This is a guest post by Nick Abraham, originally published on Oil Check Northwest

Peabody Energy, the largest private coal company in the world, is one of the last remaining coal majors to still be floating above the bankruptcy tidal-wave that has hit the industry. But it now looks like that even this coal behemoth will likely go under. Languishing under the same over capitalization and changing market structures that have plagued the entire industry (more on that below) Peabody’s stock has dropped 30% just since the final fiscal quarter of last year.

Peabody is now $6.3 billion in debt. Its Gateway Pacific terminal, just north of Bellingham, WA, (which if built would be the largest facility of its kind in North America) has been in a holding pattern as local communities weigh whether a project like this is in the collective interest.

Coal’s demise has been well-reported. Once the standard bearer of our power grid, coal has dropped from providing a substantial 50% of the nation’s electricity to 29%. Just last week, the Oregon legislature passed a bill to transition off coal power completely. The result of this downturn is that many domestic coal companies were becoming heavily dependent on exported coal (and exports have been falling since 2012)—carried by train through American cities and towns—to make up the difference.

While the United States continues its transition to a clean energy economy, companies like Arch Coal, Cloud Peak and Peabody made huge financial bets on foreign coal markets, namely metallurgic coal, Dave Roberts at Vox has an excellent piece that digs into this much deeper. Two major factors have put a tremendous dent in the coal industry’s dreams of exporting coal while domestic consumption dropped.

First, despite industry claims of “insatiable demand” from “power hungry” Asian nations, countries like China don’t want to be anchored to coal any more than the U.S. or Europe. The largest protests in modern Chinese history have been over pollution and the ruling party knows that clean energy is their next path to an even stronger, modern economy.

By many measures China has been transitioning even faster than the U.S. — the country is set to shut down 1,000 coal-mines this year. Many believe China’s emissions may have already peaked. When questioned about China’s domestic energy policy, Chinese Premier Li Keqiang said: “Environmental pollution is a blight on people’s quality of life and trouble that weighs on their hearts, we must fight it with all our might.”

While the economic shifts and industry mistakes sealed coal’s fate, resistance from residents who fought coal export terminals made these efforts vastly more costly and time consuming than the industry ever expected. From Oakland, California, to British Columbia, Canada to Queensland, Australia locals have fought coal coming through their neighborhoods on massive scale and have mounted coordinated campaigns to fight proposals. Permits are being delayed for a wide range of issues; from local health and traffic delays to indigenous fishing rights.

The process for these projects has taken years longer than companies expected and many have simply pulled out of the process. In many areas this solidified the transition away and kept massive coal infrastructure from expanding. In Oregon and Washington State only 2 of an original 6 projects still remain.

The coal industry did not see any of these seismic shifts coming and after incurring huge debts buying assets during coal’s early 2000s boom, there has been an unprecedented string of coal bankruptcies.

Over the last 4 years, twenty-six companies have gone bankrupt and over 260 U.S. mines have shuttered their doors. Arch Coal’s January 2016 chapter 11 filing was the latest and largest company to fall. Arch is the second largest coal company in the U.S. and is one of the major backers of an enormous potential coal export facility in Longview, WA.

Why Peabody is Likely Next

Peabody has fallen prey to many of the same industry issues as its competitors. A massive company with assets across the US and Australia many thought Peabody would be much better insulated from the financial disasters that have sunk so many industry peers. But the current energy reality is shifting so quickly it looks likely to swallow up even this industry behemoth. To pay back many of its creditors, Peabody already has begun selling off a large chunk of its assets. Some believe this will help the company stabilize but others like David Desjardins of the well regarded investment site Seeking Alpha doesn’t think this is nearly enough:

“The problem is its over leveraged balance sheet. The decent operating margin is dilapidated by the expenses associated with the debt load. In my opinion, the bankruptcy seems extremely probable.

This affirmation is corroborated by the credit analyst. As of January 14, the unsecured bonds are trading at 8.6 cents on the dollar for an impressive yield of 99%. The bankruptcy looks already priced-in.”

This means that creditors buying Peabody’s bonds have set a price that gives funds back in an incredibly short time span because they are already expecting the company to go bankrupt.

Desjardins continues:

“The second scenario is to continue to sell a meaningful amount of assets at a distressed price. Based on the atmosphere in the coal industry, the totality of its assets is probably not worth the principal of $6.3 billion in my opinion.

In conclusion, the bankruptcy looks inevitable in my opinion. I believe the asset sales are only buying time and not solving the real problem. I would not touch the stock with a ten-feet pole.”

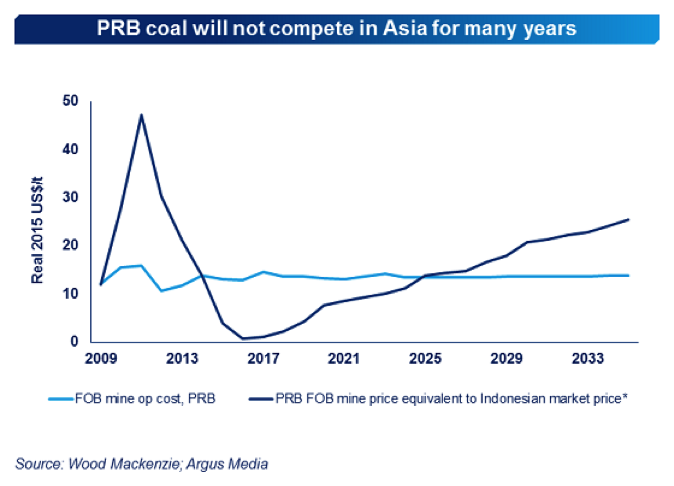

Energy industry data analysis firm Wood Mackenzie corroborates the plight of coal exporters and their rapid decline highlighted in this graphic showing American Powder River Basin coal being uncompetitive with international markets for nearly the next decade:

Fiddling while Wyoming and Appalachia burn

What’s most troubling is how the coal industry has responded. Rather than make essential market adjustments or executive pay cuts, the industry has poured money into front groups, opposition and bonuses.

As bankruptcies continue, more information about coal companies’ inner workings comes to light. Through chapter 11 creditor reports, researcher Lee Fang of the Intercept uncovered direct links between Alpha Natural Resources and organizations that actively promoted climate denial and harassed scientists. Arch Coal just this week was found to have similar ties, likely giving significant funds to these organizations.

In Wasington and Oregon state alone, coal companies and their local backers have poured hundreds of thousands into local politics over the last three election cycles and lobbying to try and shift the political balance in their favor.

Even after companies have gone bankrupt, many still show a shocking level of indifference. In exchange for staying on board with the company through its bankruptcy, Alpha Natural Resources has negotiated to pay executives millions in bonuses. This comes while Alpha has seen fit to cut employee pensions, health insurance and disability payments in order to pay back creditors.

Locally, the coal industry front-group the Alliance for Jobs and Exports responded to news of Arch’s bankruptcy by repeating tired rhetoric and a lack of understanding for what’s happening to the industry.

“Despite the lengthy delay in reviewing their applications, and the disconcerting signal it sends to other outside investors looking at Washington as a place to do business, there’s plenty of interest as well as a high-level of confidence in the need for these projects; whether it be markets overseas or here at home.”

As its bankruptcy looms, here’s hoping Peabody takes a sober look at what a just transition away from its products will look like and learns from the industry’s recent tragic mistakes.

Related: DeSmog’s Energy Market Tracker: Coal Industry Stock Tickers

Blog image credit: Paul Sableman via Flickr

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts