Which would you trust: a poll commissioned by a nonprofit philanthropic group and conducted with academic partners, or a survey paid for by an advocacy group with financial ties to the industry in question and conducted by a for-profit lobbying firm with clients that are directly impacted by the issues discussed?

Two conflicting opinion polls concerning electric vehicles have just been released, and — surprise! — the one tied to the oil refining billionaire Koch brothers claims that American voters don’t support electric cars or the electric vehicle (EV) tax credit.

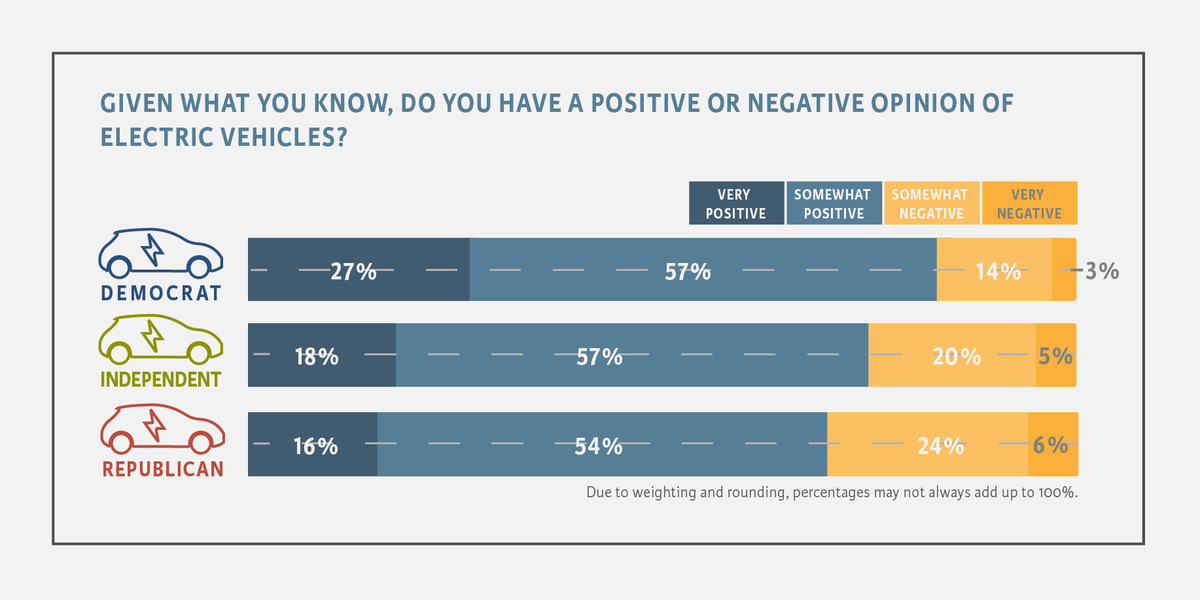

Last month, a poll by Climate Nexus and academic partners at Yale University and George Mason University showed that Democrats, Republicans, and Independents all shared positive opinions of electric vehicles (EVs), and that the federal EV tax credit made voters across all political parties more likely to buy or lease a plug-in car.

A week later, an advocacy group led by a former Koch Industries lobbyist released the results of its own electric car survey, which the group claimed would show that American voters were opposed to the EV tax credit.

Why the conflicting reports? Consider the sources and the methodology. The Climate Nexus poll was conducted using well-accepted and scientifically sound polling methodology (which is described in the published materials).

The American Energy Alliance (AEA) survey, on the other hand, “is a highly biased poll,”* according to Dr. Ed Maibach, a communications scientist and professor at George Mason University who also worked with Climate Nexus on their poll. “The questions have been purposefully designed to get the response that the pollster — or more correctly, the pollster’s client — wants,” Maibach told DeSmog.

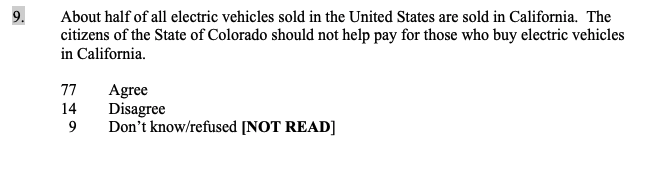

Consider this example, where the question exaggerates California’s percentage of the electric car market and intentionally biases the results by presenting the tax credit as unfair to Coloradans.

First, the population of California (the most populous state, with nearly 40 million people) is roughly seven times higher than Colorado (with almost 5.7 million).

Second, drivers in Colorado have the same access to the EV tax credit as drivers in California or any other state; that California drivers choose to take advantage of the credit more often is largely irrelevant.

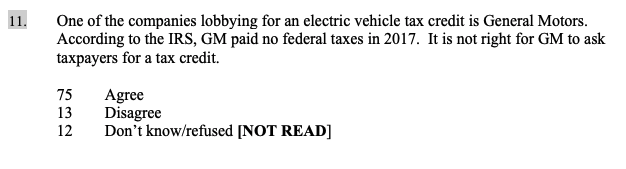

Or consider this question, which entirely misrepresents how the tax credits actually work.

General Motors would only indirectly benefit from the EV tax credit, as only the party purchasing the vehicle is able to claim the tax incentive.

With very few exceptions, the questions asked in this survey were clearly designed to generate desired responses, intentionally skewing public opinion of electric car incentives to support the AEA’s campaign to kill the EV tax credit.

“The proper place for these poll results is the trash bin,” said Maibach.

American Energy Alliance and MWR Strategies: Biased Advocates Pretending to Conduct Nonpartisan Polling

The deceit here is unsurprising when you consider who is behind the anti-EV poll, and that last year around this time, the AEA did essentially the same thing — releasing results of a survey that misrepresented public support for clean car standards and electric vehicles.

The group that commissioned the survey, the AEA, is a self-described “advocacy” organization, which according to its website, “engages in grassroots public policy advocacy and debate concerning energy and environmental policies.”

The president of AEA, Tom Pyle, has a long history of working with and for the Koch brothers and Koch Industries. He was the top lobbyist at Koch Industries, and then later as a private lobbyist, he lobbied on behalf of Koch Industries and the National Petrochemical & Refiners Association (now the American Fuel & Petrochemical Manufacturers), of which Koch Industries is a core member and beneficiary.

The poll itself was conducted by long-time energy lobbyist Mike McKenna for MWR Strategies, a lobbying firm with clients including Koch Industries and the American Fuel & Petrochemical Manufacturers. As Mark Renburke reported here on DeSmog last year, McKenna was forced out of Virginia politics during an ethics scandal of his creation, before eventually leading President Trump’s energy transition team before choosing to resign rather than de-register as a lobbyist. Coincidentally, McKenna was replaced as the head of the energy transition team by Pyle.

The AEA is a central player in the Koch-funded campaign to kill the EV tax credit and suppress sales of electric cars. Under Pyle’s watch, the group has coordinated a number of letters to Congress opposing the tax credit, and consistently pushes deceptive talking points to mislead the public and policymakers on the economic and environmental benefits of electric cars.

The survey AEA released last year was cited in a number of op-eds and commentaries as “evidence” that American voters didn’t want the tax credit to be extended. This newly released survey seems positioned to be a similar citation to back misleading arguments as Congress considers extending and reforming the tax incentive.

Actually, Americans Like the EV Tax Credit

There is substantial evidence, however, that American voters actually support the EV tax credit and that it is serving its purpose in helping spur the adoption of plug-in cars. The recently released Climate Nexus poll found that 77 percent of American voters have a positive opinion of electric cars (including seven out of every 10 self-identified Republican voters), and that a $7,500 tax incentive would make it more likely for nearly three-quarters of American voters overall (and 71 percent of Republican voters) to purchase an electric vehicle.

Another poll conducted last year by Autolist, a car sales platform, found broad support for preserving and extending the federal incentives. Of the drivers and car shoppers surveyed, 74 percent said that the tax credit would affect their decision to buy an electric car, and one-third of respondents said that the 200,000 vehicle cap on the tax credit should be lifted entirely.

A full 63 percent of consumers in the Autolist survey said that the $7,500 tax credit was important to support electric car adoption in the United States.

The Koch network is paying for deceptive talking points in a likely attempt to preserve its oil refining fortunes, but it hasn’t succeeded in buying American public opinion. Legitimate opinion polls show the vast majority of Americans favor the electric car tax credit.

*Update 6/4/19: This story has been corrected to note that the AEA survey was not technically a “push poll” (as originally stated), which is a phrase used to describe polling practices where the intent is to change voters’ minds, and not simply influence the results.

Main image: Courtesy of Union of Concerned Scientists

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts