The U.S. liquefied natural gas (LNG) market, once the promising golden child of the fossil fuel industry, has a major long-term problem. While it’s facing financial disaster due to the current crash in oil and natural gas prices, that’s only the short-term threat.

The real issue for the LNG industry is an existential one: It’s a fossil fuel in a rapidly warming world, and these polluting fuels are losing public favor fast.

In late April, Ian Nathan, Manager of Global Gas and LNG at industry research and advisory firm Energy Intelligence, highlighted the issue during a webinar Q&A session.

“Some executives from some large sellers … are really scared to death about the rate at which the demonization of gas has really just come to the fore and how gas was a solution just yesterday,” said Nathan, “and tomorrow gas-fired power is not green and methane emissions are an issue.”

The oil and gas industry has been working very hard to sell natural gas as a climate solution — efforts that started in 2006. The American Petroleum Institute — the leading lobbying arm of the oil and gas industry — continues to push the concept of natural gas as a clean fuel that is lowering emissions. (LNG is simply super-chilled and pressurized natural gas in a liquid form that is easier to ship.)

But research and analyses increasingly show that natural gas can be worse for the climate than coal when the supply chain’s methane emissions are taken into account. And while the oil and gas industry has been able to hide the true scope of methane emissions until recently, new satellite technologies have revealed that the methane emissions from major fracked oil and gas fields in the U.S. are much higher than the industry has claimed in the past.

As DeSmog reported earlier this year, European LNG buyers are considering measuring the true climate impacts of U.S. LNG, which means considering methane emissions — another strike against the U.S. LNG industry.

Growing public awareness and concern about the climate impacts of natural gas apparently are frightening industry executives.

“Natural gas is a much dirtier #fossilfuel than previously thought, with emissions that can be comparable to coal” https://t.co/W0V34OzH03 #bcpoli #LNGinBC #fracking #CoastalGasLink

— Council of Cdns, Vic (@cocvic) May 6, 2020

Last September, Woodside Petroleum CEO Peter Coleman warned his colleagues at an industry conference about the potential for this turning tide of public opinion on the fossil gas.

“The industry really is at a critical juncture,” Coleman said. “We run the risk of being demonized like that other fossil fuel out there called coal.”

But gas may already be crossing that threshold.

At the Duke Energy shareholder meeting this month, shareholders were pressuring the company on its plans to expand natural gas infrastructure instead of investing in renewables. Lynn Good, Duke’s President and CEO, defended this approach. “I am disappointed to learn that the tool of natural gas is under such assault,” Good said.

But the LNG companies that don’t get wiped out in the coming financial bloodbath will likely face the same “assault.”

U.S. LNG Troubles Began Long Before COVID-19

On April 23, the senior editor of the industry publication Natural Gas Intelligence wrote: “The LNG market was already oversupplied before the COVID-19 pandemic crushed demand worldwide and sent global gas prices into a freefall.”

Mike Sultan, editor at Energy Intelligence, recently made the same point about U.S. projects. “They were facing an oversupply situation before any of this happened,” Sultan said. “Before the U.S.-China trade war happened, before the oil price crash, before COVID-19 ever showed up, they were in serious trouble.”

But The New York Times recently missed this key context when reporting on the financial woes of the LNG industry, failing to mention the industry’s previous oversupply issues and putting the blame on the pandemic drying up demand and crashing prices.

The LNG industry has the same problem as the oil industry. It’s economics 101. If you supply more product than the market can absorb, prices go down. The current global prices for LNG mean that shipping U.S. LNG to world markets is a money-loser.

On April 26 Reuters reported that the price for LNG in Asia dropped to just below $2 per million British thermal units (mmBtu). Meanwhile, delivering U.S. LNG to Asia costs just under $6/mmBtu, which is why agreements for U.S. LNG deliveries are being swiftly canceled. The economics of exporting U.S. LNG don’t make sense.

US LNG exports took another hit today, falling over -1.0 Bcf/d as Sabine Pass’ receipts dropped below 2.2 Bcf/d. #ONGT #natgas $UNG $UGAZ $DGAZ #LNG pic.twitter.com/gsD7YMxMqQ

— Criterion Research (@PipelineFlows) May 12, 2020

Despite the LNG market oversupply, the U.S. has a number of new LNG infrastructure projects that have been recently completed or are in the works. However, the Institute for Energy Economics and Financial Analysis (IEEFA) highlighted energy companies already backing out of, deferring decisions on, and losing financing for three U.S. LNG projects, as of April 24.

The global rush to export LNG has led to the oil and gas industry building too much infrastructure while producing too much gas. Much of this oversupply is due to the prolific production made possible by fracking and horizontal drilling in shale basins, both for gas specifically and as a by-product of oil drilling. As with the money-losing U.S. shale oil business, the current pandemic has simply hastened the demise of another financially flawed industry, U.S. LNG.

As LNG Falters, Renewables Stand to Benefit

While the pandemic has exacerbated the structural financial flaws in the U.S. oil and gas industry, it does not seem to be having the same impact on the renewable energy industries.

Renewables may stand to gain from the troubles in the LNG industry, according to The New York Times’ recent article about LNG woes. And in early April, The Times reported that the wind and solar industries were expected to continue growing, albeit more slowly, during the pandemic while oil companies were “collapsing.”

A contributor article appearing on Forbes in early May noted that Fatih Birol, director of the traditionally oil and gas friendly International Energy Agency, was suggesting that countries place clean energy technologies “at the heart of their plans for economic recovery.”

According to Bloomberg, International Monetary Fund Managing Director Kristalina Georgieva also argued that green energy should be part of coronavirus recovery plans in an effort to combat the looming climate crisis.

“Taking measures now to fight the climate crisis is not just a ‘nice-to-have,’ it is a ‘must-have’ if we are to leave a better world for our children,” Georgieva said.

These aren’t the usual players making such strong arguments for renewable energy.

For the first time ever, the U.S. used more renewables than coal to produce energy — and experts say the country is now one step closer to relying on clean energy for the long-term https://t.co/ua4DU9sbVg pic.twitter.com/3m2aiaCxPM

— CBS News (@CBSNews) May 6, 2020

Oil and gas just aren’t good financial investments anymore. While the U.S. appears poised to bail out the fossil fuel industry with a bond buyback program worth at least $750 billion, this effort would just prop up a failing business model, rather than investing in surging renewables.

As prospects for LNG projects dry up around the world, natural gas experts question its future.

“People are wondering: Is development delayed, or will it even happen?” Nikos Tsafos, Senior Fellow at the Center for Strategic and International Studies, said. “That’s my sense regionally and also globally.”

The U.S. LNG market is facing the same fate as the quickly dying coal industry: Finances that don’t pan out and demonization for its climate impacts.

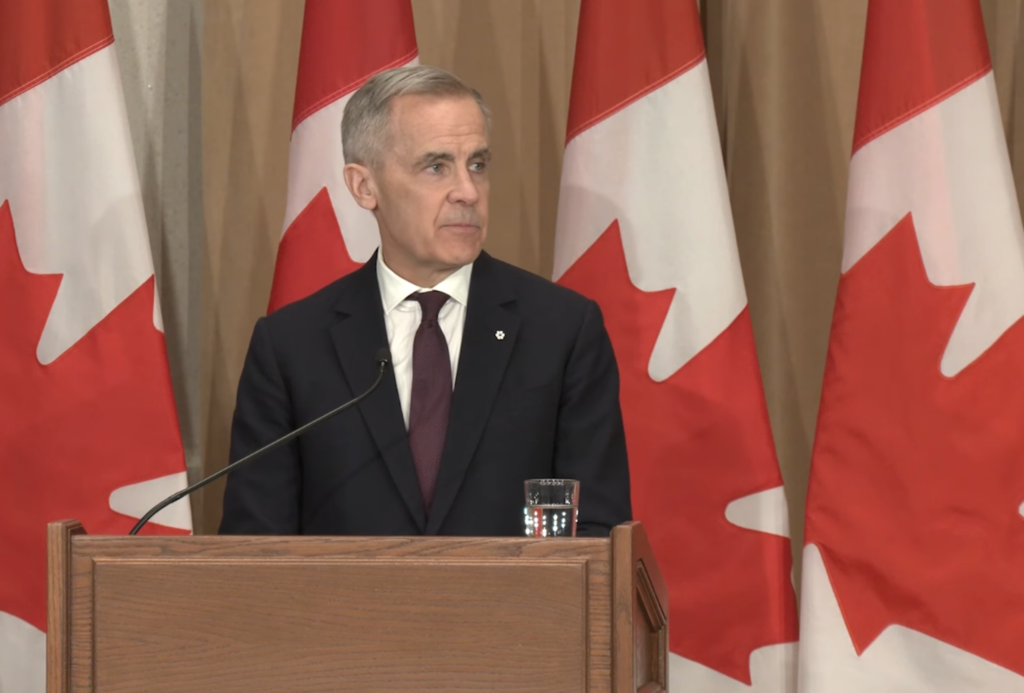

Main image: Seattle City Councilmember Kashama Sawant hosted a press conference to oppose a liquid natural gas facility in Tacoma, Washington, in January 2018. Credit: Seattle City Council, CC BY 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts