Still own some Exxon Mobil stock and been dithering about divestment?

You’re leaving money on the table, and exposing your portfolio to severe risks that the company itself is underestimating. That’s according to a new report published by the Carbon Tracker Initiative, which finds that the stock’s recently sub-par performance can partially be explained by the company’s increasing dependence on tar sands.

Carbon Tracker says that Exxon is “significantly underestimating the risks to its business model from investments in higher cost, higher carbon reserves; increasing national and subnational climate regulation; competition from renewables; and demand stagnation.”

Back in March, Exxon responded to a shareholder resolution by Arjuna Capital and As You Sow, two shareholder advocacy organizations, regarding potential carbon asset risk. The original resolution had demanded greater transparency in how Exxon assesses the risks to its significant carbon-based assets in a future where low-carbon policies and changing market forces could strand these assets. Exxon responded with a 29-page report, “Energy and Carbon – Managing the Risks.”

The Carbon Tracker Initiative closely examined Exxon’s report and has now published a firm rebuttal.

The report, published on September 12, looks at the recent past and into the future. It’s first section examines Exxon’s recent low returns to shareholders, drawing a correlation between the stock’s underperformance and the company’s considerable recent investments in Canadian tar sands.

The second section looks forward, revealing how the company seriously underestimates — and even disregards — the potential financial risks of carbon policies and changes in the energy markets.

Diminishing Returns

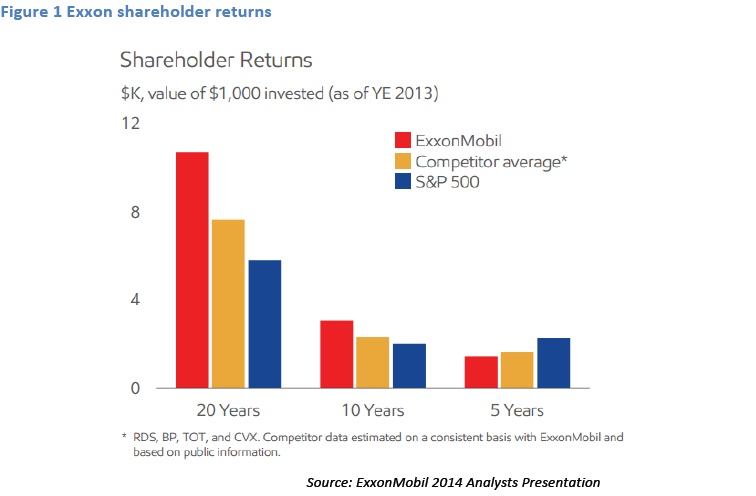

Over the past five years, ending in July 2014, Exxon Mobil (XOM) stock has underperformed the S&P 500, by 8 percent. This is a sour turn at the end of four straight decades of dominance, which saw XOM outperform the broader market, beating the S&P 500 by 4 percent for the past 40 years. If you invested in Exxon stock in 2009, your returns would be just 60 percent what you could’ve earned by investing in the S&P Index.

Significantly, CTI’s analysis found that the company’s increasing investments in Canadian tar sands and other unconventional, expensive oil plays are at least partially to blame. The report’s authors write that the deteriorating stock returns “[reflect] Exxon’s choice to put increasingly more investment in to capital intensive, low return projects. These include tar sands, heavy oil, arctic developments and mega‐ projects such as Kashagan.”

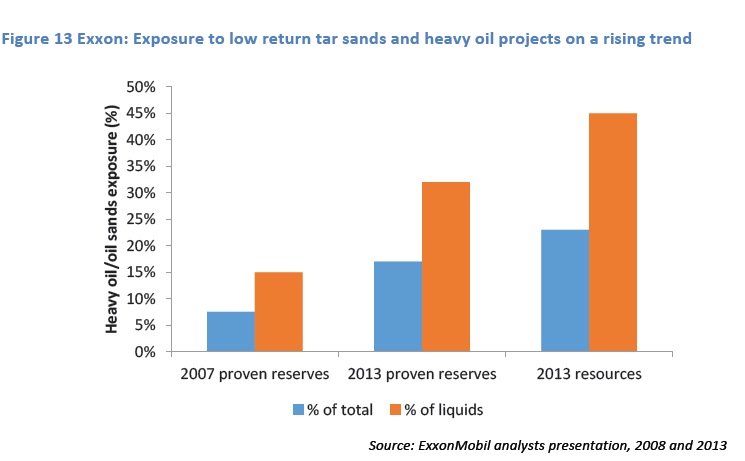

The numbers better illustrate the trend. In 2007, tar sands and heavy oil accounted for just 7.5% of all Exxon’s proven oil and gas reserves, and around 15% of its liquid reserves. By 2013, these numbers had grown to 17% and 32% respectfully.

Tar sands projects are “capital intensive,” which is analyst speak for incredibly expensive, and they take a long time to pay for themselves. The high cost — and hence low return — projects are contributing significantly to Exxon’s recent deterioration in “return on capital,” a key metric considered by investors.

“Exxon’s cost profile is headed in the wrong direction as they invest in high cost unconventional assets,” said Natasha Lamb, director of equity research and shareholder engagement at Arjuna Capital. “This flawed strategy has contributed to a significant deterioration in returns over the last 5 years – essentially reversing a 40-year trend of outperformance.”

CTI’s authors agree: “If, as we believe, Exxon’s investment in low return, high cost projects is a factor behind its deteriorating returns, increasing investment in such projects seems at odds with Exxon’s emphasis on improving shareholder returns.”

Exxon’s current growth strategy includes many more expensive tar sands and unconventional oil projects. These would already be concerning to the investor for the low return potential described above. But they become all the more alarming when considering a potential future with lower-than-anticipated oil demand, which could be brought about by low carbon policies at the national or regional levels, or by other unanticipated market forces.

As revealed in the second section of the CTI report, Exxon is pretty much disregarding any potential for carbon policies or prices, and any trend in oil demand that comes up short of their blue sky scenario.

No Stranded Assets to See Here

In it’s “Managing the Risks” report (the one the company released to address the Arjuna Capital and As You Sow request), Exxon makes the bold claim that none of its proven reserves are at risk of becoming “stranded.”

“All of ExxonMobil’s current hydrocarbon reserves will be needed, along with substantial future industry investments, to address global energy needs,” said William Colton, ExxonMobil’s vice president of corporate strategic planning, in a press release announcing the company’s report.

The concept of “stranded assets” gained prominence last year when another report by the Carbon Tracker Initiative calculated that 60-80% of the world’s coal, oil, and gas reserves would be “unburnable” if the world leaders agreed to emissions reductions to limit warming to 2°C.

While that classification of “stranded assets” assumes the most optimistic carbon reduction policies, assets of the carbon sort could become stranded by any real policy or market shift.

As quoted in the CTI report, the IEA defines stranded assets in the oil industry as “those investments which are made but which, at some time prior to the end of their economic life (as assumed at the investment decision point), are no longer able to earn an economic return, as a result of changes in the market and regulatory environment.” (Emphasis added.)

In essence, any price on carbon or emissions reduction policy could cut oil demand enough to strand any number of a company’s proven reserves.

Exxon, in its own words, dismisses the potential of any such low-carbon scenario as “extremely unlikely.”

“It is difficult to envision governments choosing this [low-carbon] path,” the company claims in its report.

CTI rebuts this claim with the fact that globally, greenhouse gas emissions subject to national legislation or emissions reduction strategies rose from 45% to 67% from 2007 to 2012.

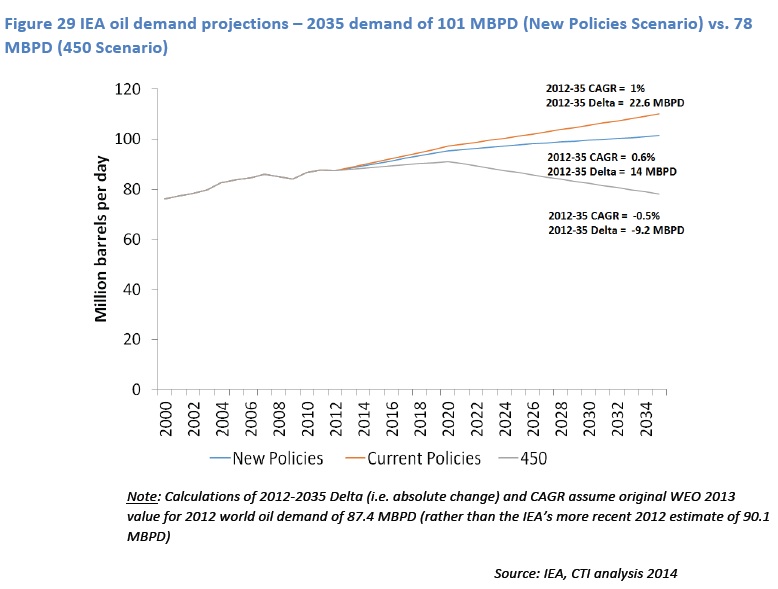

Politics and policy aside, Exxon uses highly optimistic predictions of ever-increasing fossil fuel consumption, which it ties to population and GDP growth. CTI counters that many industrialized nations have enjoyed rising GDP alongside falling energy demand in recent years, and that some scenarios modeled by the International Energy Agency predict “a plateau in oil demand from 2020 through to 2035, followed by a decline thereafter.”

Exxon’s hand-waving dismissal of these real world climate and economic risks is shortsighted, argues CTI.

“For a report entitled ‘Managing the Risks’ to actually dismiss the risks out of hand, rather than consider the dangers and any steps that could be taken to mitigate them, represents a major shortcoming in our view.”

And to the shareholders at Arjuna Capital and As You Sow, Exxon’s assumptions put investors themselves at risk.

“As the Carbon Tracker analysis demonstrates, Exxon’s low returns over the past five years are the result of a fundamental shift in oil market dynamics – changes which Exxon ignores at its peril,” said Danielle Fugere, President of As You Sow. “The one constant is that markets change. Failure to recognize and adjust to such changes has led to storied companies, including Kodak, falling under their own weight and failure to adapt. As investors, we hope this will not be the case with Exxon”

The CTI report’s authors punctuate its introduction with this warning to shareholders:

“It should be worrying for investors that Exxon, although recognizing the need for ‘Managing the Risks’ from climate change, continues with an investment strategy that seems to assume business as usual.”

If you own Exxon stock or manage a fund or endowment that holds it, have any stake, the report is well worth perusing in detail. But a short takeaway could well be: get out now!

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts