In his speech at the Conservative Political Action Conference (CPAC) last week, President Donald Trump commemorated the one-month anniversary of his executive orders calling for the approval of the Keystone XL and Dakota Access pipelines, as well as one calling for U.S. pipelines to get their line pipe steel from U.S. facilities.

“I said, who makes the pipes for the pipeline?” Trump told the CPAC crowd. “If they want a pipeline in the United States, they’re going to use pipe that’s made in the United States, do we agree?”

But while the pipe may be made in the U.S., as DeSmog has shown in previous investigations, ownership tells a different story. Enter: TMK IPSCO, a massive producer of steel for U.S. oil country tubular goods (OCTG) and line pipe, and a subsidiary of TMK Group. A DeSmog investigation has found ties between TMK Group’s Board of Directors and Russian President Vladimir Putin.

TMK Group was incorporated in 2001, and in 2008, TMK IPSCO opened its doors as a U.S. subsidiary with a heavy focus on making oilfield pipes on behalf of companies performing hydraulic fracturing (“fracking”) techniques in the Marcellus Shale basin located in the northeast U.S. TMK IPSCO, which has said it wants to be a direct competitor of U.S. Steel Corporation in the Marcellus, also makes steel for companies doing fracking in the Bakken Shale basin, located primarily in North Dakota.

TMK Group also has a subsidiary named TMK Completions, which manufactures “multi-stage completion systems and tools for both uncemented and cemented well completion designs” for the fracking process. TMK did not respond to repeated requests for comment for this story.

“Walked into a Revolution”

According to a presentation given to the U.S. Department of Energy in July 2014 by TMK IPSCO‘s CEO, Piotr Galitzine, the company occupies 16 percent of the oilfield pipe market in the U.S. (and 9 percent of the global pipe market). Two of TMK IPSCO‘s major steel production facilities are located in Pennsylvania in the towns of Koppel and Ambridge, both well-situated for tapping into the Marcellus.

“It took me 36 hours after I landed here in 2008 after we bought the American pipe making assets of IPSCO to go back to Moscow and say that we just walked into a revolution,” Galitzine told the Pittsburgh Post-Gazette in 2015. “We were probably the quickest company to realize how important the shales were. It also helped that we had two factories on top of the shales, the Marcellus, that helped us focus our thoughts. So that has been our specialty the last six-and-a-half years.”

TMK IPSCO also has steel production facilities in Brookfield, Ohio, and Wilder, Kentucky, both situated closely to the Marcellus and Utica Shale basins. The Brookfield plant manufactures 500 pipes per day, “enough for slightly less than two Utica wells,” according to The Vindicator.

Additionally, TMK has a production site in Odessa, Texas, located within the Permian Basin. In all, TMK IPSCO “operates 11 plants in the United States, and more than 90 percent of the company’s tubular products go to the oil and gas industry,” explained the Pittsburgh Tribune in a 2011 article. “It has the capacity to make 1.3 million tons of pipe annually.”

In 2014, the company signed two three-year contracts with Shell to vend oilfield pipes to Shell for both onshore and offshore drilling purposes. Those parts are made at five different TMK facilities. TMK IPSCO also signed a deal that same year with oil services industry giant, Baker Hughes, “to jointly develop integrated well completion solutions.”

In a company brochure, TMK Group lists clients including Shell, Total, ExxonMobil, Occidental Petroleum, Saudi Aramco, Anadarko, Marathon, BP, Gazprom, Rosneft, and others.

Russian Fracking Revolution

After a half-decade in the country which pioneered fracking, TMK Group has taken its skills with the horizontal drilling technique from the U.S. back to Russia, bringing the fracking revolution to the Davydovskoye oilfield located in Orenburg Oblast. In 2013, TMK signed a deal with Orenburgneft, a Rosneft subsidiary, to provide the pipes needed to tap into that field.

TMK directly acknowledged its lessons learned from the U.S. experience in a press release announcing the joint venture.

“The high quality of our pipes and our multifaceted approach to customer service enable us to participate in complex projects involving state-of-the-art technology and exclusive standards of equipment and services,” TMK said in the release. “Our successful track record including the Company’s experience in North America is a solid base for enhancing our cooperation with partners in various areas, including unconventional methods of hydrocarbon production.”

Putin’s “Brain Trust”

TMK‘s Board of Directors features one member, Anatoly Chubais, who maintains close ties with Russian President Putin and symbolizes an era of more amicable U.S.-Russia relations.

Chubais is perhaps best known as the man who ran Russia’s “shock therapy” mass privatization program in the 1990s in the aftermath of the Cold War. The program was a collaboration with the U.S. Agency for International Development (USAID), the International Monetary Fund (IMF), and the World Bank. Chubais was covertly on the USAID payroll, with money funneled through the now-defunct Harvard Institute for International Development (HIID), assisted by then-U.S. Deputy Secretary of the Treasury, Larry Summers, under the Clinton administration.

Chubais served as the main liaison between the Russian and U.S. governments, IMF, and World Bank during this era, with Summers referring to those working on the project as the “dream team.” Months before the funding stream became public knowledge in a 1996 U.S. Government Accountability Office (GAO) report, Russia’s then-president, Boris Yeltsin, asked Chubais to step down as his Deputy Prime Minister and his chief-of-staff.

“In early 1996, after [Chubais] was temporarily removed from high office by Yeltsin because he represented unpopular economic policies, H.I.I.D. came to his rescue by placing him on its U.S.A.I.D.-funded payroll,” wrote George Mason University professor of anthropology, Janine Wedel, in a 1998 article published by The Nation titled, “The Harvard Boys Do Russia.”

Wedel, who authored a book on the subject, Collision and Collusion: The Strange Case of Western Aid to Eastern Europe, 1989-1998, also testified in front of the U.S. House Committee on International Relations about her research findings in 1998.

Image credit: U.S. Government Printing Office

The collaboration to privatize Russia’s assets was vastly unpopular in the country, so much so that Chubais and Yeltsin often had to rely on presidential decrees to push through privatization measures.

Radio Free Europe-Radio Liberty reported that Yeltsin gave Chubais sole power over the presidential decree process. This state of affairs eventually led to Yeltsin’s resignation and replacement by Putin.

”It is a brilliant decision, extremely precise and profound, and apart from anything else, very brave,” Chubais told the New York Times on January 1, 2000 when Yeltsin resigned. ”I think that this decision was very difficult for [him] as a person.”

The New York Times also reported in 2000 that Chubais recruited Putin to come to Moscow in 1996 to begin working in politics, and soon thereafter Putin began overseeing the presidential decree process for Yeltsin. Chubais served as part of the “brain trust,” as Bloomberg Businessweek put it, for Putin’s successful 2000 presidential campaign and Putin has been described by some as “Chubais’ man.”

“Putin is relying on Chubais, 44, for political advice as well as money,” Bloomberg wrote in January 2000. “Although Chubais is reviled in Russia for presiding over a privatization program that transferred little of the country’s wealth to the masses, he is a shrewd political operator. Now … he’s helping run Putin’s campaign. He says Putin’s most important priority is to combat business corruption and lawlessness.”

Chubais now serves as CEO of the company RUSNANO, a nano-technology firm which also operates a joint venture with TMK named TMK–INOX.

Aleksandr Shokhin, another TMK board member, heads up the Russian Union of Industrialists and Entrepreneurs, the country’s powerful business lobbying group. Shokhin formerly served on Putin’s Public Chamber, an entity “tasked with personifying the public interest in supervising government, the Duma, media, and law enforcement,” as reported by the Christian Science Monitor.

Steel Caucus Applause

On February 24, the day of Trump’s CPAC address, leaders of the U.S. Congressional Steel Caucus praised Trump’s January 24 steel order. But answers to questions about ownership and what “American” means remain murky.

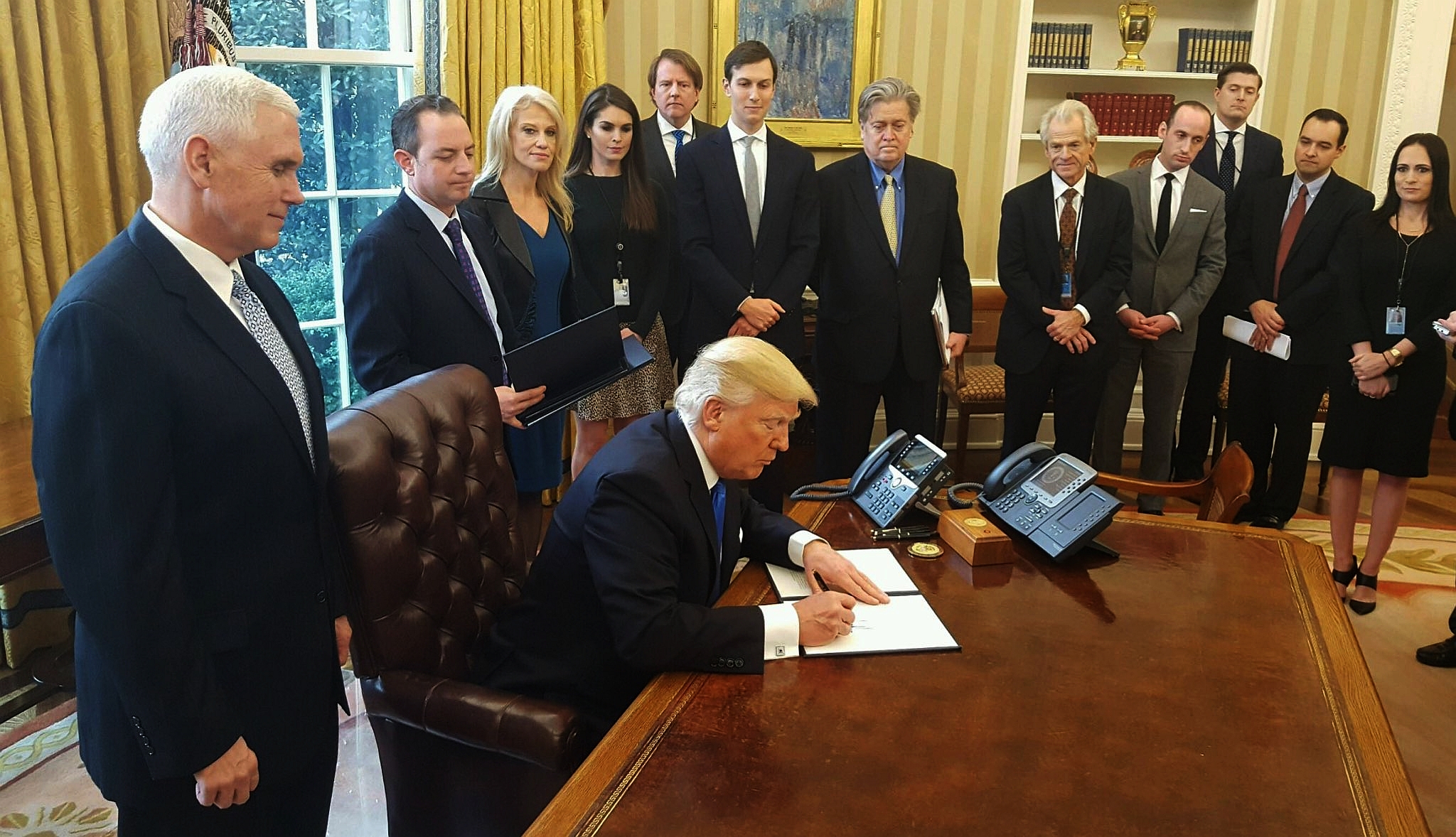

President Donald Trump signs Keystone XL, Dakota Access and U.S. steel executive orders; Image Credit: Office of the President of the United States

“From highways and bridges, to pipelines, to our military fleet, the Congressional Steel Caucus applauds any and all efforts to use American-made iron and steel for these federal projects,” a spokeswoman for the caucus told the industry publication, World Trade Online. “As we prepare for our annual State of Steel hearing next month, we have high hopes of great success working with the new Administration to fully enact long-fought agenda to keep it Made in America.”

As the case of TMK and Chubais shows, the definition of “made in America” — and who really benefits from such initiatives — is not so cut and dry. But we do know one potential major beneficiary: in this case, Chubais, a long-time associate of Vladimir Putin and yet another steel industry oligarch with ties to the U.S. line pipe industry who can claim credit for the Russian president’s rise to power.

Main image: YouTube Screenshot of TMK pipes.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts