The American public is facing a potential bill of $280 billion for the cleanup of 2.6 million unplugged oil and gas wells, according to Billion Dollar Orphans, a new report from London-based think tank Carbon Tracker.

While this number is alarming, it does not even include an estimated 1.2 million undocumented orphan oil and gas wells.

‘Orphan well’ is an industry term for non-producing oil and gas wells that “have no financially viable operator capable of plugging them.” With the current state of the oil and gas industry, the number of financially viable operators is rapidly decreasing while bankruptcies rise, which is exacerbating this whole issue.

One troubling aspect of this problem is that it should not exist. Regulators at both the federal and state levels have the tools in place to hold companies accountable for the costs of well plugging and abandonment. Yet those regulators have not used those tools, and now, as the industry is struggling financially, in many cases it simply may be too late.

Ideally when an oil and gas company applies for a permit to drill a new well, it would be required by regulators to purchase a surety bond from a third party that would cover the cost of plugging and abandoning the well when it had finished producing oil or gas. This should even protect against the possibility of the oil and gas operator going bankrupt.

But regulators have set the limits for those surety bonds far below the actual costs to plug and abandon wells. Carbon Tracker estimates that these bonds currently would cover approximately 1 percent of the estimated $280 billion clean up tab — leaving the rest of the bill to be paid by the public.

CRC is the first big oil driller in CA to go bankrupt, but it won’t be the last. New analysis from @SierraClub shows why the state needs to take action to make sure taxpayers aren’t left to cover these companies’ huge well cleanup costs #CleanUpOilWells https://t.co/s3R5kzAvTq

— Carbon Tracker (@CarbonBubble) October 1, 2020

Bankruptcies Adding to the Problem

With essentially no bonding in place to cover the cost of well plugging and abandonment, regulators have effectively allowed oil and gas operators to self-bond, and for the states to rely on the promise that these companies remain financially viable and fulfill their legal obligations to plug and abandon wells.

The current financial crisis in the oil and gas industry makes that outcome unlikely for many of the existing companies, as the industry is experiencing a wave of bankruptcies — with many more expected — as oil prices remain low. Without proper bonding in place, this is essentially the worst-case scenario.

“If companies are in dire straits, plugging these wells is probably one of the very last things on the list of management ideas for how to use cash,” Robert Schuwerk, co-author of the report, explained to the Financial Times. “If they happen to go bankrupt, and nobody wants to pick up the well out of the bankruptcy, then the state’s going to end up picking up the tab.”

Carbon Tracker highlights Petroshare as an example of how the bankruptcy process is adding to the problem of shifting cleanup costs from the private oil companies to the public. Petroshare had bonds that amounted to 3 percent of expected plugging and abandonment costs for its 89 wells.

After Petroshare declared bankruptcy, a new entity was formed by some of Petroshare’s creditors to acquire the remaining assets that had value. The state of Colorado let the new company abandon any of the 89 wells that it didn’t want — leaving the cleanup costs to the taxpayers of Colorado. Carbon Tracker estimates that 67 wells could now be the state’s responsibility, with a potential price tag of almost $12 million to plug and abandon the wells.

The Denver Business News reported on an exchange at a hearing of the Colorado Oil and Gas Conservation Commission (COGCC) about the Petroshare case, an exchange which neatly sums up the bigger situation the country is facing as oil and gas companies go bankrupt:

“They become our responsibility for the rest of their lives?” asked Pam Eaton, a commissioner with the Colorado Oil and Gas Conservation Commission, during a June 10 hearing about PetroShare.

“That’s correct,” replied Steven Kirschner, COGCC enforcement officer.

Colorado taxpayers are picking up the bill for these abandoned oil wells while the new company that acquired the valuable wells from the bankruptcy walks away from the cleanup costs.

The problem of unfunded environmental liabilities isn’t just a problem with small companies like Petroshare. In July, The New York Times reported that the large fracking company Chesapeake Energy likely had cleanup liabilities of $1.4 billion for 6,800 wells and had only $41 million allocated for that task.

We featured in this @nytimes front page story Monday – revealing U.S. oil & #gas companies are hurtling toward bankruptcy, raising fears #oil wells will be left leaking planet-warming pollutants, with cleanup costs dumped on taxpayers https://t.co/58UBBl6JKf #OOTT #shale

— Carbon Tracker (@CarbonBubble) July 15, 2020

It is increasingly likely as U.S. oil and gas companies continue to file for bankruptcy that the process will be used to shift cleanup costs to the public while investors pick up the remaining valuable assets from the bankrupt companies. And without a major change in how states handle the bonding and permitting process, the same scenario will eventually unfold with the remaining wells too.

Fracking Makes The Problem Worse

While the current scale of this problem is overwhelming for states that simply do not have the budget to address it, the business of fracking shale deposits for oil and gas is likely to make the problem much worse in the future.

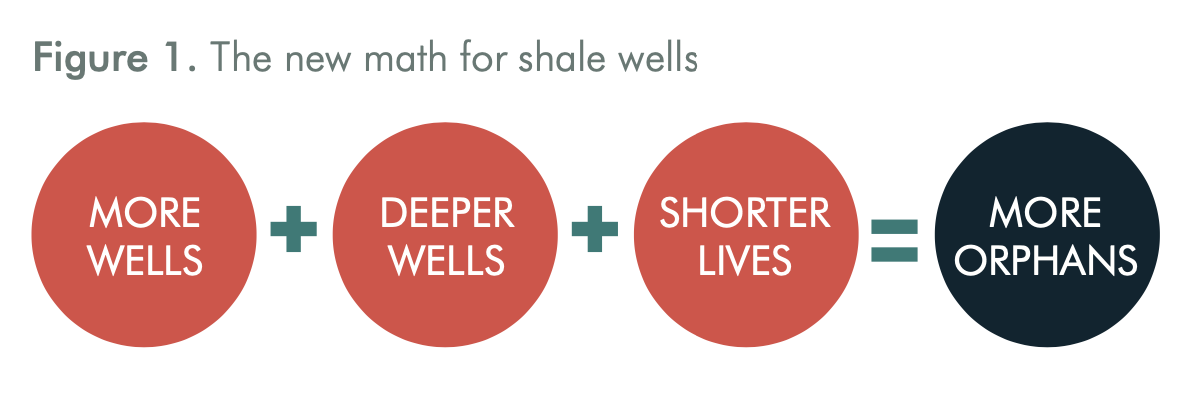

Carbon Tracker notes the unique aspects of fracking for oil and gas that make the cleanup costs an even bigger problem than for conventional wells. Fracked wells are deeper than conventional wells which increases the cost to plug and abandon them. The wells also deplete much faster which means the wells become economically unviable sooner than conventional wells.

The new math of shale wells. Credit: Carbon Tracker

The inadequate bonding required by regulators for conventional wells will cover even less of the costs of dealing with fracked wells.

Since the fracking industry has been a financial failure, fracking companies are also going bankrupt, further adding to the problem.

The severity of the bankruptcy problem with fracking companies was noted in a comment to the Financial Times by Charles Beckham, a partner in the law firm Haynes and Boone.

“I would expect on the producer side, we’re going to continue to see more bankruptcies,” Beckham told the Financial Times. “The only question I have is, at some point, it would seem we will run out of inventory — [exploration and production] companies that have not filed bankruptcy yet.”

In that scenario the only thing that stops oil and gas bankruptcies is when all of the companies have already gone bankrupt.

Regulators Need To Start Working for the Public

Last October, DeSmog asked the question: Will the Public End up Paying to Clean up the Fracking Boom? In that article Bruce Hicks, Assistant Director of the North Dakota Oil and Gas Division, was quoted raising the alarm about the issue of companies abandoning wells saying, “It’s starting to become out of control.”

This new report from Carbon Tracker quantifies just how out of control it is across the whole country. However, it is quite clear how regulators can begin to address the problem. When permitting new wells they must 1) Properly estimate well plugging costs and 2) Require bonding in that amount for each new well that is permitted.

This would be a radical new approach for regulators but the only other option is to continue to let the oil and gas industry make the money from the wells while they can — and then walk away and leave the bill to the public when it is time to clean up. This would continue to add to what is already a massive indirect public subsidy for the financially failing oil and gas industry.

Main image: Addiction. Credit: C.L. Baker, CC BY–ND 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts