Though President Barack Obama and his State Department nixed the northern leg of TransCanada’s Keystone XL tar sands pipeline in November, the Canadian pipeline company giant has continued the fight in a federal lawsuit in Houston, claiming the Obama Administration does not have the authority to deny a presidential pipeline permit on the basis claimed that he did.

As the lawsuit and a related North American Free Trade Agreement (NAFTA) challenge proceed — and as Keystone XL has become a campaign talking point for Republican Party presidential candidate Donald Trump — TransCanada has quietly consolidated an ambitious North America-wide fracked gas-carrying pipeline network over the past half year.

Since Keystone XL North got the boot, TransCanada has either won permits or announced business moves in Canada, the United States and Mexico which will vastly expand its pipeline footprint and ability to move gas obtained via hydraulic fracturing (“fracking”) to market.

Oh Canada

North of the U.S. border, TransCanada landed the last permits it needed from the British Columbia Oil and Gas Commission on May 5 to build its proposed Coastal GasLink pipeline project. Coastal GasLink aims to carry gas obtained via fracking from the Montney Shale westward to LNG Canada’s proposed liquefied natural gas (LNG) export facility in Kitimat, B.C.

“This is a significant regulatory milestone for our project, which is a key component of TransCanada’s growth plan that includes more than $13 billion in proposed natural gas pipeline projects which support the emerging liquefied natural gas industry on the British Columbia Coast,” Russ Girling, TransCanada’s CEO said in a press release.

Coastal GasLink awaits a final investment decision from LNG Canada by the end of the year. If it gets the green light, pipeline construction of the 416-mile line will begin in early 2017.

Build Them or Buy Them?

In the U.S., while TransCanada’s NAFTA lawsuit drags on, the corporation also announced a major $13 billion buy-out acquisition of pipeline behemoth Columbia Pipeline Group on March 17.

Columbia maintains a gargantuan 15,000-mile network of gas pipelines running across the U.S., with a crucial hub of crisscrossing pipelines based in the prolific Marcellus Shale basin, an epicenter for fracking in the northeast, particularly Pennsylvania. In a press statement announcing the deal, Girling pointed out just how big his company’s gas-carrying pipeline capacity has become in the U.S. and its nascent potential ability to carry that gas to U.S.-based LNG export terminals.

“The acquisition represents a rare opportunity to invest in an extensive, competitively-positioned, growing network of regulated natural gas pipeline and storage assets in the Marcellus and Utica shale gas regions,” Girling said in the company’s press release announcing the Columbia deal. “The assets complement our existing North American footprint which together will create a 91,000-kilometre (57,000-mile) natural gas pipeline system connecting the most prolific supply basins to premium markets across the continent. At the same time, we will be well positioned to transport North America’s abundant natural gas supply to liquefied natural gas terminals for export to international markets.”

The deal has yet to be sealed, however, awaiting both a final shareholder vote on June 22 and antitrust approval by the U.S. Federal Trade Commission. Wall Street giant Goldman Sachs acted as the financial adviser for the sale.

Kevin Allison, global resources columnist at Reuters Breakingviews, pointed to the acquisition of Columbia by TransCanada as an example of its shifting business strategy post-Keystone XL (even though the lawsuit, most certainly, is also part of the company’s business strategy). Rather than focusing on building new lines, he says TransCanada increasingly sees profit margin opportunities in buying ones already permitted and pumping oil and gas, like those owned by Columbia.

TransMexico

As a general rule, oil and gas related developments in Mexico — helped along by the privatization of the country’s energy and electricity sectors, itself spearheaded by the U.S. Department of State under Hillary Clinton — have flown under the radar as compared to its neighbors to the north in North America. TransCanada’s pipeline moves south of the U.S. border, documented here on DeSmog days after Obama’s November Keystone XL announcement, also have garnered far less attention than Keystone XL.

Canadian Broadcasting Corporation took note of these dynamics in a recent article.

“The regulatory oversight and environmental opposition is a fraction of what it is in Canada and the United States for a company looking to construct new pipelines,” wrote the CBC. “Mexico is proving to be a low-risk, high-reward business venture at a time when the pipeline company is struggling to construct new projects elsewhere in North America.”

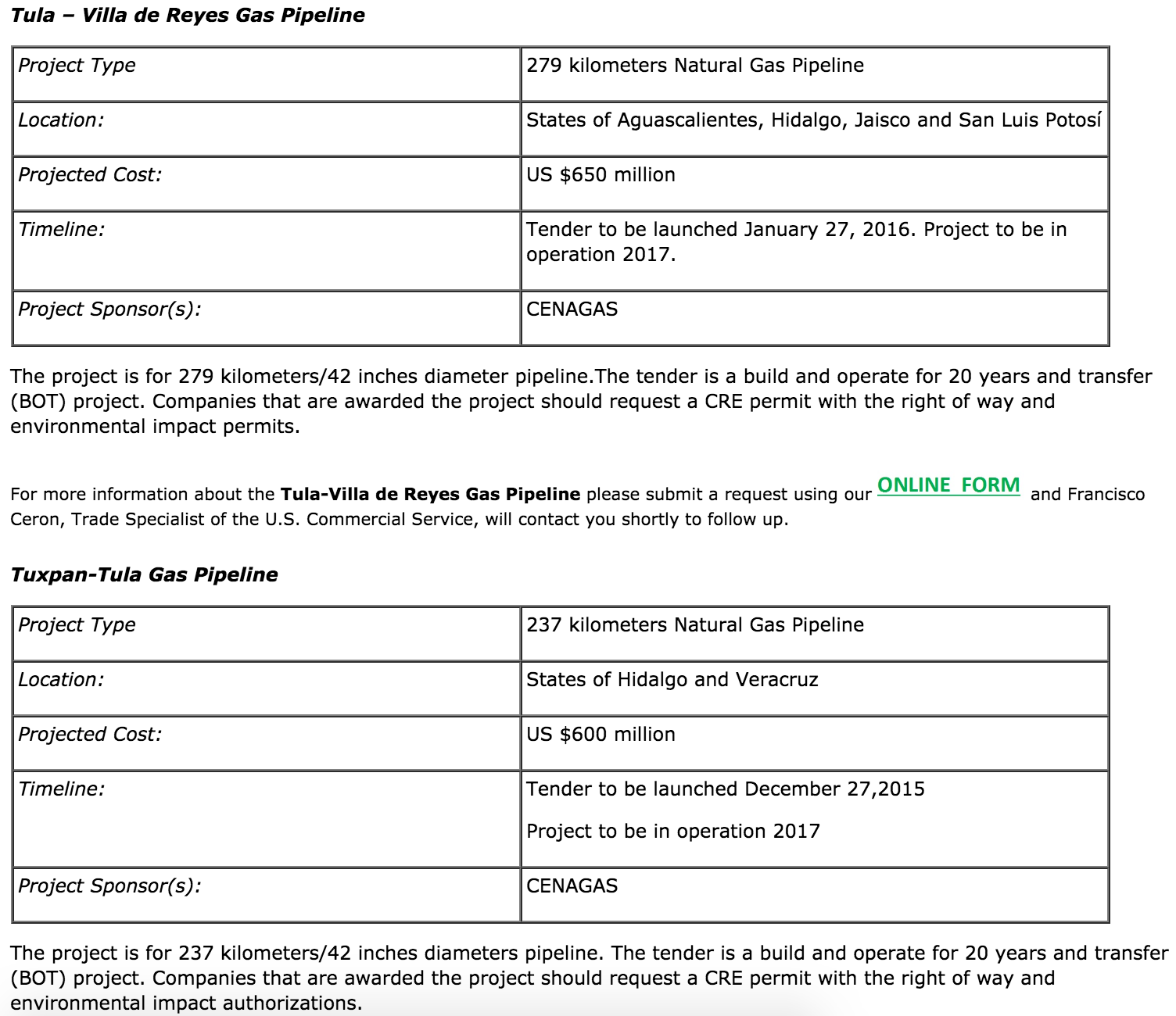

Since November, when the company announced its victory in a bid from Mexico’s government to build the 155-mile Tuxpan-Tula pipeline set to carry fracked gas from the U.S. to supply Mexico’s electricity grid, TransCanada has announced other key maneuvers in Mexico. All of them, it turns out, connect to Tuxpan-Tula.

For example, on April 11, the Mexican government chose TransCanada to build, own and operate the 261-mile long Tula-Villa de Reyes pipeline in Mexico. Tula-Villa is slated to connect to the existing 81-mile long Tamazunchale Pipeline.

Further, on May 20, Infraestructura Marina del Golfo (IMG) — a joint venture between the Sempra Energy subsidiary company IEnova and TransCanada — submitted a bid to operate the Sur de Texas-Tuxpan gas pipeline, which would connect to the Tuxpan-Tula pipeline (and to which the Tula-Villa de Reyes pipeline would connect). The 500-mile Sur de Texas-Tuxpan would carry gas initially obtained via fracking from Texas’ Eagle Ford Shale basin underwater through the Gulf of Mexico, into the other Mexico-based TransCanada pipelines and then flood Mexico’s energy grid with fracked gas.

BNAmericas has reported that the Mexican government will announce the winner of that bid later this month.

The U.S. Commercial Service, an arm housed within the U.S. Department of Commerce’s International Trade Administration, promoted both Tuxpan-Tula and Tula-Villa de Reyes as potential business opportunities for U.S. corporations on its website.

Image Credit: U.S. Commercial Service

Girling, TransCanada’s CEO, sees Mexico as the land of business opportunity for his company moving forward. And understandably so, given all of the company’s recent gas pipeline bid victories there, totaling 916 miles in length.

“Mexico has been a very good place for us to do business,” he told CBC. “I have a very positive long-term view of the growth of Mexico and its position in North America. We foresee there will be more opportunities on the horizon in Mexico.”

The 916 miles of fracked gas pipeline TransCanada has carved out for itself in Canada amounts to just 250 miles shy of the length of the originally slated Keystone XL pipeline and longer by nearly an order of two than the 485-mile operational southern leg of Keystone XL (now called the Gulf Coast Pipeline).

And that’s not even counting the mileage obtained from the Columbia purchase or British Columbia’s Coastal GasLink pipeline. That aside, it’s safe to say that TransCanada is quickly morphing into “TransMexico” and more broadly into a North American fracked gas pipeline empire.

Photo Credit: National Nurses United | Flickr

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts