As Canadian oil-by-rail numbers reach record new volumes (and expected to rise), Canada’s Transportation Safety Board (TSB) announced recently that it would no longer list shipping the hazardous material by rail as a top safety concern.

Just a month later, the Alberta provincial government — where the majority of tar sands oil is produced — announced plans to bail out the tar sands industry by getting into the oil-by-rail business.

Here’s why that’s bad news for the communities in both Canada and the U.S. where this influx of oil train traffic will pass.

Canada’s Transportation Safety ‘Watchlist’

At the end of October, the TSB said it is was removing the issue of transportation of flammable liquids by rail from its “watchlist” of safety issues.

In a letter explaining the decision to The Hill Times, TSB Chair Kathleen Fox wrote: “Since the two CN [Canadian National Railway] accidents in Northern Ontario in February and March 2015, there has been one main-track train accident involving a spill of crude oil; in this case, only a small amount of product was released.”

She also makes the case for the decision by pointing to the (slow) phase-in of a new type of safer tank car required by regulations and the resulting removal of the riskiest tank cars from oil-by-rail service, saying that the risks of oil trains have been adequately addressed.

A rather glaring omission from Fox’s statement on oil-by-rail accidents was the June 22 train derailment in Iowa that resulted in a 230,000 gallon oil spill into the flood waters of a local river. While the derailment and oil spill happened in the U.S., the train originated in Canada and was carrying Canadian crude oil.

Not only that: The train was carrying that oil in retrofitted DOT-117R tank cars, which meet the new highest safety standards that Fox was touting.

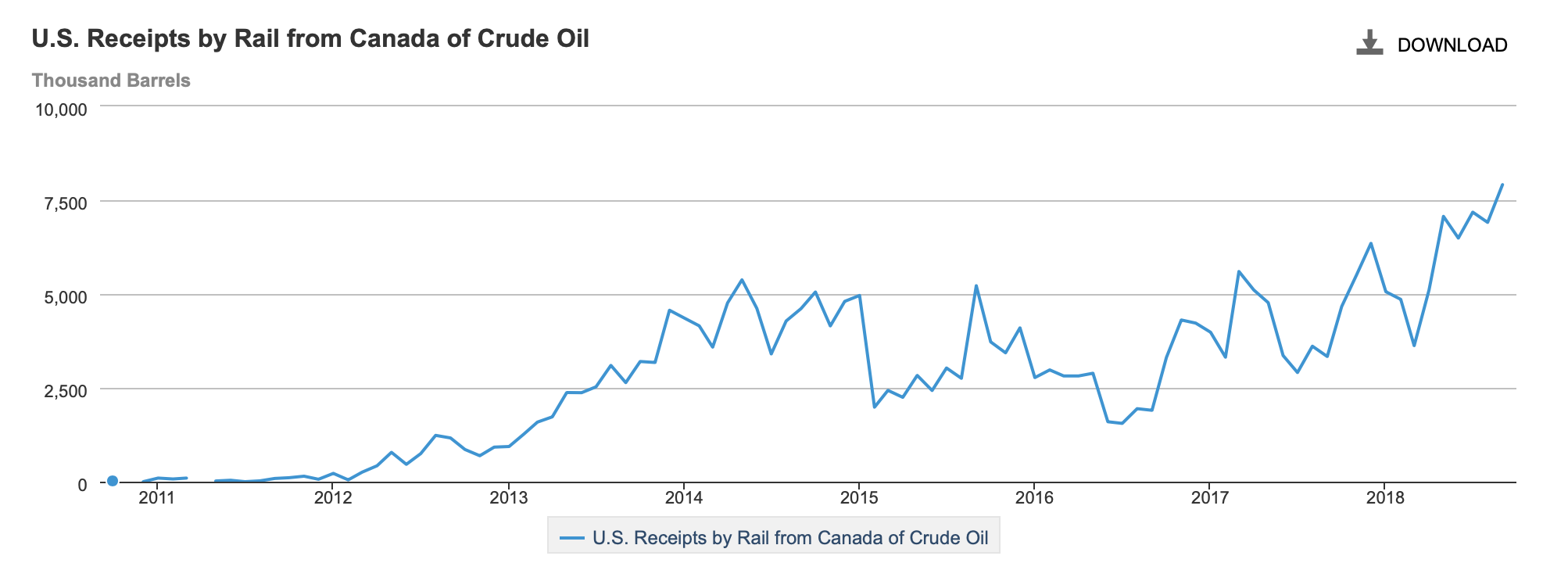

U.S. imports of Canadian oil by rail. Credit: U.S. Energy Information Administration

To add to safety fears, Fox is apparently ignoring an issue that is on the rise with rising volumes of Canadian oil trains. An internal Transport Canada document, obtained by CBC news via Canada’s Access to Information Act, notes that rail crew fatigue is an increasing risk and was likely a contributing factor in the Lac-Mégantic oil train disaster which killed 47.

Ottawa warns of dangerously exhausted train crews as Alberta ramps up oil-by-rail – https://t.co/fek5GycK0R

— Safe Rail (@safe_rail) December 10, 2018

Record volumes, rail tank cars that spill during derailments, and fatigued crews — and yet the TSB decides this is the time to de-prioritize the safety of the oil-by-rail industry.

Bailing Out Failing Tar Sands Industry With More Oil Trains

Not long after the Transportation Safety Board said oil-by-rail safety issues have been addressed sufficiently in Canada, Alberta Premier Rachel Notley and the pro-tar sands Alberta government made an unusual proposal to the Canadian government: Going in together to buy oil tank cars and locomotives to help the struggling tar sands industry deal with a lack of pipeline capacity and an oversupply of tar sands oil.

The proposal would help move an additional 120,000 barrels of tar sands oil per day over rail on top of the already record-breaking 275,000 barrels per day currently being shipped. That represents a major increase in potential oil-by-rail volumes over the next several years.

Premier Rachel Notley tells Ottawa business audience Alberta is in talks to buy rail cars to increase the province’s oil export capacity by 120,000 barrels/day. Deal could come within weeks, with increased rail capacity beginning in late 2019. Background: https://t.co/nu7g4AW6R1

— CBC News Alerts (@CBCAlerts) November 28, 2018

And while the national government initially appeared to oppose the idea of buying oil trains, Prime Minister Justin Trudeau and his administration now seem more open to it. Trudeau said the proposed purchase is “something we’re happy to look at.”

Getting into the oil train business seems like a natural extension after earlier this year, the Canadian government bought the troubled Trans Mountain pipeline expansion project for $4.5 billion, which would further connect tars sands suppliers in Alberta with ports in British Columbia. Justin Trudeau and Canada’s government appear to be going all-in on the tar sands industry, even as it continues to lose between roughly $50 million and $100 million a day.

However, as the majority of Canadian oil heads to the U.S. for refining and increasingly for exports, both Canadian and American communities will be exposed to the risks of the Canadian oil-by-rail boom.

Oil Trains to Supply Tar Sands Exports for U.S. East Coast

Oil train headed East in New York August 2018 Credit: Justin Mikulka

Oil-by-rail traffic to U.S. East Coast refineries dropped dramatically when oil prices began rising after the 2014 price crash and the Dakota Access pipeline began operations in 2017.

However, recent low oil prices and record Bakken oil production once again are leading to pipeline constraints, and oil-by-rail volumes out of the Bakken oil fields in North Dakota and Montana are increasing again. While Bakken oil has continued to move by rail to the West Coast at any price, the oil industry has just restarted moving it to the East Coast by rail. (When prices drop, East Coast refineries shift to buying cheaper oil from Africa, rather than buying oil shipped by rail from the Bakken, an option not available for West Coast refineries.)

For the first time, however, this Bakken cargo isn’t just destined for East Coast refineries. The crude oil also is being exported from Perth Amboy, New Jersey, Reuters reported in late November.

Buckeye, the oil company undertaking the endeavor, began by exporting small amounts of Bakken oil but has plans in the works to export much larger volumes of tar sands oil from the same terminal on New York Harbor in 2019. Its CEO recently told investors the company was close to locking in a “long-term contract” for “Canadian heavy crude.”

Exporting Canadian tar sands has been the long-term plan for the Perth Amboy facility since at least 2014. And with Canada’s current desperation to move tar sands oil to export markets and Buckeye’s promise of a long-term contract, oil trains look set to become a fixture for East Coast communities once again.

With all of these factors, and similar pipeline constraints in the Permian Basin in Texas, the oil-by-rail industry is making a comeback in a big way and appears to be a growth market for the next several years.

Hobbled After Years of Pipeline Fights, Tar Sands Industry Forced to Cut Production

The reason the Alberta government is planning to buy approximately 7,000 rail tanker cars and 80 locomotives is because the region lacks sufficient pipeline capacity to move all of the tar sands oil being produced — even with the current record levels of oil shipped by rail.

Without a place for all that oil to go, the price of Canadian tar sands oil plummeted below $20 per barrel, leading both to huge losses for the capital-intensive industry and to the provincial government announcing it would mandate lower production output. In other words, telling the tar sands industry — as activitists like to say — to keep it in the ground.

Whether you agree or not w anti-pipeline activism, one of args against (incl in Obama KXL env review) was that blocking it makes no diff since oil can find other ways to mkt. So it’s notable Alberta is shutting in production bc of lack of pipeline takeaway https://t.co/znkIPSyeHU

— Jason Bordoff (@JasonBordoff) December 3, 2018

For years, anti-oil activists have stopped and delayed the construction of new oil pipelines in North America, a tactic which appears to be paying off when it comes to the tar sands. While this lack of pipeline capacity has shifted some of that oil to move by rail, the rail industry can only replace a fraction of the capacity of the delayed or canceled pipelines.

At the same time, community and environmental activists also shut down almost all attempts to build new oil-by-rail infrastructure in American ports, which would have exported Canadian tar sands oil arriving by rail. The proposed oil-by-rail project in Vancouver, Washington, canceled earlier this year, was designed to handle up to 360,000 barrels per day. That was just one of many proposed oil-by-rail projects that were blocked by local communities on both U.S. coasts.

There is no question that the financial woes Canada’s tar sands producers currently face are in large part due to the efforts of activists to block pipeline and oil-by-rail infrastructure. As a result, tar sands oil has not reached the ports where it could be sent to China and other oil-hungry Asian markets.

Oil industry supporters like to say that blocking pipelines leads to more oil on the rails, but that scenario hasn’t exactly played out. And these arguments ignore the primary issue for many oil-by-rail activists trying to stop these projects, which is trying to protect their communities from the dangerous and inadequately regulated practice of moving large volumes of this flammable substance by rail.

Toronto-based columnist Linda McQuaig best sums up the Canadian failure to regulate oil-by-rail when she wrote:

“And, no, the answer isn’t more pipelines. The answer, for God’s sake, is proper regulation of our railways.”

If the Canadian and U.S. governments properly regulated the oil and rail industries, and the many necessary steps were taken to make oil safe to move by rail, the cost would likely render oil-by-rail economically unviable.

Main Image: Alberta Premier Rachel Notley met with Prime Minister Justin Trudeau on September 5, 2018 to discuss the Trans Mountain pipeline expansion project. Credit: Chris Schwarz/Government of Alberta, CC BY–ND 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts