EOG Resources is one of the top companies in the fracking industry, and thanks to the new tax bill passed by Republicans and President Donald Trump at the end of last year, EOG had an exceptionally strong year compared to 2016.

In 2017, the company reported a net income of $2.6 billion. The previous year? A loss of $1.1 billion. That financial turnaround seems very impressive until you realize that $2.2 billion, or about 85 percent, of its 2017 income was the result of the new tax law. Without that gift from the GOP and Trump, EOG would have lost approximately $700 million between those two years. Instead they are $1.5 billion ahead of the game.

With numbers like these, it is easy to see how the Tax Cuts and Jobs Act of 2017 was a much-needed lifeline for the money-losing fracking industry. EOG is routinely touted as one of the best shale oil and gas companies. Yet the company still lost $700 million in the past two years. Or at least it would have if not for the tax bill.

This is the same company that an analyst at the investment advice website Seeking Alpha says is “generally considered one of the best unconventional upstream oil and gas players in the business, and its financials back it up.” If those are the best financials in your industry, your industry has a big problem.

An interesting side note is that EOG stands for Enron Oil and Gas, which was spun off as its own company from Enron — the company notorious for one of the great energy Ponzi schemes of the 20th century. Today, an Enron spinoff company is being held up as the most fiscally sound in the shale oil industry.

And Seeking Alpha is now pushing EOG as a good investment and wondering when “the equities market will wake up and smell this opportunity” despite EOG still being over $6 billion in debt. Without the tax overhaul it would be much harder to make this argument.

There is one prominent person in the shale industry warning against rosy forecasts for shale oil, and that is Mark Papa, head of independent oil company Centennial Resource Development. Papa’s last job? CEO of EOG Resources.

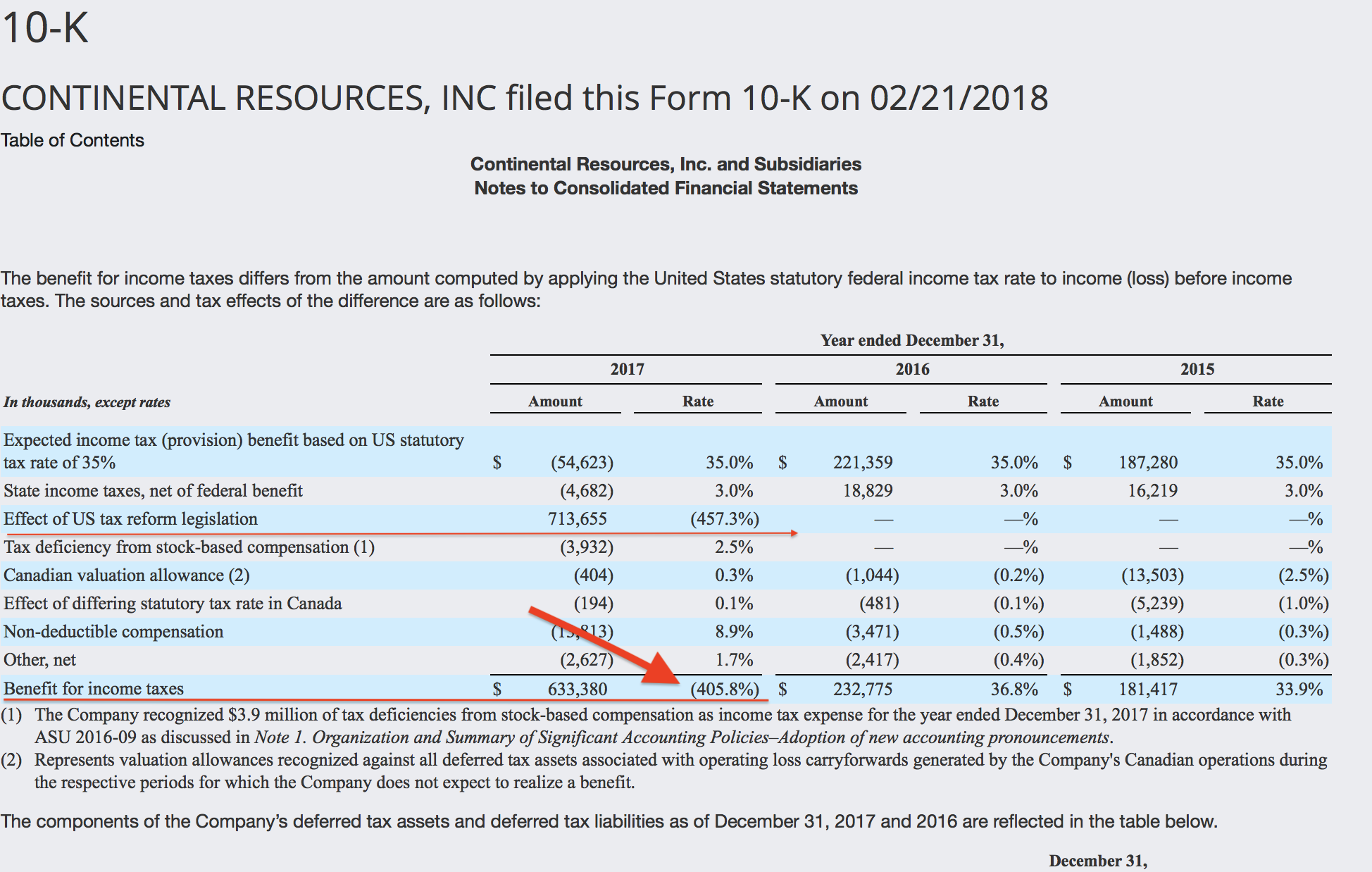

Continental Resources is another of the shale companies being heralded as a good investment in 2018. Continental is run by Harold Hamm who was an advisor to the Trump campaign and has taken the title of “Shale King” that once belonged to Aubrey McClendon. Hamm’s net worth is estimated at over $13 billion.

Thanks to the new tax law, Continental took home an extra $700 million because its effective tax rate for 2017 was negative 406 percent.

Continental Resources 2017 Annual 10-K Filing

And Continental needed that money (although Hamm certainly doesn’t). In 2007 Continental had $165 million in debt and paid $13 million a year in interest on that debt. In 2016 its debt had ballooned to $6.5 billion and the annual interest payments rose to $321 million. The GOP tax law essentially pays off two years of Continental’s interest payments, allowing this failing business model to continue because Continental has not been generating enough income to pay even the annual interest on its debt.

While the company he leads is drowning in $6.5 billion of debt, Harold Hamm is personally worth twice that amount. He’ll be fine. He was easily able to afford one of the most expensive divorce settlements ever.

These are just two examples of shale companies receiving an immediate financial lifeline from the GOP tax bill. These companies also will benefit from lowered tax rates in future years. However, this one-time handout simply masks the reality that the shale revolution looks a lot like a Ponzi scheme enriching CEOs and Wall Street financiers by producing oil and gas with borrowed money that is unlikely to be paid back in the future.

And Hamm and the Wall Street financiers have no incentive to do anything differently. Sure bankrupt energy companies destroy worker pensions, wipe out investors equity, layoff thousands of workers — but if we use the coal industry as an example — CEOs will still get bonuses after driving their companies into bankruptcy.

Tax Bill Especially Beneficial to Oil Companies

The benefits of the new tax bill are certainly not unique to oil and gas companies. Utility companies did even better and the big Wall Street banks who are financing the cash-burning shale industry also are awash in new profits thanks to the GOP tax overhaul.

However, due to the nature of how oil and gas companies book profits and losses — and the epic money-losing streak the shale industry created over the past few years — these companies benefited more than most.

To be clear — this bill which was signed at the end of 2017 was applied to the deferred tax liabilities that were already on the books — thus erasing a large chunk of the liabilities for these companies that had built up while the industry kept borrowing to drill more and ultimately lose more money. Simply a bailout of reckless financial behavior by any other name.

And it wasn’t just the companies primarily working in shale that benefited. ExxonMobil raked in a $6 billion benefit from the new tax law, which even CNN Money referred to as a “gift.”

Industry Will Use Bailout to Borrow and Drill More

In discussing the trade deficit President Trump recently tweeted the following:

When you’re already $500 Billion DOWN, you can’t lose!

— Donald J. Trump (@realDonaldTrump) April 4, 2018

Coming from a man whose career includes multiple bankruptcies, this shouldn’t be surprising. The shale oil industry definitely has a kindred spirit in the White House.

What happens when you give free money to gamblers on an epic losing streak? In the shale industry, they double down.

ExxonMobil has promised to use the billions it gained from the tax bill to … drill and frack more shale oil. Which is likely to result in further discounts of Permian Shale oil, which will lower the price of oil and put more pressure on the heavily leveraged shale companies.

While the mainstream media is pushing the industry message that shale companies now are focused on profits instead of just production volume, record U.S. oil production and predictions for even greater increases would appear to reveal the lie in that promise. Just as most sharks must swim to stay alive, shale companies must drill to preserve CEO bonuses, which are often tied to oil production, not profits. So, they drill. Even when that means losing money on nearly every barrel of oil they pump.

A graphic from the Wall Street Journal reveals just how much money the shale industry has been losing compared to traditional oil — all while CEOs such as Harold Hamm were amassing billions in personal wealth. The shale oil industry generated free cash flow pumping oil for one brief period in the last seven years. Hamm has done a bit better personally during that time frame.

Shortly after President Trump signed the new tax bill, he took another vacation to Mar-a-Lago where he reportedly told those in attendance: “You all just got a lot richer.”

A rare moment of honesty from the President. And while he wasn’t speaking specifically to shale oil CEOs — it’s safe to say they got the message loud and clear.

Follow the DeSmog investigative series: Finances of Fracking: Shale Industry Drills More Debt Than Profit

Main image: “Creative Commons Natural Gas Fracking in Louisiana” by Daniel Foster used under CC BY–NC–SA 2.0 combined with original photo by Justin Mikulka

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts