For years, the shale industry has touted the economic benefits it can provide. An overflowing supply of domestic natural gas will help keep heating and electric bills low for American consumers, they argue, while drilling jobs and astounding royalty windfalls for landowners will reinvigorate local economies. These tantalizing promises have caught the attention of politicians in Washington, D.C. who argue that the rewards of relying on shale gas outweigh the risks, especially because harm can be minimized by the industry or by regulators.

But across the U.S., communities where drilling has taken place have found that the process brings along higher costs than advertised. Even when properly done, drilling carries with it major impacts — including air pollution, truck traffic, and plunging property values — and when drillers make mistakes, water contamination has left residents without drinking water or cleaning up from disastrous well blow-outs.

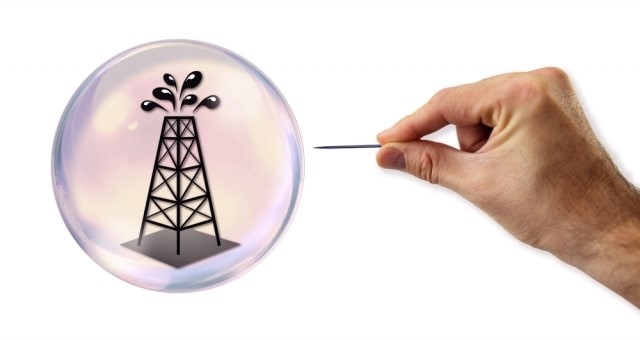

And as the shale drilling boom moves into its 12th year, the most crucial benefit claimed by drillers — cheap and abundant domestic fuel supplies — has come increasingly into question. The gas is there, no doubt, but most of it costs more to get it out than the gas is worth.

A new report from New York state, where a de facto shale drilling moratorium has persisted since 2008, concludes that unless natural gas prices double, much of the shale gas in the state cannot be profitably accessed by oil and gas companies.

Using public data from Pennsylvania, the researchers predict that shale gas will be far more expensive to extract than current natural gas prices would suggest. And even if gas prices double, their analysis of production history suggests only small regions of the Marcellus in New York can be profitably tapped.

“At current gas prices near $4.00-4.50/MMBtu (Million British Thermal Units), the results of this study indicate that no area in New York is likely to be commercially viable,” petroleum geologist Arthur Berman and petroleum engineer Lyndon Pittinger wrote in their report, which was commissioned by the League of Women Voters of New York State, adding that at $8/MMBtu, at most 9.1 trillion cubic feet of gas can be profitably drained from the Marcellus.

Their conclusions were based on a review of production data from over 4,000 active Marcellus wells in Pennsylvania and West Virginia.

These projections stand in sharp contrast to the projections described in New York state’s draft 2014 energy plan, now open for public comment. In that report, state regulators cite up to 516 trillion cubic feet of gas held in the formation, while adding in a footnote that only 10 percent of that gas is likely to be economically recoverable. The new report finds only a fraction of that can be produced even at $8/MMBtu, double what gas costs today.

“If New York is building an energy plan based upon access to a resource, such as natural gas, it is critically important to know whether and to what extent that resource exists,” said attorney Elisabeth Radow, Chairwoman of the New York State League of Women Voters’ Committee on Energy, Agriculture and the Environment.

A sprint to lock down oil and gas leases in shale fields nationwide released a huge glut of natural gas onto the market over the past few years. But as the hard slow work of drilling hundreds of thousands of shale wells across huge swaths of the U.S. truly begins – in industry parlance, the shift from “land rush” to “build out” – major oil and gas companies like Exxon and Shell have admitted that shale projects are too expensive to be profitable while gas prices remain low.

“Financial performance there is frankly not acceptable,” Shell CEO Ben van Beurden said last month, referring to shale projects in North America. “Some of our exploration bets have simply not worked out.”

Some industry analysts say that his comments simply show that Shell is worse at shale development than its competitors. “Whether this is a signal, as some argue, that the US oil boom is overhyped, it is too soon to tell,” said a column in November’s Economist, after Shell announced it was slashing onshore operations in North America. “What is clearer is that Shell paid dearly for unexplored land at the peak of shale mania.”

But other companies have also struggled in the shale and at times have had to admit that investors lost money over their attempts, like Exxon CEO Rex Tillerson did in July 2012. “We are all losing our shirts today,” Mr. Tillerson said. “It’s all in the red.”

Another major oil and gas company, BP, recently spun off its shale division, arguing that a smaller company would be more nimble and “compete more effectively with independents.”

But industry analysts saw a bigger trend. “Shell has failed miserably in generating any returns from US shale, and BP does not want to make the same mistake,” Fadel Gheit, an oil analyst at Oppenheimer & Co, told the Financial Times on March 4.

If the Marcellus shale boom’s economic potential has been over-hyped, as the new report suggests, that does not mean that drilling and fracking will simply peter out. In the face of challenging economic conditions, companies find ways to adjust.

They may try to drill multiple formations at once, for example, targeting both the Utica and the Marcellus shale formations simultaneously, although the potential returns from the Utica are even less well understood than in the Marcellus and targeting the two formations would add costs for drillers.

“The Utica is older and deeper than the Marcellus and while the two have areas of potential overlap, the Utica in Pennsylvania and New York becomes very deep and very hot and over-mature in a hurry,” explained Mr. Berman. “If the Utica were a viable target, people would be drilling for it right now.”

There are signs that even for smaller shale gas companies, these costs have eroded profits. To adjust, some drillers have adopted cost-cutting measures that left their business partners — investors and the people living in the gas fields who leased their land — feeling burnt.

In Pennsylvania, landowners who leased their land for drilling to Chesapeake Energy complain that the company has begun making massive and potentially illegal deductions from their royalty checks. Landowners report that their monthly royalty checks have plunged as much as 94 percent, an investigation by ProPublica found. Using these techniques, Chesapeake raised $5 billion dollars. “They were trying to figure out any way to raise money and keep their company alive,’’ one industry source told ProPublica.

For years, the company was also accused of using deals called Volumetric Production Payments to keep debt off its books. In its most recent report to investors, ProPublica found, Chesapeake for the first time revealed just how extensive those deals were: the company had $36 billion in “off balance sheet arrangements” — vastly higher than the $1.4 billion in such deals that the Wall Street Journal estimated in 2012.

Without strong regulation, drillers under financial pressure may also cut corners by failing to follow industry “best practices” — and that can lead to serious environmental harms and mistakes that cause accidents.

The simplest way for shale gas to become profitable, however, is for prices to rise. Although the EIA currently projects shale gas prices will stay at roughly $4/MMBtu for decades, their prediction would change dramatically if more natural gas export terminals are opened up across the U.S.

And if gas prices rise sharply after natural gas power plants and pipelines are built, American consumers are the ones who could wind up feeling burnt by the shale gas boom.

Photo Credit: Oil value Bubble about to explode by a needle, Via Shutterstock.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts