A London-based mining company accused of extensive human rights abuse and environmental damage in India has delisted from the London Stock Exchange amidst concerns it is seeking to escape public scrutiny.

Vedanta Resources Plc delisted from the London market on Monday amidst strong accusations by protesters that the company was “fleeing” the stock exchange without being held accountable by the regulatory authorities for “corporate massacres” .

Vedanta made headlines earlier this year after 13 protesters demanding the shutdown of India’s second largest copper plant in the southern state of Tamil Nadu were shot dead by police and dozens were injured.

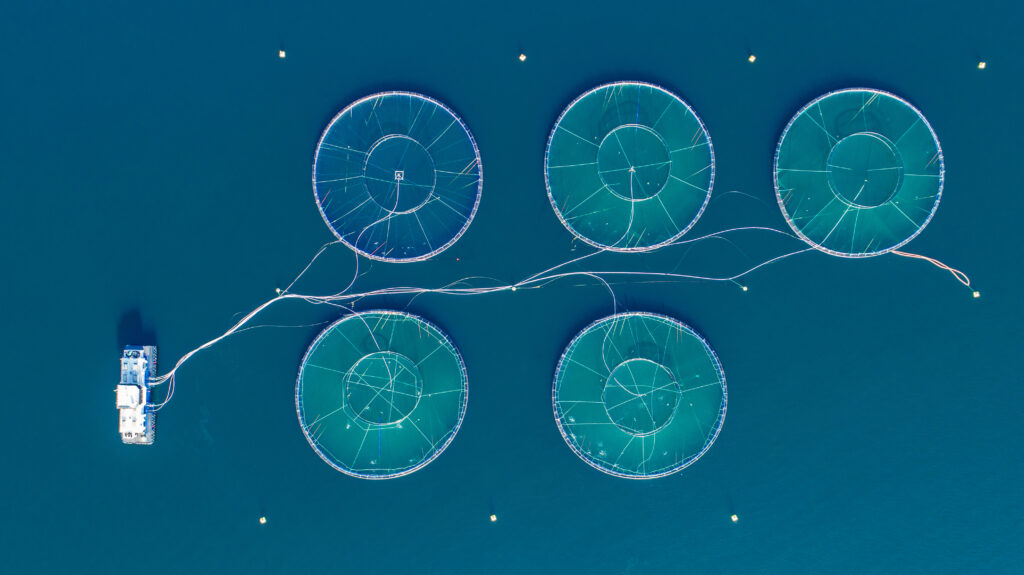

Police opened fire on the crowd of unarmed protesters who demanded the closure of the plant citing environmental concerns including pollution of groundwater and the threat to the local fisheries.

At the time, Vedanta’s chairman and main shareholder, controversial billionaire Anil Agarwal, made a personal address to the people of Tamil Nadu in which he said being “very sad” to hear about the deadly incident, which he called “unfortunate”.

State officials subsequently announced the permanent closure of the plant.

Following the incident, campaigners called on the UK regulatory authorities to investigate allegations Vedanta was complicit in the police opening fire and demanded it be delisted from the London Stock Exchange (LSE).

India’s state-funded National Human Rights Commission said it was carrying out its own probe into the events. The state government of Tamil Nadu also appointed judge Aruna Jagadeesan as a one-person commission to investigate the killings. Jagadeesan is reported by the Indian press as a judge known for her controversial judgements.

Just over a month after the deadly protests, Vedanta announced its possible delisting from the LSE following a cash offer by Volcan Investments, a holding company registered in the Bahamas and controlled by Agarwal.

In a statement published this week, Vedanta confirmed its delisting following a successful buyout of the company’s shares by Volcan Investments.

Miriam Rose, from the UK-based campaign group Foil Vedanta, told DeSmog, that while protesters were celebrating the delisting of Vedanta because it “curtailed its corporate ambition”, she suggested the company was leaving the LSE to avoid further scrutiny.

“They are jumping before they are being pushed,” she said. “Vedanta should not be allowed to simply escape London without being investigated as a London-based company. Instead, they are being allowed to delist and start again with a clean slate.”

Repeated calls for investigation

Campaigners protested outside the Financial Conduct Authority (FCA) and Vedanta’s annual general meeting (AGM) in London on Monday demanding the company be investigated over the deadly protests in Tamil Nadu.

Fatima Babu, from the Anti Sterlite People’s Movement, one of the campaign groups attending the company’s AGM protest, said: “The people of Thoothukudi in Tamil Nadu are still reeling from the massacre of innocent women, men and children in May, which was carried out in the name of protecting Vedanta’s industry from the people whom it has polluted for so many years.

“The Tamil Nadu, Indian and British government’s must all take responsibility for the lawlessness and disproportionate power wielded by Vedanta, which led to this tragic event.”

Samarendra Das, from Foil Vedanta, who wrote a report delivered to the FCA which accused Vedanta of “corporate massacre”, accused Agarwal of “being so desperate to avoid public” that he failed to attend Vedanta’s AGM.

“We cannot let him and his board escape accountability and justice in the UK, under whose jurisdiction they have committed widespread financial, human rights and environmental crimes,” she said, urging the FCA and the City of London to initiate proceedings against the company or risked being “complicit in enabling and mitigating these abuses”.

Neither the FCA nor Vedanta responded to DeSmog UK’s requests for comment. But Vedanta Resources’ chairman Agarwal has previously denied any links between the company’s delisting and the backlash against the deadly mass protests which took place in Tamil Nadu in May.

Agarwal previously told India Today that delisting Vedanta from the LSE would help simplify the Vedanta Group’s corporate structure and that the “maturity of the Indian capital markets” makes a seperate London listing “no longer necessary to achieve the group’s strategic objectives”.

Lack of corporate regulation

But Foil Vedanta’s Rose said the case reflected a systematic failure of the City of London’s regulatory authorities to investigate allegations of corporate wrongdoing.

“London is known as the money-laundering capital of the world. But it is also a capital for criminal companies using the City’s reputation to boost their credentials,” she said.

“British finance is allowing companies to commit crimes abroad without being investigated for those crimes at home. This is a systematic problem of the total lack of regulation on the London Stock Exchange.”

Rose added that British courts are currently considering the eligibility of a group of claimants from Zambia, who are suing Vedanta and its local subsidiary KCM for extensive pollution from the Nchanga copper mine, to have their case against the parent company heard in the UK.

She told DeSmog UK’s that Vedanta’s lawyers have warned that allowing this case to take place under British jurisdiction would “open the floodgates” to claimants against British listed companies.

She argued that while profits from mining flow freely into the City of London, victims of the liabilities they create have no recourse to justice in the UK.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts