A little-known network of London-based oil and gas companies tied to international tax havens and operating in the shadow of major industry players are seeking opportunities in Africa’s frontier oil and gas markets, a DeSmog UK investigation can reveal.

These companies are willing to take risks operating in politically unstable areas to dig out potentially lucrative resources under the African soil, despite analysts saying the activities are in direct conflict with global climate targets.

A study published in the journal Nature estimated 21 percent of Africa’s oil reserves and 33 percent of gas reserves would need to remain in the ground if the world is going to limit warming to an agreed target of around 1.5 degrees.

DeSmog UK examined the activities of 12 private and public limited oil and gas companies headquartered in London that have operations in Africa, and found that all make use of tax-havens in British overseas territories and crown dependencies such as the British Virgin Islands, the Cayman Islands and Jersey.

While it is not illegal for companies to manage their business assets in tax havens — and DeSmog UK’s research does not suggest the companies identified are involved in illegal behaviour or wrongdoing — doing so creates complex offshore company structures.

All the companies identified by DeSmog UK were contacted for a response. Three of the 12 companies responded with comment, and four declined to do so. Where possible, the companies are quoted in this article. You can read their full responses here.

After the release of the Panama papers, which revealed the offshore holdings disclosed by 11.5 million secret files, the then prime minister David Cameron said the UK needed to take “additional measures” to “make it harder for people to hide the proceeds of corruption offshore, to make sure that those who smooth the way can no longer get away with it and to investigate wrongdoing”. The offshore system is currently subject to an inquiry by parliament.

This first article in DeSmog UK’s three-part series takes a closer look at companies operating from the heart of London and drilling for oil in Africa, while using offshore tax havens.

UK government (in)action

The UK government has been permissive in allowing London-based companies to use the financial hub of the City and offshore accounts in British jurisdictions as the springboard to carry out polluting activities abroad.

In a 2014 report, a group of NGOs claimed wealthy countries such as the UK were using aid as a smokescreen to hide the exploitation of Africa, which was losing an estimated $60 billion (£42.4 billion) through tax evasion and the flight of profits earned by foreign multinational companies.

Speaking to the Guardian at the time, Martin Drewry, director of Health Poverty Action, one of the NGOs behind the report, said of UK aid: “Let’s use more accurate language. It’s sustained looting — the opposite of generous giving — and we should recognise that the City of London is at the heart of the global financial system that facilitates this.”

The UK is one of 51 countries signed up to the Extractive Industries Transparency Initiative (EITI), a global scheme that compels oil, gas and mining companies to disclose any payments made to governments.

Until now, companies registered in crown dependencies and overseas territories did not have to make financial disclosures under the EITI.

Barnaby Pace, from NGO Global Witness’ investigation team, urged the UK government to put pressure on authorities to disclose the true beneficiaries and owners of offshore anonymous companies.

Earlier this month, the UK Parliament voted to accept an amendment to the sanctions and anti-money laundering bill that requires the UK‘s overseas territories — such as the Cayman Islands and the British Virgin Islands — to publish public registers of company ownership by the end of 2020.

But until recently, the UK government had rebuffed calls to compel tax havens under British jurisdiction to reveal their company owners. Meanwhile, the government continues to support dirty fossil fuel projects abroad by providing millions of pounds of finance to boost UK companies’ exports.

As Brexit looms, UK government ministers, including foreign secretary Boris Johnson and international trade secretary Liam Fox have been reaching out to African ministers in the hope of building further trade links with the continent.

Speaking to the Africa All Party Parliamentary Group last year, minister for trade policy Greg Hands said the government wants to establish a thriving relationship with Africa:

“As we leave the EU, we will build and strengthen ties between British and African businesses and help turn the UK into Africa’s trading partner of choice.”

Critics of the offshore tax haven system argue that this renewed interest to trade with the African continent increases the imperative for scrutiny of companies such as those identified as part of London’s African oil hub.

From London to tax havens

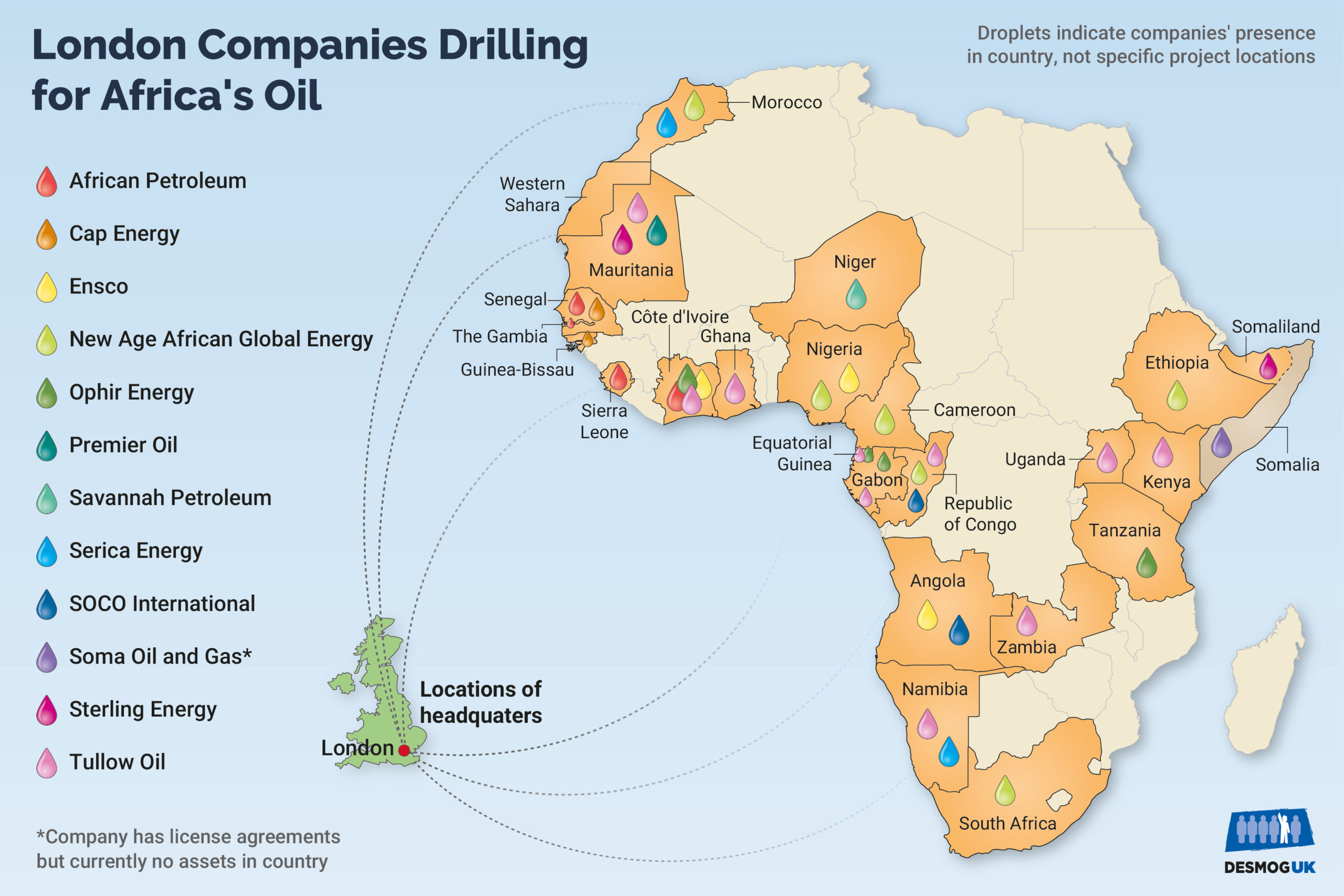

This first part of DeSmog UK’s investigation looks at 12 companies, headquartered in London and either exploring or producing fossil fuels in Africa. These include African Petroleum, Cap Energy, Ensco, New Age African Global Energy, Ophir Energy, Premier Oil, Savannah Petroleum, Serica Energy, Soco International, Soma Oil and Gas, Sterling Energy and Tullow Oil.

UK oil majors, UK subsidiaries and oil companies with headquarters outside of London have been excluded from this list.

While these companies are not household names in the UK, some have become major players in oil and gas industries across the African continent, often operating alongside oil majors to exploit large assets.

The size of the companies and their assets vary. For instance, last year, offshore drilling company Ensco, which is listed in New York, announced revenues reaching $2.78 billion (£2.08 billion) while privately owned Soma Oil and Gas still holds no assets.

DeSmog UK’s analysis reveals all of these companies have links to tax havens either through a holding company, subsidiaries or a major shareholder.

It is not illegal for companies to register offshore neither does it imply these companies are involved in tax avoidance, evasion, or corruption. However, the tax haven system is designed in a way that makes it much more difficult to expose the companies that are involved in such activities.

With headquarters in Mayfair, Westminster and Knightsbridge, a majority of these companies are concentrated at the heart of London, close to potential investors.

The map shows where the headquarters of the 12 companies identified by DeSmog UK are located in London.

Since its creation in 2013, Soma Oil and Gas has changed its registration address five times in central London according to Companies’ House. Soma Oil and Gas was founded in 2013 by the former leader of the Conservative Party and now company chairman Lord Howard of Lympne to pursue oil and gas opportunities in Somalia.

In 2015, it was the subject of a criminal investigation by the Serious Fraud office (SFO) “in relation to allegations of corruption in Somalia”. In 2016, the SFO closed the case because of “insufficient evidence”. No charges were ever made.

The company told DeSmog UK the address change was due to the “initial founding of the company” that was “followed by three moves to different sublet offices to lower costs in response to the low oil price”.

Cap Energy is located in Berkeley Square in Mayfair where Edinburgh-based Cairn Energy and newly-incorporated Sonaco Energy Limited, also have offices.

Ensco shares an address in Mayfair with British Virgin Islands-incorporated Seven Energy International Limited, an integrated Nigerian gas company.

Seven Energy came under scrutiny in Nigeria after the governor of the country’s central bank Sanusi Lamido Sanusi told the National Assembly the company had been involved in an “unconstitutional and illegal transaction”.

The case came into the spotlight as part of a wide corruption probe following President Muhammadu Buhari’s pledge to “clean-up” the industry. Seven Energy refuted the “unfounded allegations” made against the company and denied any wrongdoing.

Savannah Petroleum, which is listed on London’s junior stock exchange, the Alternative Investment Market (AIM), is an oil exploration company with assets in Niger. Savannah Petroleum has also entered an agreement for the acquisition of certain of Seven Energy’s oil and gas assets in Nigeria.

Besides their London head offices, these companies manage a complex structure of holding companies and large numbers of subsidiaries, making their activities difficult to trace.

New Age African Global Energy was formed in Jersey in 2007 by Steve Lowden, an oil veteran who previously held senior roles at Marathon Oil and Premier Oil. The company is backed by US hedge-fund Och-Ziff, which had to pay more than $400 million (£295 million) in a settlement following an investigation by the US government that found the company had paid more than $100 million (£74 million) in bribes to government officials in Libya, Chad, Niger, Guinea and the Democratic Republic of Congo to secure natural resources deals and investments.

The director of the Securities and Exchange Commission’s enforcement division Andrew J. Ceresney, said: “Och-Ziff engaged in complicated, far-reaching schemes to get special access and secure significant deals and profits through corruption.”

A lawyer for Och Ziff told a federal judge presiding over the case in New York that “Och-Ziff has taken substantial remedial efforts to improve its compliance programme to ensure something like this can never happen again”, Reuters reported.

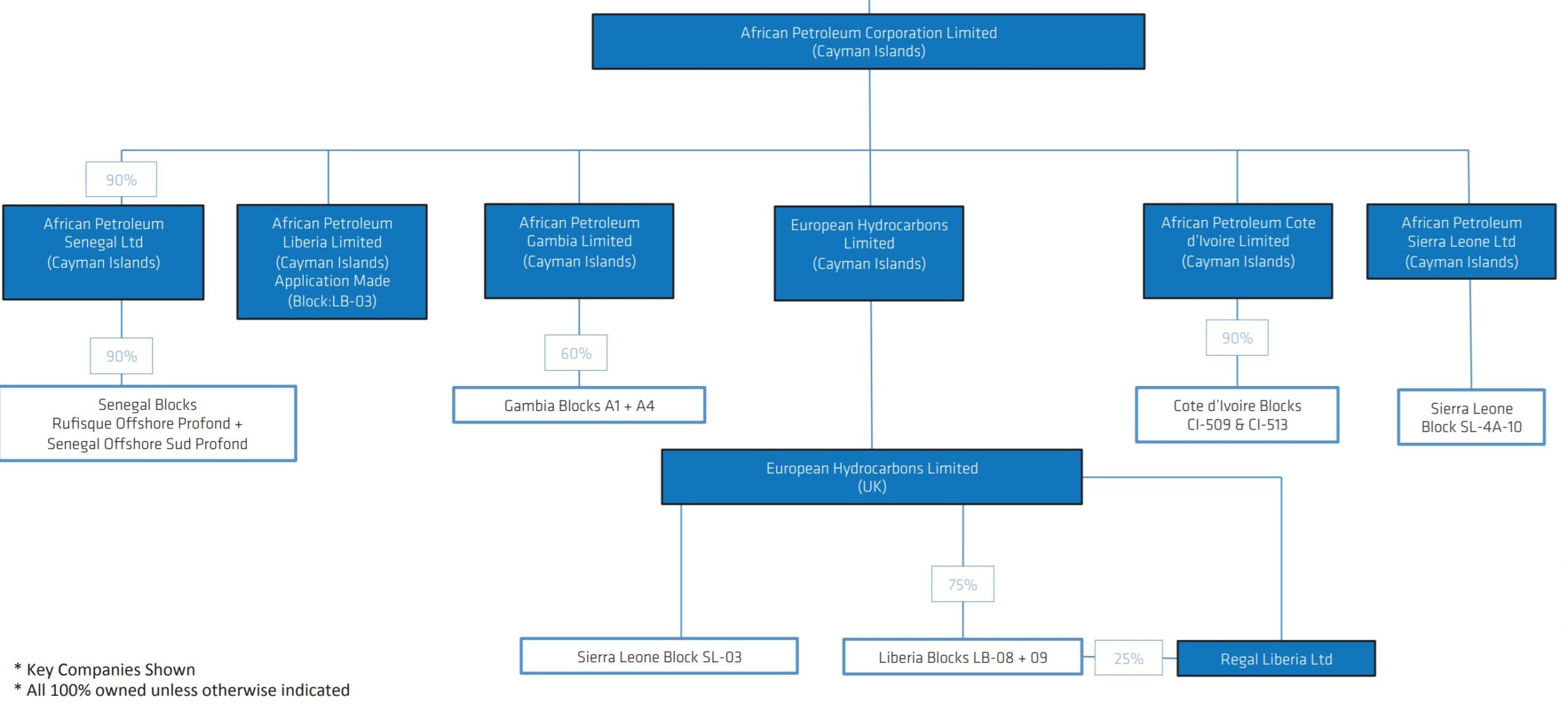

African Petroleum, which was founded by controversial Romanian businessman Frank Timis, has its holding company and all of its subsidiaries incorporated in the Cayman Islands.

Timis has a track record of listing companies on AIM that have been engulfed in allegations of wrongdoing. In 2009, he was handed a record fine of £600,000 by AIM regulators for failing to ensure information provided “was not misleading, false or deceptive” and for overstating the oil reserves of his earlier AIM-listed ventures, Regal Petroleum.

In a statement, Regal Petroleum said it was “disappointed at the outcome” but “pleased to finally divorce the company from this historic episode”, adding there had been no suggestion that the current management team “conducted their responsibilities in anything other than a proper and professional manner”.

Timis later listed mining company African Minerals. Its subsidiary, Tonkolili Iron Ore limited, has been accused of being “both complicit and directly involved in violence” as “villagers were unlawfully assaulted and imprisoned by the Sierra Leonean Police” while contesting the mine’s activities. The case is being heard by the British high court in Sierra Leone. African Minerals eventually went into administration in 2015 for failing to repay its lenders.

The graph shows the company structure of African Petroleum. Screenshot of African Petroleum presentation document dated July 2013.

Serica Energy’s holding company — Serica Energy Corporation — was incorporated in the British Virgin Islands and is based in Singapore, also a tax haven. Savannah Petroleum’s holding company SPN Limited was also incorporated in Jersey.

Official documents from the US Securities and Exchange Commission show Ensco is operating through a string of subsidiaries and holdings companies registered in the Cayman Islands, the British Virgin Islands and Delaware.

Tullow Oil also operates dozens of subsidiaries, often with two in each country of operation including one registered in the UK and one registered offshore in the Channels Islands. This is the case with subsidiaries for Ivory Coast and the Republic of Congo registered respectively in Jersey and the Isle of Man.

Last year, an Oxfam report warned the Kenyan government that it could lose billions of its oil revenue and taxes because multinational companies were operating oil blocks through subsidiaries registered in tax havens.

Tullow Oil did not respond to DeSmog UK’s request for comment but previously told the Guardian that it did not use tax havens to avoid tax: “Our clear aim in tax planning is to ensure that the appropriate amount of tax is paid in the jurisdiction in which the activities are undertaken”.

Like Tullow Oil, Ophir Energy operates a similar structure with subsidiaries in Equatorial Guinea and Ivory Coast registered in Jersey and the British Virgin Islands.

A spokesman for Ophir Energy said: “The use of different territories for registering businesses is for managing legal and administrative costs as efficiently possible. The place of incorporation does not necessarily correlate with the tax residency of the company.”

Soco International also has dozens of subsidiaries registered in the Cayman Islands and Jersey, where Sterling Energy’s subsidiaries — Sterling Energy (East Africa) Limited and Premier Oil Finance (Jersey) — are also incorporated.

In a statement, Soco International said: “The company openly discloses where its subsidiaries are and its payments to governments as well as its tax strategy which can be accessed on its website.”

A Premier Oil spokesperson told DeSmog UK its Jersey-based subsidiary only holds convertible bonds.

Companies’ ties to tax havens also occur through a major shareholder. This is the case of Soma Oil and Gas and Cap Energy.

More than 50 percent of Soma Oil and Gas is owned by Winter Sky Investments Limited, a private equity fund registered in the British Virgin Islands which invested more than £50 million in Soma.

Cap Energy’s major shareholder is Global Energy Trade Limited, a firm owned by two Cap Energy directors and incorporated in the British Virgin Islands.

Some of the companies continue to be involved in policymaking around the taxation regimes of countries in which they operate.

Last year, Cap Energy announced that it obtained an amendment to its fiscal terms from the Ministry of Resources in Guinea Bissau, stating “the new terms are more favourable to Cap’s activities”.

Fighting corruption and ensuring multinational companies conform with local tax laws have become a priority for many African countries in need of finance. A UN report previously warned domestic resources such as oil and gas “are the largest untapped source of financing to fund national development plans”.

Speaking at an anti-corruption summit in London in 2016, Nigerian President Muhammadu Buhari said:

“Every dollar siphoned through dirty deals and corruption to offshore tax havens makes the livelihood and survival of the average African more precarious.”

However, bribery, corruption and tax evasion continue to be a risk in countries with large oil and gas reserves, with anonymous offshore accounts often acting as a smokescreen for these activities to go unnoticed.

Following the publication of the Panama Papers, analysis by the International Consortium of Investigative Journalists identified 37 companies that were named in court actions or government investigations involving natural resources in Africa — with Mossack Fonseca’s records showing the firm was a major provider of secrecy to companies involved in extractive industries.

Recently, one case has caught the industry’s attention.

Afren, a former FTSE 250 independent exploration and production company registered in London, had operations focused in Nigeria and Africa’s West coast until its collapse in 2015.

This followed an investigation by the UK Serious Fraud Office which accused Afren’s chief executive Osman Shahenshah and chief operating officer Shahid Ullah of “receiving payments via secret companies they controlled relating to over $400 million (£295) of Nigeria business deals”.

Both Shahenshah and Ullah were sacked by Afren in 2014 for “gross misconduct” following an independent review into the claims.

The pair are now facing fraud charges over the allegations they profited £45 million through an entity in the British Virgin Islands.

Both have denied wrongdoing. A lawyer for Shahenshah told the FT: “My client is fully aware of the proposed charges, which are considered to be without foundation. Accordingly, they will be vigorously defended.”

Transparency

The fact these companies are headquartered in London also means some information has to be disclosed under the Extractive Industries Transparency Initiative (EITI).

Barnaby Pace, of Global Witness, told DeSmog UK the EITI scheme was important because it ensured African governments are receiving the appropriate tax revenue from UK-based companies.

He said:

“Frontier exploration exposes these companies to even greater risk because they are operating in areas which can be politically challenging and so the need for greater transparency on their activities is heightened.”

“Yet some of these companies are operating in countries where the EITI is not being implemented,” Pace said.

Countries which are not signed up to the EITI scheme include (but are not limited to) Morocco, Angola, Namibia, South Africa, Zimbabwe, Somalia and Kenya.

However some UK companies operating in those countries have also endorsed the EITI guidelines. This is the case of Soma Oil and Gas, which operates in Somalia where EITI guidelines do not apply.

A spokesperson for Soma Oil and Gas told DeSmog UK that the company “was specifically founded and registered in the UK to facilitate full compliance with UK anti-bribery and corruption law and to access transparent UK financial and legal services since our business was to be conducted in the challenged country of Somalia.”

Full comment from companies that responded to DeSmog UK’s questions can be found here.

FIND OUT MORE ABOUT THE SECRECY LAWS OF TAX HAVENS AND WHY THEY MATTER HERE.

New frontiers

The group of London-based companies identified by DeSmog UK focus on oil and gas opportunities in so-called frontier markets, even if this means moving into riskier environments and unstable political contexts.

In Somalia, experts estimated there could be up to 110 billion barrels of proven oil reserves off the country’s coast.

On its website, Soma Oil and Gas states: “Eastern Africa has seen some of the most dramatic hydrocarbons discoveries in the world in recent years. Yet Somalia is at present the last remaining frontier on the region’s energy map. Industry experts consider it to have huge prospective resources, both onshore and offshore.”

Screenshot of the homepage of Soma Oil and Gas’ website.

In 2013, Soma Oil and Gas signed an agreement with the Somali government granting exclusive rights to the company to carry out offshore seismic survey and then bid for up to 12 oil blocks.

At the time of the deal, the company was the first to be awarded a contract for oil exploration since the country’s civil war in the 1990s.

The company said it would assist the government “in its objective to promote the oil and gas sector to attract investment and activity, boosting Somalia’s economy and helping the process of normalisation” while generating “employment and economic opportunities” along the way.

The agreement with the Somali government came under scrutiny after a leaked UN report accused the company of “serious conflict of interest, [and] in a number of cases appearing to fund systematic pay-off to senior ministerial officials”.

The company denied any wrongdoing and claimed UN officials “fundamentally misunderstood” the payments. In December last year the Serious Fraud Office (SFO) dropped its case against the company, citing “insufficient evidence to provide a realistic prospect of conviction”.

A spokesperson for Soma Oil and Gas told DeSmog UK that the allegations of corruption were “unfounded” and the company’s “foresight for transparency and principled governance proved extremely beneficial” in responding to the SFO’s investigation.

In February, the company’s executive director, Hassan Khaire, resigned from his post to become Prime Minister of Somalia.

View of a mountain range in the Virunga Park, in the Democratic Republic of Congo. The park is home to about a quater of the world’s critically endangered mountain gorillas. Image Credit: MONUSCO Photos/ Wikimedia Commons CC BY–SA 2.0

Companies’ exploration strategies have also led them to seek licenses for untapped reserves in national parks, despite the opposition of environmental groups and local populations.

After it received undercover recordings, Global Witness claimed Soco International paid thousands of dollars to an army officer who organised violence and intimidation against opponents of the company’s plans to explore for oil in the Democratic Republic of Congo’s Virunga nature reserve, one of Africa’s oldest national parks.

Soco International denied any wrongdoing, but ceased its operations in the Democratic Republic of Congo in 2014.

At the time, the company told Global Witness it “does not condone, partake in or tolerate corrupt or illegal activity whatsoever” and that bribes to park rangers “have never been nor will ever be sanctioned by Soco”.

In a statement to DeSmog UK, Soco International said: “There have been a substantial number of false and inaccurate allegations levelled against SOCO in the media. We maintain that SOCO has not supported any inappropriate activities, which was confirmed by an independent review of activities conducted by Clifford Chance law firm.”

In Uganda, UK government support for a multi-billion dollar plan by Tullow Oil, Total and Chinese oil company CNOOC to drill in Murchison Falls National Park was strongly opposed by environmentalists warning the park is home to one of the most endangered species of giraffes.

Tullow Oil did not respond to DeSmog UK’s request for comment but told Greenpeace’s Unearthed at the time that the company had “very strict and clear procedures with regard to operating in protected areas” and that it “minimizes the risk of impact to protected areas by avoiding them as best we can”.

Tullow Oil and its partners continue to work on the development of the Lake Albert oil project on the edge of the park, which is anticipated to produce 230,000 barrels of oil a day at full production.

Last year, Tullow Oil announced a transfer of the majority of its interest in the project to Total but said that the company “will remain an active investor in Uganda’s oil and gas sector”.

On other frontiers such as Namibia and Zambia, companies from London’s oil hub have also secured unexplored assets.

In Namibia, where experts have been anticipating an oil-boom for the last three years, Serica Energy claimed a seismic survey has revealed a “billion-barrel oil potential”in the offshore basin of Luderitz and is looking for partners with the capacity to carry out the extraction.

Meanwhile, Tullow Oil, which describes its activities as “finding and monetising oil”, is hoping to be the driving force behind a new oil industry in Zambia.

Tullow Oil carried out the first oil survey commissioned by Zambia President Edgar Changa Lungu, who hopes to diversify the country’s economy and reduce its reliance on copper resources.

According to Tullow Oil, exploration in northern Zambia could take up to 10 years, development between three years and a decade, and production 20 to 50 years.

Days after Tullow Oil started exploring for oil in the country’s northern provinces, Mr Changa’s cabinet approved a bill to amend the Petroleum (Exploration and Production) Act. Zambia’s government said the new bill would boost investment for oil and gas exploration by reforming previous fiscal and licensing legislation, which were described as “not investor friendly”.

“The gaps in the current law include, among others, unclear mode for government participation in the sector, lack of clarity of the fiscal regime, and absence of clear licensing system for blocks reserved for government,” a government spokeswoman said in a statement.

In Equatorial Guinea, Ophir Energy’s multi-billion dolar Fortuna project will be Africa’s first deepwater floating liquefaction facility, with an anticipating production capacity of 2.2 million tonnes per year when it is expected to start in 2020.

The company is working on a similar $30 billion (£23 billion) project in Tanzania with the BG Group (a division of Royal Dutch Shell), Statoil, Exxon Mobil and state-run Tanzania Petroleum Development Corporation.

With large profits expected, the Tanzanian government implemented some reforms to increase revenue transparency in the private sector. Last year, the government submitted three bills to parliament that would allow it to force mining and energy companies to renegotiate their contracts under a new taxation regime.

Reuters reported that the new bill prompted six unnamed foreign companies to rethink their business and investment plans in Tanzania.

In contrast to others’ booming projects, Premier Oil said is preparing to stop production in Mauritania due to “low production volumes and resulting marginal cash flows”. The asset generated less than 400 barrels of oil in 2016.

Read Part Two —Taking AIM: London’s Wild West Stock Market

Read Part Three — Exposed: The Elite ‘Boys Club’ Running London’s Opaque Oil Network

Got a tip or story? Here’s how to contact us securely.

Editors: Mat Hope, Mike Small, Kyla Mandel, & Christine Ottery; Graphics: Sam Whitham; Other multimedia: Jill Russo

Main image credit: Friends of the Earth International/Flickr/CC BY–SA 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts