A new report showing the U.S. overtaking Russia as the leading producer of oil and gas in the world should put to rest any doubt that the fracking revolution that has occurred in the U.S. is for real, or as BP’s chief economist put it, “profound.”

And now with the recent Environmental Protection Agency report on the impacts of fracking on drinking water being touted by the American Petroleum Institute as proof that fracking is safe, the industry’s insatiable greed got another boost. More recently, the Harvard Business School has also joined in the discussion calling for the end of the ban on exporting U.S. crude oil and warning about the implications of missing the “opportunity” offered by fracking.

So with all of this momentum, what does ExxonMobil CEO Rex Tillerson think should be next? Less regulation. As previously mentioned on DeSmog, at this year’s CERAweek conference Tillerson complained that the industry was overly regulated and held back by “the noise.”

“Regulators must look at facts and they must look at sound science and not just respond to the noise,” Tillerson said.

As Tillerson and the industry get set to roll out the fracking revolution to every possible shale location in North America and the rest of the world, now is a good time to review what the inventor of modern fracking had to say on the subject of regulating his invention.

Fracking Inventor Warned of Trouble

George Mitchell became a billionaire due to fracking but even that amount of money didn’t keep him from speaking the truth about his invention. In an interview with MarketPlace a year before his death in 2013, Mitchell was clear that without strong regulations, fracking was a serious danger to the environment.

“I’ve had too much experience running independents,” Mitchell says. “They’re wild people. You just can’t control them. And if it doesn’t do it right [sic], penalize the oil and gas people. Get tough with them.”

As with many inventors, Mitchell was a bit of a dreamer. Thus his tendency to spout fantasies about the government getting tough with the oil industry.

Mitchell reiterated his concerns about fracking in an interview with Forbes when asked why fracking needed strong regulations saying, “if they don’t do it right there could be trouble.”

He wasn’t even talking about the earthquakes or “frackquakes” like the ones that Exxon is being questioned about in Texas. Mitchell was talking about drinking water contamination, which he was well aware of.

According to Russell Gold’s book “The Boom,” Mitchell’s fracking efforts led to well water fires way back in 1977 — and lawsuits from landowners with contaminated water. Mitchell really earned his title of The Father of Fracking.

While Mitchell was considered a fool by many in the years he struggled to figure out fracking with little success, he now has an international cult of believers in the most powerful boardrooms and government positions around the world.

And so the plan to frack the globe is in motion.

Will The Fracking Revolution Go Global?

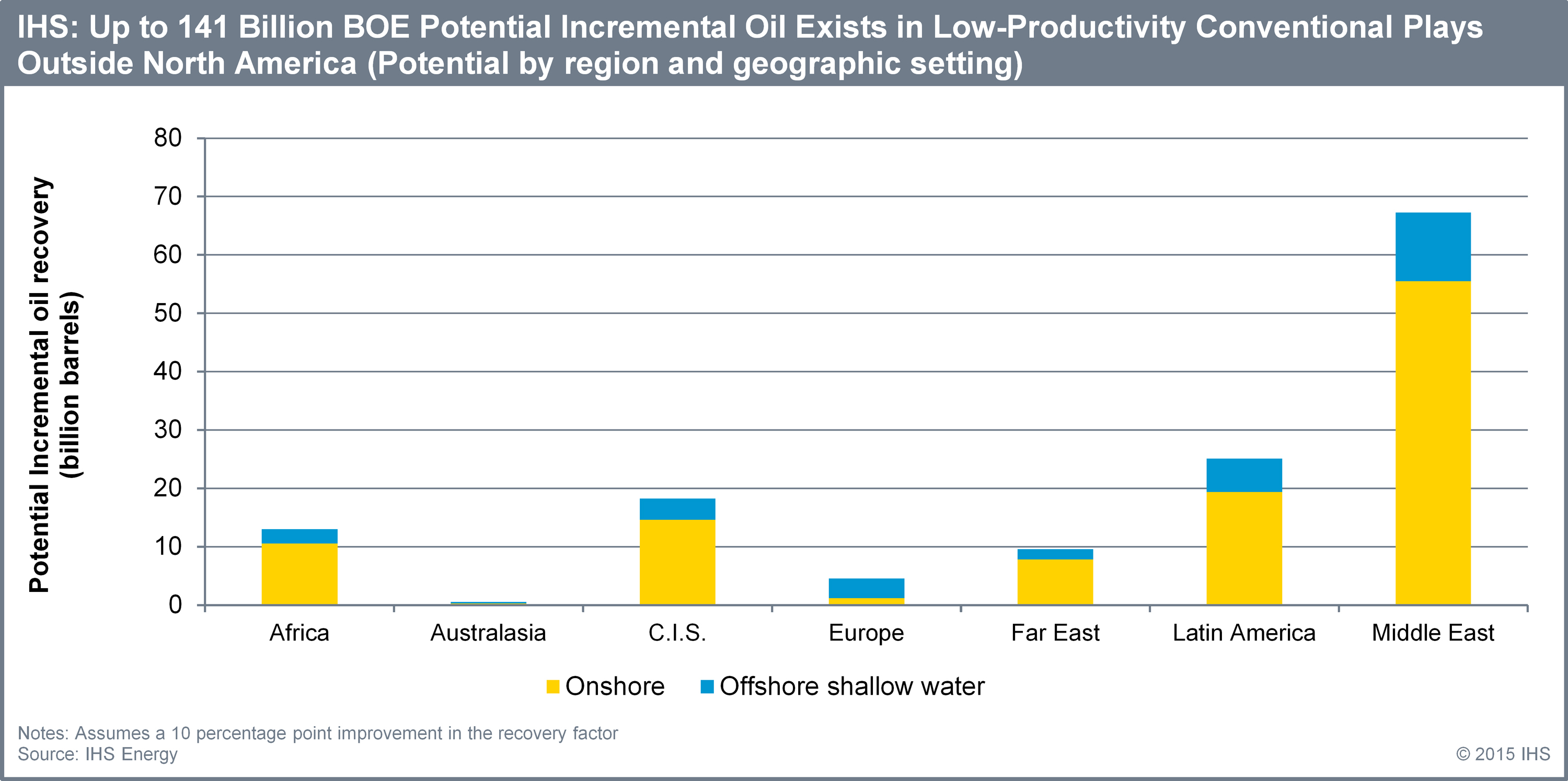

Energy consultancy IHS, and its vice chair Daniel Yergin who is a champion of fracking and all things oil, recently released a new report detailing estimates for all of the conventional oil fields around the world that could be revived by fracking.

The estimated amount of oil that could be fracked is 141 billion barrels. To put that in perspective, the proven reserves of oil in the U.S. are 36 billion barrels.

Based on information in the new report, two locations likely to move into fracking in the near future are Mexico and Saudi Arabia.

Mexico, which shares known shale resources with the U.S. like the Eagle Ford play that straddles the border between Mexico and Texas, can’t wait to start fracking.

“The United States and Canada are exploiting their shale resources on a massive scale, and we’re still in the prospecting stage,” Gustavo Hernandez, the director of exploration and production at Pemex, said in an interview with the Washington Post. “But we believe the volumes we have are enormous.”

Nighttime satellite photos of the Texas-Mexico border clearly highlight the border between the two countries in the Eagle Ford. In Texas, flares burning off excess natural gas as a result of the fracking operations light up the sky. Southwest of the border, nothing but darkness. With Mexico’s plans for fracking, along with opening up their country to foreign investment, it shouldn’t be long before the whole Eagle Ford is lit up at night.

As with the U.S., Mexico isn’t looking to proceed in a cautious way. Fracking uses large amounts of water — something Mexico doesn’t have. So how are they planning to deal with this issue?

Mexican geologists and petroleum engineers told The Washington Post that they will worry about water later.

Much like North Dakota created a dangerous oil-by-rail industry because they fracked oil before building infrastructure to move it safely, it appears that the appeal of fracking will also lead the Mexican oil industry down a similar “profits before all else” approach. And since it will be many of the same multi-national corporations running things, this should come as no surprise.

In 2011, Mexico suffered a massive drought and at the time the Wall Street Journal quoted Coahuila’s deputy minister of rural development, Reginaldo de Luna Villarreal saying, “The intensity of this drought surpasses the ability of government resources to address it.”

But when it comes to fracking, they are going to “worry about water later.”

And how about those strict regulations the father of fracking recommended to avoid trouble? Highly unlikely in a country Forbes called “among the world’s most corrupt nations.”

Rex Tillerson and the oil industry should have a wild time in Mexico. Will they bring the Texas earthquakes with them?

Saudi Arabia – If You Can’t Beat ‘Em, Join ‘Em

With the volume of misleading headlines about the demise of OPEC due to U.S. fracked oil production, it is no surprise that oil producers in the Middle East want to join the fracking revolution. At the recent OPEC conference, ConocoPhillips CEO Ryan Lance was welcomed to speak about the success of fracking shale.

In the past, Lance had predicted shale oil would be a game changer but wasn’t taken seriously. However, at this year’s OPEC meeting he stated “shale is here to stay,” and Lance’s words were definitely not met with skepticism this time around.

In a classic case of “if you can’t beat ‘em, join ‘em” the Saudis are currently investing heavily in fracking or “unconventional” technology as it is often called by the oil industry. The IHS report estimated that there are 70 billion barrels of oil that could be accessed in the Middle East via fracking old conventional oil fields. However, in the short term, the Saudis will be fracking for gas, and the head of Saudi Aramco is optimistic.

“Saudi Arabia will be the next frontier after the U.S., where shale and unconventional will make a significant contribution to our energy mix, especially gas,” said Saudi Aramco’s chief executive Khalid al-Falih.

In addition to the rollout of fracking technology around the globe, a reason to believe predictions like “shale is here to stay” is that fracking technology is rapidly developing and costs are coming down, as explained by ConocoPhillips’ CEO.

Lance said that shale break-even costs have dropped 15 percent to 30 percent in recent months while the amount that drillers are able to suck out of the ground from each well has increased up to 30 percent.

While fracking has been going on for many decades in the oil and gas industry, the fracking of shale is still relatively new and the techniques used are being refined and upgraded. This reality was explained to Marketplace by a former Saudi Aramco official.

“The level of the intelligence is very low,” said Nansen Saleri, a former top manager at the Saudi national oil company. He thinks people will look back at today as “the initial dinosaurish phase of shale and unconventional resource development.”

Fracking the Future

There is no arguing that fracking hasn’t been a very successful and revolutionary invention for the oil and gas industry. Fracking essentially killed the concept of peak oil. It is now well known that the technology exists to extract far more oil and gas (and subsequent pollution) than will be needed to create catastrophic climate change. The fear isn’t that the world will run out of oil but that the world won’t be able to stop consuming it before it is too late.

Ironically, George Mitchell wasn’t solely focused on making money and fracking oil and gas. He donated large amounts of money to support the idea of creating a sustainable planet.

But Mitchell’s genie is out of the bottle and it is highly likely that he will have unleashed a technology on the world that will play a critical role in supporting the cult of permagrowth and greed that, if left unchecked, will ultimately result in a chaotic, overheated world.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts