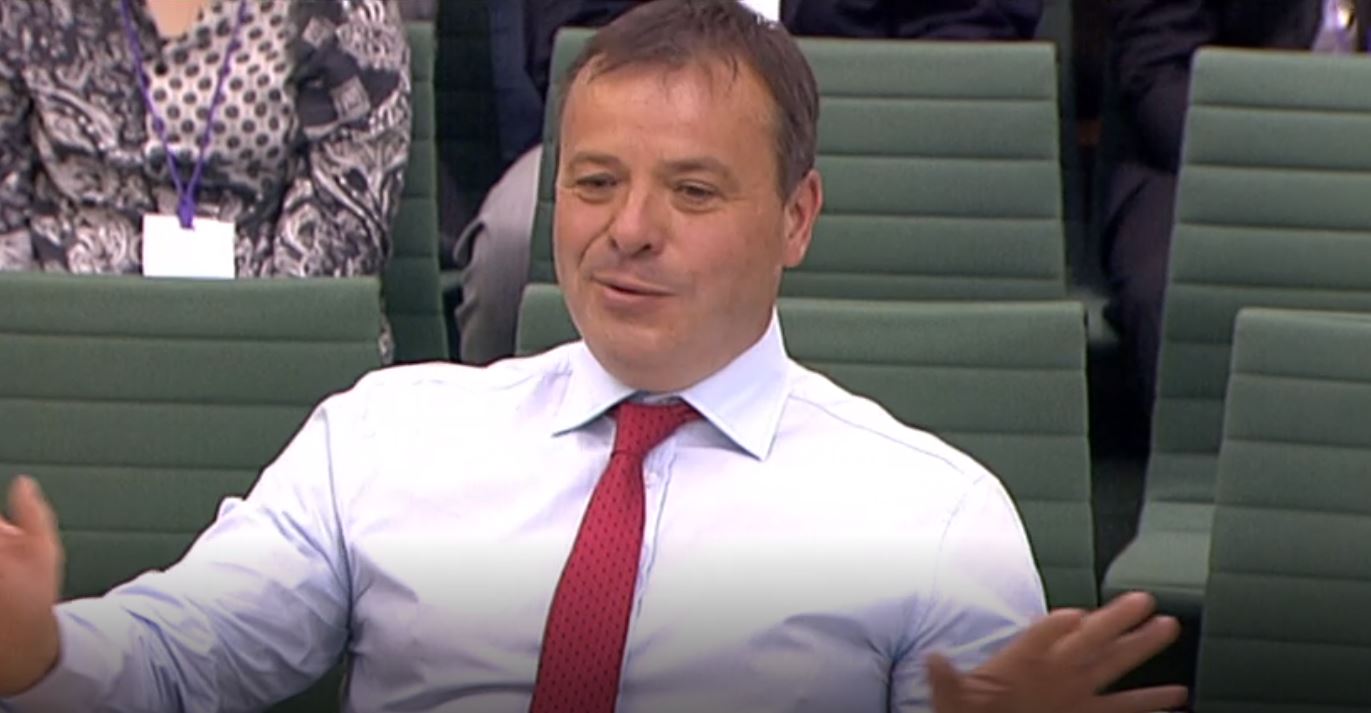

Millionaire businessman Arron Banks, a major donor of the Leave.EU Brexit campaign, has come under the spotlight again. This time, Russian gold is also involved.

Banks’ involvement in the Leave campaign has come under close scrutiny from MPs after leaked emails showed he held multiple meetings with Russian officials in the run-up to the EU referendum, including three with the Russian ambassador Alexander Yakovenko.

The documents, obtained by the Sunday Times, also showed Banks flew to Moscow in February 2016 which Banks admitted was to discuss a business deal concerning “six Russian gold mines in Siberia” owned by Russian magnate Siman Povarenkin.

Gold mining businessman Peter Hambro and former army chief Field Marshal Lord Guthrie are also reported to have been involved in the deal.

Eastern Russia and Siberia holds some of the country’s largest gold reserves and the area is increasingly attracting Russia’s largest gold producers.

Banks told the Sunday Times the deal never went ahead but questions are being asked over whether Banks benefited from the prospective deal in any other way.

Responding to questioning from the select committee investigating fake news, Banks insisted the deal was “a proposal” and that “doesn’t mean there’s any wrongdoing”.

But less than a week before the EU referendum, Banks tweeted: “I’m buying gold at the moment and big mining stocks…”

He and his colleague Andy Wigmore also admitted to MPs having lied to journalists during the referendum campaign to gain publicity for their cause — a revelation which may not have helped Banks defence.

DeSmog UK takes a closer look at the key players reportedly involved in the Siberian mining deal proposition.

‘Goldfinger’: Eton mining boy Peter Hambro

Peter Hambro, an Eton educated British citizen also known as “Goldfinger”, co-founded gold mining company Peter Hambro Mining in 1994 later renamed Petropavlovsk Plc.

Petropavlovsk is a London-based company with some of the biggest mining operations in the far east of Russia. The company is also listed on the London Stock Exchange.

Hambro served as the company’s chairman until June 2017 when he was ousted from the company’s board by a rebellion of shareholders led by Russian investment Group Renova, which eventually sold all of its own shares in the company last December.

At the time, Hambro said he could not hide his disappointment about the vote and added he will “enjoy his new role as an ordinary shareholder”.

Meanwhile, the battle over who should lead Hambro’s company is rife.

Shareholders CABS Platform and Slevin, which together hold 9.11 percent of the company’s shares, have been calling for the return of former directors to the company’s boards — a move strongly opposed by the company’s largest shareholder Sothic Capital Management which cited concerns over “good corporate governance”.

Petropavlovsk’s board of directors criticised some of its major shareholders for hiding their true beneficiaries through secret accounts and investment vehicles registered in Cyprus and the British Virgin Islands.

This comes after CABS Platform told the company that its legal registered shareholder was Cyprus-registered holding company Patia Trading Ltd which was holding shares for five “ultimate unrelated trust beneficiaries”.

But in a public statement to its shareholders, Petropavlovsk responded saying its board of directors “did not believe these individuals are the ultimate owners behind CABS” denouncing “another veil of secrecy” with “further layers to be peeled back before the true identity of the controlling persons is revealed”.

In a previous investigation Empire Oil, DeSmog UK showed why the use of secret offshore accounts to hide the identity of shareholders’ true owners is problematic and has been used by the world’s elite and wealthy to launder money, finance dirty ventures and carry out frauds.

Lord Guthrie

Former head of the British armed forces, Field Marshal Lord Guthrie, is also reported to have been involved in the deal over Siberian goldmines.

Initially a Remainer during the referendum campaign, Guthrie switched sides to join the Leave campaign less than a week before the vote saying he was worried about the prospect of a “European Army” and than leaving the EU would be “better for defence”.

Guthrie is also a member of the advisory board of the pro-Brexit group Veterans for Britain.

Following his career in the army, Guthrie joined the private sector and served as director of Petropavlovsk between 2008 and 2015 — a job for which he was paid more than £800,000 according to the company’s annual reports over that period.

Guthrie also served on the boards of a range of companies including as non-executive director of Gulf Keystone Petroleum, an oil and gas exploration company operating in the Kurdistan region of Iraq, from 2012 to 2015.

Russian mining magnate: Siman Povarenkin

Banks was introduced to Povarenkin, a member of the Business Council of the Russian Ambassador to the UK, by the Russian ambassador.

The council aims to strengthen bilateral economic and investment cooperation between the two countries and includes oil and gas companies Gazprom, Lukoil and SoyuzNefteGaz.

Povarenkin’s family is reported to live in London while he operates his business interests from Russia.

According to the Sunday Times, his wife bought a multimillion-pound flat in Belgravia in 2012.

Povarenkin is the founder, chairman and a major shareholder of the privately-owned gold and copper mining firm GeoProMining (GPM), which operates in Armenia and Siberia.

GeoProMining is registered in the town of Limassol in Cyprus, a long-standing “offshore gateway” for the Russian wealthy elite.

According to the Armenian investigative platform Hetq, the company’s ownership is hidden behind a series of shell vehicles and investment companies registered in Cyprus and the British Virgin Islands.

Under existing rules, companies registered offshore are not obliged to reveal who their beneficial owners are — making these companies much more difficult to trace.

Russian state-owned bank Sberbank, which is listed on the London Stock Exchange and has offices in the city, also owns 31 percent of GeoProMining’s shares.

Recalling his business meeting in Moscow, Banks said he was told by gold mining businessman Hambro that Sberbank was “the Russia bank onside”.

Banks added: “And he said the goldmines are all owned by Sberbank, and if the Russians want to do it, they will do it. And I asked him, ‘What do you think?’ And he said, ‘It’s problematic and it’s difficult’, and at that point it dropped away and nothing happened.”

Sberbank is Russia’s biggest bank and has deep ties with the gold business.

Last July, the bank began trading physical gold on the Shanghai gold exchange and is looking to finance direct imports of Russian gold into India while strengthening the two countries’ business relations.

A report by Bank Track dated 2012 found that coal mining in Russia was dominated by small companies but that Russian oligarchs “also have a considerable role” in the gold mining sector – owning close to an aggregated 40 percent of the shares in Russia’s largest gold mining companies.

The report adds: “These Russian businessmen are almost all billionaires.”

The London-Russia mining network

Russian mining interests are no strangers in the UK and particularly in London.

London is the leading financial capital for the global mining industry because of the strength of the London Stock Exchange’s main market and the concentration of financial services experts in the City. Some of the world’s biggest mining companies such as Rio Tinto, Anglo American and Vedanta Resources have set-up their headquarters there.

Russian mining companies and UK companies operating in Russia are part of this City hub. Here are a few other examples:

Russia’s largest gold producer is Moscow-headquartered Polyus Gold, a company registered in Jersey and which is listed on the London Stock Exchange.

Despite ongoing tensions between the UK and Russia following the Skripal scandal, Polyus is hoping to gain the trust of UK investors to expand its mining operations in the far east of Russia.

Another mining giant, Nordgold which has assets in Russia, Burkina Faso, Kazakhstan and French Guiana is also headquartered in London. It delisted from the London Stock Exchange in 2007 saying its shares were being undervalued.

Russian mining companies are also taking advantage of the lax regulation environment of London’s junior exchange, the Alternative Investment Market (AIM).

Jersey-registered Highland Gold Mining, which also operates in the far-east of Russia, is listed on AIM.

Newly-founded Siberian Goldfields Limited is headquartered in London but operates through subsidiaries registered in Cyprus and Russia. It was established by the privately-owned UK mining finance group Dragon Group and is seeking an AIM listing.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts