This is a guest post by Ross Macfarlane, recently Senior Advisor with Climate Solutions

Recently unsealed court documents reveal the money-making secret at the heart of Trump University. The managers even had an acronym for it: OPM, standing for “Other People’s Money.” As reported in People Magazine:

Playbooks used to market Donald Trump’s now-defunct Trump University were unsealed by court order on Tuesday, showing that the training program’s aggressive sales force promised would-be students they would learn “the technique of using OPM … other people’s money.”

While the instructors claimed to be teaching people how to leverage banks to make fortunes in real estate, former Trump University executives now disclose that the OPM they were really targeting was in their students’ pockets. According to these managers, their business plan focused on mining the credit card balances and savings accounts of gullible and desperate clients, often elderly and poor, who fell for the slick sales pitch and the promise of a quick solution for their financial challenges.

So what does Trump University have to do with coal exports?

Even a casual glance at the financial press shows that Wall Street and private investors have abandoned the coal sector.

The four largest US coal companies, worth a combined $34 billion in 2011, now have a combined market capitalization of less than $150 million and three, Peabody Energy, Arch Coal, and Alpha Natural Resources, are struggling to emerge from Chapter 11.

Bankers have largely stopped financing coal projects for the simple reason that lending to the coal companies is too risky. And private investors do not see any reason to continue putting money in a dying industry.

Need more proof? Take bankrupt coal giant Arch Coal, which recently walked away from its 38% ownership share of the proposed Millennium Bulk coal export terminal in Longview, Washington. Millennium’s sole remaining owner, Lighthouse Resources, is in turned owned by a shadowy hedge fund, registered in the Cayman Islands, that has a track record of flipping risky projects.

Lighthouse has neither the resources nor the experience to finance a massive infrastructure project. Although Arch and Millennium tried to spin this as a “sale,” bankruptcy filings make it clear that Arch received nothing of value other than the right to walk away from a $60 million investment and stop throwing good money after bad. Arch is hemorrhaging cash, and its creditors were watching every penny in the bankruptcy proceeding.

Or take Wood MacKenzie, long the coal industry’s favorite consultant, whose rosy forecasts of soaring Asian demands and rising prices were used to justify export plans and massive amounts of debt. Wood MacKenzie recently concluded that “[b]uilding new Pacific Northwest coal ports, once seen as essential, is now viewed as nothing more than a risky long term bet.”

All this begs the questions: if private markets have turned their back on coal mining and export infrastructure investments, why are several zombie projects still staggering on? And if these projects are a “risky long term bet,” whose money do they hope to put on the table?

Answer: Other People’s Money. Specifically, Millennium and other coal export backers hope to make this risky bet using taxpayer money. They are seeking funds from coal dependent states who see coal exports to Asia as a “Hail Mary” pass that might slow or reverse the industry’s precipitous decline. And they have reason for this hope.

Wyoming has placed the biggest potential pile of chips on the table. Its legislature authorized up to $1 billion in publicly backed bonds that can be issued to support development of coal export infrastructure in Washington State. In case you think this is a drop in the bucket, Wyoming recently passed a $3 billion, two year budget, with huge cuts to basic state services. The $1 billion authorized in bond funding to build a coal port in another state would amount to approximately 2/3 of Wyoming’s total annual budget. Given the state’s reputation as one of the most conservative in the nation, it might be surprising to see its legislature embracing “socialism for coal.” Other People’s Money.

Similarly, Utah’s legislature approved a bill this March that authorized spending up to $53 million in taxpayer money to build a coal export terminal in Oakland, California. Researchers found that the proponents of this bill received significant campaign contributions from the coal industry. Or take Montana, where Millennium’s former owner sought a $10 million loan from the state’s economic development trust. Other People’s Money.

Trump University managers have revealed that they sold elderly and poor clients expensive classes by “giving [them] hope again.” With coal production down more than 40% across the United States since 2011, it is easy to see why states dependent on the industry can fall for this kind of hustle. But it’s past time to demand that Millennium and other coal export proponents “show us the money” backing their schemes. And it had better be real investments from private investors, not taxpayer money.

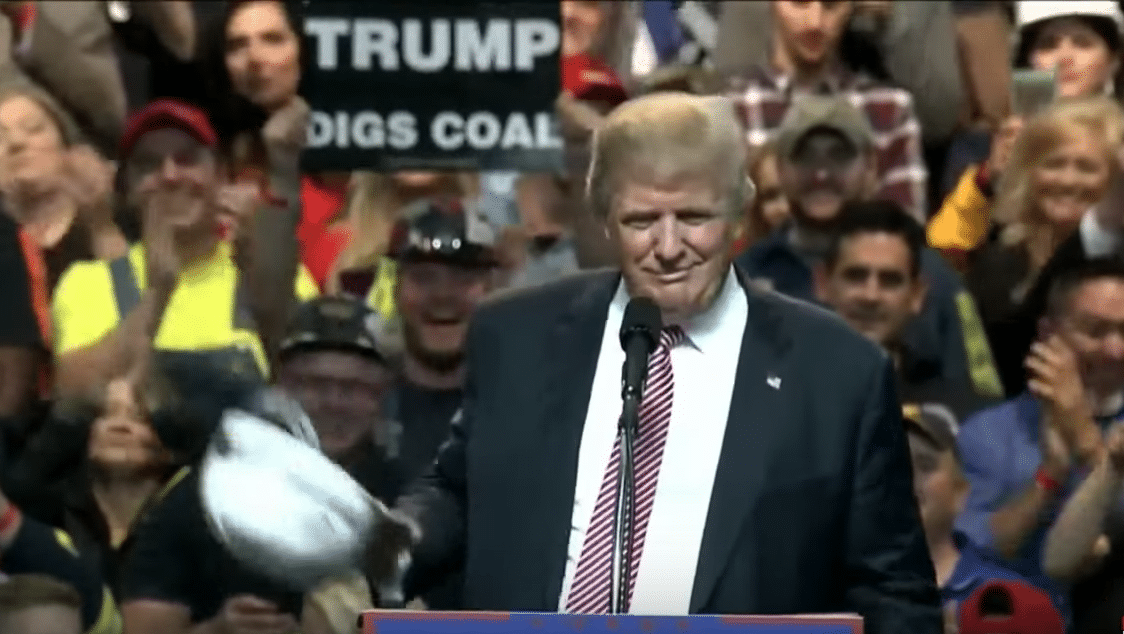

Image: Screenshot of Trump receiving endoresment from West Virginia Coal Association.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts