Some on the political right in Canada have been quick to gloat over the re-election of Donald Trump as U.S. president. Alberta Premier Danielle Smith plans to attend his inauguration, publicly doubting that the government of Canada will adequately advocate for the oil patch. “For Alberta’s story to be told and Alberta’s interest to be represented, I’ve gotta do it myself.”

But as they say, be careful what you wish for. While Canada has been a vital and reliable trading partner to the U.S. for decades, the protectionist policies of the incoming administration could have a devastating impact north of the border – especially for Alberta.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts

Trump has promised a 10 percent tariff on all U.S. imports, and as high as 60 percent for China. Many are hoping that Canada will get special treatment, particularly on oil. The much-hyped $34 billion Trans Mountain pipeline has done little to diversify our international markets with most TMX shipments still going to U.S. refineries on the west coast. Last year, 97 percent of Canadian crude oil exports were destined to the U.S.

According to a recent report from the Canadian Chamber of Commerce, 10 percent tariffs from our biggest trading partner would shave over five percent from our national GDP and cost our economy more than $45 billion. The energy and auto industries are unsurprisingly the most exposed. Alberta’s oil and gas shipments to the U.S. represent more than 80 percent of all provincial exports.

Lowered Prices

Even if Canadian oil is exempt from U.S. import tariffs, Trump’s campaign promise to vastly scale up American production to reduce U.S. gas prices by 50 percent would have big implications on oil sands producers and Alberta resource revenues.

Even before the U.S. election, many analysts were predicting global oil prices to tank due to diminishing demand from a slowing Chinese economy and accelerating uptake of electric vehicles. The International Energy Agency just predicted in their World Energy Outlook that global fossil fuel demand will peak in 2030.

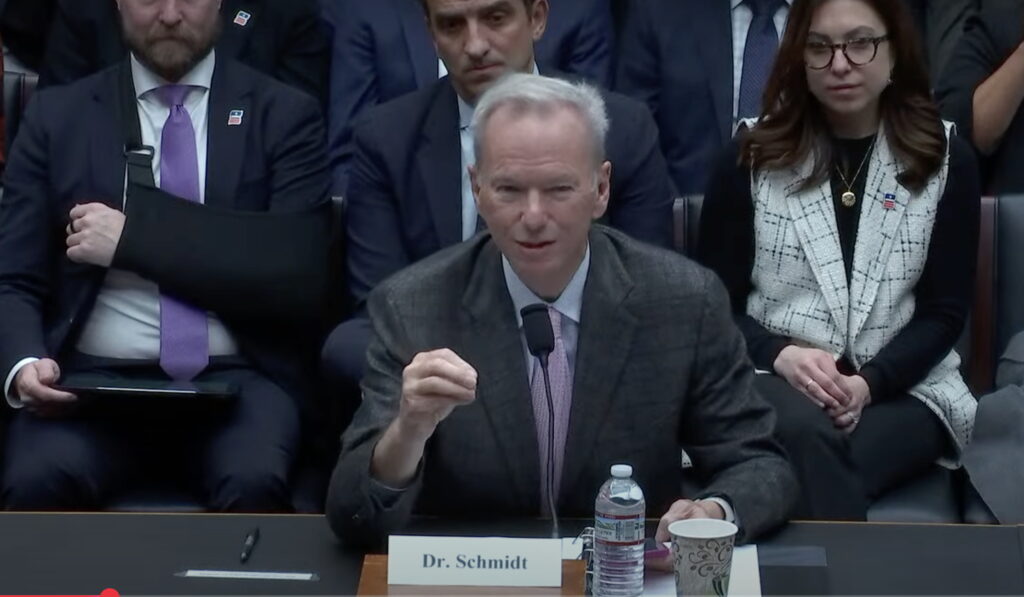

U.S. oil production already tops any country at any time in history. Contrary to what many believe, the Biden Administration approved more drilling permits than those issued in Trump’s first term. Can American oil production go even higher? The nomination of fracking CEO Chris Wright as Energy Secretary certainly signals they are going to try.

This is terrible news for oil-dependent Alberta with Premier Danielle Smith stating last month that the province would run a deficit if the price of west Texas intermediate (WTI) crude dropped below $74 per barrel that her government projected in the last budget.

Global traders swiftly signaled where they thought prices were heading after the U.S. election with WTI dropping over seven percent in eight days. Some analysts now believe global oil prices will average $60 per barrel in 2025. Even at $69 per barrel, Alberta would be $1.9 billion in the red next year.

Gas Glut

The Trump victory is also a major blow to Canada’s liquified natural gas (LNG) industry. Two approved export terminals on the west coast are scheduled to come online by 2027 and their already-questionable economics just got a lot worse. Federal and provincial governments shoveled over $6 billion of taxpayers money at these boondoggles that are projected to coincide with a global glut of LNG.

Citing climate concerns, the Biden Administration paused further approvals of additional LNG facilities on the U.S. gulf coast already projected to increase American export capacity 80 percent by 2028. With climate-skeptical Chris Wright as energy secretary, the Trump Administration is almost certain to lift those restrictions, further exacerbating oversupply.

Trump has also boasted he will end the war in Ukraine on his first day in office. Beyond what may be a swift abandonment of the Ukrainian people, this could also mean lifting of sanctions on Russian natural gas exports – further flooding the global market.

LNG cheerleaders on this side of the border have been bombarding Canadians with ad campaigns promoting an additional six proposed export terminals. Trump’s election and ensuing oversupply would likely tank the business case for these projects no matter how much taxpayer’s money is thrown at them.

Trump’s planned tariffs of up to 60 percent on China would also lead to retaliatory tariffs from the world’s number two economy. The ensuing trade war would slow growth around the world, leading not only to higher interest rates and inflation, but lower global oil prices due to decreased demand. “America first means commodities second” warned Bank of America strategist Francisco Blanch in a post-election interview with Bloomberg.

The hidebound narrative within the oil patch is that Ottawa is their enemy. It would be a mistake to assume that Trump is their friend, regardless of any assumed ideological alliance.

It has been said that if someone tells you who they are, believe them. On that front, Trump has been clear and blunt: “we are going to take other countries’ jobs.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts