By some estimates, there might be 2.4 billion barrels of oil deep below the waters of the Atlantic ocean off the coast of Suriname, South America’s smallest country.

The problem for multinational oil companies seeking to extract that oil is what’s mixed in with it: trillions of cubic feet of methane, often referred to as natural gas.

In May, the U.S. oil giant ExxonMobil and its partner, the Malaysian oil company Petronas, announced their latest well in Suriname’s waters had struck oil. The find — their third fossil fuel discovery in the region — stirred speculation about the potential for a floating oil production platform off Suriname’s coast, and even the possibility of a floating liquified natural gas (LNG) export project.

ExxonMobil has already established itself in neighbouring Guyana, whereno for the past decade the company has discovered increasing amounts of oil under a partnership with Hess Corp. (pending acquisition by Chevron) and the China National Offshore Oil Corp. (CNOOC) — amid legal challenges from environmental advocates.

But last month, just six months after announcing its latest discovery in the region, ExxonMobil pulled up its anchors and left Suriname, closing out its only remaining foothold in the nation’s waters. The third — and final — offshore well drilled by the partnership, known as the Fusaea-1 well, had produced more natural gas than expected, oil industry analysts noted in May.

ExxonMobil’s exit is the latest sign that natural gas is causing big headaches for the international oil companies prowling the Guyana-Suriname basin, who are under increasing pressure to stop simply burning off unwanted methane, a polluting and wasteful process known as flaring, or unleashing the powerful greenhouse gas into the atmosphere unburned.

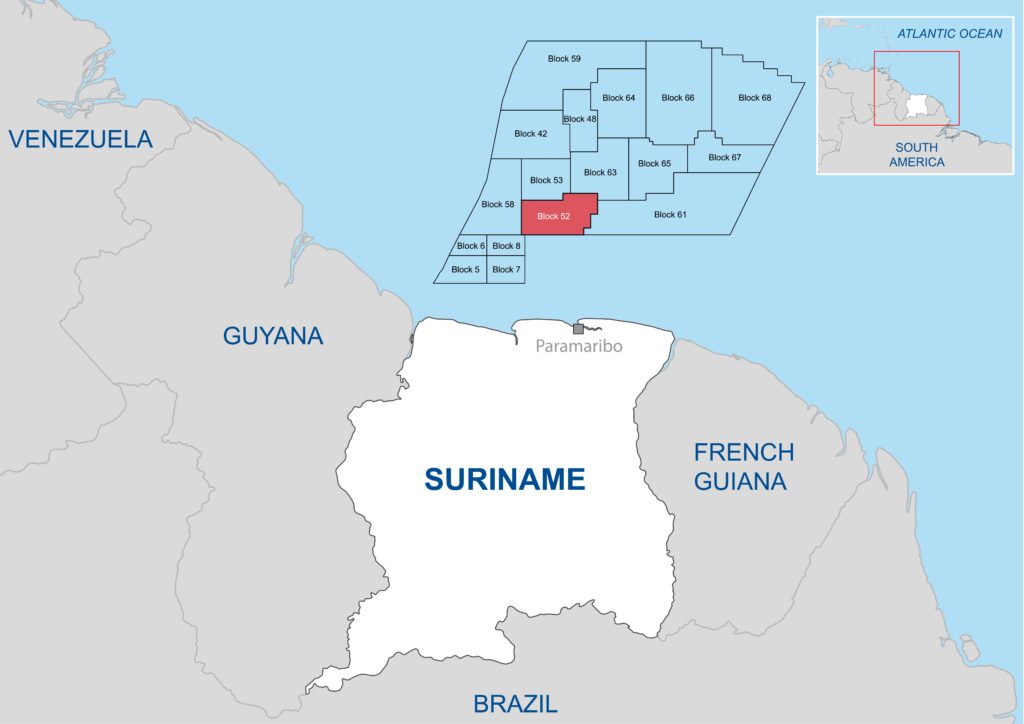

“The development of an offshore gas field is more challenging and complex to explore in technical and economical perspective than an offshore oil field,” Suriname’s state oil company Staatsolie acknowledged in March as it described talks surrounding ExxonMobil’s activities in Block 52.

ExxonMobil did not immediately respond to a request for comment and has not publicly commented on Suriname since leaving in November. In a corporate plan update released on December 11, the company emphasized that it intends to put 70 percent of its capital expenditures from now to 2030 into what the company described to investors as “advantaged assets — the Permian, Guyana and LNG – where all our plans are well matured.”

“My opinion on ExxonMobil exit is simple,” Erlan Sleur, founder of the grassroots environmental watchdog Protect Our Biodiversity Suriname (ProBioS), told DeSmog. “It doesn’t seem that Suriname has the oil bonanza that was predicted and they want to focus on the exploitation in Guyana with 1 million barrels a day now.”

Over the past few years, Guyana has seen a surge in production fast enough to make the tiny tropical nation, with a total population of roughly 800,000 (about equal to Jacksonville, Florida or Indianapolis, Indiana), into the third-fastest growing oil producer outside of OPEC, according to the U.S. Energy Information Administration. In Guyana, ExxonMobil is partnering with Hess Corp. (pending acquisition by Chevron) and the China National Offshore Oil Corp. (CNOOC), and the trio is on track to transform Guyana into one of the largest oil producers in South and Central America, second only to Brazil.

Handling natural gas off the coast of Suriname and Guyana poses major challenges and involves significant environmental risk, however. Companies have repeatedly been caught breaching pledges to eliminate natural gas flaring and venting in South America’s remote offshore oilfields.

“You know that oil companies in this region are not so happy with natural gas as it costs billions more to exploit, transport, liquefy for transport and deliquefy etc., the gas than it is worth,” Sleur said.

“Oil companies are forbidden in most countries to burn natural gas/flaring,” he added, “but we still see it happening everywhere.”

ExxonMobil’s abrupt exit likely throws a wrench into discussions for an LNG export project in Suriname.

In March, Staatsolie said it was in talks with ExxonMobil and Petronas for a floating LNG project that Suriname’s government would incentivize with a 10-year tax holiday under the terms of a Letter of Agreement.

“Staatsolie expects Petronas to continue the activities in Block 52 without interruption and is confident in the continuation of the good partnership between the two companies,” Suriname’s state oil company said as it disclosed ExxonMobil’s exit on November 20.

Finding The Wrong Fossil Fuel

ExxonMobil isn’t the only multinational to give up on Suriname. “We have decided to withdraw from the deepwater block 59 exploration license in Suriname and we don’t intend to seek further exploration opportunities in the country,” a spokesperson for Norwegian oil and gas company Equinor told Reuters in August.

But a handful of other fossil fuel giants appear undeterred.

On October 1, France’s TotalEnergies and the U.S. independent APA announced a final investment decision of up to $10.5 billion for an oil project the companies are calling GranMorgu in Suriname’s Block 58. Staatsolie. Shell, Chevron, Hess, and Qatar Energy also remain active in Suriname’s waters.

That’s despite the fact that there’s generally far more natural gas in an average barrel of oil from Suriname than what’s been discovered so far in Guyana, with Wood Mackenzie estimating Suriname’s fossil fuel deposits are about 48 percent natural gas compared to an estimated 20 to 30 percent across the border.

Many of the options for handling the natural gas produced by those offshore wells are quite risky, Sleur said.

“Most companies were burning the gas but now they’re pumping it back into the well as they more and more need to comply to international norms to mitigate greenhouse gases,” he said. “These are all very risky operations as it is known that the natural gas is polluted by H2S hydrogen sulfide and in contact with water it becomes an acid that can corrode metal pipes.”

The alternative, of course, is to flare the gas despite the environmental consequences — which include not only carbon dioxide emissions from burning huge volumes of gas, but also hazardous air pollution and the release of unburned methane — a powerful greenhouse gas — from incomplete combustion, a November report by the Clean Air Task Force found. Critics say fines are too paltry to deter companies from illegally flaring.

In Guyana, ExxonMobil had pledged since 2016 to avoid “routine” flaring entirely.

But the company has struggled to deliver.

ExxonMobil blamed a faulty flash gas compressor on one of its production platforms, the Liza Destiny, for causing excessive flaring in 2022, announcing in mid-year that it had reduced its “background flare” to “less than 1 million cubic feet” per day.

Larger flaring events appear to have continued, with the company drawing a small fine in 2023 following an incident reported in the third quarter.

Floating LNG Plans

The region’s oil companies know natural gas is a headache. Nonetheless, APA and TotalEnergies are pushing forward in Suriname, with the companies estimating over 700 million barrels of oil in the area targeted by their Gran Morgu project.

Like ExxonMobil in Guyana, TotalEnergies has promised “zero routine flaring and full reinjection of associated gas into the reservoirs” in Suriname. Last August, APA had said it was “pursuing further discussions” for a floating LNG project that could pull in gas from Guyana and Suriname, Bloomberg reported.

In neighboring Guyana, ExxonMobil has considered building its own floating LNG export project. “We will have to have a production facility that just separates liquids and gas and handles probably tens of thousands of barrels a day of liquids production,” Alistair Routledge, president of ExxonMobil Guyana, told S&P Global in a September 2023 interview. “But do you then have a floating LNG facility next to a [liquids] production facility? Do you have that in shallow water? Do you have it onshore? We’re looking at all of those kind of concept options.”

This summer, the Guyanese government chose Fulcrum LNG, a company run by a former ExxonMobil executive, to spearhead an ExxonMobil-linked LNG export project that’s expected to cost up to $30 billion. Fulcrum’s proposal would rely on financing from the U.S. Export/Import Bank and private equity, according to Reuters.

But Fulcrum, a little-known start-up, has faced big doubts about its ability to raise the funds needed and the government has found itself defending its choice of the company.

Just days before ExxonMobil pulled out of Block 52, the oil consultancy Wood Mackenzie released a report touting the potential for LNG projects in Guyana and Suriname, specifically citing the natural gas in Block 52 and the ten-year tax break. Noting the United States’ LNG permit pause (and LNG project construction delays), Wood Mac predicted a “supply window in the mid-2030’s” that could be met by projects in Guyana and Suriname.

But if a floating LNG project is built in the region, there’s little guarantee it would find buyers.

Just ask the oil giant BP. “The range of outcomes for LNG trade widens post-2030,” BP wrote in its Energy Outlook 2024, noting that under the company’s “net zero” scenario, “no additional liquefaction capacity beyond that already under construction is required” to meet global demand.

“This widening range of outcomes adds to the uncertainty associated with investments in LNG facilities, which typically have an economic life of 15-20 years,” BP noted.

While it may be too early to say what impact ExxonMobil’s Suriname exit might have on potential LNG projects in the region, it does seem clear that Guyana will now feel the full brunt of the U.S. company’s interest, environmental activists predict.

“With the high oil prices now and the bargain with Guyana they want to put all their focus and energy in Guyana to produce as much oil now before things change in the world,” Sleur told DeSmog. “Suriname so far has only cost them money.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts