Roughly four years ago, Energy Transfer Partners (ETP) filed a federal application to build a 1,172 mile oil pipeline from North Dakota’s Bakken shale across the U.S. to Illinois at a projected cost of $3.8 billion.

Before that application was filed, on September 30, 2014, the Standing Rock Sioux Tribe met with ETP to express concerns about the Dakota Access pipeline (DAPL) and fears of water contamination. Though the company, now known as Energy Transfer, had re-routed a river crossing to protect the state capital of Bismarck against oil spills, it apparently turned a deaf ear to the Tribe’s objections.

Following that approach proved to be a very costly decision, a new analysis concludes, with ETP, banks, and investors taking billions in losses as a result.

“This case study estimates that the costs incurred by ETP and other firms with ownership stake in DAPL for the entire project are not less than $7.5 billion, but could be higher depending on the terms of confidential contracts,” a new report, “Social Cost and Material Loss: The Dakota Access Pipeline,” concludes, noting that represented nearly double the initial project cost. “The banks that financed DAPL incurred an additional $4.4 billion in costs in the form of account closures, not including costs related to reputational damage.”

In addition, the company’s “poor social risk management” caused taxpayers and “other local stakeholders” to incur at least $38 million in costs, the report concludes.

“This is what it’s all about,” protestor says. “Sacred water.” Not sure guys on left agree. #NoDAPL #DAPL pic.twitter.com/vHPRC2OHU5

— Wes Enzinna (@wesenzinna) October 27, 2016

As opposition to DAPL grew from a handful of locals to a movement attracting thousands of supporters to Standing Rock and backers worldwide, construction fell behind schedule and over-budget, with costs rising from a predicted $3.8 billion to at least $7.5 billion, the new report finds. Over that time, Energy Transfer’s stock price fell 20 percent — at the same time as the tech investment index S&P 500 grew roughly 35 percent, the report noted. Energy Transfer’s stock also underperformed other companies in the same industry.

“Across the board, this project was out of line with the existing principles outlined in the United Nations Declaration on the Rights of Indigenous Peoples and other international standards for resource development near indigenous peoples’ lands,” Carla F. Fredericks, author of the study and director of Colorado Law’s American Indian Law Clinic, said. “The losses in this study underline that companies need to take those principles into account.”

Making a ‘Material Loss’

The study points to early decisions by ETP as the cause of those losses.

“The Standing Rock Sioux Tribe communicated their opposition to DAPL for three years and they were frustrated by the lack of meaningful consultation from Energy Transfer Partners (ETP), DAPL’s parent company, and the U.S. Army Corps of Engineers (USACE),” Fredericks, an enrolled citizen of the Mandan, Hidatsa, and Arikara Nation of North Dakota, and co-author Mark Meaney of the University of Colorado’s Leeds School of Business wrote. “In fact, those opportunities for early engagement were ETP’s, the USACE’s and other investors’ missed opportunities to understand the developing social risks that subsequently manifested into intense social conflict and ultimately resulted in material loss.”

US / indigenous rights: @UNSR_VickyTauli urges consistent policies for projects like Dakota Access Pipeline https://t.co/fVdVZtcsnG

— UN Human Rights (@UNHumanRights) March 3, 2017

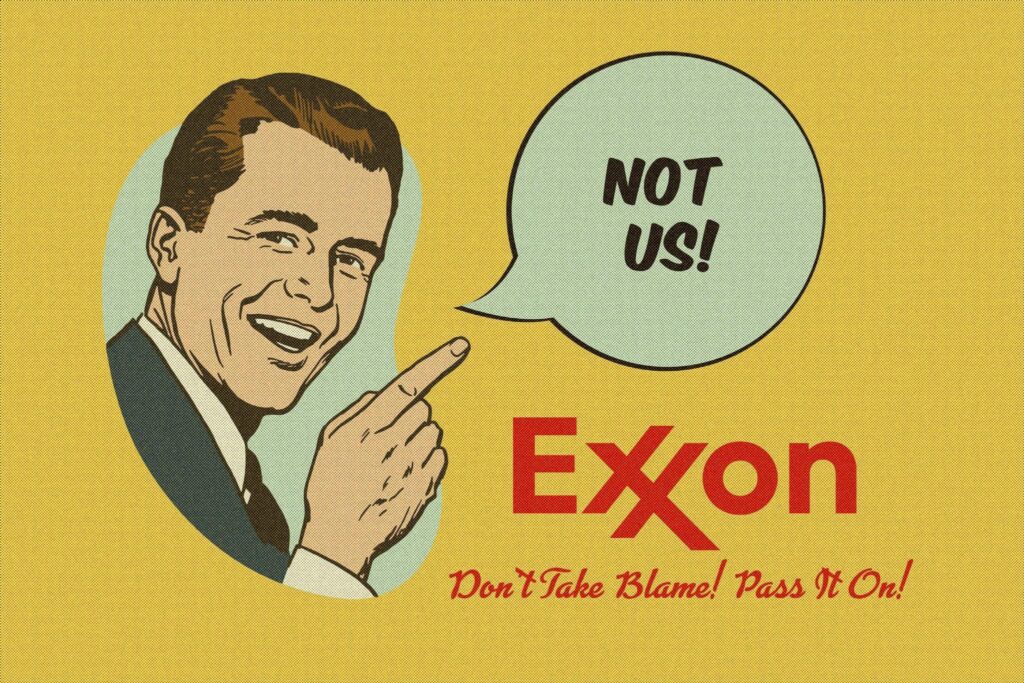

When it comes to human rights issues, the report’s authors dismiss the notion that a company’s management can adequately protect shareholders from losses or liability if they use compliance with state and federal laws as their only benchmark.

“Unfortunately, the companies and financiers behind DAPL presumed that compliance with national laws was sufficient for the project to move forward on Sioux territory rather than abiding by international human rights standards,” the report finds. “Their lack of attention ultimately resulted in material loss.”

The report faults Energy Transfer’s management specifically for failing to disclose risks of costly delays due to public opposition to investors at an earlier stage.

Guerrilla street painting against fossil fuel pipeline investment outside Wells Fargo World Headquarters in San Francisco, November 6, 2017. Credit: Peg Hunter, CC BY–NC 2.0

“In this case, ETP’s reporting concerning the project was silent or exclusively positive until the publication of its third quarterly report on November 9, 2016, in which the company acknowledged that ‘protests and legal actions against DAPL have caused construction delays and may further delay the completion of the pipeline project,’” the report finds. “By this time, social pressure had been mounting for months and there is evidence that the company knew of these risks long before they were disclosed to investors.”

“The timeline shows that ETP made few good faith efforts to understand and integrate the Standing Rock Sioux Tribe’s concerns about the environmental, social, and cultural risks into their operations and that ETP did not disclose known risks to investors until a later date,” it adds. “As a result, investors were not aware of the potential for delays and it is possible that this resulted in the overvaluation of ETP’s stock price.”

It wasn’t only ETP’s investors that suffered an economic blow due to DAPL. Reported account closures at banks that funded the DAPL project totaled $4.4 billion, including 150,000 personal bank account closures worth $86.2 million, with the remainder coming from city divestments.

“It is reasonable to suggest that the degree of public criticism directed towards banks — relative to the size of the transaction — was greater than expected and was underestimated during the banks’ own review of the project’s viability,” the report says.

Courtroom Fights

DAPL is now flowing oil — but legal battles continue. In early November, Energy Transfer announced that it would seek to expand DAPL’s capacity from 525,000 barrels per day to 570,000 barrels a day, spurred by growing oil production from North Dakota’s Bakken shale.

The DAPL fight is far from over. Lawsuits and criminal prosecutions of pipeline opponents now include a federal class action filed by five plaintiffs against private security firm TigerSwan and state and county officials, alleging that the defendants violated plaintiff’s constitutional rights by closing public roads for prolonged periods in 2016 to 2017, part of an effort to quiet resistance to the DAPL project.

As DeSmog previously reported, the lawsuit “also alleged that, beyond impeding access to sacred grounds for the self-proclaimed ‘Water Protectors’ — the term also used by [plaintiffs’ attorneys] Smith-Drelich and Harcourt in their complaint — the blockade imposed by government and law enforcement did not impact those who lived in the area or employees of Energy Transfer.”

Separately, Sophia Wilansky, who was shot three times by rubber bullets and suffered severe arm and hand injuries from what she alleges was a police “flashbang” grenade at Backwater Bridge on November 20, 2016, filed a lawsuit against Morton County law enforcement and other agencies this month. And over 700 criminal cases brought against the pipeline opponents known as water protectors have been processed, with NPR reporting that “[m]any have had their charges reduced or dismissed.”

“Happi” American Horse from the Sicangu Nation locked himself to equipment at a Dakota Access pipeline construction site on August 31, 2016. Credit: Desiree Kane, CC BY 3.0

In November, the Standing Rock Sioux Tribe challenged the adequacy of the Army Corps of Engineers’ environmental review of DAPL, arguing that the Corps’ assessment of the risks, particularly the risk of an oil spill in Lake Oahe, which is on Sioux land, fell short of required standards and disregarded technical information provided by the Tribe to the Corps.

In July, federal judge Billy Roy Wilson partially dismissed a racketeering lawsuit that was initially filed in August 2017 by ETP against nonprofits Greenpeace and BankTrack, as well as the environmental movement EarthFirst! (as represented by the publishers of a magazine of a similar name).

“While the complaint vaguely attempts to connect BankTrack to acts of ‘radical eco-terrorist,’ an international drug distribution and money laundering enterprise, and violations of the Patriot Act, BankTrack’s actual conduct in this case was allegedly writing a few letters to financial institutions and posting links to the letters on its website,” Wilson wrote in a July ruling dismissing claims against BankTrack.

In August, after a ruling that EarthFirst! is an environmental movement too amorphous too be named to a lawsuit and that suing the magazine would be “futile and possibly frivolous,” ETP added five individual defendants to its lawsuit, including a Greenpeace staffer.

ETP is also involved in the construction of other controversial pipeline projects, like the Bayou Bridge pipeline in Louisiana and the Mariner East projects in Pennsylvania.

A proposed new Bakken pipeline, dubbed the Liberty Pipeline, was recently announced by Phillips 66 and Bridger Pipeline LLC. That pipeline would move 350,000 barrels a day of fracked oil from the Bakken shale to Corpus Christi, Texas, near major export terminals.

The authors of the new report had advice for companies contemplating building new pipeline projects or investing in them.

“These losses show how important it is for companies to fully account for environmental, social, and governance risks before projects get going,” Meaney said in a statement accompanying the report. “Social risks are clearly overlooked in the market.”

Main image: Bank divestment protests in Philadelphia. Credit: © 2017 Laura EvangelistoSubscribe to our newsletter

Stay up to date with DeSmog news and alerts