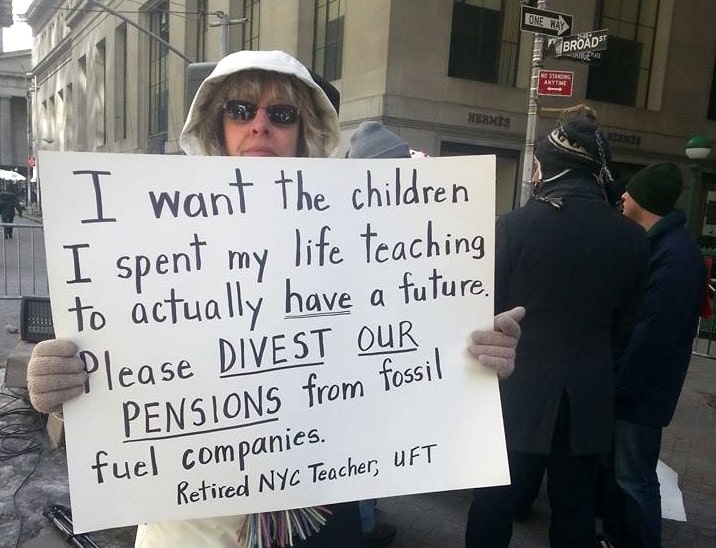

Monica Weiss attended her first fossil-fuel divestment protest on a frigid February day in 2015. She joined college students, financial experts, faith leaders, and then-New York City Public Advocate Letitia James in front of the New York Stock Exchange to demand that the city’s five public pension funds factor the financial risks of climate change into their investment decisions.

Over the course of her two-decade career teaching first and third grade in New York City public schools, Weiss infused nature and sustainability into her lessons. Now newly retired, Weiss had taken a look at her own pension fund — and didn’t like what she saw.

“You worked for it, you earned it, it’s there and it’s the next part of the journey, and then suddenly you realize there’s something really bad here,” says Weiss, who has a masters in environmental education and taught mostly immigrant students in Jamaica, Queens. “There’s something that’s directly contradictory to the purpose of my entire teaching career, which was to provide the best possible future for the youngsters.”

Whenever Weiss and other activists spoke with Scott Stringer, then the city’s comptroller, he would assure them that he agreed philosophically on divesting the pension funds — the Teachers Retirement System of the City of New York (TRS), the Board of Education Retirement System (BERS), New York City Employees’ Retirement System (NYCERS), and the city police and fire pension funds — of fossil fuel investments. However, he’d say, he also had a fiduciary obligation to protect the pensions of city workers.

“We understood that,” Weiss says. “Nobody in that position would just agree to divest. It wasn’t arbitrary, it wasn’t capricious, and it took a very long time with very, very thorough analyses.”

There were also successful precedents, says Weiss, pointing to the decisions TRS made to jettison investments in South Africa in the mid-1990s, and firearms in the 2010s. “They found a way to do this and continue funding pensions.”

In 2018, the city’s five funds began studying what divestment on climate grounds — including the imperative to move to clean energy to meet the nation’s Paris Agreement commitments — might entail. Subsequently, two independent reports suggested that the funds would “face high potential risk for economic disruption from the transition to a low carbon global economy” if they continued to invest in fossil fuel.

By the end of 2021, three of the city’s five pensions — the Employees’ Retirement System, the Teachers Retirement System, and the Board of Education Retirement System — had divested close to three percent of their total funds from more than 150 oil and gas related companies or funds, including Chevron, ExxonMobil, BP, and Shell, and stated that they would pace further divestment with ongoing evaluation of the risks.

Even though the police and firefighter pensions chose not to divest, Weiss says she considers it a major victory. “Five years of dedicated, strategic and relentless campaigning, unpaid, grassroots lobbying and activism, [and] we finally got Mayor de Blasio and Comptroller Stringer to agree to this.”

But the move has come under attack. Last May, four former and current city employees, joined by Americans for Fair Treatment, an anti-union advocacy group, sued the pension funds. They contend that current city Comptroller Brad Lander, who was elected in January 2022, is following his predecessor Stringer in “using that office to advance an environmental agenda at the expense of retirement security.”

On February 28, the Supreme Court of the State of New York is scheduled to hear oral arguments on the city’s motion to dismiss the lawsuit. “This is a meritless case, and we await the court’s decision,” said Nick Paulocci, director of public affairs and press secretary of the NYC Law Department.

Trump-era labor secretary Eugene Scalia, a partner with the law firm Gibson, Dunn & Crutcher, is the plaintiffs’ lead counsel, and has publicly stated that the case is aimed at discouraging other institutional investors from shedding fossil fuel holdings. As a lawyer, Scalia has an anti-union history, and has represented Chevron and the American Petroleum Institute in the past. Gibson Dunn employs nearly 90 lawyers involved in defending the oil and gas industry.

Public Pensions Control Trillions in Investments

According to the U.S. Census Bureau, there are more than 4500 public pension systems in the United States, with close to $5.5 trillion in cash and investments.

It’s unclear how much of that total is invested in coal, oil, or methane gas. According to the activist group Climate Safe Pensions, the California and New York State pension funds alone recently held as much as $20 billion in fossil fuel investments.

Inside Climate News has reported that New York City’s funds had about $3 billion in fossil fuel holdings prior to divesting them.

New York City’s pension funds collectively manage more than $264 billion dollars in investments. They are funded by tax dollars, employee contributions, and investment earnings. Investments supplied 78 percent of retirees’ checks in 2020 — nearly 10 percent more than the national average. Retirees are paid their full pension even if a given fund takes a dip.

For pension fund managers tasked with thinking far beyond the next quarter to the next decade or more, reevaluating their coal, oil, and gas holdings aligns with their fiduciary responsibilities. With a global shift off fossil fuels gathering momentum, and scientists exhorting the world to cut carbon emissions as fast as possible, the risks are growing that the fossil fuel sector may end up losing billions invested in oil and gas that it will have to leave in the ground.

Economist Gregor Semieniuk and earth scientist Philip Holden have found that these “stranded assets” could reach $681 billion, with investors including pension funds losing up to $164 billion.

According to a 2023 analysis, six major U.S. public pensions would have been about $21 million richer if they had divested from fossil fuels 10 years earlier. According to the study, led by Olaf Weber of the University of Waterloo, if the New York State Teachers’ Retirement System (which is separate from the city teachers’ fund) had shed fossil fuel investments in 2013, its value would have been about five percent higher by 2022.

Divestment Movement’s Roots

The climate-focused divestment movement has picked up on past activist successes. From the late 1970s to the early 1990s, at least 155 colleges, as well as a number of pension funds, withdrew investment from securities and stock related to South Africa, in protest of the country’s policy — and brutal enforcement — of racial apartheid. Hampshire College students led the way in pressuring their administration to pull funds, which they did after students occupied the science center in 1977.

This movement is widely credited with raising public awareness of the plight of Black South Africans, as well as increasing pressure on the United States and other powerful nations to oppose the apartheid policy.

Weiss joined the fossil fuel divestment movement when it was gaining popularity across the globe. Between 2012 and 2015, 220 institutions committed to redirect some or all of their fossil fuel holdings, a number that has only risen since. Included in the list of more than 1600 institutions that have committed to divest so far are American University, which in 2020 sold off $350 million in holdings that had some connection to fossil fuels, and the city of Baltimore, where Mayor Brandon M. Scott signed a bill obligating public pensions to divest by 2026.

Just this month, New York State Comptroller Thomas DiNapoli announced that the state’s Common Retirement Fund will divest about $27 million from eight oil and gas companies, including about $25 million of its shares in ExxonMobil. (Reuters reported that this is only a fraction of the fund’s $500 million in Exxon holdings, however, and the announcement got mixed reviews from campaigners. Journalist and activist Bill McKibben characterized DiNapoli’s move as “part of the slow, grinding shift away from a fossil-fueled world.”)

The oil and gas industry seems to be acknowledging the movement’s potential to affect both its brand image and its bottom line. Chevron noted in a recent Securities and Exchange Commission filing that divestment has the potential to “lead to negative investor sentiment toward Chevron and to the diversion of investment to other industries, which could have a negative impact on our stock price and our access to and costs of capital.”

‘I Hope Others Will Take Note of It’

In picking a fight over New York City’s pension divestment plans, the plaintiffs are acting locally and thinking nationally.

Kentucky, Oklahoma, West Virginia, and Texas have enacted legislation blacklisting “financial entities that engage in boycotts of fossil fuel companies for divestment purposes” from getting government contracts, according to a team of attorneys from the firm Thatcher and Bartlett who compiled a list of all anti-ESG legislation.

The lawsuit in New York is a cousin to these types of restrictions, and — as Scalia himself has stated — is designed to intimidate organizations considering divestment.

“I hope others will take note of it — plan trustees in other states and cities, who may be considering similar actions,” said Scalia at a Federalist Society function in September.

The plaintiffs “don’t want these large pots of money being treated as a weapon,” he said at the event, “that can be deployed by city politicians, city union leaders to pursue other objectives that hold more interest for them than managing the funds.”

Gibson Dunn declined to make anyone available to be interviewed for this story. Three plaintiffs in the case also declined to be interviewed or did not respond to requests for comment.

In 2021, Americans for Fair Treatment received $375,000 from the Dunn Foundation and $75,000 from the Searle Freedom Trust. Both groups are known to fund “climate change counter-movement organizations,” according to a study by Brown University professor Robert Brule and his colleagues.

In 2020, AFFT received legal services from The Fairness Center, which is funded in part by the Charles Koch Institute.

AFFT is also associated with the State Policy Network, a group promoting legislation opposed to environmental, social, and governance-based investing, or ESG. According to tax filings, the group gave AFFT a total of $110,000 in donations in 2019 and 2020.

AFFT was founded “to help public interest law firms identify plaintiffs to challenge different laws, specifically in the space where unions intersect with public employees,” CEO Elizabeth Messenger said on a 2023 episode of Giving Ventures, a podcast produced by DonorsTrust, a conservative donor-advised fund. DonorsTrust gave $64,450 to AFFT in 2022.

Americans for Fair Treatment did not immediately respond to DeSmog’s request for comment.

The suit focuses on proclamations by then-Mayor Bill de Blasio in 2018 that divestment would help fight climate change. “Our announcement sends a message to the world that a brighter economy rests on being green,” said de Blasio at a press conference announcing the city’s intention to move toward divestment.

“In presenting their plan, de Blasio and Stringer did not discuss, cite, or refer in any way to any financial analysis or study indicating that the wholesale divestment of fossil fuel holdings would be in the interest of plan participants and beneficiaries,” according to the complaint.

“The lawsuit puts the funds on notice that they can’t hijack worker savings to serve their own political purposes,” the Wall Street Journal editorial board weighed in when the lawsuit was filed last year.

The suit also contends that current and former city workers’ pension funds missed out on recent oil profits related to Russia’s invasion of Ukraine.

In its motion to dismiss the suit, the city argues that despite recent gains in the fossil energy sector, these stocks have returned just 0.58 percent when averaged over the past 10 years, much less than the market’s overall 10.5 percent gain over the same decade.

“Fossil-fuel companies are free to bet that their industry will continue to make money even in the face of expanding regulation, ever-rising temperatures, and the increasingly intense global impacts of climate change,” states the city in its filing. “But public pension funds are not required to bankroll that bet.”

The divestment decision “was a long, deliberative, thoughtful process that placed fiduciary duty above all else,” says Natalie Green Giles, who was a trustee of both TRS and BERS at the time.

Chloe Field, a fellow at the Sabin Center for Climate Change Law at Columbia Law School, says the suit is evidence that fossil fuel companies have become worried about the divestment movement.

“What they’re seeking is for the court to say, ‘You cannot divest wholesale from fossil fuels without violating your fiduciary duty as a trustee,’” Field says. “That’s really where they see the money in this case, is to set a precedent.”

But that’s not a strong argument, she says. “One of the reasons defendants say there’s not much of a case here is because there’s actually no financial harm to the pensioners,” Field says, referring to New York City pension recipients, because the funds aren’t at risk of losing any money.

With this case, Scalia may be aiming less to get New York City’s pension funds to reinvest in fossil fuels, and more to stem the financial and reputation problems that the divestment movement has already created for the industry — by making other potential divestors think twice.

“The financial arguments for moving on divestment are so strong and becoming stronger, almost on a daily basis,” says Richard Brooks, climate finance director at the group Stand.Earth, who regularly meets with public pension fund managers from across the country.

The suit has already had some of the desired chilling effect, according to Brooks, who campaigned alongside Monica Weiss nearly a decade ago to divest New York City’s pension funds from fossil fuels. “It has perhaps slowed down the announcement of some new divestment commitments,” he says. “But I don’t think it will stop the movement.”

Disclosure: Elizabeth Rosenberg formerly taught in New York City public schools for six years. When she retires, she will be eligible to receive a pension of up to $3700 per year from the Teachers’ Retirement System of the City of New York.

CORRECTION (02/28/24): The original version of this article stated that New York City’s pension funds manage more than $40 trillion dollars in investments. It has been updated to correct that amount to $264 billion. Collectively, more than 1600 institutions that have divested in part or entirely from fossil fuels to date hold over $40 trillion in assets, according to the Global Fossil Fuel Divestment Commitments Database.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts