Diesel generators could make millions from subsidies and tax breaks, despite the government’s commitment to decarbonising the UK’s energy system.

The government handed out £176 million in subsidies to dirty small power generators over the past year through the capacity market scheme, according to a report released today by think tank InfluenceMap. Much of this went to diesel generators and inefficient gas plants.

These generators are set to receive even more funding when the government announces details of the latest round of hand-outs later this week.

This is despite the government’s pledge to end fossil fuel subsidies by 2025.

The Capacity Market

Renewables generated around a quarter of UK’s power in 2015. And that share is likely to grow as more solar and wind farms come online.

But as the wind doesn’t always blow and the sun doesn’t always shine, National Grid occasionally needs to call on small generators that can quickly start up, often run on diesel or gas.

Uncertainty around how often the grid needs these fast-dispatch generators means they need some extra financial encouragement to stay online. So the capacity market was introduced in 2014 to ensure security of supply by providing these generators with contracts ahead of time.

Capacity market contracts are awarded after generators bid in an auction, held every year, to provide power in four years’ time. Firms bid at a level they say they need to keep their generators open, or to build new plants.

The latest capacity market auction takes place today.

Coal power plants are included in the scheme, and got a £273 million windfall from the first auction in 2014.

Since then, lots of contracts have gone to either diesel or inefficient gas generators, two of the most polluting types of small-scale power plants behind coal. Diesel generators, for instance, can produce about 30 to 40 percent more carbon dioxide per kilowatt hour than gas power. And both emit a lot more than alternative ways to balance the system, such as batteries or companies temporarily curbing the amount of power they use.

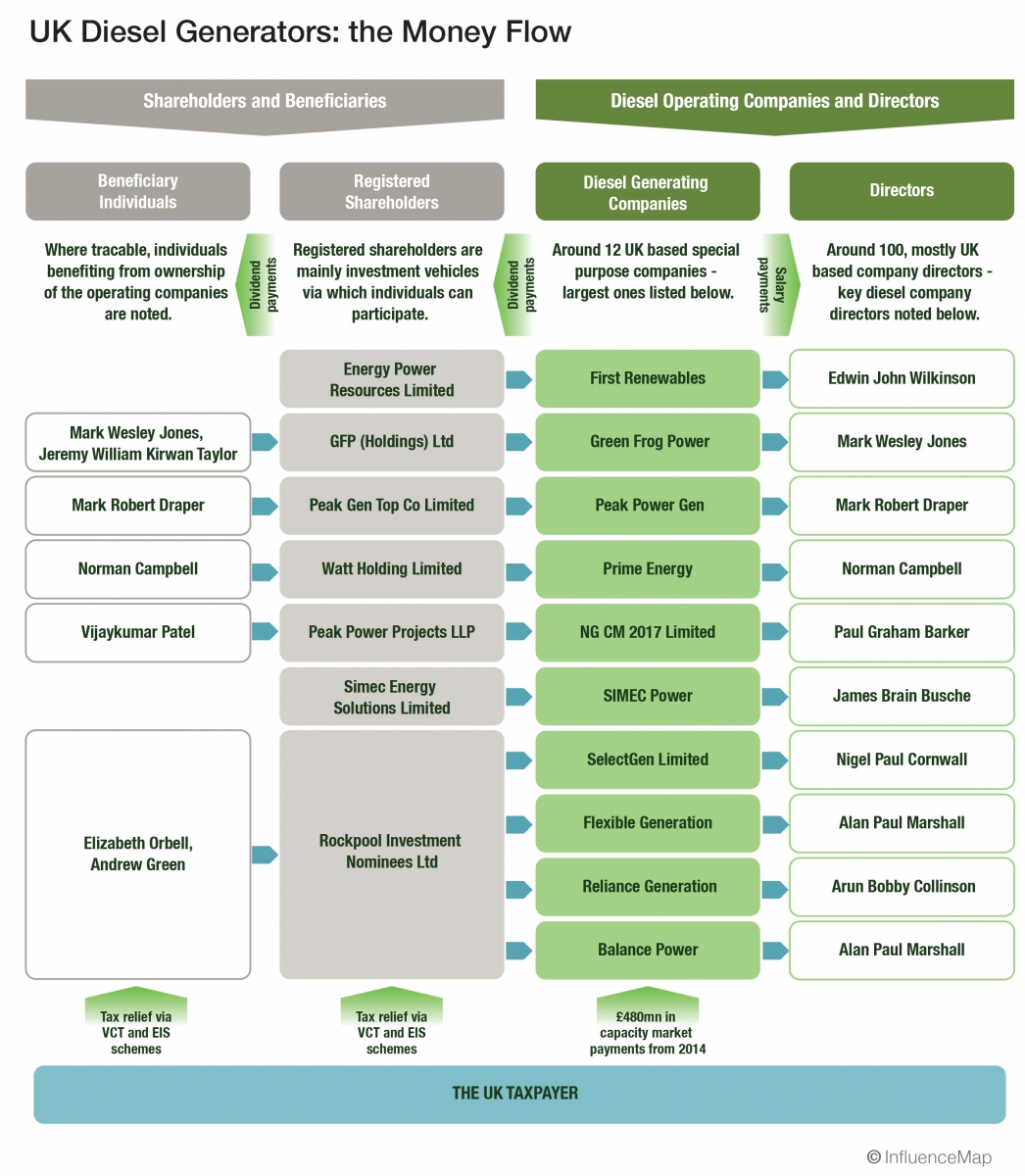

InfluenceMap identified a block of 12 diesel companies that are in line to receive £480 million from the capacity market after lodging successful bids over the last two years.

One generator set to benefit from the scheme is Warwickshire-based Peak Power Gen. InfluenceMap estimated that Peak Power Gen could receive £157 million from capacity market payments over the course of its contracts. A spokesperson for Peak Power Gen told DeSmog UK that it expects its maximum income from the contracts to only be “a fraction” of that amount, however.

Nonetheless, the UK now has a system where it both penalises fossil fuel generation (through measures like the carbon price floor) and subsidises it (through the capacity market).

Caroline Lucas, co-leader of the Green Party, questioned how such a system fits with the government’s wider energy and climate policy. “The fossil fuel industry receives £6bn a year in subsidies from this government whilst support for clean energy has been slashed over recent years. This report raises serious questions about who is benefiting from these handouts”, she said in a press release.

There was some hope the EU would crack down on the schemes in proposals announced as part of its winter energy package. But it decided against an outright ban, bowing to pressure from the fossil fuel lobby.

Double Subsidy

The capacity market isn’t just bad news for the UK’s emissions. Fossil fuel companies may also take advantage of related tax breaks to maximise their profit, according to InfluenceMap.

As the report explains, many of the diesel generators are start-ups, so their owners can also take advantage of two tax breaks, called Venture Capital Trusts (VCT) and Enterprise Investment Schemes (EIS), ensuring they get a double subsidy for dirty power generation.

These are meant to encourage investment in start-ups, but mean diesel generators are getting “abnormally high returns” due to the capacity market, InfluenceMap said. The analysis suggests companies can make as much as six times their original investment over four years.

Rockpool Investments is the largest of the small generators. It owns eight diesel generators that receive subsidies from the scheme.

InfluenceMap said “several investors that own many of the diesel companies were set up specifically to take advantage of the EIS/VCT tax incentive schemes. This includes RockPool Investments”.

The Treasury refused InfluenceMap’s freedom of information request to reveal the names of the diesel companies in receipt of these tax breaks, and the amount invested by individual investors.

Rockpool Investments did not respond to a request for comment. Peak Power Gen told DeSmog UK it does not take advantage of any tax relief under the EIS or VCT schemes.

The government recently announced the results of a consultation on reforming the capacity market to end these subsidies.

While some reforms may make it harder for dirty generators to participate in the capacity market, a loophole remains that would allow companies to continue to benefit from the tax breaks.

Ken Huestebeck, a lawyer for NGO ClientEarth said in a press release that the tax schemes “could contravene EU state aid rules” and called for “increased transparency” to address the issue.

Alan Whitehead, Labour’s shadow minister for energy and climate change, called on the government to end subsidies to the dirty power producers. He said in a press release that MPs “surely now ought to be urgently looking at ways to remove these diesel sets from auctions now, and if possible claw back some of the money that has already gone out of the window in their direction”.

Main image credit: Les Chatfield via Flickr CC–BY

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts