In little-noticed news arising out of a recent Gulf of Mexico offshore oil and gas lease held by the U.S. Department of Interior’s Bureau of Ocean Energy Management, the floodgates have opened for Gulf offshore hydraulic fracturing (“fracking”).

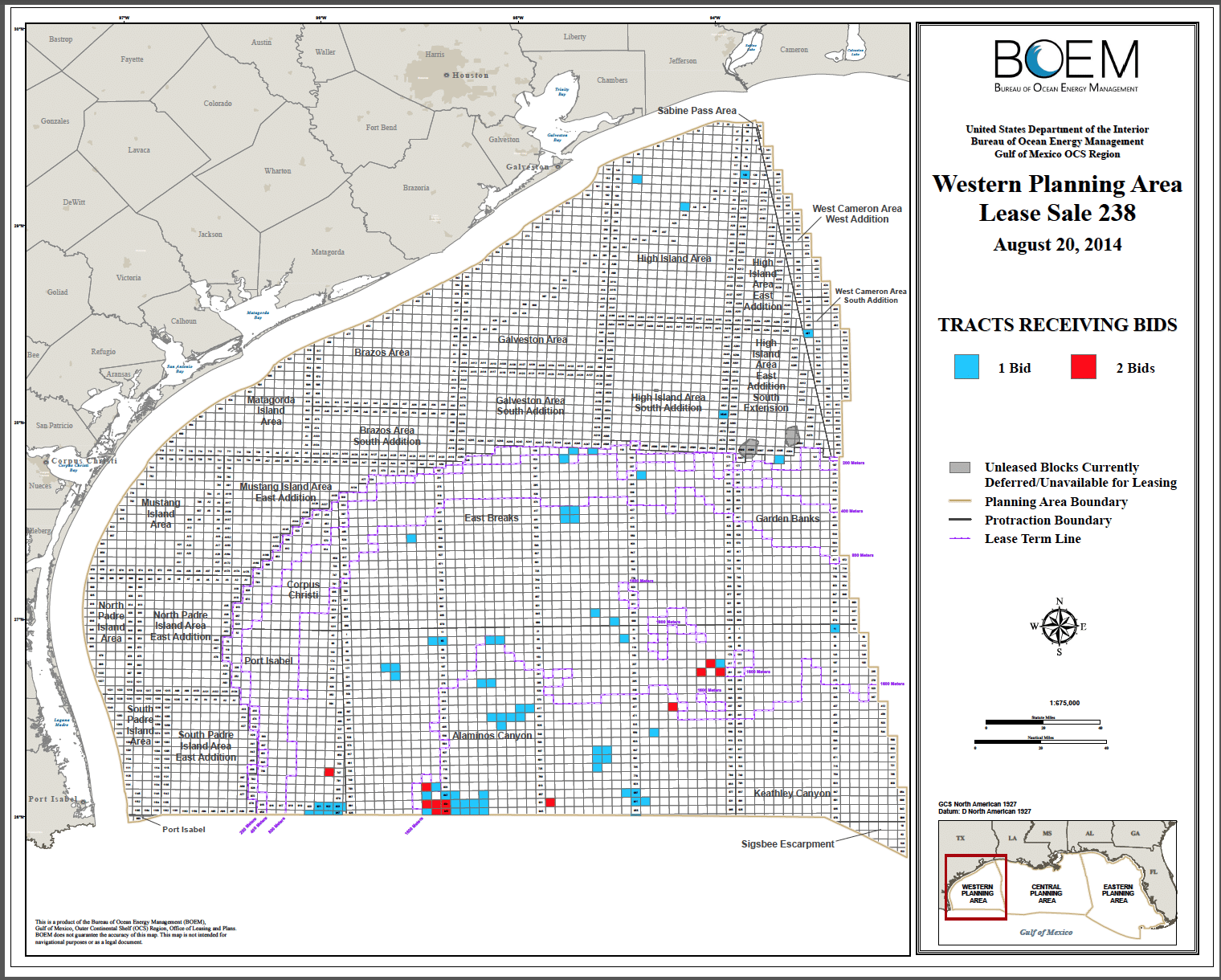

With 21.6 million acres auctioned off by the Obama Administration and 433,822 acres receiving bids, some press accounts have declared BP America — of 2010 Gulf of Mexico offshore oil spill infamy — a big winner of the auction. If true, fracking and the oil and gas services companies who perform it like Halliburton, Baker Hughes and Schlumberger came in a close second.

Map Credit: U.S. Bureau of Ocean Energy Management

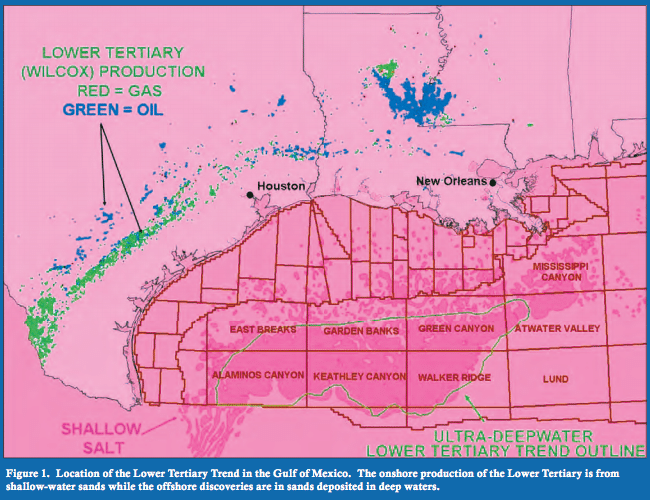

On the day of the sale held at the Superdome in New Orleans, Louisiana, an Associated Press article explained that many of the purchased blocks sit in the Lower Tertiary basin, coined the “final frontier of oil exploration in the Gulf of Mexico” by industry analysts.

“The Lower Tertiary is an ancient layer of the earth’s crust made of dense rock,” explained AP. ”To access the mineral resources trapped within it, hydraulic fracturing activity is projected to grow in the western Gulf of Mexico by more than 10 percent this year, according to Houston-based oilfield services company Baker Hughes Inc., which operates about a third of the world’s offshore fracking rigs.”

Map Credit: U.S. Bureau of Ocean Energy Management

Unlike other Gulf oil and gas, Lower Tertiary crude is located in ultra-deepwater reservoirs, industry lingo for oil and gas located 5,000 feet — roughly a mile — or deeper under the ocean.

Just over a week before the lease, the Mexican government passed energy reform legislation that will prop open the barn door for international oil and gas companies to sign joint ventures with state-owned oil company Pemex, including in Mexico’s portion of the Gulf of Mexico.

Baker Hughes Fracks the Tertiary

The May edition of World Oil explains that Baker Hughes has lead the way in technology innovation to tap into Lower Tertiary oil and gas, described as existing within “harsh HPHT conditions,” or high pressure, high temperature conditions.

Using offshore fracking techniques, Baker Hughes has aided Petrobas in developing a test well in the Cascade offshore field. The company believes the recent Gulf acreage sale by the Obama Administration will serve as a boon for further offshore fracking in the months and years to come.

“We expect that there will be more offshore stimulation in coming years,” Douglas Stephens, president of pressure pumping at Baker Hughes, told the AP in the lease’s aftermath.

Baker Hughes maintains roughly one-third of the world’s offshore fracking operations.

Fracking as “Next Frontier for Offshore Drilling”

Two weeks before the lease, Bloomberg published an article declaring that fracking could serve as the “next frontier for offshore drilling.” That next frontier will come at a steep cost: $100 million spent per well, according to Bloomberg.

Even Halliburton, key innovator of onshore fracking technology and the force behind the “Halliburton Loophole” within the Energy Policy Act of 2005, admits offshore fracking is risky business.

“It’s the most challenging, harshest environment that we’ll be working in,” Ron Dusterhoft, an engineer at Halliburton, told Bloomberg. “You just can’t afford hiccups.”

The article further explained that the oil industry at-large, and not just Baker Hughes and its fellow oil services companies, stand to win big from the push to frack the Gulf of Mexico.

“Those expensive drilling projects are a boon for oil service providers such as Halliburton, Baker Hughes Inc. and Superior Energy Services Inc. Schlumberger Ltd., which provides offshore fracking gear for markets outside the U.S. Gulf, also stands to get new work,” Bloomberg reported.

“And producers such as Chevron Corp., Royal Dutch Shell Plc and BP Plc may reap billions of dollars in extra revenue over time as fracking helps boost crude output.”

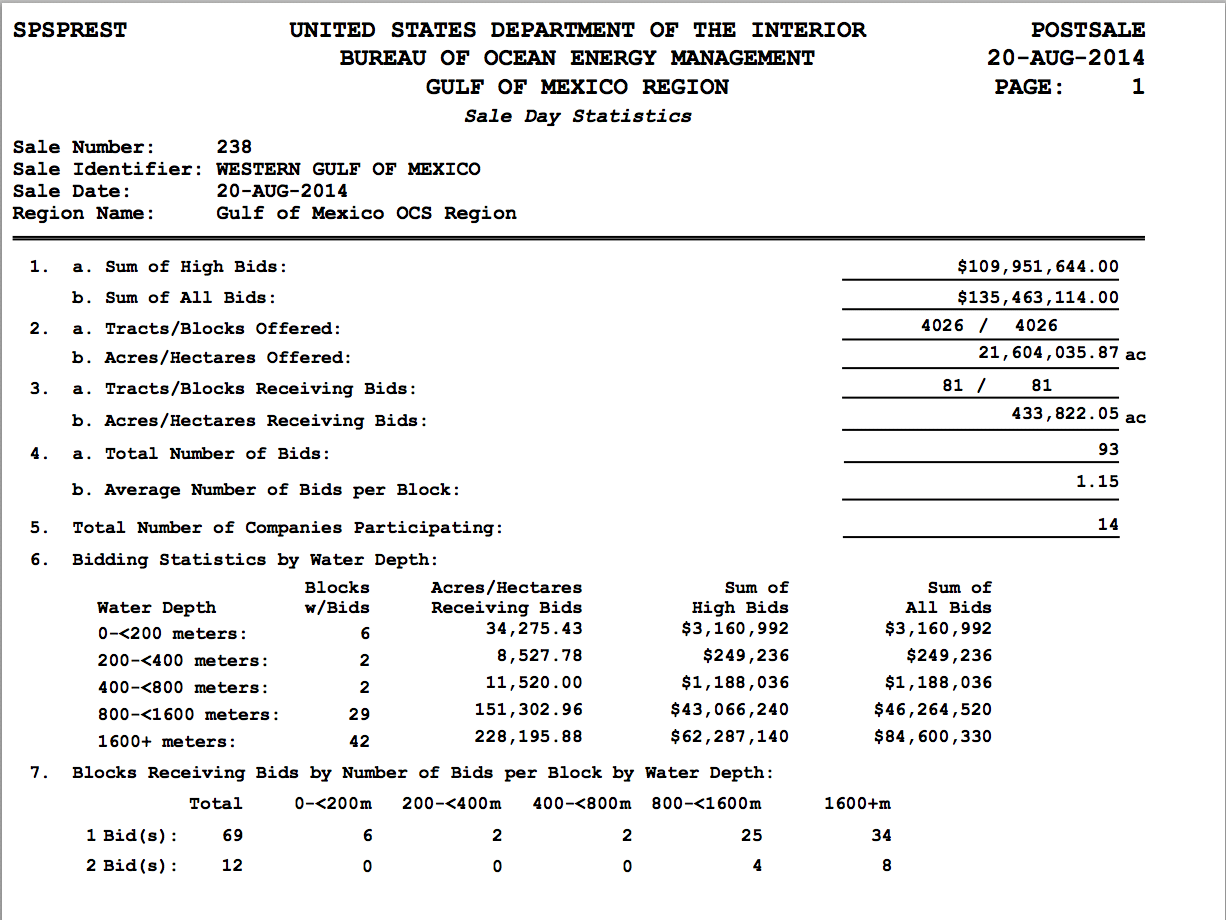

According to lease statistics made public by BOEM, 42 of the 81 blocks of oil and gas auctioned off on August 20 sit in water depths of over 1600 meters (roughly a mile, or 5,280 feet).

Image Credit: U.S. Bureau of Ocean Energy Management

Measured by total acreage leased, that equates to 54 percent of the land.

“All of the Above”

A BOEM press release declared the Gulf lease falls under the broad umbrella of President Obama’s “all of the above” energy policy, which critics point to as a form of climate change denial.

“This sale underscores the President’s commitment to create jobs and home-grown energy through the safe and responsible exploration and development of offshore energy resources,” Mike Connor, Department of Interior’s deputy secretary, said in the release.

“The Gulf of Mexico has been and will continue to be a cornerstone of our domestic energy portfolio, with vital energy resources that spur economic opportunities and further reduce our dependence on foreign oil.”

The oil and gas industry, for its part, has shown signs of elation in reaction to the lease.

“Industry’s Arrogance”

Jonathan Henderson, coastal resiliency organizer for the Gulf Restoration Network, is not quite as pleased about these latest developments.

“Deepwater fracking in the Gulf should be banned immediately as the true impacts to the marine environment are unknown,” Henderson told DeSmogBlog. “A full environmental review is a legal requirement for these kind of high risk deepwater extraction activities, yet the industry seems to view it as optional.”

“The fact that companies are already fracking the Gulf of Mexico and discharging untold amounts of unknown chemicals speaks to the industry’s arrogance and yet another failure of federal agencies charged with protecting our environment to do their job.”

And Cherri Foytlin, a Rayne, La.-based contributor to the blog BridgeTheGulfProject.org, told DeSmogBlog she believes the new push to bring fracking to the Gulf of Mexico speaks to even deeper economic and social issues.

Foytlin speaks at July 13 rally in Washington, D.C.; Photo credit: Caroline Selle

“The debate concerning the belief that unlimited corporate, privatized growth is tatamount to the jeapordizing of an entire fragile and unique ecosystem seems to continue to be lost in these conversations,” said Foytlin.

“If the BP oil spill of 2010 taught us nothing else, then perhaps it should be that policies, both environmental and economic, should center around the compatibility of an ethic that truly represents the value of our oceans and waters as a life source that we who live in the Gulf know them to be.”

Photo Credit: Wikimedia Commons

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts