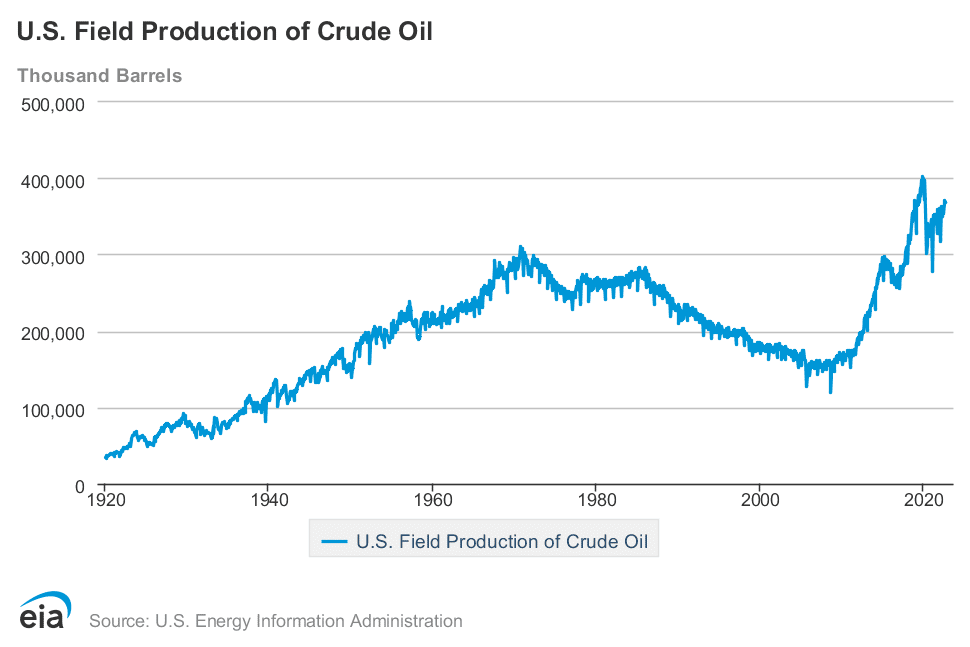

It appears that the U.S. fracking boom is ending far earlier than many industry experts and CEOs predicted. After an understandable dip in 2020 due to the pandemic, oil production still has not regained the record levels achieved in 2019, and predictions that the industry would set new records this year have not materialized, despite 2022’s high oil prices.

In late 2018, DeSmog first raised the alarm about the reality that the U.S. shale industry was likely to hit peak production much sooner than most experts expected.

At the time and since, the oil industry has continually promised big things for the future of U.S. shale oil production.

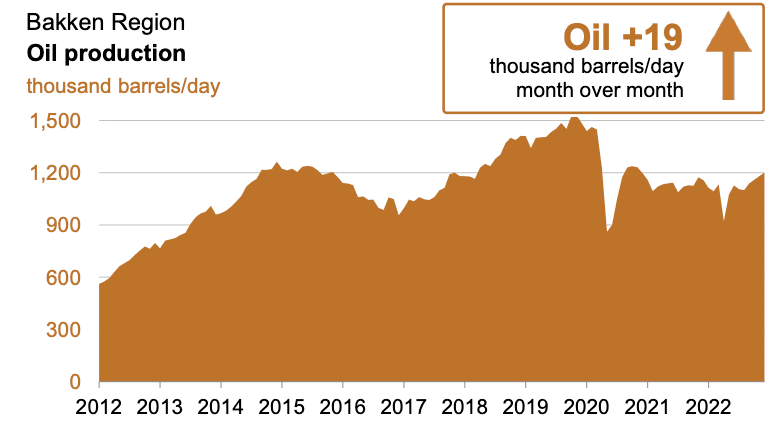

In 2017, Inside Energy reported that the governor of North Dakota was aiming to have the Bakken shale play produce 2 million barrels per day. In that same article an analyst for S&P Global Platts predicted that even in 2027 the Bakken would be producing 1.5 million barrels per day. The Bakken peaked at 1.5 million barrels per day in 2019 but has yet to return to that level.

Similarly, a 2019 article in industry publication oilprice.com noted that “there is a consensus in the market that the Permian Basin will be the dominant part of 2040 US oil supply.” In that article, industry analysts Rystad predicted the Permian could be producing 7.5 million barrels per day in 2040.

And in 2020, Rystad made optimistic predictions for the future of U.S. shale oil at its Energy 2020 Americas Virtual Annual Summit.

“If supply is to keep up with demand, we need a lot of shale volumes going forward,” Leslie Wei, Rystad’s vice president of E&P research, said according to reporting from S&P Global. “We believe shale needs to deliver 6 million -11 million b/d [barrels per day] from wells not yet drilled.”

S&P Global reported that conference panelists agreed that U.S. shale oil production could reach new highs, but that would require oil prices around $60 a barrel.

But those new highs have not materialized, despite oil being well above $60 a barrel for all of 2021 and 2022.

So what happened?

The Rocks Don’t Lie

There’s a saying in the oil industry: “The rocks don’t lie.” It means that regardless of what is predicted, geology calls the shots on how much oil can be extracted.

Although rocks don’t lie, it is becoming increasingly evident that the shale oil industry greatly over-promised how much oil it could produce and knowingly relied on flawed models. These faulty models inflated the amount of oil production promised to investors by up to 30 percent.

This deception by shale executives led shareholders of bankrupt oil and gas companies to sue the companies for fraud. Alta Mesa, a bankrupt shale oil company that is the target of one of those lawsuits, attempted to have it thrown out only to have the judge deny the request, noting that there was evidence of “requisite severe recklessness.”

The industry also harmed oil production by placing wells too close together — a practice resulting in what are called “child wells.” With more wells trying to access a fixed amount of oil in a shale reservoir, each well ultimately produced less oil. The models ignored this, but it was a big part of the reason the shale industry lost approximately a half trillion dollars in the first decade of its boom.

Whether due to over-estimation of production, or child wells cannibalizing production, all U.S. shale plays outside the Permian — which just set a new record for production — are producing at levels well below their recorded peaks. However, a closer look at recent data hints that the Permian is likely to follow the other major shale plays into decline. Last month, Reuters reported that in December 2020, new oil wells in the Permian produced a record of 1,545 barrels per day. New Permian wells are now down to 1,049 barrels per day.

Reuters columnist John Kemp recently questioned “Is the U.S. shale oil revolution over?” while an oilprice.com article stated that “U.S. shale production is peaking due to declining inventory quality and the inability of the industry to substantially increase drilling.” This week, independent energy analysts Enersection stated that “the U.S. shale boondoggle of capital infused growth is over for good.”

Now multiple forecasters across the US shale industry say they believe a peak and decline of both US oil and gas production is imminent in coming years /13 https://t.co/kro3hrToFH

— Dr Nafeez Ahmed FRSA (@NafeezAhmed) November 30, 2022

It seems the Energy Information Administration (EIA) has come to the same conclusion. In November, the EIA cut its U.S. crude production forecast for 2023 by 21 percent, although it still predicted a new record of 12.31 million barrels per day. However, that would only surpass the current record, set in 2019, by just 0.02 million barrels per day — practically a tie.

Shale oil CEO John Hess recently predicted that U.S. oil production would eventually exceed 13 million barrels per day, but there is a long history of oil CEOs offering rosy forecasts that never materialize.

Despite his optimism, he also noted that many U.S. oil companies have “about a decade of life remaining” and that “a lot of companies have already hit the wall.” But if oil prices over $120 a barrel didn’t spur production growth in the U.S. shale industry, it is likely nothing will, making 13 million barrels per day an increasingly unrealistic goal.

Pulling Production Forward Means Steeper Future Declines

The U.S. shale industry is in a Catch-22 situation. Producing more oil in the short-term to hit aggressive barrels-per-day goals means it won’t be there in the future. This would ultimately result in a much more rapid decline of the domestic shale industry after it peaks. Just as child wells cannibalize other well production, increasing shale production in the near term means less of this finite resource in the future.

The industry likes to blame the Biden administration, inflation, supply chain issues, and ESG for its inability to produce more oil. However, the reality is that the industry knows that it faces limited remaining reserves.

“You just can’t keep growing 15% to 20% a year,” Scott Sheffield, CEO of shale company Pioneer Resources, told the Wall Street Journal in February. “You’ll drill up your inventories. Even the good companies.”

When an oil company has depleted its inventories, its next move is usually bankruptcy, which often saddles the public with cleanup liabilities.

This new approach of shale oil companies managing inventory that Sheffield described, was also noted in investment advisors Goehring & Rozencwajg’s third quarter 2022 market summary, “Why won’t energy companies drill?” The newsletter explains that with finite good resources (known as Tier 1 acreage) left, executives were choosing to limit short-term production growth in their remaining acreage as “inventory management becomes more critical.”

Another way to see inventory management: It’s the first step of a managed decline for the industry.

Despite Facing Peak Production, Industry Building More Export Capacity

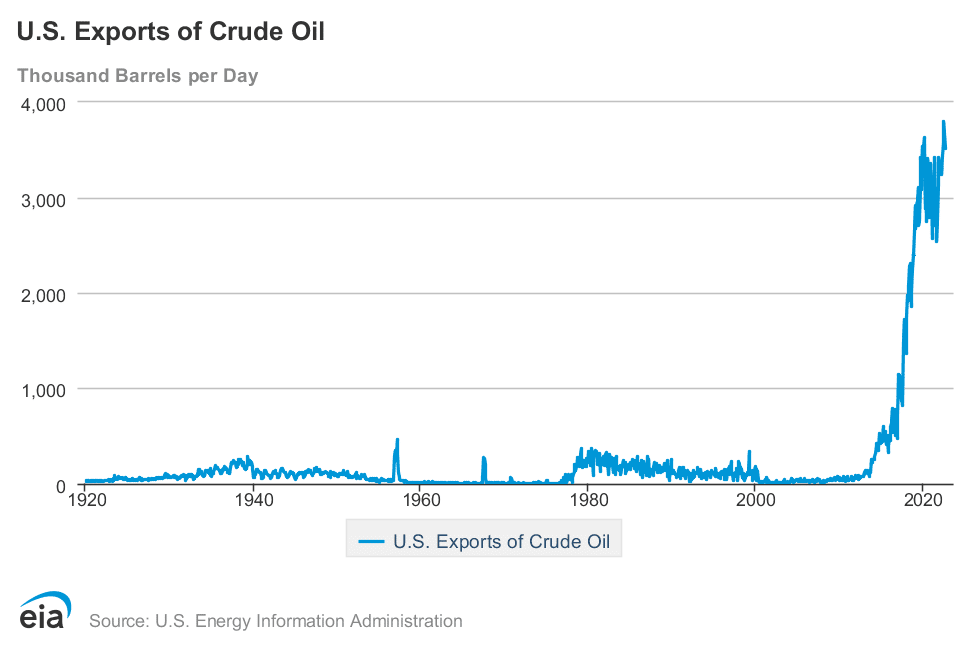

In 2015, the lifting of the U.S. crude oil export ban unleashed a massive expansion of domestic fracked oil. However, as a result of being able to sell oil for export, many companies drilled their best acreage much faster than if the crude export ban had remained in place.

Now facing a lack of good acreage, the industry’s inability to increase production is limited — and the growing acknowledgment among analysts, industry executives, and the EIA is that the U.S. oil industry is likely to peak soon. Despite this, the Biden administration approved a large, new crude oil export terminal in November.

The Sea Port Oil Terminal (SPOT) is planned to be built 30 miles off the coast of Texas, where it is deep enough to provide access to the largest crude oil carriers that can’t navigate most shallower ports.

The owners of SPOT justify the need for this new infrastructure — which will be able to export 2 million barrels per day — by saying they expect the U.S. will export 8 million barrels of oil per day by 2025.

But the math doesn’t add up.

U.S. crude oil exports averaged just under 3.5 million barrels per day in the first 11 months of 2022. With U.S. shale oil peaking, how are exports expected to more than double?

There are three options — all of them bad and unrealistic. The first would be simply to take the oil currently being supplied to U.S. refineries and export it. This would send domestic gasoline prices skyward and crash the economy.

The second would be to bring Canadian oil to the Gulf Coast for export. The United States imported an average of 3.8 million barrels per day of Canadian crude through the first 9 months of 2022, with most of that going to U.S. refineries. In 2021, the U.S. exported a record amount of Canadian crude from the Gulf Coast, but this amounted to a mere 180,000 barrels per day. To be exporting 8 million barrels of oil per day, the United States would need to vastly — unrealistically — scale up the amount of Canadian crude it imports and then exports.

The final non-starter option would be to produce another 4.5 million barrels per day of U.S. shale oil by 2025. That would require the industry to find another shale play comparable to the Permian, which is unlikely to happen since few people are currently spending the money to look for new shale oil “hot spots” in the United States, as the Wall Street Journal reported.

The SPOT export terminal perhaps made sense in 2019 when Rystad was predicting a big and bright future for U.S. shale. Now it is likely to be a stranded asset, and it is not the only crude oil export terminal in the works: three others are being planned, for a total of 6.5 million barrels per day of export capacity when combined with SPOT.

However, that the United States will ever have 6.5 million barrels of oil per day to export is highly unlikely as the oil simply isn’t there — remember, the rocks don’t lie. Finite resources are real constraints that no magical thinking or predicting by the industry can overcome.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts