Natural gas’s notorious price volatility has been making a comeback — in a big way.

The UK is experiencing a natural gas price surge so severe that the government stepped in to prevent a cascade down the supply chain that threatened to create food shortages. In the U.S., deals to sell natural gas this winter carry a price tag that’s roughly double or triple the costs in recent years, with a few traders placing bets that U.S. prices could multiply again, hitting $40 per thousand cubic feet (mcf), up from about $5 now. Major bank Citi said it won’t rule out $100/mcf for cargoes of liquefied natural gas (LNG) this winter, a tab for the supercooled form of the fossil fuel that’s used to ship it between continents which dwarfs even today’s record-setting heights.

Today’s price surges follow gas price spikes during the Texas freeze last February that shattered cold-weather records across the U.S. South and caused widespread power outages. Hundreds of people died as a result of the arctic blast, while gas producers whose product managed to make it to market reaped an $11 billion windfall — and now face allegations of price gouging.

Already, the natural gas industry and its backers have begun casting blame on others for the gas market’s upheaval, suggesting that consumers hold the industry’s proposed villains responsible for the industry’s price issues.

In reality, a wide range of factors — starting with a blast of LNG exports that now consumes roughly 10 percent of the United States’s total gas production — have launched prices higher in the U.S. And shale drillers themselves have proved reluctant to drill more wells even as prices lurch up — a fact that stems far more from drillers’ own wild overspending during the shale rush (and the resulting wave of bankruptcies and cratered stocks) than from anything related to, say, proposed-but-not-implemented climate policies or a small but growing shift to renewable power.

But there’s no shortage of examples of industry advocates suggesting the public should blame renewables for upheaval in the natural gas market. “The situation illustrates the intermittency problem with renewables like wind and solar power and how outages can increase demand for fossil fuel generation,” Energy In Depth, a project of the Independent Petroleum Association of America that is run by FTI Consulting, wrote about Europe’s gas price crisis on September 22. “In many parts of the world, you’ve overbuilt wind, you’ve overbuilt solar,” one Goldman Sachs executive told Bloomberg TV. “We’ve made the case that dropping natural gas and oil from the U.S. energy portfolio, heavily relying on come-and-go energies, is unwise, bordering on foolishness. It’s disconnected from reality, a reality that’s playing out right now in Europe,” a September 29 American Petroleum Institute post reads.

Attempts to pin the blame for natural gas price swings on renewables drew immediate pushback from the International Energy Agency (IEA). “Recent increases in global natural gas prices are the result of multiple factors,” IEA Executive Director Fatih Birol said in a September 21 statement, “and it is inaccurate and misleading to lay the responsibility at the door of the clean energy transition.”

The reality too is that natural gas has long suffered from wild price swings and volatility that — while tamped down in the recent past by the shale gas glut — just might be re-emerging into a pandemic-pressured world.

these gas price spike charts look like ppm concentrations…. https://t.co/kur6wcGsur

— Ketan Joshi (@KetanJ0) September 29, 2021

In the U.S., the past decade was marked by a shale gas production glut that was perhaps dwarfed only by the industry’s own hype, as leading executives gushed over “two Saudia Arabias of gas” in the U.S. and politicians promised an era of American “energy dominance.” The shale rush rapidly expanded into oil, the fossil fuel used to make gasoline (gasoline is the “gas” you use to fuel your car — which, confusingly, is an entirely different thing from natural gas, an odorless, colorless, lighter-than-air fuel that can be burned in homes for heat and at power plants to make electricity.)

But while an extraordinary amount of both oil and gas unleashed by fracking flooded U.S. markets, a growing number of outside observers warned that fracking looked financially unstable and that spending was outpacing earnings by too large a margin.

Today’s natural gas price volatility — arriving months before winter — raises new questions about risks associated with allowing the unpredictably priced fuel to play a growing role in the nation’s energy mix.

‘Abundant’ Gas ‘Ensures Less Price Volatility’?

Say what you will about Aubrey McClendon, the one-time CEO of Chesapeake Energy who died in a fiery one-car crash in 2016 while under investigation by the Department of Justice, he was by all accounts an extraordinary salesman.

Fracking’s fiercest front man, McClendon spent his career championing methane molecules (the primary component of natural gas), as he ran Chesapeake Energy through wild booms and at least one staggering bust.

Excellent (and sad) story about the last days of energy billionaire Aubrey McClendon https://t.co/8YfOP7nJxF pic.twitter.com/4ujbPcZYTY

— Henry Blodget (@hblodget) March 12, 2016

Perhaps one of McClendon’s biggest and most enduring feats was convincing America’s energy policy experts that fracking had finally abolished the notorious Achilles’ heel that had always hobbled natural gas and kept it from carrying its full weight in America’s energy systems: its price volatility.

For decades, the U.S. power supply was dominated by coal, which historically pumped out the cheapest — and, by many measures, the dirtiest — electricity around. But coal power was also inflexible and slow — and utilities need to be able to respond rapidly when power demand surges. That’s where natural gas stepped in.

“Definitely not something that they would be relying on for baseload power or high utilization,” Mark Dyson, a senior principal at RMI, a research nonprofit focused on the clean energy transition, said, describing how utilities viewed natural gas about a decade ago, before the fracking boom. Gas could be scarce when demand was high and the electricity it generated tended to be significantly more expensive than that from coal.

Shale gas could change all that, McClendon argued, by making methane supplies abundant.

The vital importance of that idea to McClendon was on display when he arrived to give a talk at Harvard University on February 24, 2010, opening his talk by promising a “different thought” on energy for attendees. “And that different thought is that natural gas is abundant,” he told those gathered.

The word “abundant” became an enduring watchword for natural gas advocates — in part because an abundant supply not only drives prices down, it can keep upward price volatility at bay by ensuring demand doesn’t outpace deliveries.

Utilities were wary, at least initially. “Consumers such as the chemical industry and competitive power generators have been reluctant to commit to U.S. natural gas because of the perception that natural gas prices exhibit unacceptable volatility. These consumers base their lack of trust on history, both long-term history and the very recent behavior of the natural gas market,” one 2010 report prepared for The American Clean Skies Foundation — a now-defunct organization founded by McClendon — observed, adding that gas development was “seriously undermined by a lack of trust in price stability.”

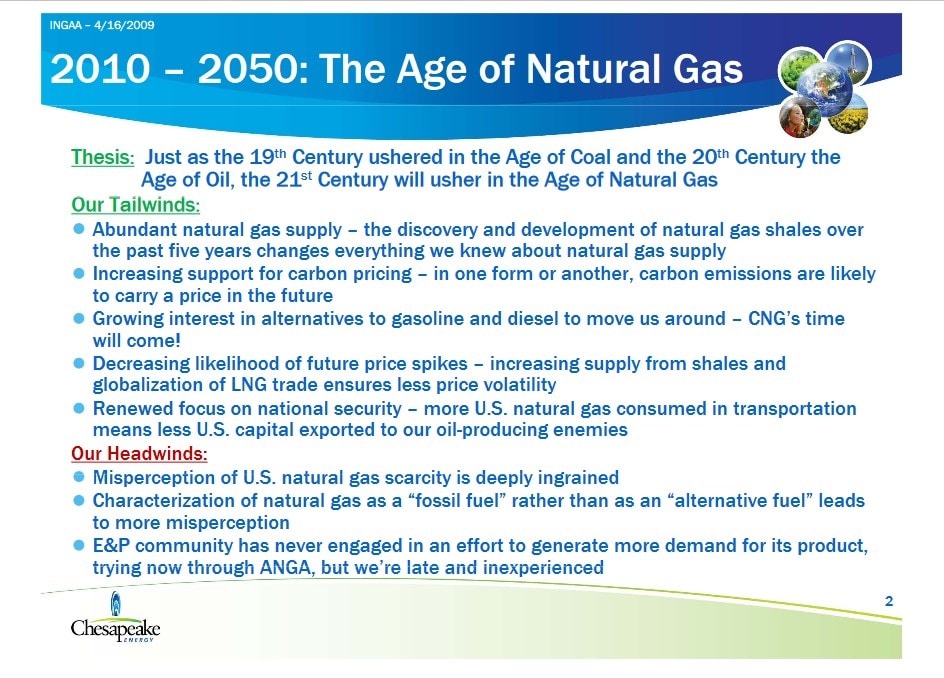

To assuage those sorts of fears, Chesapeake Energy began marketing the idea that 2010 to 2050 would be a golden era for natural gas.

Fracking would offer an “abundant natural gas supply” for decades to come, one Chesapeake slideshow from around that time predicts, “decreasing likelihood of future price spikes” while the “increasing supply from shales and globalization of LNG trade ensures less price volatility.”

Chesapeake Energy did not respond when asked if the company still foresees an era of extended low natural gas prices and less likelihood of price spikes.

Spending Spree

For about the last dozen years, natural gas prices in the U.S. were indeed driven down aggressively by fracking. Excitement over the new technology spurred investors to gamble massively on the shale rush.

As capital rushed in, drillers flooded the market with so much gas that prices plummeted from over $16/mcf in 2008 to about $2/mcf in January 2020. A “drill baby drill” mentality and management incentives based on gas production growth, not earnings, opened a seemingly limitless tap of the invisible fossil fuel.

That gas found ready buyers among utilities eager to shift away from coal.

But as natural gas prices kept falling, shale drillers’ earnings always seemed to drop a little lower than their investors might have hoped — and by this summer, shale oil and gas companies had spent $300 billion more than they’d earned from selling the twin fossil fuels, according to Bloomberg.

Last year, after the COVID-19 pandemic threw the oil industry — along with much of the rest of the world — into turmoil, Wall Street nearly abandoned the industry (with analysts at Deloitte writing that “beneath this phenomenal growth, the reality is that the shale boom peaked without making money for the industry in aggregate”).

“The cheap natural gas thesis always hinged on the idea that Wall Street — Wall Street in particular — would continue to fund a gas glut,” Clark Williams-Derry, an energy finance analyst at the Institute for Energy Economics and Financial Analysis, told DeSmog. “And it looks like they’re not so interested anymore.”

“The gas industry is being asked to live within its cash flows and when it does that, it keeps production flat,” he said, adding that in some heavily drilled regions of the United States, producers have begun reaching the limits of short-term tactics that have kept production buoyed, like tapping their backlog of wells that had been drilled but never completed.

DUCs soon done. In 2022 we will finally know real field decline rates pic.twitter.com/o2JR25m4o5

— Alexander Stahel (@BurggrabenH) October 1, 2021

Some of gas’s competitors in the power sector pushed for LNG exports in the hopes of driving domestic natural gas prices up, Williams-Derry noted, pointing to a May 2016 meeting between candidate Donald Trump and coal magnate Bob Murray (a meeting where Trump memorably assured the coal baron that he’d support LNG exports, then asked, “what’s LNG?” in Murray’s recounting). “The hope is if more natural gas can be exported, it might reduce the glut in the U.S., which has driven prices so low that it’s killing coal,” Vox reported at the time.

Today, that strategy just might be working: as LNG exports ramp up, domestic gas prices are rising too. “In an era of low gas prices, volatility means ‘up,’” Williams-Derry noted, explaining that when natural gas prices hover near the floor, there’s limited ability for prices to move down but unlimited room for prices to rise.

But the road ahead seems bumpy, in part because LNG prices themselves are notoriously hard to predict.

“We’re exporting LNG,” Williams-Derry said. “We’re importing volatility.”

‘Very Exposed’

This August, Bloomberg declared “the era of cheap natural gas is over.”

If today’s higher prices do indeed hold, that’d be very bad news for utilities that spent massively on new power plants that burn natural gas. Ten years ago, America’s utilities got the biggest chunk of their electrical power from coal, followed by natural gas at a distant second (then nuclear and finally renewables like hydroelectric, wind, and solar).

These days, natural gas has taken over the lead, providing about 40 percent of U.S. electricity in 2020, with coal plunging to just 19 percent of the energy mix, surpassed even by renewable energy sources’ 20 percent. Utilities went on a natural gas power plant construction binge in the 2010s, investing billions in new power plants and the infrastructure to support them.

56% of new U.S. electricity-generating capacity additions in the fist half of this year were solar. 37% was wind. A decade ago, 33% was coal but it's clear that we're now shifting away from coal and natural gas toward solar and wind. pic.twitter.com/mi7DZy7NGh

— Meghan Nutting (@MeghanNutting) October 3, 2021

“The glut of construction in gas-fired power has left the electricity sector here very exposed to that globally traded price,” RMI’s Dyson said. “And we have in some sense guaranteed volatility in the domestic price of gas and therefore domestic electricity prices because of the expansion of LNG export capacity in this country.”

That boom in natural gas power plant construction also has major consequences for the climate — since right around the time that the fracking rush kicked off, scientists at Cornell University first warned natural gas’s methane leaks were so severe throughout its life-cycle that gas-fired electricity was worse for the climate than coal-fired power in the short-term.

On the supply side of the gas market today, there might be trouble brewing. This year, for the first time, some analysts say, frackers may be forced to spend only as much as they earn, keeping a lid on supplies.

“The other key thing about shale is you have to keep drilling,” David Hughes, a Post Carbon Institute fellow who has for many years taken federal energy analysts to task for their unrealistically rosy views of shale gas, told DeSmog. “New wells decline 85-90 percent in their first 3 years. So a vicious treadmill” for drillers.

Exports of LNG, meanwhile, are expected to accelerate, propelled in part by today’s massive gap between the price natural gas sells for in the U.S. and the far higher price LNG fetches on the global market. The capability of U.S. industry to chill LNG for export has also taken off after hovering near zero for many years, with two new export projects along the Gulf Coast, Cheniere Energy’s Sabine Pass Train 6 and Venture Global’s Calcasieu Pass, expected to start shipping gas this winter, RBN Energy notes. Industry forecasters predict that LNG export terminals will run at full capacity this year, driving 12.2 billion cubic feet of gas per day off U.S. shores.

Already, natural gas prices have dealt a brutal blow to the claim, popular in the Obama era, that fracking would give the U.S. a valuable card to play against Russia, a major natural gas exporter, when it comes to foreign policy. “This market reality also exposes another flawed idea that gained traction over the years: that U.S. LNG could protect Europe against Russia,” the Center for Strategic and International Studies’ Chair for Energy and Geopolitics Nikos Tsafos wrote in a September 24 commentary. “The proposition itself has always been suspect, reducing a complex system into a two-player game. In today’s market, its hollowness is even clearer. U.S. LNG, like other LNG, responds to market forces, and if other markets are willing to pay more than Europe, Europe has no immediate remedy. New supply, including from the United States, can offer a bargaining tool that keeps prices in check in the medium to long term. But it is no response to a short-term shock.”

The news is full of fossil fuel price spikes causing political chaos and fossil fuel spills causing ecological devastation and I just want to remind everyone that one way to avoid these problems would be to stop using fossil fuels. pic.twitter.com/MOxfjXPq5U

— David Roberts (@drvolts) October 5, 2021

Even at very low natural gas prices, the costs of wind and solar energy have fallen so far that it’s difficult for gas to compete on the economics for power generation. “The interesting thing is that the gas price doesn’t change the outcome that much, at least given the shifts that we’re seeing,” Dyson, who authored a 2019 RMI study that found low-cost renewable energy was already making natural gas power uncompetitive, told DeSmog. Most proposed gas plants today are “uneconomic” even if gas costs just $3/mcf, he said. “Those plants don’t compete against clean energy.”

Natural gas price volatility, however, adds another layer of difficulty for gas sellers, making gas not just expensive but also hard to budget around. “When you really need them, they’re really expensive,” Dyson said about gas power plants.

Dyson said it was too early to say for sure that price volatility is permanently back in the gas market after the fracking frenzy’s glut. “It’s hard to say how much this is an indicator of structural challenges or structural shifts versus the craziness that COVID and the slow bounce-back from COVID has imposed on not just the upstream and midstream fossil fuel sector but also just the whole economy,” he told DeSmog.

“Current natural gas prices remain relatively low and stable compared with history,” Jake Rubin, a spokesperson for the American Gas Association, a trade organization representing natural gas utilities, told DeSmog in response to questions about higher prices and price volatility. “A short-term change in prices reflecting market fundamentals does not alter the fact that the U.S. has significant natural gas resources and an extensive delivery infrastructure that helps grow the economy and meet our environmental goals. This winter, natural gas is still positioned to be the most affordable fuel for heating your home.”

The American Gas Association publishes an annual winter outlook on prices for gas as a heating source and their outlook for this coming winter is expected later this month. A spokesman pointed to a Department of Energy forecast published earlier this summer that predicted natural gas would remain the least expensive fuel for home heating this winter.

Meanwhile, many energy industry experts and policy-makers have begun to speak openly again about the erratic nature of natural gas and LNG prices.

“Today’s situation underlines that we have to end our dependence on foreign volatile fossil fuels as soon as possible,” European Union Energy Commissioner Kadri Simson told a press conference on September 22. “LNG is now being looked upon as a commodity with volatile prices,” an official from GAIL, India’s state-owned gas utility, told the Gastech trade conference on September 23. “The market is super tight so not much needed to move the needle and blow up the market,” Oystein Kalleklev, CEO of Flex LNG, told Bloomberg. “Strong volatility is surely not done, and in fact is likely just getting started,” Bespoke Weather Services, a forecaster used by natural gas traders, wrote in a note to clients, Natural Gas Intelligence reported on September 29.

😬 Crazy natural gas price surge in Europe.

— Dr. Robert Rohde (@RARohde) October 5, 2021

Good news for Russian oligarchs, coal interests, and heat pump salesmen.

Bad news for Europeans using natural gas for heating, cooking, or electricity.

A clean energy transition can also make the world resistant to fuel price spikes. pic.twitter.com/MSK3I8SF9I

And, although there are regulatory tools to protect consumers from the worst of the gas market’s swings, when natural gas prices surge, consumers — both industrial users and households relying on it for home heating or power — often ultimately take the hit.

That doesn’t have to be inevitable, Dyson noted, describing tactics that a few state regulators have begun adopting to protect customers. “Hawaii is an example of a state that’s tried to make the utility accountable for decisions that it makes that pass on price risks to its customers,” Dyson said. “And the end effect is basically making the utility wear some of that risk, making the shareholders wear some of the risk, and not passing all of the fuel-price risk onto the customers.”

With some forecasters predicting a mild winter, it’s far from clear whether today’s high natural gas prices might simply melt away in the face of low demand — or whether, for example, a major hurricane might upend gas production or exports along the Gulf Coast.

But however natural gas prices move, at least in the short run, many American utilities and policy-makers chose to hitch their wagons to natural gas — and it seems we’ll all be going along for the ride.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts