Hydraulic fracturing‘s horizontal drilling technique has enabled industry to tap otherwise difficult-to-access oil and gas in shale basins throughout the U.S. and increasingly throughout the world. And now “fracking,” as it’s known, could soon arrive at a new frontier: Alaska.

As Bloomberg reported in March, Paul Basinski, a pioneer of fracking in Texas’ prolific Eagle Ford Shale, has led the push to explore fracking’s potential there, in what’s been dubbed “Project Icewine.” His company, Burgundy Xploration, is working on fracking in Alaska’s North Slope territory alongside the Australia-based company 88 Energy (formerly Tangiers Petroleum).

“The land sits over three underground bands of shale, from 3,000 to 20,000 feet below ground, that are the source rocks for the huge conventional oilfields to the north,” wrote Bloomberg. “The companies’ first well, Icewine 1, confirmed the presence of petroleum in the shale and found a geology that should be conducive to fracking.”

Why the name “Project Icewine”? “Everything we do is about wine,” Basinski told Alaska Public Radio. “That’s why it’s called Icewine. Because it’s cold up here, and I like German ice wine”

Geographical Terrain

A report by DJ Carmichael, an Australian stockbroker firm, notes that the Project Icewine oilfield is located in close proximity to the Trans-Alaska Pipeline System, which flows from northern to southern Alaska and is co-owned by BP, ConocoPhillips, ExxonMobil, and Chevron.

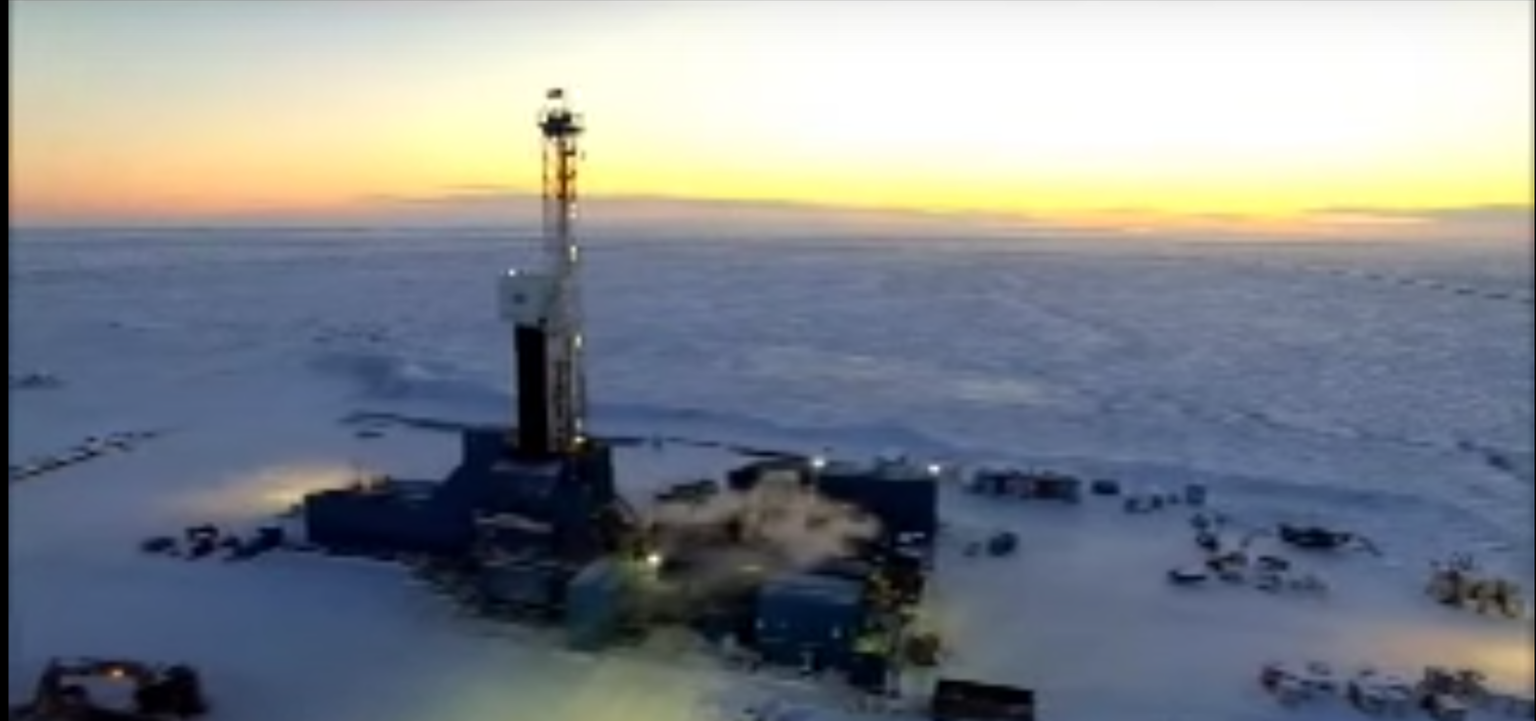

Drone footage, taken in 2016 by a company owned by Alaska Sen. Lisa Murkowski’s campaign manager, Steve Wackowski, shows a fracking test well being drilled for Icewine 1.

According to an Australian Securities Exchange filing, in April of this year, 88 Energy and Burgundy Xploration began pre-drilling procedures for Icewine 2, a second fracking test well. In the filing, which also noted receipt of a Permit to Drill from the Alaska Oil and Gas Conservation Commission, 88 Energy said it expects to begin “stimulation and production testing” in June or July.

When all is said and done, the two companies may soon have a plot of land 690,000 contiguous acres in size, according to the Securities Exchange filing. A May 3 Securities Exchange filing noted that 88 Energy is still on schedule for Icewine 2.

Credit: Australia Stock Exchange

Tax Subsidies

In a February 2016 research note, the Australian investment company Patersons Securities Limited noted that the 88 Energy-Burgundy Xploration joint venture is the beneficiary of a tax subsidy system put in place by the Alaska Legislature.

“In an effort to encourage exploration activity in order to ultimately promote an increase in oil production in Alaska and maintain the financial viability of the [Trans-Alaska Pipeline System], the State Legislature passed the More Alaska Production Act (MAPA) in April 2013,” reads the research note. “The Act effectively eliminated the progressive production tax on oil production and replaced it with a flat rate of 35 percent. In addition, companies like 88E operating above 68 degrees North latitude would qualify for a combined cash rebate on exploration of 85 percent for all qualified expenditure until 31 December 2015, reducing to 75 percent for the period ending 30 June 2016, and 35 percent thereafter.”

The More Alaska Production Act (MAPA) was so controversial that it came up for a referendum during the 2014 election cycle. This effort to overturn the law was defeated 52.7 percent to 47.3 percent after industry power players such as ExxonMobil, ConocoPhillips, and BP spent roughly $13 million on an advertising blitz to fend off the ballot initiative.

In its 2013 annual report filed with the U.S. Securities and Exchange Commission, ConocoPhillips said the legislation has helped the company’s corporate bottom line.

“Following the April 2013 enactment of revised oil tax legislation, MAPA, we have increased our exploration and development investments and activities on the North Slope by adding rigs and progressing new development opportunities,” wrote the company. “We will continue to work with co-owners to identify additional opportunities to increase our investments in Alaska.”

Oil and Money

Fracking is a capital-intensive procedure, made all the more so given northern Alaska’s isolated geographical location and its Arctic drilling terrain.

Perhaps in a nod to this, the GOP-dominated Alaska Legislature attempted to offer $430 million worth of tax subsidies for the oil and gas industry in the fiscal year 2017 budget. That was vetoed by Alaska Governor Bill Walker, an Independent, meaning the industry only got its statutory limit of $30 million in subsidies.

Patrick Galvin, chief commercial officer for Great Bear Petroleum, formerly served as petroleum land manager for the Alaska Department of Natural Resources and commissioner for the Alaska Department of Revenue. When Walker vetoed the $430 million proposed subsidy, Galvin publicly criticized him.

“What seems to have developed in this particular moment is the Governor having to kind of take hostages in order to get the legislature to act on what he wants them to act on with regard to a fiscal plan,” Galvin told Alaska Public Radio. “It has an impact down the chain for all of the business that company wanted to do and they were expecting to get these payments and now they’re basically stuck waiting to see when the state will ultimately pay its bill.”

Galvin’s company also drilled fracking test wells earlier in the decade but has yet to commercialize the technique. Great Bear previously estimated it could frack 200,000 barrels of crude per day by 2020 and 600,000 barrels per day by 2056, though it appears a long way from reaching those aspirations.

Another tax subsidy fight in Alaska is currently underway over the proposed Alaska House Bill 111, which passed 21-19 in the Democratic-controlled House and awaits a Republican-controlled Senate vote. The state bill — opposed by ConocoPhillips, BP, Great Bear Petroleum, and the Alaska Oil and Gas Association — would essentially undo the tax subsidy in place under the More Alaska Production Act, while also forcing the oil and gas industry to pay more taxes to fill the state’s coffers.

In the end, tapping Alaska’s shale resources via fracking, not unlike the attempts to drill for its Arctic oil, may come down to a simple issue of money. Whether enough cash will flow to the 49th state to make fracking a commercial-scale endeavor remains to be seen.

Main image credit: Share Talk | YouTube Screenshot

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts