At a recent natural gas industry conference in Houston, Woodside Petroleum CEO Peter Coleman warned his colleagues to avoid the fate of another fossil fuel, according to trade publication Natural Gas Intelligence.

“The industry really is at a critical juncture,” Coleman said. “We run the risk of being demonized like that other fossil fuel out there called coal.”

Oil and gas companies have been feeling mounting pressure, as signs emerge that oil is losing favor, both with the public amid climate concerns and with some investors.

CNBC recently asked in a headline, “Did we just witness the beginning of the end of Big Oil?” And investment website Seeking Alpha called Exxon CEO Darren Woods’ recent comments to investors “fantasy” because the CEO made so many incorrect statements about renewable energy. The article concluded that the company’s “business model is fatally flawed, with serious consequences.”

The industry response to such pressures was for multinational CEOs to gather in New York during the United Nations Climate Week and tout natural gas as a clean energy source while also taking shots at electric vehicles.

Ben van Beurden, CEO of Royal Dutch Shell, said that to achieve the goals of the Paris Agreement, “Natural gas could be a part of the solution.”

Not an average day. I just confronted CEO’s of @BP_plc @exxonmobil @CNPC @WeAreOxy @Shell @petrobras @saudiaramco15 @RepsolWorldwide @eni @Chevron on how their expansion is inconsistent w Paris pic.twitter.com/xh0dmCDxUO

— Tzeporah Berman (@Tzeporah) September 23, 2019

Meanwhile, Exxon’s Woods continued attacking electric vehicles, which DeSmog’s KochvsClean project has shown represent a serious perceived threat to the oil industry.

ExxonMobil CEO dismisses electric vehicles: ‘What’s the point?’: Exxon CEO Darren Woods recently expressed his doubts about the transportation sector’s transition to electric vehicles. In comments during the 2019 Oil and Gas… https://t.co/AO4VHLg3Tc #Cars #Autos #Automotive

— Autotestdrivers.com (@Autotestdrivers) September 24, 2019

Despite evidence that electric cars are vastly better for the climate than gas-powered cars even when powered by coal, Woods repeated the myth, saying, “What’s the point of having electric vehicles that will end up being charged by power generated from coal.”

Perfectly timed with the fossil fuel greenwashing at Climate Week, former Obama Secretary of Energy Ernest Moniz co-wrote a Wall Street Journal op-ed pushing the oil and gas industry talking point that natural gas “Will Make Africa Greener.” This is more of the same from Moniz who has long been a champion of fracking and natural gas.

Like Coal, Natural Gas Is Failing on the Economics

Fracking has produced so much natural gas in the U.S. that prices are at historically low levels due to the “glut” of natural gas — something a recent article in Natural Gas Intelligence predicted could last another five years. Lingering low gas prices could mean that in 2020 global buyers of liquefied natural gas (LNG), a major growth area for the industry, “could start rejecting U.S. cargoes.”

A recent analysis by the Institute for Energy Economics and Financial Analysis colorfully summarized what the glut and predicted low prices into the 2020s meant to the gas industry.

“…heads must be exploding in the board rooms of oil and gas producers throughout the U.S. and Canada,” wrote authors Tom Sanzillo and Kathy Kipple.

While environmental advocates certainly “demonized” coal due to its contributions to climate and other air pollution, the main reason coal use in the U.S. has declined is that it is too expensive to compete with cheaper natural gas and renewables — much like nuclear power. And now the same dynamic is happening to natural gas, even with historically low prices driven by an oversupplied market.

As we have noted before on DeSmog, natural gas prices can only go up from here, while renewable energy and storage prices just keep falling.

The economics of the U.S. coal industry have led to several major bankruptcies in 2019 — something echoed by the fracking firms producing a glut of natural gas but a shortage of profits (which DeSmog has been investigating for more than a year).

Scott Forbes, a vice president with leading energy industry analyst Wood Mackenzie, gave a similarly bleak assessment for the fracking industry:

“I talk to those guys, all the fracking companies, on a daily basis. I’m very engaged in what they are doing with their business, and I completely believe that the current model is unsustainable.”

The Lone Star State is the #1 producer of oil and natural gas in the United States—and production is BOOMING under President @realDonaldTrump. pic.twitter.com/RPSZzTOGE7

— The White House (@WhiteHouse) September 22, 2019

Much like coal, the economics of natural gas production in the U.S. and Canada are unsustainable, and the writing is on the wall for all those willing to read it.

The city of Medicine Hat in fossil fuel–rich Alberta, Canada, has been producing natural gas for more than 100 years — earning it the nickname “Gas City.” However, Medicine Hat is going to need a new nickname.

After losing money on it for the past several years, the Gas City has announced that it is getting out of the gas business. Brad Maynes, the city’s commissioner of energy and utilities, explained the decision to the Calgary Herald, “We could just not see ourselves returning to profitability.”

The U.S. fracking industry hasn’t been profitable for the past decade, investors are understandably losing faith in the industry’s broken promises, and the industry is facing a major debt crisis. As Scott Forbes pointed out: This simply isn’t sustainable.

Renewables Beat Coal and Will Eventually Beat Natural Gas Too

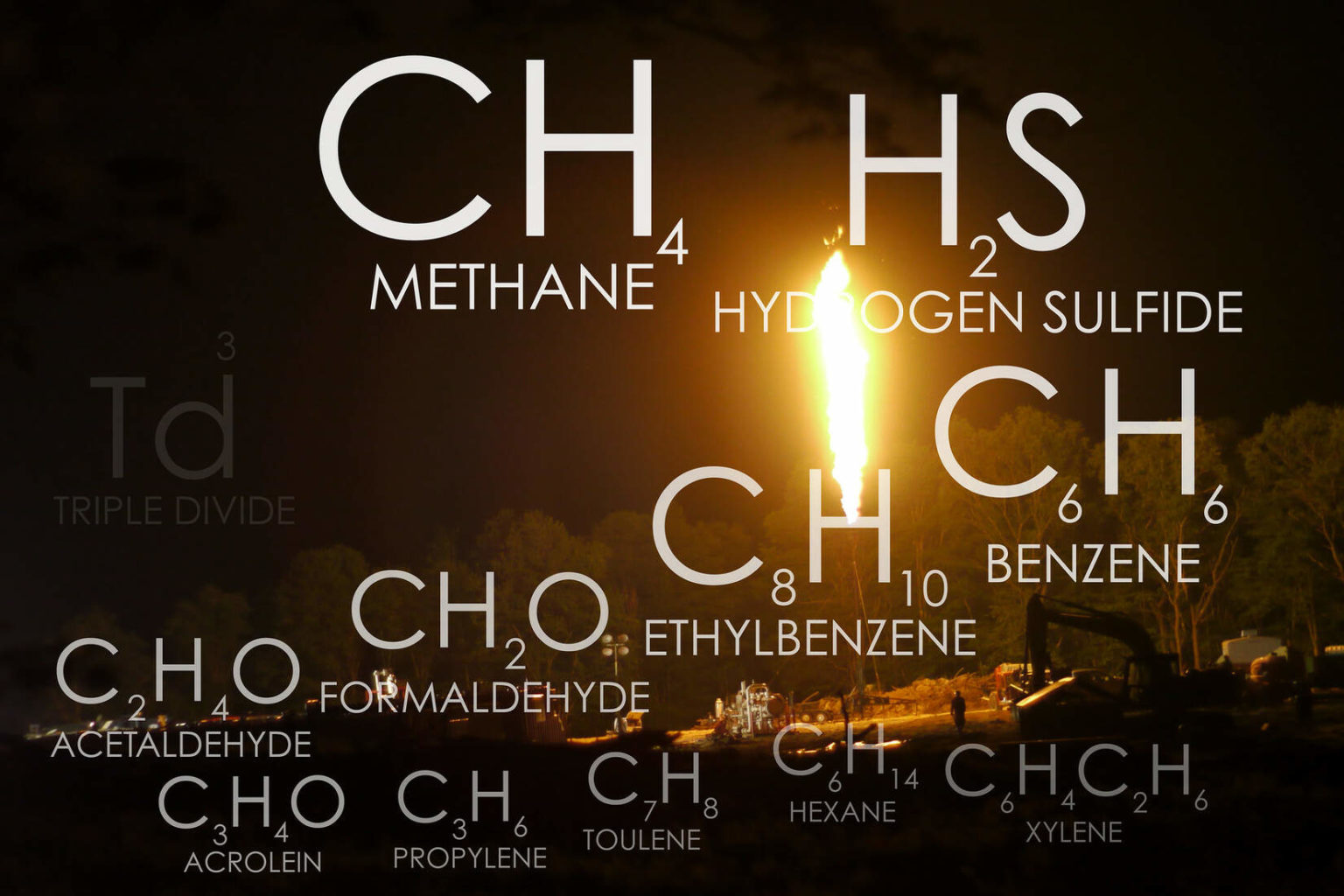

The oil and gas industry is betting big on natural gas and continues to push the idea that it is a climate solution while launching a slick new ad campaign. That’s even as the CEOs of Chevron and Equinor admitted during UN Climate Week that methane leaks and burning related to fracking are a serious issue that the industry won’t be able to hide for long.

And while it makes sense for the industry to try to lock in its product for the long-term, natural gas — like coal and nuclear — simply won’t be able to compete with the rapidly falling prices of renewable energy and storage in the future.

Two reports released this month by the Rocky Mountain Institute (RMI) concluded that many of the natural gas power plants and pipelines currently being built will end up as failed investments and stranded assets.

According to Rocky Mountain Institute, it will be more expensive to run 90% of natural-gas-fired power plants than to build wind and solar farms with storage systems by 2035 in the US.#EnergyTransition #energyinsights #EnergyandScale #renewables https://t.co/qQ0u2ScbJP pic.twitter.com/83MNpaBaJv

— James Ellsmoor (@jellsmoor) September 26, 2019

“If planned [gas] projects are built,” the RMI report says, “investors will likely face tens of billions of dollars’ worth of stranded assets in the 2030s, as running these gas plants quickly becomes more expensive than building new [clean energy portfolios].”

In sum, not only is natural gas bad for the climate and environment, but like coal, it’s a bad investment. Whether and how quickly society at large comes to terms with these realities could mean all the difference for the future of a livable climate.

Main image: Illustrated here is a comprehensive list of emissions found in the air after a well is fracked and then flared or vented. Credit: © J.B.Pribanic/Public Herald, CC BY–NC–ND 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts