Update: UT-Austin has released the Steering Committee roster for the study. It consists of lead author David Allen, two EDF employees, and nine oil industry representatives, including lobbyists and PR staff from ExxonMobil, Shell, Southwestern Energy and more. See DeSmog’s follow-up coverage.

The long-awaited Environmental Defense Fund (EDF)-sponsored hydraulic fracturing (“fracking”) fugitive methane emissions study is finally out. Unfortunately, it’s another case of “frackademia” or industry-funded ‘science’ dressed up to look like objective academic analysis.

If reliable, the study – published in the prestigious Proceedings of the National Academy of Sciences and titled, “Measurements of methane emissions at natural gas production sites in the United States” – would have severely reduced concerns about methane emissions from fracked gas.

The report concludes .42% of fracked gas – based on samples taken from 190 production sites – is emitted into the air at the well pad. This is a full 2%-4% lower than well pad emissions estimated by Cornell University professors Robert Howarth and Anthony Ingraffea in their ground-breaking April 2011 study now simply known as the “Cornell Study.”

A peek behind the curtain show the study’s results – described as “unprecedented” by EDF – may have something to do with the broad spectrum of industry-friendly backers of the report which include several major oil and gas companies, individuals and foundations fully committed to promoting the production and use of fracked gas in the U.S.

One of the report’s co-authors currently works as a consultant for the oil and gas industry, while another formerly worked as a petroleum engineer before entering academia.

The study will likely be paraded as “definitive” by Big Oil, its front groups and the media in the days and weeks to come.

A DeSmogBlog exclusive investigation reveals the study actually stands to make its pro-gas funders a fortune in what amounts to industry-favorable data meant to justify shale gas in the public mind as a “bridge fuel” – EDF‘s stance on gas – now and into the future.

Cornell’s Howarth Reacts

Howarth has issued a press statement unpacking the long-anticipated study, beginning by explaining a key caveat (emphases mine).

“First, this study is based only on evaluation of sites and times chosen by industry,” Howarth stated.

“The Environmental Defense Fund over the past year has repeatedly stated that only by working with industry could they and the Allen et al. team have access necessary to make their measurements. So this study must be viewed as a best-case scenario.”

Howarth next explains industry cooperation – while a nice sales pitch – isn’t necessary to “get the goods.”

“[M]any other scientists have proven over the past 2 years that you can measure methane emissions from gas development without industry cooperation, for instance by using aircraft to fly over operations,” he said.

“Many studies have now been published, and many more presented at national scientific meetings, on methane emissions using techniques which capture the emissions at regional scales and do not require industry permission to sample…All of these studies are reporting upstream [well pad] emission estimates…10- to 20-fold higher than those reported in this new paper.”

Why the vastly better results on methane emissions?

“How can we explain this huge discrepancy?” Howarth asked. “[Industry does] it better when they know they are being carefully watched. When measurements are made at sites the industry chooses and at times the industry allows, emissions are lower than the norm.”

Lastly, Howarth points out that unlike his April 2011 study, this study didn’t do a lifecycle analysis, limiting the data set to fracked well sites.

“Finally, methane emission from upstream at the well sites is only part of the problem,” he commented. “Methane is also emitted as gas moves to consumers, and again new studies are indicating these emissions may be even larger than the 1.4 to 3.6% of lifetime well production.”

EDF announced this is just the first of a series of 16 articles to come on the climate impacts of shale gas production at various stages of its lifecycle.

People and Money Behind the Study

Without getting to into the minutiae of the study’s science, it’s key to dig into what at face-value seems like minutiae – when examined in piecemeal fashion and not as an aggregate – about the people and money behind the study.

Study sponsors listed in the ‘Acknowledgments’ section of the report include Anadarko Petroleum, BG Group, Chevron, Encana, Talisman and ExxonMobil subsidiary XTO Energy in addition to EDF. These are the obvious “frackademia” culprits raising red flags regarding the study’s findings.

But that only scratches the surface.

Others listed as key funders include – but are not limited to – Fiona and Stanley Druckenmiller, the Robertson Foundation and Tom Steyer. All have key connections to fracking and pro-industry stances that tell an important tale about the study and its findings.

Druckenmillers: EDF, Bloomberg, “Clean Heat”

Stanley Druckenmiller – a well-known New York City-based hedge fund manager – serves as a member of EDF‘s Board of Trustees. His wife Fiona serves on the Board of Directors of the Bloomberg Family Foundation.

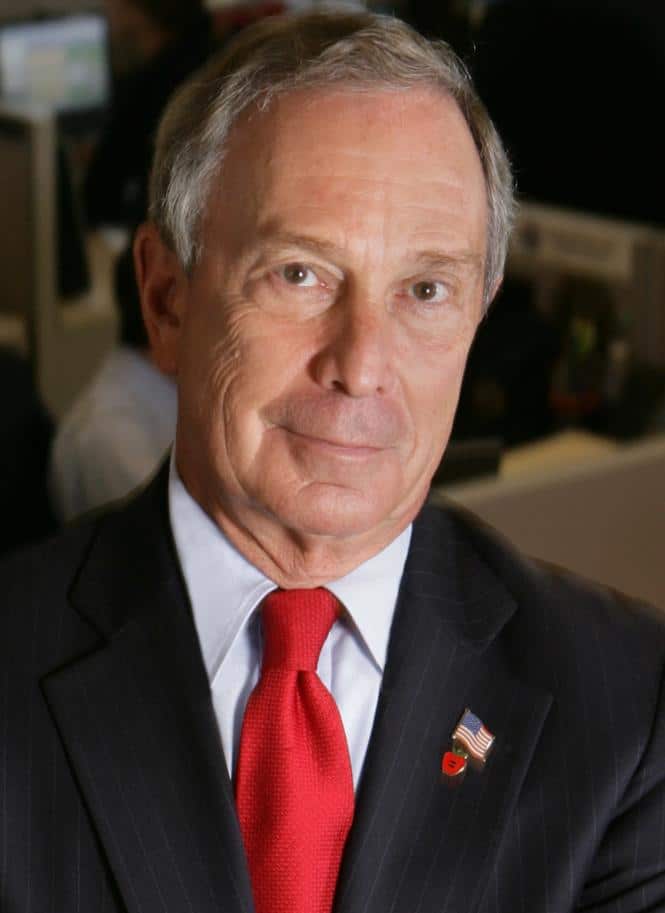

In August 2012, New York City Mayor Michael Bloomberg gave EDF a 3-year $6 million grant “to minimize the environmental impacts of natural gas operations through hydraulic fracturing.”

Michael Bloomberg; Photo Credit: Wikimedia Commons

“The funding will support EDF‘s strategy of securing strong rules and developing industry best practices in the 14 states with 85 percent of the country’s unconventional gas reserves,” EDF spelled out in a press release.

Before the studies’ findings even came out – or for that matter, before the studies even began – Mayor Bloomberg explained the rationale behind the studies in a less than objective manner. This came on the day after he endorsed fracking in New York’s portion of the Marcellus Shale basin.

“Here’s the truth on natural gas. The environmentalists who oppose all fracking are wrong, and the drillers who claim that regulation will kill the industry are wrong,” he told EDF. “What we need to do is make sure that the gas is extracted carefully and in the right places, and that has to be done through strong, responsible regulation.”

Under Bloomberg’s watch, New York City is in the process of moving from oil to gas for heating, popularly referred to as the “NYC Clean Heat” initiative, a recipient of a $100 million grant from Bloomberg. The gas will be obtained predominantly via fracking in the Marcellus Shale basin.

EDF serves as a lead sponsor of the “Clean Heat” initiative and its website was registered in April 2011 by the EDF itself.

The genesis of “NYC Clean Heat” centered around the release of a December 2009 report published by EDF and the Urban Green Council titled, “The bottom of the barrel: How the Dirtiest Heating Oil Pollutes Our Air and Harms Our Health.” One of Urban Green Council’s key sponsors is Bloomberg L.P.

Though co-published by EDF and Urban Green Council, the report was actually written by M.J. Bradley & Associates, according to the Acknowledgements.

M.J. Bradley & Associates’ clients include the American Clean Skies Foundation (a Chesapeake Energy front group), Dominion (owner of the recently-approved Lusby, Maryland-based liquefied natural gas export facility), EDF and the Natural Resources Defense Council.

Steyer, Paulson, Bloomberg: Backing Fracking

Another key study funder of the study was Tom Steyer. Referred to by Bill McKibben in the Rolling Stone as “Daddy Greenbucks,” he’s best known these days for his activism fending off the northern half of Transcanada’s Keystone XL tar sands pipeline.

Tom Steyer; Photo Credit: Wikimedia Commons

Before leaving to work full time as an alternative energy investor, Democratic Party super-PAC donor and climate change activist, Steyer ran a multi-billion hedge fund called Farallon Capital Management.

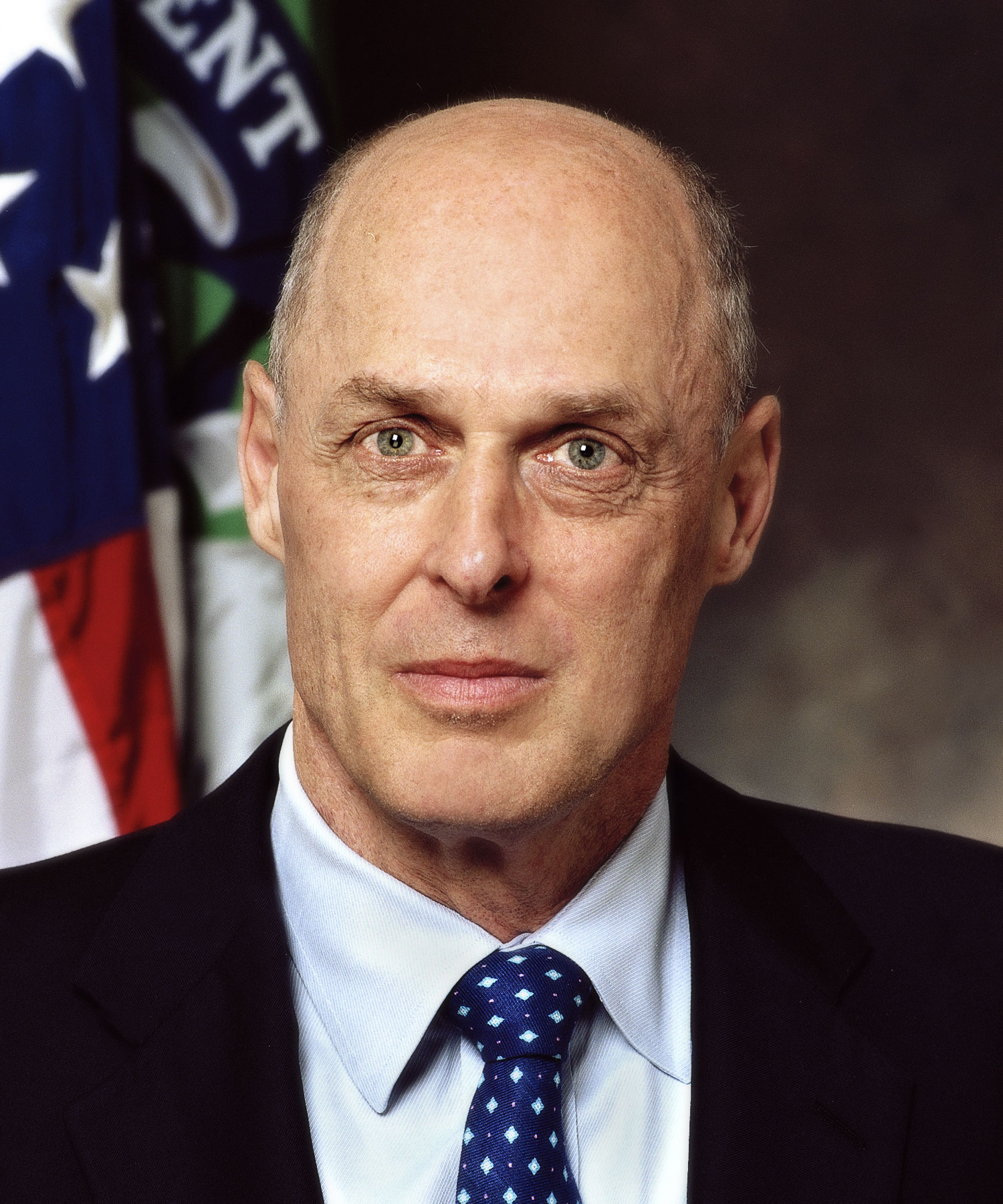

Steyer began his career as a colleague of both Robert Rubin and Henry “Hank” Paulson, former U.S. Secretaries the Treasury under Presidents Bill Clinton and George W. Bush, respectively.

“In 1983, after finishing business school, Tom returned to New York and worked in the risk-arbitrage division of Goldman Sachs under Robert Rubin, Clinton’s future Treasury Secretary,” explained a recent piece appearing in The New Yorker of the relationship between Steyer and former Goldman CEO Rubin.

At the time, Paulson was leading Goldman Sachs’ Midwest Region Investment Banking group.

Henry “Hank” Paulson; Photo Credit: Wikimedia Commons

Steyer, Bloomberg, Paulson, Rubin and former U.S. Secretary of State under Ronald Reagan George Shultz have reunited to form a climate change initiative whose details will be revealed in October, according to The New Yorker.

In a January 2012 op-ed appearing in The Wall Street Journal co-written by Steyer and Center for American Progress chairman John Podesta – now serving as Steyer’s aide – they both offer a full-throttled endorsement of fracking while avoiding use of the term.

“Under President Obama’s leadership, we appear to be at the beginning of a domestic gas and oil boom,” they wrote. “This can free us from our addiction to foreign-sourced barrels, particularly if we utilize our dramatically larger and cheaper natural gas reserves.”

Perhaps alluding to the forthcoming EDF study, Steyer and Podesta say that if the questions are answered positively, shale gas can serve as a game-changer.

“There are critical environmental questions associated with developing these resources, particularly concerning methane leakage and water contamination,” they wrote.

“Yet as long as we ensure high regulatory standards and stay away from the riskiest and most polluting of these activities, we can safely assemble a collection of lower-carbon, affordable and abundant domestic-energy assets that will dramatically improve our economy and our environment.”

Via his TomKat Trust named after him and his wife Kat Taylor, Steyer is also a major funder of the ClimateWorks Foundation.

ClimateWorks got off the ground in 2007 by authoring a key report titled, “Design to Win: Philanthropy’s Role in the Fight Against Global Warming.” Among other things, the report calls for converting coal-fired power plants to gas-fired power plants, a de facto endorsement of the then forthcoming U.S. fracking boom.

Will the Steyer, Bloomberg, Paulson and Rubin climate initiative promote fracking as a “bridge fuel”? Time will tell: October’s just a few weeks away.

Here’s To You, Mr. Robertson

Another key funder of the study is the Robertson Foundation, overseen and endowed by famous hedge fund manager and EDF Board of Trustees member Julian Robertson.

Formerly the manager of the hedge fund Tiger Management, Robertson now serves as a Senior Advisor for a hedge fund focusing on midstream energy asset investments: Tiger Infrastructure Partners.

Emil Henry serves as the Managing Director and Managing Partner of Tiger Infrastructure Partners. Henry was the Assistant Secretary of the U.S. Treasury from 2005-2007, reporting to Henry Paulson as his superior.

Emil Henry; Photo Credit: Wikimedia Commons

Launching in 2009, Tiger Infrastructure Partners signed a key partnership with Kiewit Corporation in June 2012 to develop midstream shale gas assets, mainly gathering systems, pipelines and processing plants.

Tiger – under the deal – is set to spend up to half a billion bucks in captial to develop Kiewit’s assets, with seed money coming from Julian Robertson and the Ziff family fortune.

“[They] are counting on continued demand for new natural gas and gas liquids and ways to transport them as energy explorers develop new drilling areas,” explained The Wall Street Journal. “The Tiger-Kiewit pact aims to build the pipelines and processing plants for explorers in those new drilling fields.”

Kiewit has helped build numerous key midstream and downstream shale gas industry assets, including Maryland’s recently-approved Dominion Cove Point LNG export terminal, Oregon’s proposed Jordan Cove LNG export facility, the massive Bakken Shale-based Tioga Gas Plant, Central Gathering Plant-72 in Texas, Mewbourne Gas Plant in ColoradoWyoming’s Lost Cabin Gas Plant, Opal Gas Plant and Riley Ridge Gas Processing Plant.

The Tiger-Kiewit partnership officially goes by the name TKT Midstream Partners.

Erik Ludtke – TKT Midstream’s Senior Vice President of Corporate Development – formerly served in executive-level positions both at BG Group and Talisman, both of whom served as sponsors of the EDF study.

“Our focus is delivering producers’ hydrocarbons to market,” TKT bluntly explains in its mission statement.

“Our capabilities include gathering, processing, treating, and transporting hydrocarbons and handling and treating of flowback and produced water. Our unique ability to design, engineer, build, own, and operate midstream assets makes us a one-stop-shop for producers.”

The Ziffs and Fracking

While Julian Robertson served as one key seed donor to TKT Midstream, so too did the Ziff family, most famous as owners of Ziff Davis Media.

The Ziffs provided seed funding for the goliath Och-Ziff Capital Management Group hedge fund overseen by Daniel Och and also own Ziff Brothers Investments and its subsidiaries.

Daniel Och; Photo Credit: Wikimedia Commons

Och-Ziff teamed up with Schlumberger to lease the drilling rights to 85,800 acres in 2007 and 2008 on tribal land located in North Dakota’s Bakken Shale basin, paying $14 million for the acreage.

“Less than two years later, the Och-Ziff group sold the rights for $949 million,” reported The Wall Street Journal of the incredible return on the group’s initial investment.

The “Frackademics”

The study didn’t become “frackademia” simply because of heavy-handed investors: two of the study’s co-authors also have career ties to Big Oil, with one of them still working as an industry consultant.

A. Daniel Hill

Enter: Texas A&M‘s A. Daniel Hill. A Noble Energy Chair in Petroleum Engineering, Hill spent five years as an Advanced Research Engineer with Marathon Oil Company before beginning his career in academia, according to his Texas A&M profile.

Daniel Hill; Photo Credit: Texas A&M

Jennifer Miskimins

Colorado School of Mines professor Jennifer Miskimins also has a career steeped in “frackademia,” beginning it as a Production Engineer, Production Supervisor, and Reservoir Engineer for Marathon Oil Company.

Jennifer Miskimins; Photo Credit: Colorado School of Mines

On top of her gig at the School of Mines, Miskimins also works as a Senior Consulting Engineer for Barree & Associates, self-described as “a petroleum engineering firm based in Lakewood, Colorado…offer[ing] consulting services for companies worldwide, specializing in stimulation and well performance optimization.”

Barree’s website hosts three industry-written “Gasland” communiqués and another bashing the FRAC Act, which would mandate the gas industry disclose the chemicals it injects into the ground during the fracking process. Its clients include Anadarko, Chevron, Encana, Shell, Talisman (five of the nine sponsors of the EDF study), along with Marathon Oil, Noble Energy, EOG Resources, ConocoPhillips and BP.

Miskimins also serves as Director of Colorado School of Mines’ Fracturing, Acidizing, Stimulation (FAST) Consortium and all 31 publications listed on FAST‘s website were co-written by Miskimins.

Describing its mission as “practical research in the area of oil and gas well stimulation” and providing an “opportunity for graduate students to work on industry-sponsored projects,” FAST‘s member company sponsors include Anadarko, BG Group, Encana, and Shell (four of the nine industry sponsors of the EDF study), as well as Barre, BP, ConocoPhillips, Devon, EOG Resources, Marathon Oil, Schlumberger and Halliburton (which helped dream up the “Halliburton Loophole” trade secret exemptions for fracking chemical fluid disclosure in the Energy Policy Act of 2005, the rationale behind the FRAC Act to begin with).

Maintaining a busy schedule, Miskimins also runs Colorado School of Mines’ Unconventional Natural Gas and Oil Institute.

“As a domestic energy source, natural gas is abundant but ‘locked up’ in these unconventional reservoirs that we’re just now beginning to really understand,” Miskimins told EnergyWire in 2009. “As a ‘bridge’ fuel to alternative energies down the road, we need to further our understanding of maximizing recovery from these types of reservoirs.”

In March 2012, the Institute secured a $2 million grant – $1 million apiece – from ExxonMobil and General Electric, which it now shares with University of Texas-Austin and Pennsylvania State University, both of which had professors who co-authored the EDF study.

GE and ExxonMobil doled out the funding “to develop programs to provide regulators and policymakers access to the latest shale resource technology and best practices.”

ExxonMobil – in turn – promoted the model bill for fracking chemical fluid disclosure arising from President Obama’s industry-stacked U.S. Department of Energy Fracking Subcommittee. EDF had a representative on that Subcommittee: Executive Director Fred Krupp.

The model bill exists as a direct response to complaints by citizens about lack of industry fracking chemical fluid transparency due to the “Halliburton Loophole.”

First passing in Texas in June 2011, it eventually became a Council of State Governments model bill and then an American Legislative Exchange Council model bill pushed by the company’s lobbyists at each of the two groups’ fall 2011 annual meetings.

Coming full circle then, Miskimins also formerly served on the Technical Advisory Board for Realm Energy International Corporation, purchased for $139 million by San Leon Energy in 2011.

“San Leon’s Board of Directors said that it made the move in part to create a more focused shale acreage position in Poland’s Baltic Basin,” noted an August 2011 press release. “In addition, the board said that it might gain even more access to shale if Realm’s applications for licenses in France and Spain are accepted.”

In December 2009, Realm signed a partnering agreement with Halliburton to “continue the evaluation of high potential shale deposits throughout Europe and select emerging countries.”

“Realm Energy is now moving into an operational phase with our European leasehold and will contract with Halliburton to leverage its extensive shale-development knowledge, gained from Halliburton’s significant presence in the North American market,” Realm Energy Chairman Craig Steinke said in a 2011 press release.

San Leon owns over 23 million acres of shale assets in Poland, Albania, Morocco, Spain, Ireland, France, Italy, Romania, Slovakia and Germany combined. Its current focus centers around Poland, Albania, Ireland and Morocco and it describes itself as “Europe’s leading shale gas company by acreage.”

One of San Leon’s Partners – Talisman – was also a sponsor of the EDF study. In July, San Leon purchased the totality of Talisman’s Polish acreage.

Through San Leon bought out Realm, it still maintains a close relationship with Halliburton, signing a Memorandum of Understanding in April 2013 to “develop a strategic relationship to jointly explore and develop the…unconventional gas potential in San Leon’s Wschowa, Gora, and Rawicz Concessions in Poland.”

Greenpeace USA, Food & Water Watch React

EDF believes the research – whose methodology is listed in-full online – will speak for itself, justifying the full development of U.S. shale gas assets going forward.

“The scientific talent leading these studies, the partnership with industry and access to their facilities, and the diverse research methods used, gives us the confidence that when the project concludes in late 2014, we’ll be able to greatly increase our understanding of the climate impacts of switching to natural gas from other fossil fuels, through this unprecedented collective research effort,” EDF Chief Scientist Steve Hamburg said in a press statement.

EDF explicitly states the study’s findings – despite key funders profiting directly from the shale gas boom – will inform policymakers’ next steps on shale gas.

“The study’s measurements will help inform policymakers, researchers and industry, providing information about some of the sources of methane emissions from the production of natural gas and better inform and advance national and international scientific and policy discussions with respect to natural gas development and use,” EDF notes in their press release on the study’s launch.

Greenpeace USA‘s Executive Director Philip Radford unpacked a worst-case scenario of how the report will be used by Big Oil in the coming days, weeks and months.

“At worst, it will be used as PR by the natural gas industry to promote their pollution,” he wrote on The Huffington Post. “In fact, methane is 105 times more powerful than carbon pollution as a global warming pollutant, so figuring out its real climate impacts has very real consequences for us going forward.”

Food and Water Watch was even more harsh in its assessment of the state of play.

“This industry-sponsored ‘study’ is more spin than science,” Wenonah Hauter, Executive Director of Food & Water Watch said in a press statement. “The Environmental Defense Fund is running interference for the industry, and the result will be more drilling and fracking around the world.

Photo Credit: Wikimedia Commons

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts