Drivers of electric cars are being unfairly punished by punitive fees in several states, according to a newly published analysis by Consumer Reports. Legislators in 26 states have enacted or proposed special registration fees for electric vehicles (EVs) that the consumer advocacy group found to be more expensive than the gas taxes paid by the driver of an average new gasoline vehicle.

These punitive EV fees have been pushed in many states by the American Legislative Exchange Council (ALEC), the corporate-funded group which produces model legislation and voted on a model resolution supporting “equal tax treatment for all vehicles” — a move that bears the fingerprints of the fossil fueled–Koch network.

“We are seeing a sudden, dramatic increase in fees that are especially unfair,” said Chris Harto, a senior policy analyst at Consumer Reports and co-author of the EV fees study. “Some of these fees could force some consumers to pay triple or even quadruple what the owner of a gas-powered vehicle pays in gas taxes.”

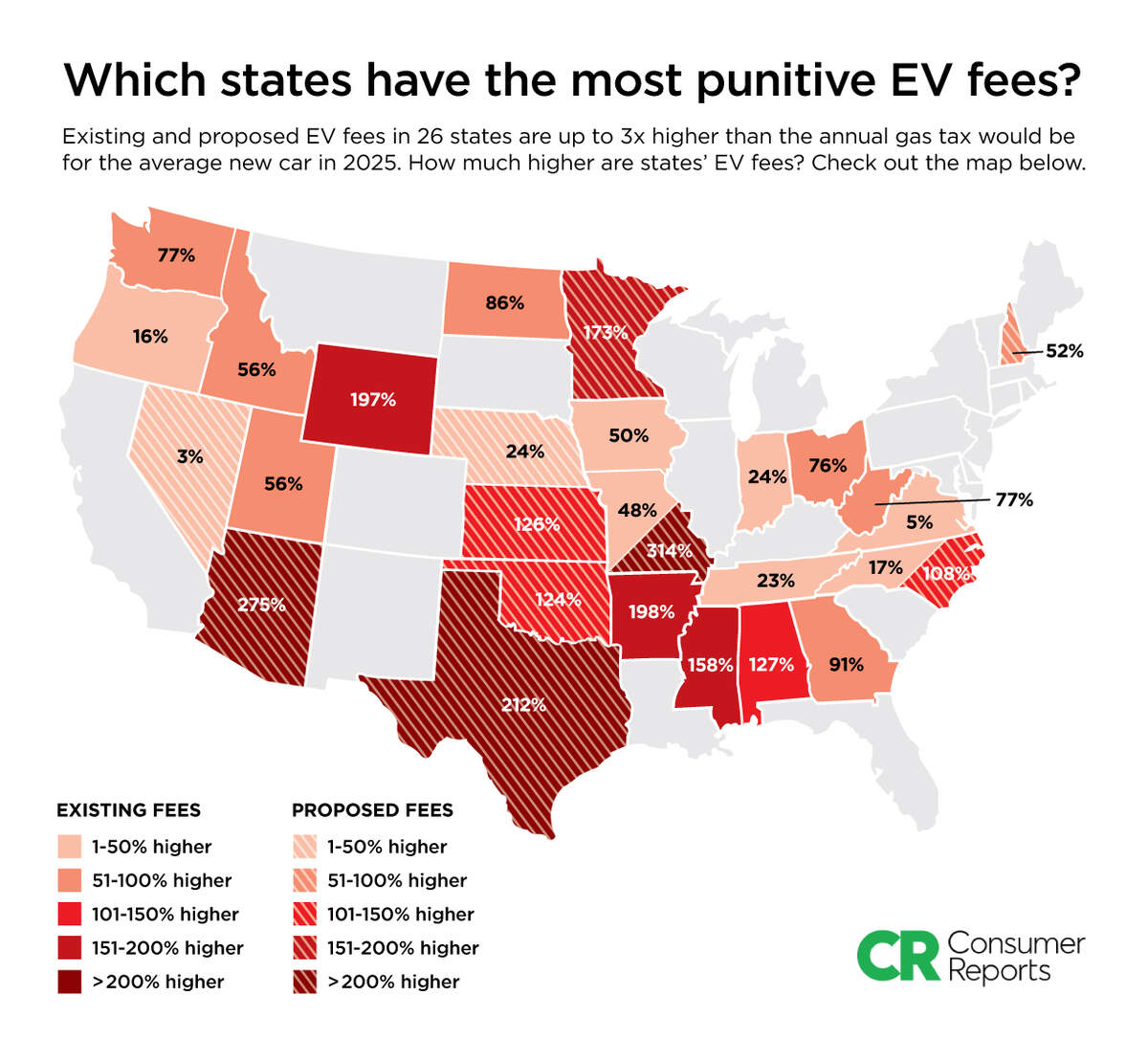

A map of U.S. states with existing or proposed EV fees and how much more they are compared to the annual gas tax. Credit: Consumer Reports

In 2019, eight states passed new fees for EV registrations or increased current fees, and of these, Consumer Reports found that all but one would be “extremely punitive” — or would cost EV drivers at least 50 percent more than the gas taxes paid by the driver of an average new gas-powered car.

All told, there are already 18 states with EV fees higher than the annual gas tax equivalent for an average new car, and at least eight more punitive fees have been proposed.

The current highest fees in place are found in Arkansas and Wyoming, where EV owners must pay what a driver of a vehicle that gets 13 miles per gallon does in gasoline taxes.

The highest proposed fees are in Missouri and Arizona, which would translate to the gas tax paid by a vehicle that gets 9 to 10 miles per gallon.

EV Fees Don’t Do What Proponents Say They’ll Do

In effect, the real world impact of these fees undermines the arguments of those who support or propose the EV tax policies. Proponents of higher EV fees say that they are necessary to ensure that plug-in cars pay their fair share for the roads. In nearly every state, highway funds are raised from revenue from gasoline taxes. Because EV drivers don’t buy gas, they aren’t chipping in for those highway funds, the argument goes.

Or so the argument went, before Consumer Reports dug into the actual numbers. The report found that these punitive fees on EV registrations don’t actually make up for declining tax revenues. Currently, fees only make up 0.04 percent of state highway funding in states where they are in use. By 2025, this is only projected to increase to 0.3 percent, even with a rapid growth of EV adoption.

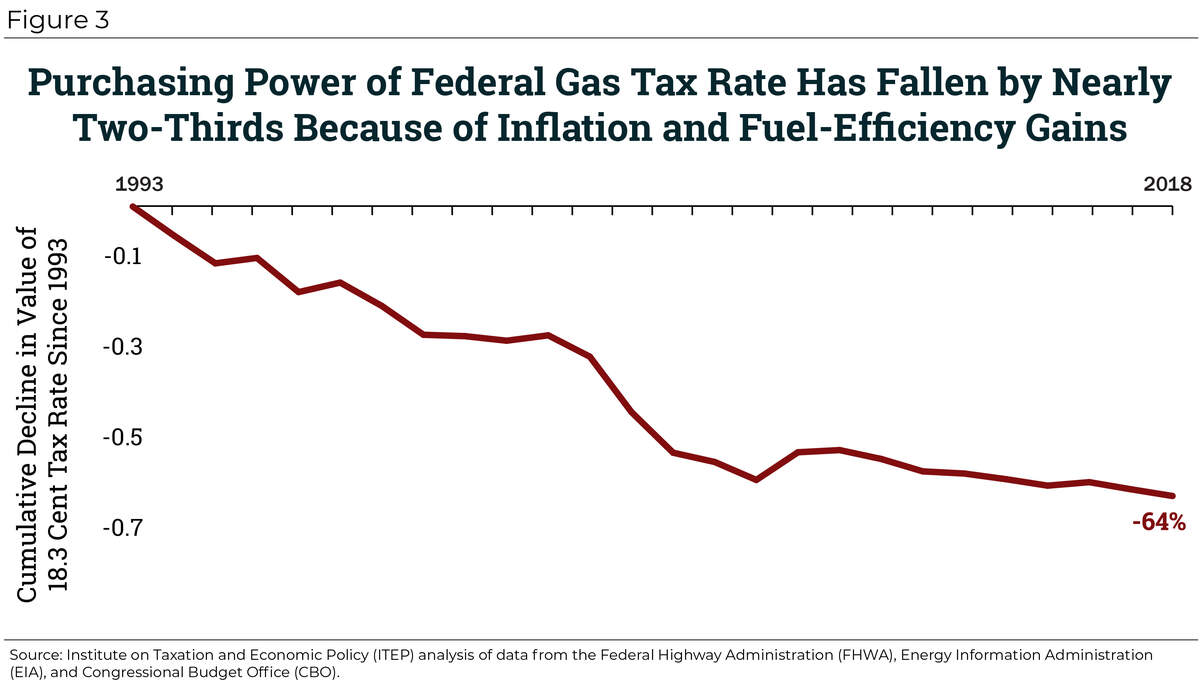

The real culprit in the loss of gas tax revenue is that conventional vehicles have become far more efficient. As they consume less gasoline, less revenue is generated for the highway funds. Moreover, gas taxes have not kept up with inflation for decades.

The purchasing power of federal gas tax rate has fallen by nearly two-thirds because of inflation and fuel-efficiency gains. Source: Institute on Taxation and Economic Policy analysis of data from the Federal Highway Administration, Energy Information Administration, and Congressional Budget Office

So while they are portrayed as a pragmatic solution to declining gas tax revenue, the EV fees are actually forcing electric car drivers to contribute more than their fair share to fund highways.

“We hope politicians see our analysis and realize that punitive taxes on electric vehicle drivers are not only a poor way to make up for road maintenance shortfalls, but are also really unfair to the average family trying to save money by going gas-free,” said Consumer Reports’ Shannon Baker-Branstetter, one of the study’s co-authors.

State EV Fees Are Being Pushed by the Oil Industry

Why are state legislators increasingly turning towards a policy that doesn’t solve the highway funding shortage and, in some cases, actively undermines state efforts to accelerate adoption of electric cars? Because the oil industry is pushing for these EV fees, both through direct lobbying of state legislatures and through ALEC itself.

As noted earlier, the ALEC resolution which passed last November claimed:

WHEREAS, certain vehicles, due to their fuel or propulsion systems, use little or no liquid fuels and therefore do not contribute to the tax revenue used for road construction and maintenance; and

WHEREAS, many non-liquid fuel vehicles are heavier than comparably sized liquid-fueled vehicles, largely due to the onboard battery packs, and thus cause more wear and tear on road infrastructure; and

WHEREAS, the elimination of special-interest tax credits for vehicles, and the establishment of a system under which the owners and operators of all vehicles using public roads share in the cost of construction and maintenance for those roads, do comply with and reflect principles of “economic neutrality,” and “equity and fairness,” principles of taxation;

THEREFORE, BE IT RESOLVED that as a part of revenue-neutral tax reform {state} specifically supports efforts to eliminate federal tax credits for new qualified plug-in electric drive motor vehicles and the creation of an alternative fuel vehicle user fee whose revenue can be used to support highway construction and maintenance.

Despite ALEC‘s claims, EVs are far less of a burden on the roads than larger SUVs and heavy-duty trucks, and create other economic benefits by improving air quality because they don’t have tailpipes spewing dangerous emissions.

The misinformation about electric vehicles is unsurprising, given that Charles Koch and the Koch network now more or less control ALEC, as described in this recent post on the Koch-dedicated web archive KochDocs. In fact, Grant Kidwell, who manages the Energy, Environment and Agriculture Task Force for ALEC, was until recently employed by the Charles Koch Institute and Americans for Prosperity, the main political advocacy arm of the Koch network.

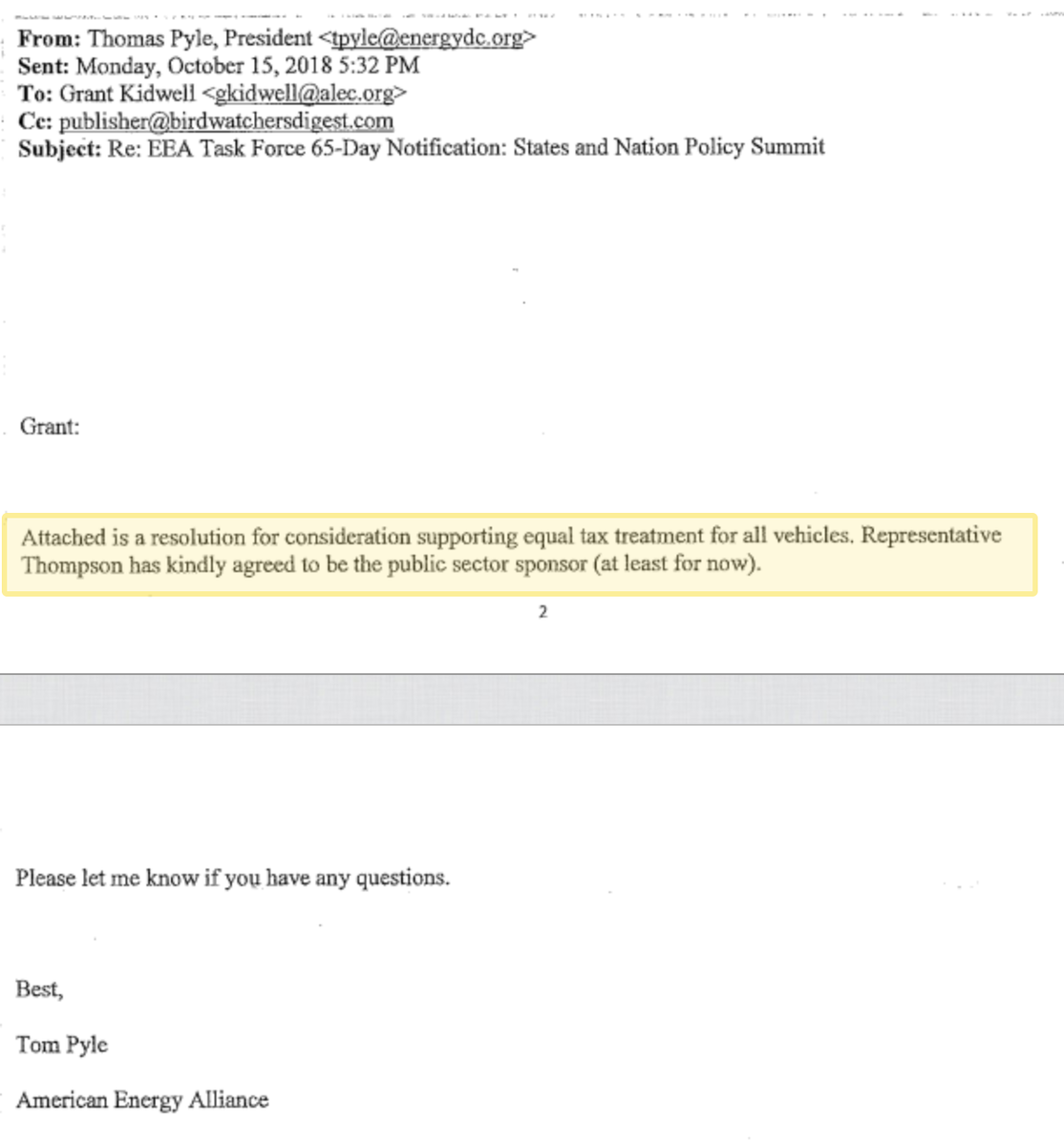

This very model resolution that coincided with the recent spike in state EV fee bills was itself shepherded into the ALEC committee by Tom Pyle, president of the Koch-funded American Energy Alliance and a former lobbyist for Koch Industries.

Emails obtained by Documented, a corporate influence watchdog, confirmed an E&E News report that Pyle was behind the model resolution. In the emails, Pyle writes, “Attached is a resolution for consideration supporting equal tax treatment for all vehicles. Representative Thompson has kindly agreed to be the public sector sponsor (at least for now).”

Tom Pyle’s email pushing the ALEC model resolution imposing higher fees on electric cars.

The correspondence reveals how Pyle finds a “sponsor” for the model resolution, and how the legislator and Pyle both approve edits that are suggested by Kidwell. Though ALEC likes to claim that its public sector representatives introduce the model legislation, in the case of this EV tax bill, it was clearly born of a Koch-funded entity.

“These special fees don’t make a dent when it comes to funding road repair, and these punitive policies could instead discourage people from purchasing a fuel-efficient or gas-free car in the first place,” said Baker-Branstetter. “Perhaps it comes as no surprise that the oil industry not only supports, but in many cases even helped to pay for the development of the legislation behind these fees.”

Main image: “Outdated” Credit: arbyreed, CC BY–NC 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts