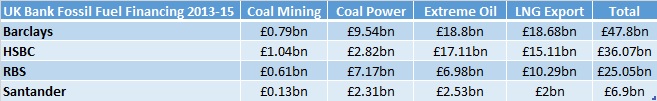

British banks have given more than £115 billion to support fossil fuel projects around the world over the last three years, according to new analysis of North American and European banks’ financing practices.

The report by the Rainforest Action Network, BankTrack, the Sierra Club and Oil Change International shows that in the UK, Barclays takes the lead with £47.8bn invested in coal, extreme oil (Arctic, tar sands, and ultra-deepwater), and liquefied natural gas (LNG) exports between 2013 and 2015.

It’s followed by HSBC (£36bn), the Royal Bank of Scotland (£25bn) and Santander (£6.9bn).

But as the report’s authors argue, this fossil fuel financing is “deeply at odds with the global climate agreement reached at COP21 last December”.

Incompatible with Stable Climate

In order to achieve the Paris Agreement’s target of 1.5C, or at most, 2C of warming above pre-industrial levels, it will require “a rapid decarbonisation of the global energy system.”

“Distressingly, levels of fossil fuel financing by major North American and European banks … are incompatible with these climate stabilisation targets.”

Table compiled by Desmog UK

Comparing the banks shows that Barclays is the second largest financier of coal power of all the major European and North American banks, lending £9.5bn over the past three years. The Royal Bank of Scotland (RBS) follows in fifth place, with £7bn.

Previous estimates from BankTrack also show that Barclays, RBS, and HSBC – the UK’s largest banks – lent out some £40 billion to the global coal industry between 2005 and 2014.

Barclays is also ranked as the third overall biggest financier of extreme oil and LNG export projects with £18.8bn and £18.6bn invested respectively in the last three years.

In the UK, for example, Barclays also backs Third Energy, a gas company which recently received the go-ahead for exploratory fracking in North Yorkshire.

Meanwhile, HSBC provides banking services to UK fracking firm Cuadrilla.

“These investments can only pay off in a future where international climate actions fails and fossil fuel demand remains robust while the global climate tips past critical warming thresholds into chaos,” reads the report.

“Therefore, a loan to one of the companies highlighted in this report is an implicit wager that governments will fail to follow through on the Paris Agreement, and that civil society will not hold its governments accountable.”

Restricting Coal Finance

There has been some progress, however. In the lead up to the Paris climate conference, several American and European banks announced plans to restrict coal financing.

Barclays, for example, pledged to cut their financing for mountaintop removal coal mining in the United States.

Following COP21, other banks including RBS also announced cuts to coal financing.

But as the report notes, “most of these policies fall well short of the necessary full phase-out of financing for coal mining and coal power production”.

And when it comes to extreme oil and LNG exports, “banks continue to finance these sectors on a nearly unrestricted basis”.

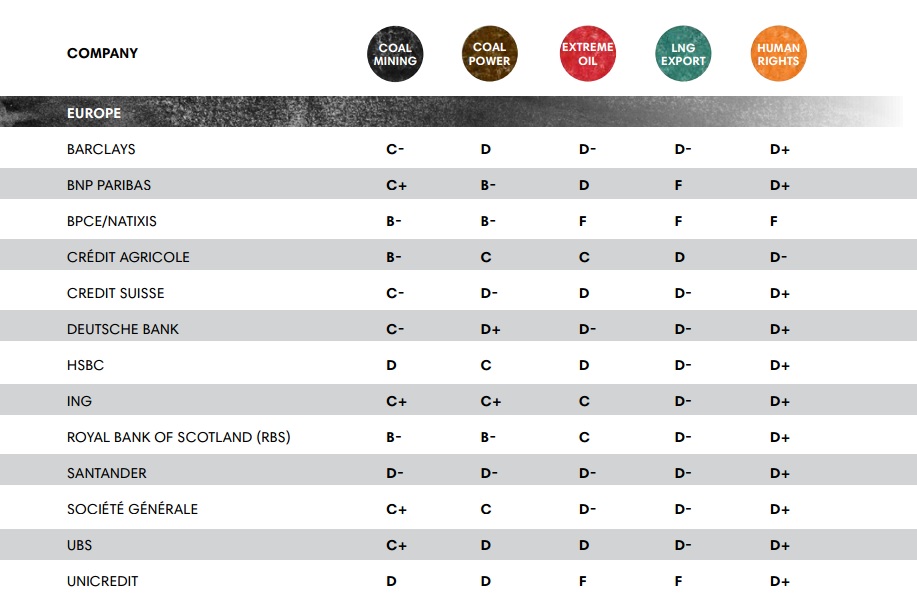

Photo credit: Rainforest Action Network and BankTrack report. The report grades banks from A to F. A top range ‘A’ grade means the bank has prohibited all financing; ‘B’ grades denote banks that have demonstrated progress towards phasing-out financing; ‘C’ grades are for banks which have demonstrated they restrict or prohibit financing; ‘D’ grades show that banks have publicly disclosed due diligence policies and processes covering financing; and an ‘F’ grade represents that the bank has not publicly disclosed policies on the issue.

“In finance industry terms, ‘short-selling,’ or shorting, is a transaction through which an investor profits if a company or asset declines in value. After Paris, financing fossil fuels is tantamount to shorting the climate,” describes the report.

It calls for a “fundamental realignment” of bank energy financing to end support for fossil fuel projects and companies that are “incompatible with climate stabilization”.

“Even if banks are able to absorb the losses from their recent investments in fracking, coal mining, and other struggling fossil fuel companies,” it argues, “the environmental and human consequences of continuing to short the climate and go ‘long’ on climate disaster by financing coal, oil and gas will continue to fall on others.”

Photo: Gerry Machen via Flickr

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts