In a scathing 2023 report, University of Calgary researchers summed up provincial oversight of the oil patch with the following opening sentence: “Alberta policy on inactive and orphan oil and gas wells is a massive regulatory failure characterized by a historical lack of transparency, excessive regulatory discretion, and regulatory capture…”

That storied tradition apparently continues with recent news that the Alberta government will not seek to increase the security posted by oil sands mining operators despite ballooning mine reclamation liabilities that have more than doubled in the last six years to an official estimate of $57.3 billion.

Only 3 percent of this amount is currently covered by the Mine Financial Security Program (MFSP) meant to protect Albertans from footing the bill for mine clean-up costs that have doubled from an estimated $28 billion in 2018. During this period, the MFSP saw only a 17 percent increase – all of which was contributed by coal mining companies.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts

Oil sands operators have only contributed a single dollar to this fund since 2010 under rules that do not require them to make additional deposits until they have 15 years of profitable bitumen reserves remaining.

And what would happen if high-cost low-value Alberta bitumen became uneconomic to extract as the world shifts away from fossil fuels? The Alberta taxpayer would likely be left holding the bag for billions in mine reclamation costs, as they have for other unfunded messes foisted on the public by the oil industry.

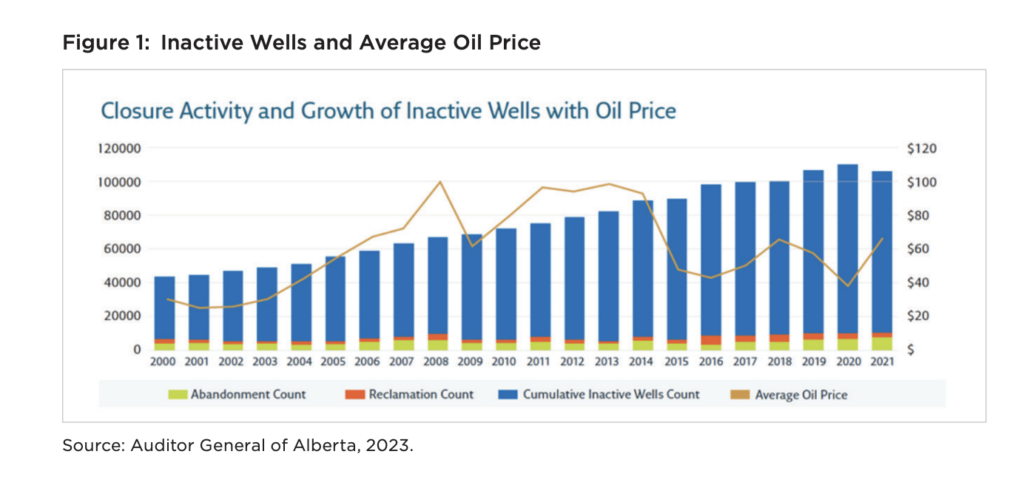

The Alberta Auditor General in 2023 pegged the clean-up costs from conventional oil and gas wells and pipelines at $60 billion. Yet the Alberta Energy Regulator (AER) has collected only $295 million in security from the companies it is allegedly overseeing. That would cover only 0.5 percent of this towering debt.

Put another way, the Alberta government has allowed each Alberta household to be on the hook for over $36,000 in unfunded well and pipeline liabilities racked up by an exceedingly profitable industrial sector. If you also include $55 billion in unfunded bitumen mine liabilities the tab for every Alberta home could exceed $70,000 per Albertan home.

Who’s in Charge?

However, even this eyewatering number might be a gross underestimate. Why? Because under AER rules, companies submit their own estimates of reclamation liability every year. Internal documents from 2018 obtained through freedom of information revealed the former AER Vice-President of Closure and Liability pegged the true liabilities as likely exceeding $260 billion.

The AER responded swiftly to this negative media coverage – not by reforming liability rules that are clearly inadequate – but by issuing a public apology for the release of the shocking numbers and announcing the resignation of AER president and CEO the day after the story broke. Problem solved.

So how could a regulatory body be so irresponsible with taxpayers’ money? Incredibly, the AER is not funded by the Alberta government; it is funded by industry it is tasked with regulating and has been since it replaced the Energy Resources Conservation Board (ERCB) in 2013. As the saying goes, “he who pays the piper calls the tune.”

The ensuing regulatory capture is reflected in public policy dating back over a decade. Oil sands operators were previously required by the ERCB to dry tailings fluids prior to closure under directive 074. The thick toxic waste stream from bitumen production consists of contaminated water, suspended clay, heavy metals and naphthenic acids with the consistency of yogurt. With no current treatment solution, tailings are instead stored behind leaky earthen dams in ever-growing volumes now exceeding 1.4 trillion litres.

Every oil sands company failed at their commitment in directive 074 to de-water this mess yet faced no penalties or regulatory consequences. Instead, the AER replaced the old rules with directive 085, which did away with this troublesome requirement. Problem solved.

Closure plans approved by the AER also allow companies up to 70 years after mining revenues cease to complete land reclamation using an unproven method called water capping. This dubious scenario involves pumping the toxic tailings slurry into empty open pits, covering it with water and calling it an artificial lake.

Mounting Risk

It is not as if companies cannot afford to post additional security to protect the Alberta taxpayer or invest in credible cleanup efforts prior to closure. Oil sands players racked up $35 billion in profits in 2022, much of which was shoveled into shareholder buybacks and dividends. Collecting reclamation bonds prior to companies going into financial distress is the obvious prudent path that is not being taken.

As they say in business, there is no free lunch. Oil companies may have captured provincial regulators, but private investors are seeing a mounting risk from environmental liabilities allowed to accumulate under such lax government oversight.

A recent investor brief warned, “the uncertain state of oil sands tailings reclamation creates regulatory, reputational, and litigation risks for investee corporations that could impact investors’ portfolios and shareholder value.” These risks will only come into sharper focus under new investor disclosure requirements soon coming into effect.

Oil sands investors may already be edging towards the door despite billions in buybacks, dividends and other shareholder inducements. Mutual funds and exchange-traded funds dumped $5 billion in oil sands private investment in the first half of 2024. Chevron just unloaded $6.5 billion in their oil sands assets, as did TotalEnergies in 2023.

A small number of Canadian-based companies specializing in bitumen extraction now control the vast majority of oil sands production. This worrisome concentration of unsecured liabilities further exacerbates the potential perils to taxpayers that have been allowed to grow larger each year.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts