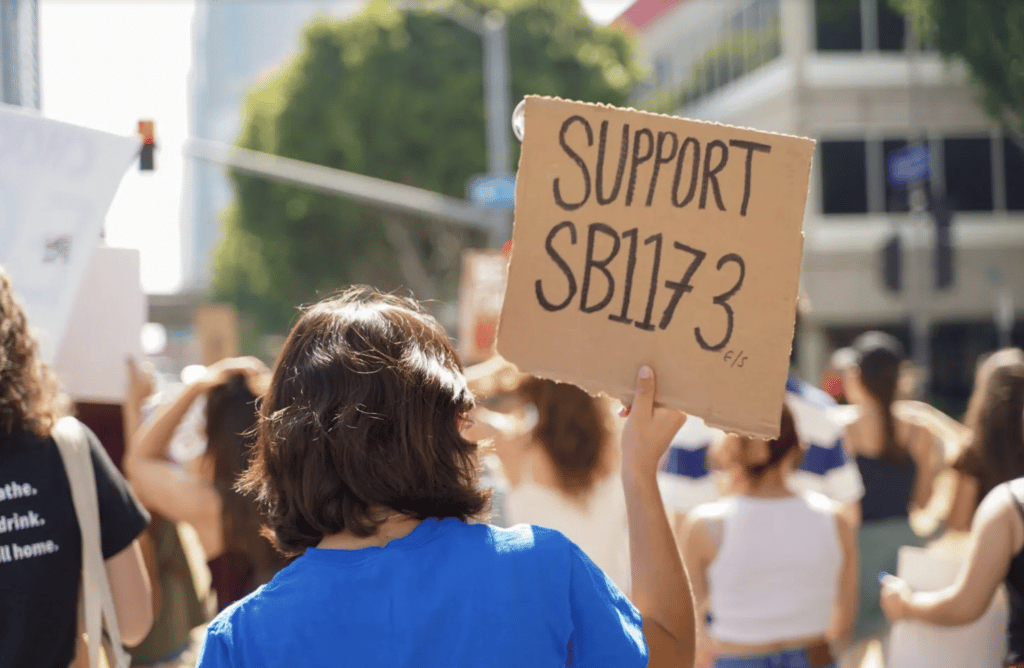

The California legislature was close to passing a bill that would require the state’s two massive pension funds to divest from fossil fuels, but on June 21 the legislation was killed by one Democratic assemblyman who has accepted tens of thousands of dollars in campaign contributions from the energy industry.

Senate Bill 1173 would have required the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS), the two largest public pension funds in the country, to divest from fossil fuels. CalPERS and CalSTRS, which manage pensions for state employees and teachers, together hold more than $9 billion in fossil fuel investments.

The global divestment movement now claims that more than 1,500 institutions have divested from fossil fuels, representing more than $40 trillion in value. New York and Maine have also committed to phasing out fossil fuel investments from their public pensions.

But because of the size of the two California pension funds, their divestment from fossil fuels would be a significant achievement for the global movement. The call comes as the state continues to suffer from long-term drought and catastrophic wildfires that are worsening with climate change. Activists say that the state cannot claim to be a leader on climate action while maintaining billions of dollars’ worth of investments in the fossil fuel industry.

Senate Bill 1173 would have required the pension funds to divest by 2027, and the legislation had the support of the California Faculty Association, the California Federation of Teachers, associations representing higher education faculty, and roughly 150 environmental and activist organizations.

However, the American Legislative Exchange Council (ALEC), a corporate-backed front group with ties to the oil industry, opposed the bill, warning that divesting from fossil fuels would put public sector pensions in financial jeopardy.

The bill already passed the state senate, and still needed to pass in the state assembly, where Democrats command a large majority. But the bill needed to move through the Committee on Public Employment and Retirement, where Democrat Jim Cooper (Sacramento) is Chairman.

On June 21, Cooper decided to let the bill die in committee, refusing to even bring it up for a hearing. Environmental groups denounced the “one-man veto.” Cooper has accepted more than $36,000 from the oil industry and other polluters over the past two years, including donations from Chevron and ExxonMobil, according to data compiled by Sierra Club, which called him a “Democratic favorite of the oil and gas industry.”

“Jim Cooper just decided to continue investing public money in the unequal suffering of my community,” said Lizbeth Ibarra, an activist with Youth vs. Apocalypse, a California-based climate justice organization.

In a report published in May, the Sierra Club found that in the last two years, a growing number of California state legislators have been taking fossil fuel money, and the number that have refused fossil fuel donations is dwindling. California Republicans and their political action committees took in far more than Democrats, but Cooper’s unique position of power proved decisive in the scuttling of the divestment legislation.

When asked for comment, a spokesperson for Assemblyman Cooper pointed to an official statement released on June 21. “With a looming recession, the Legislature should be looking at ways to protect the solvency of our pension systems, and should not be considering any proposals that negatively affect them,” Cooper said. “Throughout my time as Chair of the Assembly PERS committee, I have strongly opposed any proposals that require CalPERS or CalSTRS to divest from a particular entity or industry.”

But proponents of the legislation say that the bill had the backing of public sector employees, who not only want to see climate action, but do not want their retirement funds tied up in the industries responsible for the climate crisis.

“While I am deeply disappointed that my Senate Bill 1173 was not set for a hearing in the Assembly Committee on Public Employment and Retirement this week, I remain committed to the necessary and ongoing fight against the impacts of climate change on our state, and especially those communities in my district that are disproportionately impacted by the negative effects of the climate crisis,” said Senator Lena Gonzalez (D-Long Beach), a sponsor of the bill, said in a statement. “Teachers and state employees whose retirement futures are invested by our state’s pension funds have long demanded that CalPERS and CalSTRS cease investing their money in fossil fuel companies, and this demand will only grow stronger and louder.”

Engagement with oil industry, or legitimizing it?

The two California pension funds have pushed back against the calls for divestment, and the justification to maintain fossil fuel investments rests on two main arguments. First, the suggestion that divesting would be costly. And second, that holding shares in oil companies gives the pension funds a “seat at the table,” which allows them to press the industry to clean up its act.

But environmental groups say that logic doesn’t stand up to scrutiny. A report in May from Fossil Free California concluded that the pension funds “have wildly exaggerated losses from past divestments” in industries such as tobacco, fire arms, and coal, to justify their position of maintaining investments in oil and gas.

And a more recent report from the group argues that not only are the pension funds failing to push the oil industry to take action on climate change, just this year both CalPERS and CalSTRS went a step further. The two funds instead used their positions as investors in fossil fuel companies to vote against corporate shareholder resolutions calling for emissions targets from several large publicly-traded oil companies, including BP, Equinor, Occidental Petroleum, Royal Dutch Shell, and Woodside Petroleum.

The two retirement funds also voted against all climate resolutions considered by shareholders of American and Canadian banks this year, according to the Fossil Free California report.

“By voting against proposals to mitigate climate change at the very companies they claim to influence, CalPERS’ and CalSTRS’ shareholder activism is not only ineffective — it’s undermining climate action,” Fossil Free California stated in its report.

CalPERS declined to comment.

“CalSTRS believes climate change is one of the greatest threats to the future, with undeniable links to business and financial investments. The vast impacts of climate change threaten health and safety, our environment, and the global economy, which put the CalSTRS investment portfolio at risk,” Barbara Zumwalt, a spokesperson for CalSTRS, told DeSmog. “Divesting from fossil fuels ignores the larger climate change risks to the portfolio. CalSTRS’ approach is more holistic and includes measuring emissions, engaging directly with companies, working to expand government policies, and investing in solutions.”

Youth activists dismiss those claims, and blame the pension funds for facilitating business as usual.

“CalPERS and CalSTRS have been invested in these companies for decades, and during that time, their ‘engagement’ has come nowhere close to stopping the harm to my community or our world,” Ibarra said. “Instead, fossil fuel companies have put billions into lies and disinformation to stop life-saving action on climate and pollution, and billions into exploiting more and more dangerous forms of fossil fuel extraction. They’ve been responsible for causing sickness and death to the 2 million Californians who live within a mile of fossil fuel infrastructure, a disproportionate amount of whom are Black and Brown communities like mine.”

Despite the demise of the legislation, divestment activists vowed to bring the issue back to the state legislature next year.

“Today is a sad day in the history of California when the fossil fuel industry and its political allies defeated the will of the majority of CalSTRS and CalPERS beneficiaries and silenced the voices of the majority of the citizens of our great state,” said James Stone of Southern California Divestment Network. “This defeat is just a temporary setback, however. We will organize to come back stronger to make our demand for fossil fuel divestment heard because fossil fuel companies are driving us toward unimaginable disaster and neither CalSTRS and CalPERS management nor our elected representatives are doing enough to hold them accountable. We must prevail because our common future is at stake.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts