At current prices, Canadian tar sands oil producers are losing money on every barrel of oil they dig out. Despite signs earlier this year the industry would “turn profitable in 2018,” a much more likely scenario at this point is a fourth straight year of losses.

Producers are forced to keep cranking out product and selling it at a loss to cover the massive costs required to start one of these sprawling unconventional oil operations, a point made painfully clear when Alberta wildfires in 2016 forced some tar sands operators to shut down.

“I do think they’ll start up quickly once the danger from the fire is gone because there is a lot of motivation to do that,” Jackie Forrest, an energy economist for Arc Financial Corp, told The Globe and Mail. “They have a lot of fixed costs so they’re going to be motivated to get some revenue to pay for those costs that aren’t going away.”

In the face of such challenging economics, what are Canadian tar sands producers doing? Tapping more oil than ever.

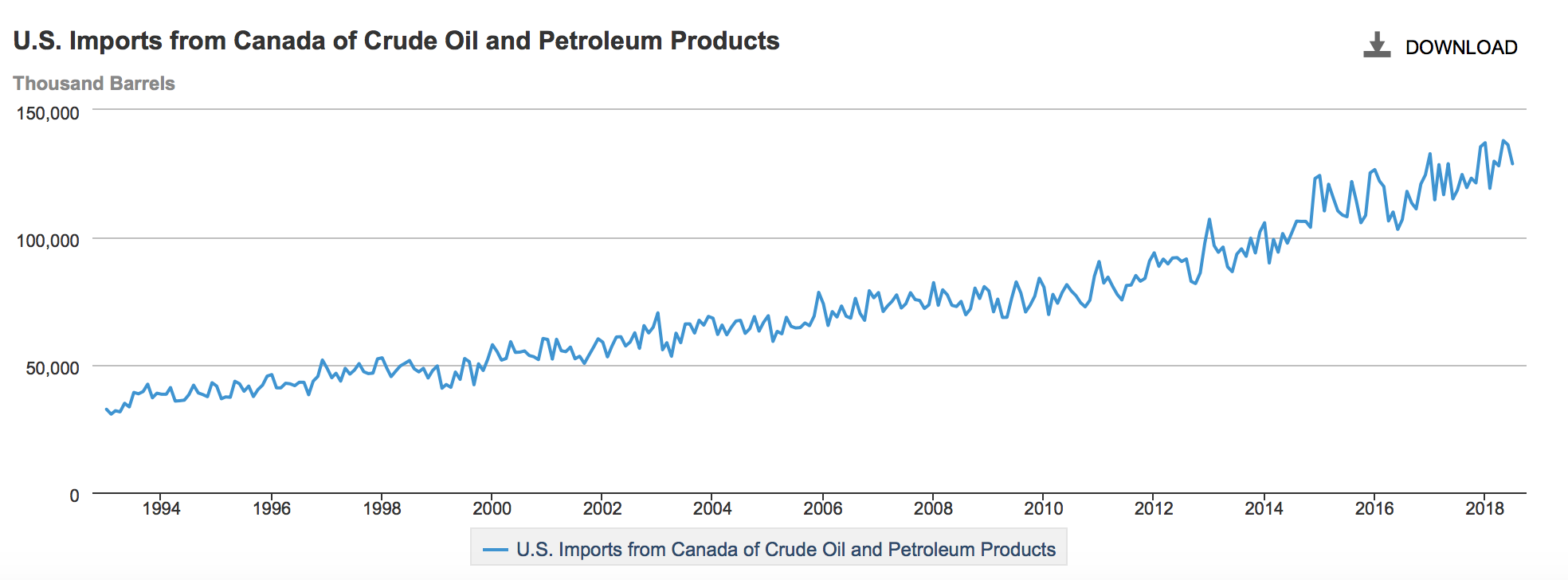

In June 2018 Canada set a new record for exporting oil to the U.S., hitting well over three million barrels per day. This record coincided with another one for oil exported by rail from Canada to the U.S. The U.S. is currently the only major market for Canadian crude, with 99 percent of its exports going to either U.S. refineries or ports for export.

Source: U.S. Energy Information Administration

America Is Maxing out on Canadian Crude

American refineries certainly enjoy buying Canadian crude at such low prices. How low are the prices? As the Financial Post reported in mid-October, Western Canadian Select (WCS) was $19 a barrel — approximately $50 a barrel cheaper than a barrel of the American oil standard known as Western Texas Intermediate (WTI).

Without a competing market in sight, American buyers likely will continue receiving huge discounts on Canadian oil. As Sandy Fielden, director of oil and products research at Morningstar, told Reuters in 2016: “If Canada can’t get their oil to another market besides the U.S. [market], you’ll always be a price taker, not a price maker.”

Even under these economic conditions, one company, Teck Resources, is proposing to build a new tar sands mining operation. Projections estimate the cost to produce a barrel of oil at this operation will be around $85 a barrel. That’s quite the mismatch with what a barrel of Canadian crude oil is fetching these days, and doesn’t bode well for a sustainable business model.

Another complicating factor is that even at such low prices, American refineries only want and need so much tar sands oil, which is a heavy, lower-quality oil. America is experiencing a boom in production of the light fracked crude oil from shale basins, which is not only more valuable to refineries but requires much lower transportation costs than importing crude from Alberta, the tar sands capital of North America.

As The Energy Mix reported recently: “Permian Basin oil is a far better fit for the only U.S. refineries capable of handling more bitumen [tar sands oil], and will likely be for at least the next decade.”

As an example of that preference, Exxon just announced plans to expand its Beaumount, Texas, refinery by 300,000 barrels per day, which would make it the largest refinery in America. This additional capacity is for light crude oil, not heavy Canadian oil.

Still, American refineries are importing, and refining, record amounts of Canadian oil right now, but at massively discounted prices compared to average global oil prices, which helps lead to huge profits for American refiners.

Yet another complication for tar sands producers is that, as The Energy Mix highlighted, “In reality, virtually every refinery in America that buys heavy crude is operating at full capacity. That is why there are no buyers willing to pay higher prices.”

Economics 101. If supply is higher than demand, prices go down. And sellers in that market have to take whatever price they can get, even if that means selling at a loss.

To help extract itself from this difficult situation, Canada is looking to build pipelines, such as the still-uncertain Trans Mountain pipeline expansion, to transport its landlocked oil to tidewaters, where companies theoretically can sell the oil to Asia’s rapidly growing market.

Never Get Involved in an Oil War With Saudi Arabia

Shell Jackpine tar sands mine in 2014. Credit: Julia Kilpatrick, Pembina Institute, CC BY–NC–ND 2.0

Canada’s tar sands pipeline plans have several fatal flaws. The first is that tar sands oil is heavy and not the most desirable oil on the market. The second is that Canada is late to the game, with some rather formidable competition from the U.S., which is exporting oil to Asia at ever increasing rates, and also from the Middle East.

While Canada’s tar sands proven oil reserves are the third largest for any country in the world, Saudi Arabia holds the number two spot (Venezuela is number one). Unlike the stiff production costs Canadian tar sands operators face, Saudi Arabia has production costs in the range of $10 per barrel. Plus, Saudi Arabia is producing more desirable grades of oil and has easy access to ports, giving the country a strong competitive edge.

However, Saudi Arabia still needs to secure markets for its oil and has been striking deals and partnerships around the world to ensure its oil is the oil that meets future global demand. It has begun shipping oil to one of these joint venture projects in Malaysia and is helping finance projects in China, South Africa, India, Pakistan, and South Korea. French oil company Total SA is also partnering with the state-owned Saudi Aramco on a huge refinery and petrochemical complex in eastern Saudi Arabia.

Saudi Aramco even owns the largest oil refinery in America, in Port Arthur, Texas, where it processes large amounts of oil imported from Saudi Arabia. Aramco’s plans to expand the facility are centered on petrochemical production, an area many oil producers see as the future for growth in the business and not one that will require tar sands oil as feedstock.

In the near term, Canada faces competition with America’s booming fracked oil trade, and in the long term, Saudi Arabia is locking up deals to supply the foreign markets Canada eventually hopes to reach if it can ever build pipelines to export its oil. Even then, The Energy Mix predicts that Canada would require prices of “upwards of U.S. $100 per barrel for decades.”

This is all assuming a significant reduction in global oil consumption doesn’t occur in the coming decades in order to address the climate crisis. Years of successful pipeline protests and global oil economics may end up keeping a large portion of the Canadian tar sands oil “in the ground.”

Canadian Prime Minister Justin Trudeau most likely wouldn’t be pleased at that prospect. In 2017 he told an oil industry conference: “No country would find 173 billion barrels of oil in the ground and leave them there.” But a country might if the oil were sold at a loss.

Looking for Bailouts

A good indicator of the failed tar sands model is how many major oil companies sold their positions in Canadian tar sands and took their losses. Their main explanation? No one could make money on those projects at current oil prices.

The remaining companies apparently have to rely on government bailouts. The first bailout signaling trouble for the industry was when the Canadian government bought the Trans Mountain pipeline expansion project from Texas-based Kinder Morgan for CAN $4.5 billion. A federal court ruled that the pipeline didn’t get the proper approvals, which means it is now in legal limbo and may not be built — but Kinder Morgan still gets its $4.5 billion. A big win for Kinder Morgan, perhaps less so for the people of Canada.

Trudeau and the Canadian oil industry need this pipeline if they have any hopes of exporting tar sands oil to Asia. Energy East, the other large pipeline designed for exports, was canceled in 2017. As the delays continue and the economics remain unfavorable for Canadian tar sands, other suppliers such as Saudi Arabia are securing future oil export markets.

More recently — indicating how desperate the situation is for tar sands producers — Alberta Premier Rachel Notley pitched the idea that the Canadian government should invest in the oil-by-rail business to help tar sands producers, which sounds a lot like corporate welfare to support a failing business model.

This request comes despite oil producer Cenovus signing a deal in September to move more of its oil by rail, and this deal reportedly isn’t the only one of its kind. Canada is set up to move far more oil-by-rail than ever before, despite the obvious risks to safety and environment.

Moving oil by rail is more expensive than by pipeline but does offer the advantage of reaching ports where the oil could be exported — and a desperate Canadian oil industry has very few options.

Technology Not the Savior

Canadian tar sands oil had very different prospects in 2010. The American shale oil and gas revolution had just begun, and producers were trying to figure out which shale plays would actually produce oil. It did not seem like a threat to the massive Canadian tar sands oil industry at the time.

Meanwhile in Canada, the industry knew where the bitumen was and how much was there (a lot). In a 2010 article in The Globe and Mail, Darin Barter, a spokesman for Alberta’s Energy Resources Conservation Board, noted that unlike the traditional oil industry, exploration costs for the tar sands industry were “zero.”

“We know the oil is there, the bitumen is there, the technology may not be there,” Barter said in 2010, “But we all know how quickly technology moves forward when there is a financial reward at the end. “

In 2018, the technology is definitely there. The bitumen can be mined and diluted and pumped through pipelines and into rail tank cars. But the financial reward that Barter was expecting technology to deliver has not materialized.

Almost 10 years later, the financial payout for tar sands oil looks less likely than ever.

Main image: Fort McMurray, Alberta – Operation Arctic Shadow. Credit: Kris Krüg, CC BY–NC–ND 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts