By David Pomerantz. Originally posted on Energy and Policy Institute.

The hedge fund trying to buy a New Mexico coal plant slated for closure has pitched legislators on its plan: it wants to install expensive technology to capture the plant’s carbon pollution, despite the fact that the plant is closing because it cannot compete economically with renewable energy.

The City of Farmington, which is in talks to sell the plant to Acme, asked New Mexico legislators on Saturday to amend a bill currently under debate, the Energy Transition Act, to allow Acme the time it says it needs to install the carbon capture technology. Legislators planned to consider the amendment on Monday. The bill aims to transition the state’s economy to 50 percent renewable energy by 2030, and 80 percent by 2050.

“Carbon capture and sequestration” technology, or CCS, has failed to reach commercial adoption in the United States, despite decades of support from many utilities, the coal industry, and some environmental groups. That’s because so far, no one has been able to implement CCS without making power plants much more expensive to build and operate.

Prior to the hearing, Acme had circulated slides to legislators, obtained by the Energy and Policy Institute, that detailed its plan to set up a newly rebranded company called “Enchant Energy.” Enchant Energy would retrofit the 847 MW San Juan Generating Station with CCS technology, and would also add a token 40 MW solar installation and 100 MW of battery storage.

Little is known about Acme Equities, but the hedge fund appears to have no previous experience in the power sector, having otherwise been involved in buying land in oil and gas production areas, as reported by the Energy and Policy Institute earlier this week.

CCS History Littered With Boondoggles

Acme called CCS for coal plants a “proven technology” in the slides it presented to legislators, but the technology’s history in the U.S. is littered with boondoggles, and only a single project that was successfully built.

Two of the most infamous CCS debacles were pursued by the biggest utilities in the country. The Southern Company tried to build a CCS coal plant in Mississippi called the Kemper project. Kemper exceeded its $1.8 billion budget to cost $7.5 billion, and Southern Company deserted the CCS part of the project as expenses spiraled out of control. According to the Sierra Club, Kemper is the most expensive dollar-per-watt power plant built in U.S. history, all for a technology which never worked.

Duke Energy encountered similar problems with its Edwardsport plant in Indiana. Edwardsport was originally slated to feature CCS technology, but like Southern, Duke gave up on CCS after costs spiraled, with the price tag still ballooning from an initial estimate of $1.9 to $3.55 billion.

The fact that most CCS projects have failed because of their expense makes the technology an odd solution to the problem facing the San Juan Generating Station, which is closing because its current utility owners have all agreed that it cannot compete against cheaper renewable energy.

“The San Juan Generating Station is in financial distress because it cannot produce electricity at a price that is competitive,” Tom Sanzillo, the Director of Finance at the Institute for Energy Economics and Financial Analysis told the Energy and Policy Institute before learning of the CCS proposal. “We have reviewed investment deals all over the country and have not found any that can reverse this fundamental market reality.”

Acme Looks to Oil Drillers and the Trump Administration for Financial Lifeboats

Acme acknowledged in its slides that “CCS is expensive,” but said it could finance the project in part by selling the carbon dioxide to oil producers, who would then use it for “enhanced oil recovery,” which entails pumping the carbon dioxide underground to force more oil out of wells. That process incidentally encourages greater carbon production elsewhere, and has environmental risks. Southern Company also had been relying on “enhanced oil recovery” for its failed Kemper plant in Mississippi.

Acme neglected to mention the failed CCS projects in its slides to legislators, instead citing the Petra Nova plant in Texas, which is the sole completed coal CCS project in the US. (In one slide, Acme misspelled the name of the plant.)

Petra Nova may not be the best comparison point for Acme, however. The owner of Petra Nova, NRG, has said that the plant will be its last foray into CCS. That’s because like Acme, NRG wanted to sell the captured carbon to oil producers, but it did not find those deals as lucrative as it had hoped. Oil drillers are already barely staying afloat with oil prices at historic lows, cooling the potential market for enhanced oil recovery significantly.

It is unlikely that New Mexico drillers would have the money or the inclination to buy San Juan’s carbon dioxide so that they could produce more oil when they’re financially stretched and already over-producing.

Acme said that it could also make the San Juan plant profitable by securing federal subsidies. “Project can receive financing and grants from DOE as there is strong political interest in demonstrating the Administration is helping the Coal Industry,” one slide read.

Other hedge funds have hoped that the Trump Administration’s pro-coal rhetoric could help them profit from distressed coal plants, but those efforts have all failed. As Bloomberg noted yesterday, the Trump Administration has not been able to extend the lifetimes of even those plants with some degree of federal ownership, like the Navajo Generating Station in Arizona, or two coal plants owned by the Tennessee Valley Authority.

Front Group Promotes CCS Plan

Acme’s plans first became public on Saturday morning at a legislative hearing, but a front group called the “Coalition for Affordable Energy in New Mexico” (CFAENM) had started tweeting and posting Facebook videos cheering the idea on Thursday.

The group, which says nothing about who set it up on its web site, also bought the URL “NMwins.com,” which redirects to a page extolling the virtues of the Acme CCS proposal and asks people to tell their senator to amend the Energy Transition Act to allow for the deal.

CFAENM started posting on social media in September, and Facebook’s political ad archive shows that it has paid to run ads for Facebook videos on 20 occasions, generally spending between $100 and $500 per video, and once up to $1,000.

Hedge funds sometimes try to set up front groups as a way to soften the ground for policy changes that will make distressed assets worth something. There is no evidence that Acme is involved in funding the group, and other parties would also have an interest in keeping the plant from closure. Whoever paid for CFAENM’s videos doesn’t seem to be getting much for their money: CFAENM has 29 followers on Twitter and 189 on Facebook.

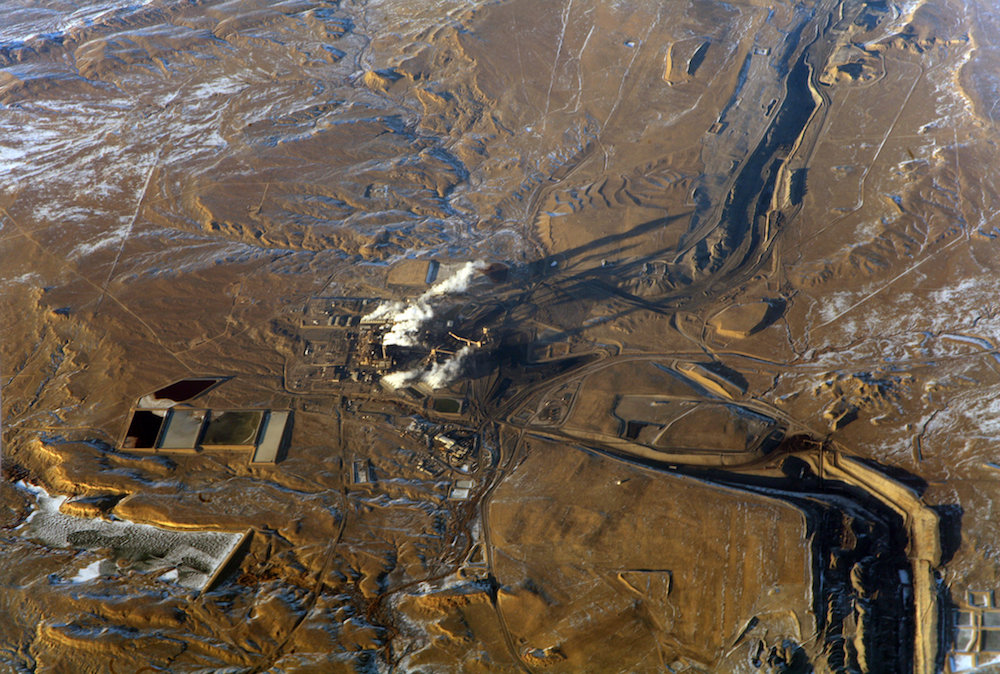

Main image: The San Juan Generating Station, flanked by its surface coal mines on the desert north of the San Juan River west of Farmington, New Mexico. Credit: Doc Searls, CC BY 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts