Pathways Alliance’s flagship carbon capture and storage project is not financially feasible without massive and consistent subsidies.

This is according to the most recent analysis of the venture, conducted by the Institute for Energy Economics and Financial Analysis (IEEFA), which identified multiple financial challenges.

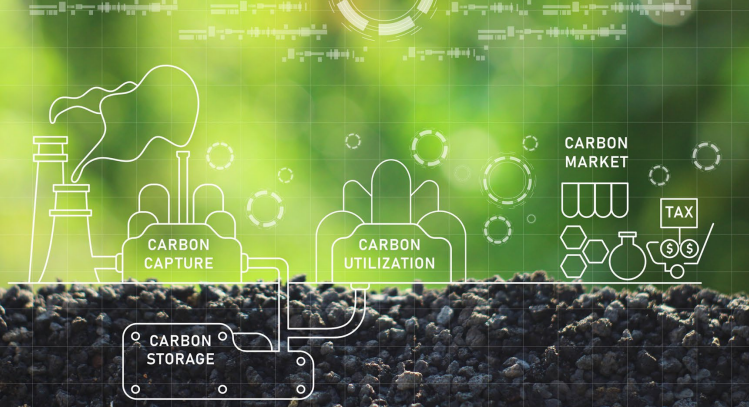

The Pathways Alliance, a lobby group representing Canada’s six largest tar sands oil producers, proposed a massive carbon capture and storage (CCS) hub based near Cold Lake, Alberta, in 2022. The build-out includes a 400-kilometer pipeline network connecting the CCS hub with 13 tar sands facilities. The group’s members are responsible for approximately 95 percent of the tar sands’ annual output.

“The growing realization that carbon capture and storage projects are likely to require permanent government subsidies resets the discussion about the viability of CCS as a tool to effectively reduce carbon emissions,” Mark Kalegha, the IEEFA’s energy finance analyst for Canada and author of the report, said in a statement.

“Public funding of CCS is a costly gamble that may not yield tangible returns on Canada’s journey towards achieving net-zero emissions,” Kalegha stated.

“This is a financial risk the government should reconsider taking on.”

Among the study’s key findings, the IEEFA determined that the total costs — such as interest, insurance, depreciation, and taxes — for existing commercial-scale carbon capture plants in Alberta are approaching thresholds that threaten profitability. In addition, operating costs are increasing at roughly twice the rate of the amount of carbon dioxide that’s captured.

Critics argue that Pathways will actually use the project for enhanced oil recovery (EOR), which is what carbon capture technology was initially developed to do in the 1970s. Companies have used other notable CCS projects explicitly in this way. In fact, Pathways Alliance has publicly stated on several occasions that it hopes its decarbonization efforts could result in increased oil production. Critics argue the oil industry proposes using carbon capture for EOR as a means to prolong fossil fuel production while appearing to work towards emissions reduction. Canadian federal and provincial governments have enthusiastically supported carbon capture initiatives by the oil and gas sector, despite the concerns and objections of environmentalists.

But Kalegha is not convinced the Pathways project would be used for EOR. Instead, he believes the alliance’s business case is based on the use of Emission Performance Credit (EPCs) under Alberta’s TIER (Technology Innovation and Emissions Reduction) carbon pricing system. That said, the IEEFA isn’t certain the necessary operating revenue will manifest.

“An effective cap on emission performance credit (EPC) pricing of $170 (CAD) per tonne limits project revenue potential, while a looming oversupply of carbon EPCs is an example of risks to project cash flows,” the IEEFA report states.

The report further notes that the option to combine Clean Fuel Regulation credits with EPCs is available to the ACTL (Alberta Carbon Trunk Line—one of the two operational carbon capture projects the IEEFA study investigated), but that this significant financial benefit is not currently available to the Pathways project.

The report warns that “without substantial efficiency improvements, the cost per tonne of CO2 captured is likely to exceed the revenue that the project can generate for each tonne captured.”

Kalegha noted that there is no guarantee carbon credits will trade for $170 and their value could face a limitless fall. “There is a severe oversupply risk, and over time, operating costs will likely increase while potential revenue will be stagnant,” he said.

The report indicates that an underperforming and unprofitable carbon capture project would invariably “struggle to bring lasting positive economic benefits to host communities and become dependent on external financial subsidies to maintain operations.”

Even under optimal conditions, “the Pathways project may struggle to break even,” the IEEFA noted. It further stated that real-world carbon capture operations are rarely optimal, echoing analysis by the International Institute for Sustainable Development (IISD), which also concluded carbon capture’s costs are persistently high in Canada, and unlikely to come down.

Though details about Pathways’ project are scant — which the IEEFA noted in its report — the institute determined that Pathways could have an estimated annual carbon dioxide storage capacity of 10 to 12 million tonnes. If completed, it would be among the largest carbon capture facilities in the world.

Safety Risks

Whether storing such a large amount of CO2 is safe is a vitally important but unanswered question. The release of an estimated 100,000 to 300,000 tons of CO2 at Lake Nyos, Cameroon, in 1986 killed about 1,700 people and 3,500 livestock animals. The rupture of a CO2 pipeline near Satartia, Mississippi, in 2020, resulted in dozens of hospitalizations, the town’s evacuation, and a chaotic emergency response that underlined the public’s unfamiliarity with large-scale carbon dioxide poisoning.

A May 2024 article in The Narwhal revealed that Pathways Alliance made it clear to the federal government that it fully expects to depend on federal government subsidies in the tens of billions of dollars.

In a letter to several federal ministers — including then-Finance Minister Chrystia Freeland and Environment Minister Steven Guilbeault — Pathways requested the government cover 50 percent of its estimated operating costs. The same letter also asked if the project would be eligible to generate Clean Fuel Regulation (CFR) for bitumen and crude oil exported using carbon capture technology. Pathways also demanded the federal government forgo an environmental impact assessment. At the provincial level, Pathways broke its project into 126 parts to avoid triggering an automatic environmental assessment.

Despite the growing body of evidence against the plan, it nonetheless maintains considerable political support in Canada. In October 2024, the Globe and Mail reported that the Canada Growth Fund (CGF) proposed funding support for the project. The CGF is a public fund of $15 billion (CAD) that supports implementing new technologies to reduce emissions, managed by the Public Sector Pension Investment Board.

“The Pathways Alliance has been in negotiations with the CGF for over a year, and wants the CGF to provide carbon contracts to mitigate financial risks and guarantee revenues,” Julia Levin, associate director of national climate with Environmental Defence, wrote in a statement to DeSmog. Levin noted that those negotiations ramped up last fall, and a decision is expected soon.

Despite Pathways’ request to abandon the environmental impact assessment, Levin also noted that the federal government is reviewing the project.

“In late November, following the Government of Alberta’s denial to conduct an impact assessment of the project, eight First Nations submitted a request that the federal government exercise its discretion to designate the Pathways Project for a federal impact assessment, given their concerns about the project impacts and the lack of a robust regulatory framework,” said Levin. “Minister Guilbeault has until the beginning of March to decide whether or not to designate the project.”

Little evidence exists showing carbon capture is effective at reducing emissions among Canada’s few extant commercial CCS projects and CCS projects worldwide.

“Neither Quest nor the Alberta Carbon Trunk Line (ACTL) have managed to keep up with projected capture rates,” said Kalegha during a recent IEEFA webinar, referring to Shell’s massive Quest CCS facility in Alberta. “Boundary Dam is struggling as well,” he added, referring to the Saskatchewan coal plant that received a $1 billion retrofit to capture carbon. The IEEFA estimates that the Boundary Dam CCS effort has never exceeded a 60 percent capture rate, despite claims by CCS advocates that it captures carbon at a rate exceeding 90 percent.

“There’s a global trend of underperformance when it comes to carbon capture,” he noted.

Kalegha’s analysis also points to considerable risk factors. He said that operating costs at ACTL and Quest appear to have doubled, while capture rates at both facilities have remained relatively flat. In addition, Pathways Alliance’s project will have to grapple with the combined performance of 13 separate carbon capture facilities.

While the oil and gas industry claims carbon capture technology is improving, Kalegha doesn’t see any data to support this.

“Current CCS projects in Canada are heavily subsidized by the public, anywhere between 50 to 85 percent,” he said during an IEEA online seminar. “This is a very expensive, subsidy-dependent technology experiencing severe technological challenges. The question is who should bear this risk?”

Julia Levin is doubtful the Pathways Alliance partners are sincerely interested in committing any of their own funds to the project. She noted in a statement to DeSmog that Canadian Natural Resources Limited (CNRL) only committed $90 million to carbon capture in its 2025 budget, compared with $45 million to move offices.

“CNRL’s 2025 budget reveals that the Pathways Alliance has no plans to invest their own funds into carbon capture and storage, instead insisting the public cover over $12 billion of their costs,” Levin noted.

“Ninety-million dollars is an insignificant amount of money, compared with the cost of carbon capture projects, as well as CNRL’s operating budget and yearly profits,” she added

“If these companies seriously believed in carbon capture as a waste management solution for their operations and were intent on moving these projects forward, they would be willing to invest more of their own funds,” Levin pointed out. “Instead they’re using the promise of capturing emissions one day as a rationale to delay the energy transition and weaken climate policy.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts