oil Change International challenges industry’s common assumption that the continued production of oilsands crude is inevitable.

The report, Lockdown: The End of Growth in the Tar Sands, argues industry projections — to expand oilsands production from a current 2.1 million barrels per day to as much as 5.8 million barrels per day by 2035 — rely on high prices, public licence and a growing pipeline infrastructure, all of which are endangered in a carbon-constrained world.

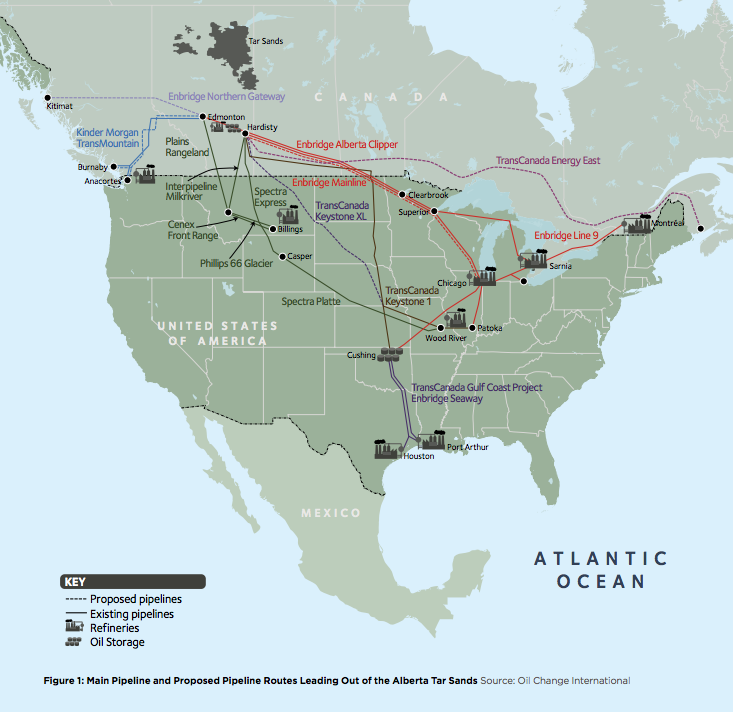

As the report’s authors find, growing opposition to oil production — especially in the oilsands, which is among the most carbon intensive oil in the world — has significantly altered public perception of pipelines, a change amplified by the cross-continental battles against the Enbridge Northern Gateway, Kinder Morgan Trans Mountain, TransCanada Energy East and TransCanada Keystone XL pipelines.

According to the report’s authors, production growth in the oilsands hinges on the construction of these contentious pipelines because the existing pipeline system is currently at 89 per cent capacity.

Oilsands Offside Canadian Values and Economic Diversity

Report author Hannah McKinnon said oilsands pipelines represent a “high risk, high carbon, high cost path” that is at odds with “diversifying the Canadian economy and building a cleaner, safer energy future.”

“Widespread public concern from citizens across the country and the continent have made it clear: we can’t afford to keep putting the transition to a clean, safe, renewable and just energy economy off,” McKinnon told DeSmog Canada.

A poll released by the Climate Action Network in April found the majority of Canadians feel addressing climate change is more important than developing the oilsands or constructing pipelines.

“And this public concern, as the report shows, has had an incredible impact in making politicians, municipalities and Canadians more generally think about the kind of future Canada wants, and as a result, pipelines and expansion are hitting legal, political and public hurdles everywhere they turn.”

McKinnon said the oil industry is making “desperate efforts” to “prove they are still in the game.”

“But, thanks in large part to inspiring people-powered movements, they are not getting away with it anymore,” she said.

“Whether it is exposing Exxon’s efforts to bury climate science for decades, calling out governments for basing energy policy on demand scenarios that take us towards five degrees or more of warming, or exposing the industry for meddling and undermining climate and clean energy policy the world over — people power is killing fossil fuel fatalism.”

Pipeline Delays Critical to Oilsands

U.S. President Barack Obama has delayed a decision on the Keystone XL pipeline, which would carry oilsands crude from Alberta to the Gulf Coast, for six years.

Canada’s newly elected Liberal government has indicated it will not support the construction of the Northern Gateway pipeline, which is currently facing 18 separate legal challenges.

The Trans Mountain pipeline also faces a legal challenge from Vancouver-area First Nations and the Energy East pipeline has generated significant opposition from Alberta to the Atlantic.

Together these four pipelines have the capacity to transport nearly three million barrels of oil per day. Pipeline uncertainty means oilsands companies do not have the security of affordable access to commercial markets. As a result, operators have backed out of oilsands projects — something that occurred well before the current oil price plunge, according to the report.

Oil Change International found that for every 1,000 barrels per day of production capacity (both under construction and approved), 500 of those barrels are trapped in delayed or suspended projects.

Oil giant Total suspended its $11-billion Joslyn North project, Statoil halted its multi-billion Corner project and Shell shelved the Pierre River project while prices were still above the $90 per barrel mark, the report notes.

“While the circumstances for rapid expansion of the tar sands have been favorable for the industry over the past two decades, there are clear signs that this perfect storm of unfettered market access, political support, growing U.S. demand and minimal regulatory constraints is shifting,” the report states.

“The groundswell of local, national and international opposition to the tar sands industry, which has become a poster child of a high-carbon future incompatible with a safe global climate, was not predicted by industry.”

Oilsands Boom Becomes Bust

The recent drop in oil prices has furthered the troubles of oilsands producers who, during the last 15 years, have dumped an estimated $200 billion into the resource.

In recent months roughly 35,000 energy industry jobs have been lost in Alberta. Pipeline builder TransCanada, oil companies Penn West, PHX Energy Services, ConocoPhillips, Nexen and Talisman Energy have all reduced their employment numbers as did waste management company Tervita.

Teck Resources, Cenovus Energy and Nexen have all delayed the start of new projects or pared down investment in the region amid the price slump.

Canadian Natural Resources, one of Canada’s largest oilsands producers, recent reported a $405-million net loss in the second quarter of 2015. The company blamed the loss on the province’s NDP provincial government, which recently raised corporate taxes by two per cent.

One unnamed oil executive and investor told the New York Times growing public sentiment that the industry doesn’t pay enough in taxes and concern around environmental protections is stifling new investment in the oilsands.

“There’s never been a time when I’ve been less optimistic,” he said.

The End of Oilsands and the Fossil Fuel Era

The oil industry’s tight profit margins, eroding public licence and access problems are in stark contrast to a flourishing low-carbon and renewable energy market.

Clean Energy Canada recently release a report that found the value of clean energy projects in Canada reached $10.9 billion in 2014, up 88 per cent from 2013.

The report also found the rate of increase for clean energy jobs outpaced every other sector. In 2013, the most recent year for which data exists, Canada’s clean energy sector provided 26,900 direct jobs.

Global investment in clean energy skyrocketed to $310 billion in 2014.

A September report from Arabella Advisors found the combined assets of those divesting from fossil fuels reached an unexpected $2.6 trillion in 2015. An estimated $784 billion of those divested funds are pledged to finding climate solutions.

The investment analysis group found uncertainty around stranded assets and unburnable carbon has significantly affected investment in the oil and gas sector. In addition, investors are noting the financial success of divested portfolios.

The Oil Change International report found that “public concern and efforts to slow and stop tar sands expansion by challenging expansion of the North American tar sands pipeline system are poised to have a meaningful impact on keeping carbon in the ground — close to 34.5 billion tonnes of CO2 — if existing hurdles to pipeline expansion are maintained.”

“This is equivalent to the emissions of 227 coal plants over 40 years,” the report states.

“No matter how you look at it, the end of the tar sands is inevitable,” McKinnon said.

“[Canada has] federal (as part of the G7 commitment) and provincial promises to decarbonize within the century,” she added.

“But how hard we make the transition on ourselves and how much climate damage we do in the meantime is still front and centre.”

Image: Julia Crawford and Jane Kleeb at the People’s Climate March. Photo by Zack Embree.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts