China threatened to slap U.S. liquefied natural gas (LNG) exports with a 25 percent tariff on August 3, escalating a trade war by threatening an industry closely allied with President Donald Trump and potentially benefitting a $55 billion Russian gas pipeline project.

The $60 billion in proposed retaliatory tariffs, which are also aimed at the metals, lumber, and agriculture industries, could have significant impacts for U.S. LNG export plans — and for the domestic shale gas industry, which has struggled to turn a profit and which has staked its hopes for years on hopes of selling gas from wells drilled and fracked in the U.S. to buyers abroad at higher prices.

The move highlights the ongoing transition away from coal in China, which has sought to curb pollution from burning coal by shifting towards gas, a fuel marketed (over urgent protests from some scientists) as a cleaner alternative. The notion that natural gas can serve as a “bridge fuel” with less climate-changing pollution than coal only makes sense if that gas — the powerful greenhouse gas methane — doesn’t leak. And the U.S. shale gas industry has a significant leakage problem.

It also calls into question the Trump administration’s heavy reliance on American “energy dominance” as a cudgel of international diplomacy, suggesting that American LNG is not such a vital fuel for China that it can be expected to automatically escape impacts from a trade war.

China’s shift to gas had been seen as a “massive opportunity” for companies hoping to export U.S. LNG, Bernstein analyst Neil Beveridge has said. The trade war adds to the level of risk associated with investing in LNG export projects, which are already competing in a crowded market.

The LNG threat came as a surprise to many industry watchers, who had predicted that exports of the fossil fuel from the U.S. to China would remain safely on the sidelines as the trade war escalated.

“LNG is clearly seen as an essential good by the Chinese government,” a Wood Mackenzie research note predicted earlier this summer. “Given this, in the event of an escalation, LNG is likely to remain outside the bounds of any additional tariffs.”

But experts in China say that actually, U.S. firms need to sell their LNG more badly than China needs to buy it.

“The U.S. gas industry will be much harder hit by this as China imports only a small volume whereas U.S. suppliers see China as a major future market,” Lin Boqiang, professor on energy studies at Xiamen University in China, told Reuters.

Trump Administration Pushing LNG

Last year, the U.S. exported 1.9 billion cubic feet of LNG per day, valued at $3.3 billion, and China was the third largest buyer of that LNG, purchasing about 15 percent of those exports. China has been busy building up the infrastructure to import LNG, and has commissioned 20 LNG import terminals as of August 2018.

The U.S. is also in the middle of an LNG construction rush, with Trump’s Secretary of Energy Rick Perry participating in the ribbon cutting at the country’s second LNG export terminal, the Cove Point project in Maryland, in July. Four more export projects are under construction, and many others are planned.

Those LNG terminals, which will rely on the continued consumption of massive amounts of natural gas worldwide for decades to come, have benefited from a political push by the Trump administration.

In December, then-Environmental Protection Agency chief Scott Pruitt (who has since left the administration but remains under multiple federal investigations) took a trip to Morocco, where he pushed that country to accept imports of U.S. LNG. The administration also recently relaxed the rules for so-called “small scale” LNG exports to countries in South and Central America (dozens of environmental watchdogs criticized a Department of Energy draft study on those exports for failing to account for climate change and other “fundamental flaws”).

In July, Kevin McIntyre, Trump-appointed chair of the Federal Energy Regulatory Commission, promised to grease the wheels for LNG exports permitting by working with the Pipeline and Hazardous Materials Safety Administration to ensure permitting would go faster.

That plan angered environmental watchdogs. “When agencies cut corners on critical environmental reviews of fossil fuel projects just to please the industry, it’s the public that pays the price,” Kelly Martin, director of the Sierra Club’s “Beyond Dirty Fuels” campaign, said in a statement following that announcement. “The only people who will benefit from more gas exports are fossil fuel industry CEOs, while Americans are left with higher energy costs and increased air and water pollution caused by fracking.”

The Power of Siberia Pipeline

The proposed tariffs are unlikely to affect the amount of natural gas that the U.S. exports, according to Bernstein analyst Nick Beveridge, but will instead mean that more U.S. gas will head to Europe and other countries.

One of the biggest winners from the tariffs could in fact be the country at the center of the ongoing investigation into the Trump administration by independent prosecutor Robert Mueller: Russia.

Russia’s national gas exporter, Gazprom, is currently building a $55 billion export pipeline called the Power of Siberia, expected to be completed in 2019, when it will connect China to Russian gas exports for the very first time.

“Having concluded a single contract, China equalled our largest European consumer,” Alexander Medvedev, Gazprom’s deputy chairman told The Financial Times in April. “This cannot but inspire hope for more.”

Energy Dominance

The LNG tariffs threatened by China not only create the suggestion that Trump will benefit Russia by continuing the trade war, they also strike at vulnerabilities in the U.S. gas industry, raising questions about the soundness of the industry that underlies the Trump administration’s plans for “energy dominance.”

The tariffs are likely to create new strains for “smaller, independent” LNG exporters, with investment advisors pointing to projects proposed by Houston-based company Tellurian and NextDecade’s Brownsville, Texas, LNG export plans.

Further, the news creates new financial headaches for the shale drilling industry, which aims to provide increasing amounts of fracked gas for export. That industry, which has spent far more than it has earned ($280 billion more, according to the Wall Street Journal, which ran the numbers from 2007 to 2017).

The industry’s financial problems have even drawn the attention of the International Energy Agency (IEA). “Since its inception, the industry has been characterized by negative free cash flow as expectations of rising production and cost improvements led to continuous overspending in the sector,” IEA analysts said in a recent report. “Over the last few months, the industry as a whole has seen a notable improvement in financial conditions, though the picture varies markedly by company, and the overall health of the industry remains fragile.”

When it comes to the climate, scientists say we should be burning less natural gas, not more. Not only does burning natural gas release roughly 50 percent as much carbon dioxide as the notoriously dirty fossil fuel coal, but natural gas itself does enormous damage to the climate when it leaks out into the air.

Methane, the main ingredient in natural gas, is a powerful greenhouse gas in its own right, causing over 86 times the amount of global warming as the same amount of CO2 in the first 20 years after it leaks. If more than roughly 3 percent of that gas leaks out, burning natural gas for power is even worse for the climate than burning coal, according to the Environmental Defense Fund.

But determining the leak rates is a challenge, and studies have found leaks might be as low as 1.2 percent (using industry figures), or as high as 12 percent, which would be enough to make gas far worse for the climate than coal.

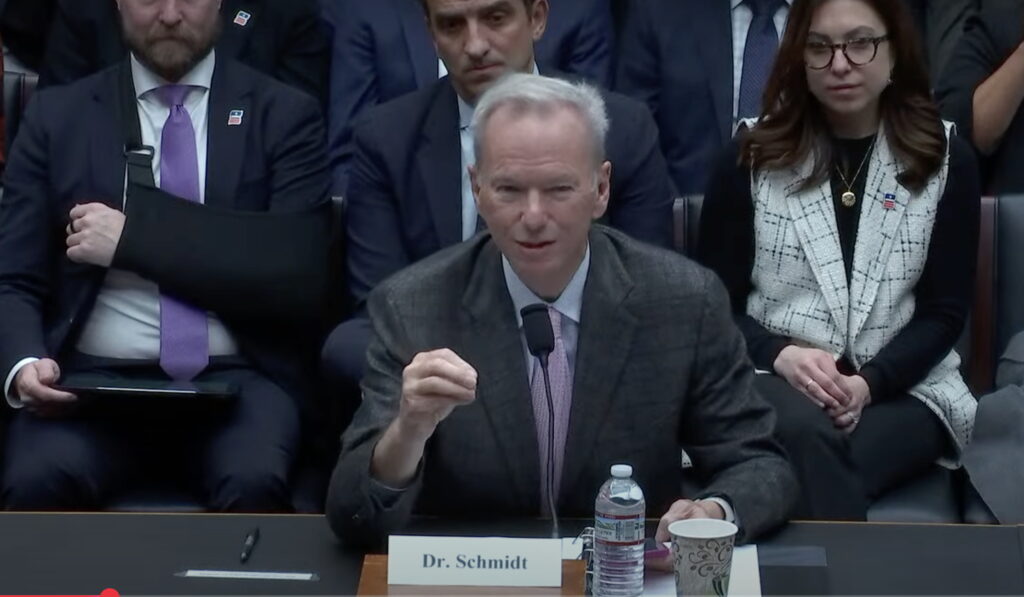

Main image: Then presidential-candidate Donald Trump spoke at the drilling industry conference Shale Insight in 2016. Credit: Laura Evangelisto, © 2016.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts