Climate campaigners and tar sands blockaders widely celebrated the announcement last month that the Norwegian energy company Statoil was halting plans for a multi-billion dollar tar sands project in Alberta, Canada. The company cited rising costs of labor and materials in Alberta, and also blamed “limited pipeline access” for “squeezing away the Alberta margins a little bit,” a point that anti-Keystone XL activists have taken as a clear sign of victory.

Don’t take your eyes off of Statoil, however. The company is quietly reallocating the estimated $2 billion investment to pursue a massive deepwater offshore project off the east coast of Newfoundland, in harsh, sub-Arctic conditions adjacent to an area drillers refer to as “iceberg alley.”

A win for Athabasca, a loss for the North Atlantic

The Statoil decision to mothball its tar sands project for at least three years is a clear win for the northern Alberta boreal forest and the First Nations peoples who live downstream in Fort Chipewyan. The atmosphere will also be spared an estimated 777.4 million metric tons of carbon dioxide.

Statoil’s decision to shelve the in situ project also helps prove the concept that, as Bill McKibben tweeted, “battling pipelines is a good idea [because] it makes it more expensive to do bad stuff.” It also dampens “the invevitability argument,” the idea that rapid tar sands development will happen with or without the Keystone XL pipeline.

Coming on the heels of a May announcement by Total SA and Suncor Energy that work would be suspended on an $11 billion tar sands project (a decision that cost those companies $1.65 billion), Statoil’s announcement indicates that fighting pipelines can be effective by applying a sort of people-powered carbon tax to fossil fuel development.

As recently as December 2013, Statoil Canada president Stale Tungesvik told The Globe and Mail that he was “still fighting for doing both,” referring to the Corner tar sands project and development of the Bay du Nord deepwater offshore find in the Flemish Pass off of Newfoundland.

However, for now — and in no small part because of the lack of pipeline capacity out of Alberta — Statoil can only afford to invest in one project, and the company has calculated better returns on the deepwater offshore play that has received little media attention and little public resistance.

Statoil’s North Atlantic Plans

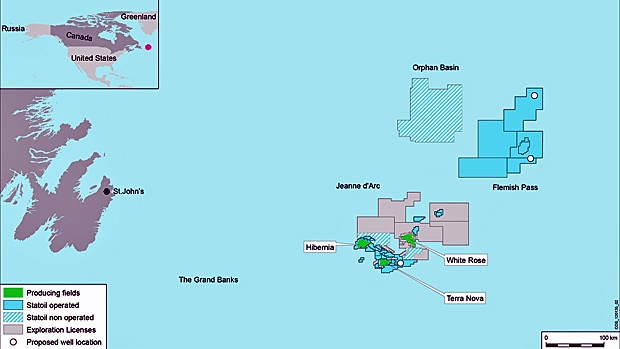

In the summer of 2013, Statoil and its partner Husky Energy made a massive discovery of oil in the deepwater Flemish Pass Basin, off of Newfoundland. Called Bay du Nord, this was the third, and largest, of Statoil’s recent discoveries in the area. Estimated at 300 to 600 million barrels of recoverable light crude, Bay du Nord was the largest oil discovery in the world in 2013, Statoil’s largest discovery since 2010, and the company’s largest discovery ever outside of Norway.

The other two plays, called Mizzen and Harpoon, are both expected to yield in the hundreds of millions of barrels. Exploration and appraisal wells are currently being drilled or analyzed in all three locations, all within 10 to 15 miles of each other.

The Flemish Pass Basin sits about 300 miles east of St. John’s, Newfoundland, under some 3,600 feet of water. The reservoirs themselves are more than one mile under the seabed.

The Bay du Nord play sits in the Flemish Pass Basin, appearing on the far right in turquoise blue. Image credit: CNW Group/Statoil Canada Limited

Geir Richardsen, Statoil Canada’s vice-president of exploration, hopes that the Bay du Nord well will be producing crude by 2020 if all goes to plan.

“Canada is a core area for us,” Richardsen said. “It’s an environment where we hope to create good value.”

Newfoundland’s Oily Ambitions

Canada’s offshore oil industry has historically been limited to three fields clustered in the Jeanne d’Arc basin, about 100 miles southwest of the Flemish Pass basin in a broader region known as the Grand Banks. Output from these fields peaked in 2007 and the national and provincial governments seem dead set on helping boost production by any means necessary.

Derrick Dalley, the minister of natural resources for Newfoundland and Labrador, said that the Bay du Nord discovery “proves there is oil in our province’s deepwater basins, and it will encourage increased offshore exploration activity.”

Bay du Nord would be Canada’s first foray into deepwater drilling — the Jeanne d’Arc fields are only about 300 feet deep. And while many residents of Newfoundland worry about the safety of drilling Canada’s first deepwater offshore oil wells, the provincial government is aggressively working to help Statoil get to the oil as soon as possible.

Ministers of the province of Newfoundland and Labrador announced in June that public funds, through the Crown corporation Research and Development Corp., will chip in $1.5 million on top of Statoil’s $2.4 million for three research projects geared towards deepwater drilling in such harsh sub-Arctic environments.

Farrah Khan, of Greenpeace Canada, told the CBC that “it’s especially galling that Newfoundland and Labrador is using public money to advance a very risky industry.”

The government of Newfoundland and Labrador also created its own Crown corporation to capitalize on what it hopes to become an offshore bonanza. In 2007, Nalcor Energy was formed, and has since been investing in hydroelectric projects, energy marketing, and, crucially, offshore energy infrastructure.

You don’t have to look far to find the inspiration for Nalcor. “We’re modeling ourselves after Statoil,” said Jim Keating, vice president of Nalcor’s oil and gas division, referring to the quasi-public structure as an “arms-length” state-owned oil company.

Who else is working off the Canadian coast?

The massive Statoil discovery underscores a busy time in exploration off of Canada’s eastern shore. On top of Statoil’s Flemish Pass plays, a number of companies, mostly foreign, are at various stages of tapping the crude under the North Atlantic.

Exxon Mobil already operates in two of the fields in the Jeanne d’Arc basin (see map above) — Hibernia (1.2 million barrels) and Terra Nova (>370 million barrels). The company is currently ramping up operations in the Hebron heavy oil field also in the Jeanne d’Arc basin, which is estimated to have 400 to 700 million barrels of recoverable crude.

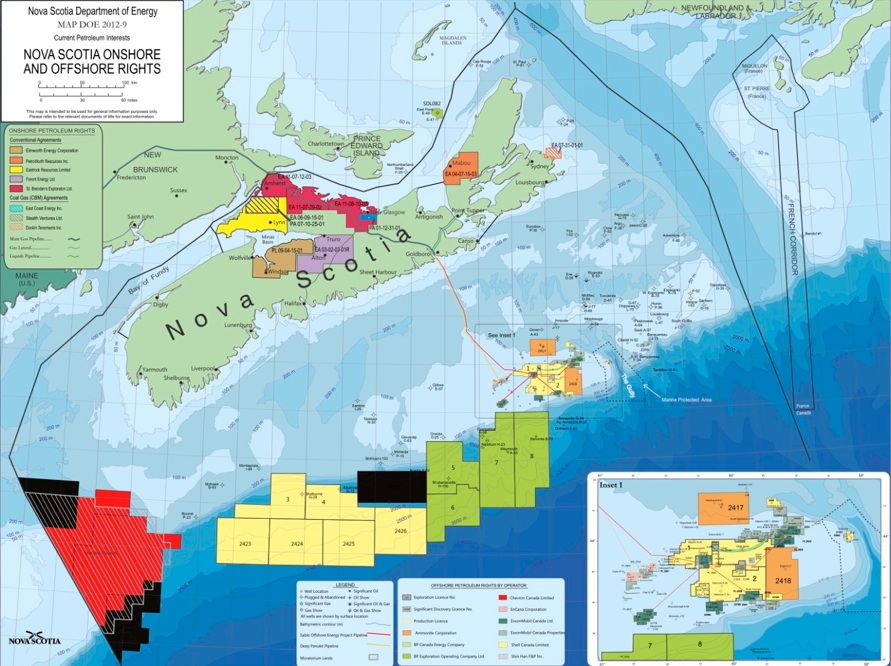

Exxon also leads investment and operations of the first and only offshore natural gas project in Canada, called the Sable Offshore Energy Project, off the coast of Nova Scotia (see map below).

The Sable Offshore region is the small cluster of yellow, orange and green, connected by pipline to the island. The Shelburne Basin fields are the yellow blocks on the left. Image credit: Nova Scotia Department of Energy (click for larger version)

Royal Dutch Shell, doing business locally as Shell Canada Limited, is leading a partnership, along with Suncor and ConocoPhillips, to explore the deepwater off of the south shore of Nova Scotia. The companies recently paid close to $1 billion for exploration rights on four parcels in the Shelburne Basin (see map above), roughly 150 miles south of Halifax.

Chevron is currently drilling its third exploration well in the Orphan basin, roughly 30 miles northwest of the Flemish Pass.

Husky Energy is partnering with Statoil on the Flemish Basin plans, as described above. Huksy also has the majority interest in the White Rose field in Jeanne d’Arc, with Suncor holding the minority stake.

With so many projects in development off of Canada’s East Coast — from conventional offshore to deepwater to gas drilling — the region seems to be on the cusp of a mini-bonanza. Many investors are predicting that 2015 will be “big year for offshore oil in Canada” as more exploratory wells are drilled and more companies invest in the area, many seeking easier profits and less resistance than they’re encountering in the Alberta tar sands.

But drilling offshore in the North Atlantic has its challenges. In future posts, DeSmogBlog will investigate the risks of drilling in this particular harsh environment, the infrastructure demands and impacts on local populations, and the climate threat that emerges as the size of these oil discoveries are better understood. We will continue to monitor the situation off of Newfoundland, Labrador and Nova Scotia, and will report important developments.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts