There’s one big reason that analysts say America’s electrical power should soon run on clean energy sources like wind and solar rather than fossil fuels like coal and natural gas: your power bill.

A lot has changed when it comes to power generation in the past 16 years. In 2003, if you flipped on a light switch most places in the U.S., odds were you were setting into motion the final link in a chain of events that started in a coal mine or a mountain-top removal project. The U.S. got more than half of its electricity from burning coal that year, followed distantly by nuclear and gas. Coal had a long-standing reputation for being a cheap, if dirty, way to get things done.

By now, natural gas — made cheap by the rush to drill shale wells and with its own dirty reputation from globe-warming methane leaks and fracking pollution — has overtaken coal as the primary source of power in America.

But that isn’t the biggest change underway when it comes to where our electrical power will come from just 16 years from now.

That shale revolution, like coal, could see its economic advantage swept away by 2035, as renewable energy choices offer electrical utilities options that not only produce no climate-changing exhaust but are also rapidly falling in price.

Big changes, in other words, are just getting under way. And everyone who pays a power bill has a stake in understanding how their power company, their government regulators, and the companies that seek to make profits from the gas and power industries plan to respond. That stake is linked not only to climate change and its enormous associated costs, but also to the direct price tag of generating the electricity that powers your lights, fridge, and phone.

A pair of reports released this week by the Rocky Mountain Institute (RMI), a nonprofit that supports the transition away from fossil fuels, outlines some of these ongoing changes.

“The analysis presents compelling evidence that 2019 represents a tipping point,” RMI concluded, “with the economics now favoring clean energy over nearly all new U.S. gas-fired generation.”

That, however, assumes that utilities, regulators, and investors all respond to rapidly changing market dynamics and build the right kind of infrastructure in time — with tens of billions of dollars on the line.

Look Ma, No Bridge

While renewables’ market share has grown rapidly, they still represent the smallest slice of America’s power generation. The U.S. Energy Information Administration (EIA) reports that in 2018, America got 35.1 percent of its power from natural gas, 27.4 percent from coal, 19.3 percent from nuclear, and 17.1 percent from a mix of renewable energy sources including hydroelectric, wind, and solar.

For the past decade, natural gas industry groups have argued, often successfully, that natural gas, which releases roughly half as much climate-changing carbon dioxide pollution as coal when burned for power, should serve as a “bridge” from coal power to a distant future of renewable energy.

That’s despite the fact that in 2011, scientists at Cornell University took a closer look at the gas industry’s pollution, and particularly its pollution of another greenhouse gas, methane. Burning natural gas instead of coal for power, they found, could be worse for the climate than coal because of the industry’s severe issues with methane pollution throughout the supply chain. Their early warnings have since been bolstered by studies from other scientists.

But a rush to drill for shale gas, spurred by fracking and horizontal drilling, drove both gas prices lower and a historic shift in America’s power markets, with natural gas displacing coal as the primary source of American electricity on a monthly basis for the first time in 2015.

Power plants, it turns out, have been buying and burning much of that extra gas production unleashed by fracking.

“Gas-fired power plants have driven over 90 percent of the growth in total U.S. gas demand, as use in other sectors of the economy has plateaued over the same period,” RMI wrote. “At the same time, natural gas transmission pipeline capacity to bring gas to power plants and customers in other sectors has increased by over 60 percent since 1997, as pipeline developers have invested over $115 billion in new intra- and interstate projects.”

But now, some electrical utilities have begun taking a bypass, skipping the gas “bridge” entirely and moving straight from coal to renewables.

Solar and other renewable energy sources are increasingly competitive with natural gas for electric power in the U.S. Credit: Pixabay

“In the Midwest, Consumers Energy and Northern Indiana Public Service Company are planning to retire most or all of their remaining coal assets and replace them with new [wind, solar, storage] and demand-side resources, avoiding any investment in new gas-fired generation and saving their customers billions of dollars,” RMI wrote. “In Colorado, Xcel Energy will retire two coal plants ahead of schedule and replace them with [wind, solar, storage] and demand-side resources, again avoiding any investment in new gas and while delivering savings to their customers.”

That path has the potential to become a lot more traveled, RMI suggests.

“I don’t think there’s a credible story that [the price of natural] gas is going to go down,” Mark Dyson, co-author of both RMI reports, told Utility Dive. “And it’s not clear that it’s going to go up either, but even with it at its current prices, renewables are starting to undercut it.”

Time Is of the Essence — for Investors and Regulators

Shifting to renewable energy rapidly, the RMI report on power plants found, could save power customers more than $29 billion, while cutting carbon pollution by 100 million tons a year. Those avoided carbon emissions are equal to roughly five percent of the power sector’s yearly carbon pollution.

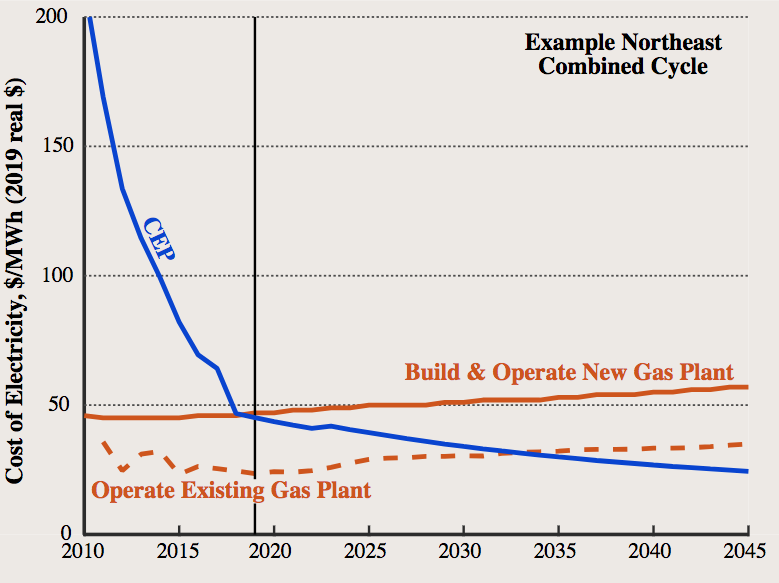

Historical and projected evolution of clean energy portfolio (CEP) costs in an example in the U.S. Northeast Credit: Rocky Mountain Institute

But right now, the report suggests, the market may be steering in the opposite direction. “There are at least $90 billion worth of new gas-fired power plants planned for construction in the coming 10–15 years, along with over $30 billion of investment associated with gas transmission projects,” RMI wrote. “We find that [clean energy options] are lower cost than 90 percent of proposed gas-fired generation at the proposed plant’s in-service date.”

By 2035 — just 16 years from now — it will cost more to keep 90 percent of the proposed new gas power plants in the U.S. running than it would cost to install a mix of new wind, solar, conservation, and storage projects that can offer the same performance. Currently, utilities have 88 gas-fired power plants in planning stages nationwide. “Our approach forces [clean energy portfolios] to match the grid services of gas generation,” RMI wrote.

“If planned [gas] projects are built,” the RMI report says, “investors will likely face tens of billions of dollars’ worth of stranded assets in the 2030s, as running these gas plants quickly becomes more expensive than building new [clean energy portfolios].”

That tipping point would have a cascading series of impacts, both on how American utilities — and their regulators — operate as well as the degree to which we heat the world’s climate.

As this new economic reality sinks in, clean energy advocates say utility regulators, who are charged with protecting American power consumers, must reconsider not only how the current rules for the power industry will apply, but also the assumptions that have been baked into those rules.

Pipelines to Nowhere

It’s a fight that’s coming not only to hearings over new power plants, but also to the battle over the rush to build new natural gas pipelines, including some of the country’s most controversial pipeline projects.

“Our story for gas plants is, if you build it, they won’t run — they won’t run at their expected capacity factors,” RMI‘s Dyson told Bloomberg, referring to the percentage of time that a power plant generates electricity. “And that filters down to pipelines, too.”

In turn, that filters down to how pipeline regulators approach a key question, which the law requires be answered before regulators authorize construction: Is the pipeline needed?

A natural gas pipeline warning at a Pennsylvania pipeline construction site. Credit: Ashley Braun, DeSmog

“Historically, as long as the pipeline developer has at least one company, even a corporate affiliate, that wishes to reserve capacity on the pipeline, FERC [Federal Energy Regulatory Commission] will find that the pipeline is required by the public convenience and necessity,” Gillian Giannetti, attorney with the Natural Resources Defense Council’s Sustainable FERC project told DeSmog. “But many other factors are relevant to whether we need to build a 40+ year asset that requires the taking of private property and has significant environmental and climatic concerns. Examples include demand projections, state policies, the existence of neighboring pipelines that might be able to handle the capacity, and more.”

“RMI’s study only emphasizes the importance of taking an ‘all relevant factors’ approach to determining need,” she added. “We are in desperate need of a 21st century approach to determining whether a pipeline is needed.”

Peering into a Pipeline’s Future

In 2018, the Federal Energy Regulatory Commission indicated that it might revisit how its rules on pipeline authorizations work — but following the departure of Commissioner Cheryl LaFleur, a Democrat, in July, FERC currently only has three out of its regular five commissioners. Commissioner Neil Chatterjee, one of two Republican appointees, has previously said that he prefers to wait until the commission is fully staffed before rewriting the rules for pipeline certificates.

DeSmog has previously covered one open question facing this group of federal regulators, which relates to a little-noticed rule that critics say has incentivized pipeline overbuilding today.

FERC Commissioners Cheryl LaFleur (second from left) and Neil Chatterjee (second from right). Credit: FERC, public domain

But other questions before FERC also could have significant implications for the power sector and the climate, including this one: How long does demand for a project need to last before federal regulators decide it’s needed?

The shifting economics of the gas industry — which arrive as shale gas producers are under pressures of their own — make existing legal questions take on new light.

Take, for example, the Atlantic Coast pipeline, a project that would cross West Virginia, Virginia, and North Carolina, and was originally projected to cost roughly $4.5 billion (a price tag which has spiraled up to roughly $7.5 billion as the project has run aground in court challenges, with Moody’s Investor Services downgrading the project to “credit negative” in February).

A report in January by the Institute for Energy Economics and Financial Analysis questioned the need for the entire project, predicting that demand for natural gas would be eroded by cheap renewables and observing that most of the companies planning to ship gas on the pipeline were actually affiliates of the pipeline’s own sponsors.

In July, 18 Virginia lawmakers wrote to FERC, urging the commission to suspend federal authorization for the pipeline, arguing that developers had failed to show the pipeline was neeeded.

That argument was potentially bolstered this week by the publication of a report focused on a proposed extension of the Atlantic Coast pipeline to Hampton Roads, Virginia. The report was sponsored by Mothers Out Front, an organization focused on fighting climate change.

Dr. Elizabeth A. Stanton, director of the Applied Economics Clinic and author of the report, concluded that the local utility, Virginia Natural Gas, had overestimated demand for natural gas in the region. She noted that the utility’s estimates were five times higher than projections by energy consulting firm Wood MacKenzie.

“You have to go to five times higher” than those projections to reach the point where the pipeline makes economic sense, Stanton said, adding that four times wouldn’t cut it. And the prospect of competition from renewable energy sources and efficiencies could add weight to the argument that gas demand can be expected to shrink rather than grow.

Stranded Assets, Sunk Investments

But even assuming a pipeline is economic on the day it’s finished, federal regulators are currently reluctant to examine if and when that pipeline might become a stranded asset.

“FERC does not require evidence that the pipeline will be needed for its entire projected lifespan,” explains NRDC‘s Giannetti. “The agreements upon which FERC typically relies often cover half or less of that lifespan.”

And the RMI reports make the case that approach can prove risky for power customers, who willl be left holding the bag for decisions made today.

“The financial implications for gas pipelines, of clean energy out-competing gas power plants, are dire,” RMI’s pipeline report says, adding that the question is who will ultimately have to bear the costs of choosing wrong. “In many cases, captive customers of regulated gas and electric utilities ultimately bear the financial risks of investment today in assets — pipelines and power plants — that are likely to become uneconomic sooner than anticipated.”

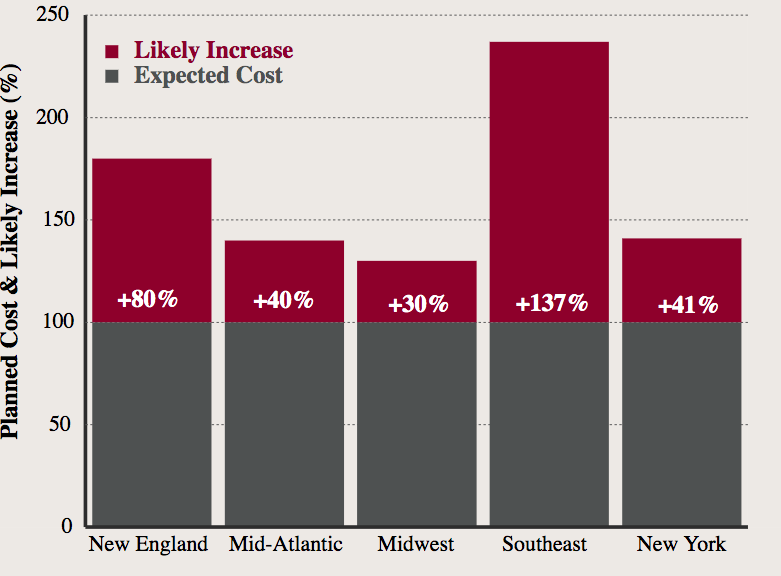

Likely cost increases for new gas pipelines due to competition from clean energy in five U.S. regions in 2035. Credit: Rocky Mountain Institute

RMI’s pipeline report focused on five regions — New England, the Mid-Atlantic, the Midwest, the Southeast, and New York state — including the states through which the Atlantic Coast pipeline will pass.

It finds that within 26 years, virtually all gas power plants will be economically obsolete in those states. “By 2045, only 3 percent of expected fuel use from proposed gas-fired power plants will remain economic within the focus regions,” RMI wrote.

Fossil fuel advocates historically found much success in arguing to regulators and consumers that, despite the harms from polluting our air, water, and climate, fossil fuels should be viewed as something of a necessary evil — and perhaps on balance, even a good thing, given the benefits that energy can provide.

But if RMI’s predictions prove to be on target and renewable energy continues the trend to becoming the cheapest power option, the industry and its backers will face a rapidly widening range of questions about the degree to which, whether good or evil, fossil fuels are necessary.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts