Today Prime Minister Stephen Harper announced the approval of two major acquisitions of Canadian energy companies by foreign state-owned enterprises. The Chinese National Offshore Oil Company (CNOOC) will commence the $15.1 billion takeover of Nexen Inc., a Canadian company with major holdings in the Alberta tar sands. Malaysia’s Petronas will proceed with the purchase of Progress Energy Resources Corp., a Calgary company with considerable shale gas plays in British Columbia, for $5.2 billion. Petronas has plans to construct an $11 billion liquified natural gas plant in Prince Rupert to prepare gas exports for Asia.

“Canadians generally and investors specifically should understand that these decisions are not the beginning of a trend but rather the end of a trend,”

said Mr. Harper. The full meaning of that statement, however, remains to be seen. The Harper government’s decision to ratify

FIPA may mean deals done with China, like today’s deal with

CNOOC, will carry a new significance.

The government previously

raised the threshold for official review of foreign takeovers from $330 million to $1 billion, signaling open arms to potential foreign investors with an eye on mega projects like the Alberta tar sands. However, today that threshold was returned to $330 million for state-owned enterprises.

“To be blunt, Canadians have not spent years reducing ownership of sectors of the economy by our own governments only to see them bought and controlled by foreign governments instead,”

Mr. Harper said.

But Harper’s assurances carry little weight after his administration

forced through a second environmentally egregious omnibus budget bill earlier this week. The combination of weakened environmental legislation with foreign management of energy development has many concerned that the country’s natural resources, especially those with a high environmental footprint like the tar sands, will be squandered with little benefit to Canadians.

In addition, if Harper follows today’s announcement with FIPA‘s ratification, Canadians will have little control over the country’s resource development and how that development is environmentally managed by Chinese companies.

Tzeporah Berman, co-founder of ForestEthics

said at the time, “the bottom line is Canada’s policies need to be designed for Canadians, not just for big oil and foreign investors.”

She added, “Our data today is an important part of the conversation around who is benefiting from this dramatic push and expansion.” The tar sands are expected to nearly triple output in coming decades. Click

here for the full report.

The conservative

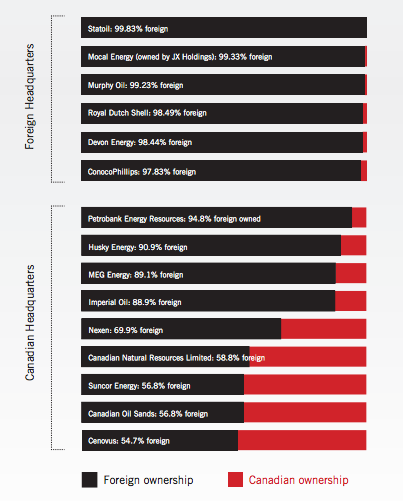

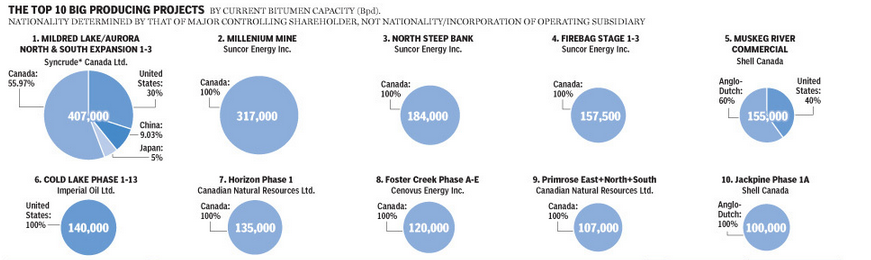

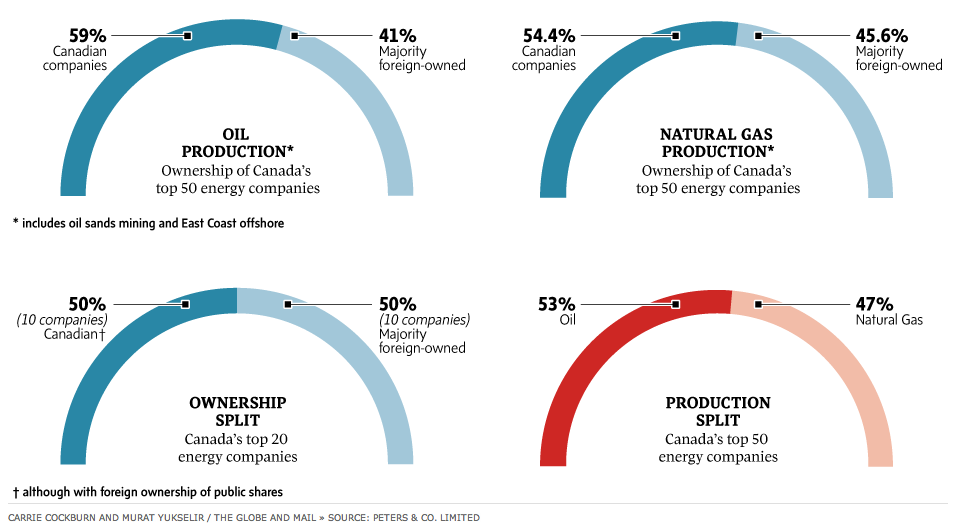

Financial Post recently responded to “national hand-wringing over foreign ownership of the oil sands,” by claiming “Canadians are still the dominant operators and employers” of the sector. However, the Financial Post based their analysis on the “top 10 big producing projects” in the tar sands, according to current bitumen capacity. The paper added this small caveat to their figures: “nationally determined by that of major controlling shareholder, not nationality/incorporation of operating subsidy.”

But that’s just a convenient way of ignoring what today’s announcement really means: the tides are changing in the Athabasca Tar Sands.

As the

Globe and Mail recently reported, Canada is teetering on the edge of its ownership majority, from all angles. As the figure below illustrates, no matter how you slice it, Canada is just barely holding the reins of this rapidly accelerating industry.

As a part of today’s landmark approval of a foreign takeover – the biggest in China’s history – the Harper government announced future foreign takeovers will only occur in the tar sands under “

exceptional” circumstances.

“We’ve seen complete confusion from this government, and today they’re trying to sugar-coat something that I think will be a rather bitter pill for Canadians, the vast majority of whom feel that this particular acquisition is not in Canada’s interests, and who want to see clarity around net benefit and who want to see above all public consultations on these kinds of takeovers,”

he said on

CBC‘s Power

& Politics.

Earlier this year the Asia Pacific Foundation

reported less than 20 percent of 3000 poll respondents felt “comfortable” with Chinese state-owned companies investing in Canadian firms.

Harper is feigning to respond to that concern:

“In light of growing trends, and following the decisions made today, the Government of Canada has determined that foreign state control of oil sands development has reached the point at which further such foreign state control would not be of net benefit to Canada,” his remarks read. “When we say that Canada is open for business, we do not mean that Canada is for sale to foreign governments.”

But if the Harper government has demonstrated anything to Canadians, it is that Canada is for sale to the oil industry. Today’s announcement only brings with it the concern that those oil companies may be operating with competing foreign interests in mind.

In October DeSmog conducted a series of interviews with foreign investment lawyer and

trade deal expert Gus Van Harten. At the time, commenting on future Chinese investment in the tar sands, Van Harten had this to say:

“I don’t think the government wants to see the whole oil patch Chinese owned, but I think it’s quite likely we’ll see significant portions of it Chinese owned, and once significant portions are Chinese owned, then you’ve also given lawyers who work for the Chinese investors this powerful tool to beat up on governments anywhere in Canada, you really frustrate the ability of Canadians to elect governments that are going to get more serious about the environmental consequences of the oil patch.”

In the end it will be the ratification of FIPA that will tell us the significance of today’s announcement.