The Great Lakes, drinking water source for over 40 million North Americans, could be the next target on tar sands marketers’ bullseye according to a major new report out by the Chicago-based Alliance for the Great Lakes.

The 24-page report, “Oil and Water: Tar Sands Crude Shipping Meets the Great Lakes?” unpacks a new looming threat to the Great Lakes in the form of barges transporting tar sands along the Great Lakes to targeted midwestern refinery markets. As the report suggests, it’s a threat made worse by an accompanying “Wild West”-like regulatory framework.

“The prospect of tar sands shipping on the Great Lakes gives rise to fundamental social and economic questions about whether moving crude oil by vessel across the world’s single largest surface freshwater system is a venture this region wants to embrace, despite the known risks,” the report says early on.

Calumet Specialty Products Partners LP is one of the major corporations hedging its bets on moving tar sands along the Great Lakes — and oil obtained via hydraulic fracturing (“fracking”) from North Dakota’s Bakken Shale basin — and may begin doing so as early as 2015.

“[I]ndustry observers and consultants speculate this crude could travel from Wisconsin across Lake Superior to Lake Michigan, and on to refineries in Whiting, Ind., Lemont, Ill., and possibly Detroit, Mich. near Lake Erie,” the report details. “Other potential destinations include Sarnia, Ontario on Lake Huron, or even an East Coast refinery.”

As a recent GasBuddy.com article explained, BP‘s Whiting, Indiana refinery – capable of refining far more tar sands crude with its Modernization Project – will soon open for business.

“Sources say that BP‘s modernization of the company’s 405,000-b/d Whiting, Ind., refinery is on schedule with all units now operating,” the article explained. “That includes a brand new 105,000-b/d coker that will eventually allow the plant to use about four times as much heavy sour Canadian crude compared with it had used previously.”

Market Glut a Market Opportunity for Great Lakes Shippers

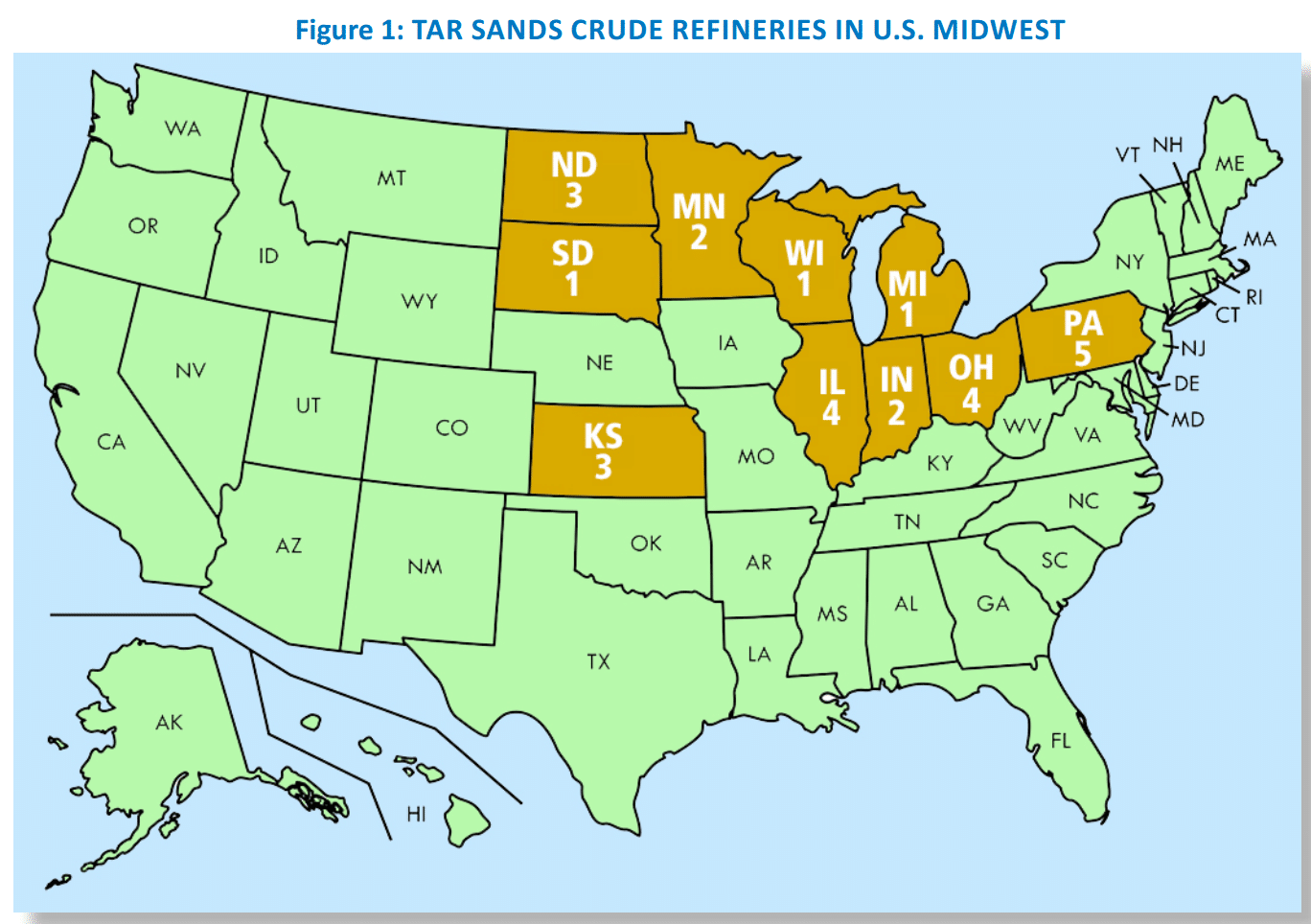

Midwest tar sands pipelines abound, such as Enbridge’s Alberta Clipper/Line 67 pipeline, the original Transcanada Keystone pipeline and the forthcoming Enbridge Flanagan South pipeline, but with nearly two dozen tar sands refineries located in the region, pipelines serve as only one way to get the product to market.

“Even today, there is more tar sands crude being extracted from Alberta, Canada than current transportation channels can bring to market,” reads the report. “About 70 percent of these extracted tar sands are sent to refineries in the American Midwest and approximately 99 percent stay in the U.S.”

Image Credit: Alliance for the Great Lakes

New Threat Looming?

Still early in the game, Calumet’s fast-paced maneuvering to ship 35,000 barrels of tar sands per day along Lake Superior has sparked opposition from close observers.

“[A]s tar sands crude spill cleanups have proved particularly problematic, a cleanup of a deep-water tar sands crude spill in the Great Lakes would present new and extraordinary challenges,” the report posits. “With the amount of tar sands crude shipped on the Great Lakes by vessel poised to expand as early as 2015, the Great Lakes will soon face a new threat that poses a substantial risk to their future.”

As recent massive tar sands spills into Mayflower, Arksansas’ Lake Conway and Michigan’s Kalamazoo River have demonstrated, once tar sands spill into major waterways, comprehensive cleanup becomes virtually impossible.

It remains to be seen whether policymakers will learn from these past spills, or will just brush them aside in the race to send massive amounts of tar sands crude to midwest markets.

“We’re at a crossroads now, with companies starting to seek permits for new oil terminals,” Lyman Welch, Director of the Alliance for Great Lakes’ Water Quality Program and the report’s lead author said in a press release. “Before our region starts sinking money into shipping terminals for the Great Lakes, our task should be to ask ‘if’ rather than ‘when.’”

Photo Credit: Wikimedia Commons

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts