The world’s largest certifier of carbon offsets has criticised an initiative to improve governance in the notoriously opaque sector, saying draft reforms are so stringent they would choke off investment to combat climate change.

Verra, which runs a carbon crediting standard used by hundreds of companies to offset their carbon dioxide emissions, said the Integrity Council for the Voluntary Carbon Market (IC-VCM), a new governance body, needed a “course correction” to deliver workable proposals.

“Our support for the IC-VCM has been shaken,” Verra said in a statement. “That said, we plan to continue engaging in this process to ensure that carbon finance can drive increasing amounts of investment for real climate action.”

Verra’s intervention came as the Integrity Council nears the end of a two-month public consultation on its draft proposals – known as Core Carbon Principles. The 124-page document was drawn up by a panel of experts aiming to address widespread concerns that carbon offsetting often fails to deliver promised climate benefits, and that badly-run projects can harm local communities.

Integrity Council Chair Annette Nazareth welcomed Verra’s comments, saying input from a wide range of stakeholders would help ensure the final proposals struck the right balance between “ambition” to set higher standards and “pragmatism.”

“That is going to be critical to strengthen trust in the voluntary carbon market and unlock urgently-needed investment,” Nazareth, a former commissioner with the U.S. Securities and Exchange Commission, said in a statement to DeSmog.

Verra’s criticisms underscored the fundamental tension involved in reconciling polluting companies’ demands to rapidly scale up the carbon offset market with the need to introduce tougher standards to guarantee project quality.

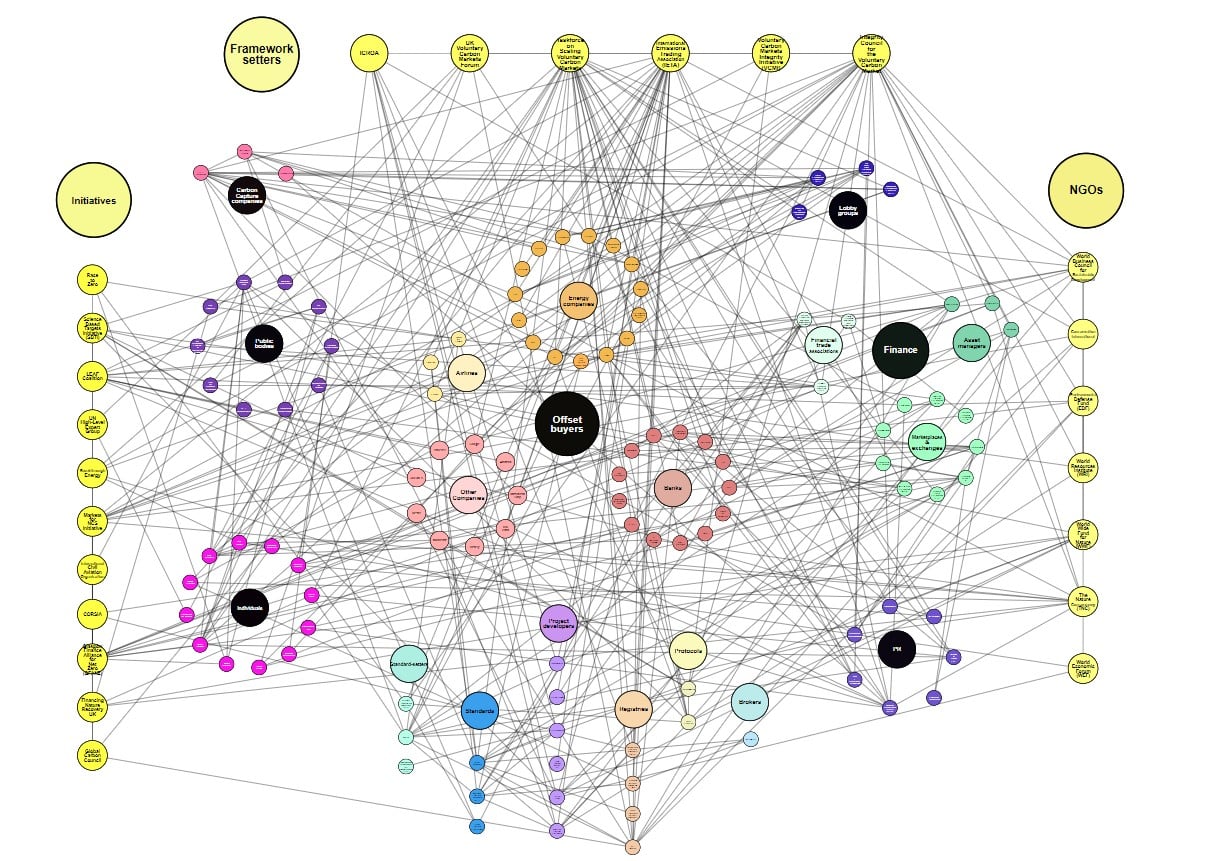

Major emitters such as banks, airlines and oil companies are flocking to what are known as “voluntary carbon markets” to help meet net-zero targets by financing projects that tackle emissions elsewhere. Each carbon credit represents a tonne of carbon dioxide that has either been reduced at source or removed from the atmosphere – often through schemes to protect tropical forests or other ecosystems.

Credit: Phoebe Cooke and Michaela Herrmann

Advocates say that rapidly scaling up carbon markets could mobilise billions of dollars to protect nature in developing countries, and finance the adoption of cleaner technologies. But climate campaigners have long documented how projects often fail to deliver on their promises. There are also concerns that much of the money companies spend on carbon credits ends up in the hands of “carbon brokers”, rather than Indigenous communities stewarding project sites.

Campaigners accused the Integrity Council’s predecessor, the Taskforce on Scaling Voluntary Carbon Markets, of effectively handing polluting companies a “get out of jail free card” by focusing on growing carbon markets as rapidly as possible.

The Integrity Council, which replaced the Taskforce in September, has sought to address that criticism by emphasising the importance of screening out offset schemes that may not deliver promised benefits, or could harm local communities by enabling land-grabbing or other human rights violations.

Pedro Barata, the co-chair of the Integrity Council’s 12-strong panel of experts that drew up the draft Core Carbon Principles, told DeSmog in July that his colleagues had laid out robust environmental and social safeguards for projects, and had “put the bar high”.

Campaigners have warned that existing market players would attempt to push back on higher standards since tougher rules could undermine their existing business models.

Verra said its initial analysis suggested the principles were so exacting that few, if any, credits would pass the test – which might satisfy “purists” but do nothing to scale investment in climate solutions.

The company, which runs its own widely-used Verified Carbon Standard, also raised concerns that the “principles-based review of programs” had been “supplanted with a blunt, one-size-fits-all approach that seeks to directly set the scope and rules of the market”.

Verra called for an “alternative approach” which did not “usurp” the work of existing crediting programs.

“In short, the proposed approach will not only fail to create a workable pathway to achieve the IC-VCM’s goals, but significantly harm the voluntary carbon market by enshrining a process that sets impossible requirements, is impervious to input from a range of stakeholders, and is unworkable from an administrative standpoint,” Verra said.

The Integrity Council’s public consultation closes on September 27.

Editing by Matthew Green.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts