Oil and gas industry insiders revealed earlier this year the high probability that we’re headed into a shale gas bubble. But that’s not what the industry’s CEOs and PR departments want you to hear.

“The reality of at least 100 years’ worth of shale gas abundance has been supported by virtually every credible third-party expert…The collective market cap of these energy leaders approaches $2 trillion – ask yourself: do I believe Rolling Stone and Arthur Berman or the world’s biggest and most successful energy companies?”

So spouts off Chesapeake Energy in a press release earlier this month responding to a Rolling Stone article which likened fracking to a huge industry Ponzi scheme. Arthur Berman is an energy consultant based in Houston, and not swayed by the industry’s vibrant plumage they are putting on display to the nation.

The energy companies want the public to believe in the “Golden Age of Gas”- as it has been dubbed- where the supplies are bountiful and the profits are high. While it’s true that there have been economic booms in some areas that have gas reserves, the numbers are showing that these booms will not be long lived. Meanwhile, the falling price of gas along with the inherent public health risks and environmental devastation that comes along with it makes the gas rush less profitable in the long run. But the gas industry wouldn’t have you believe that.

It’s reminiscent of a scene from a 1920’s movie- the wife walks into her bedroom to find her husband with another woman. Instead of confessing, the husband says, “It’s not true! You gonna believe what you see, or what I tell ya?” If you add a wad of cash to that scene, then you essentially have the gas industry- that you should believe what they say because they are powerful and have money, even if the numbers plainly show a different story.

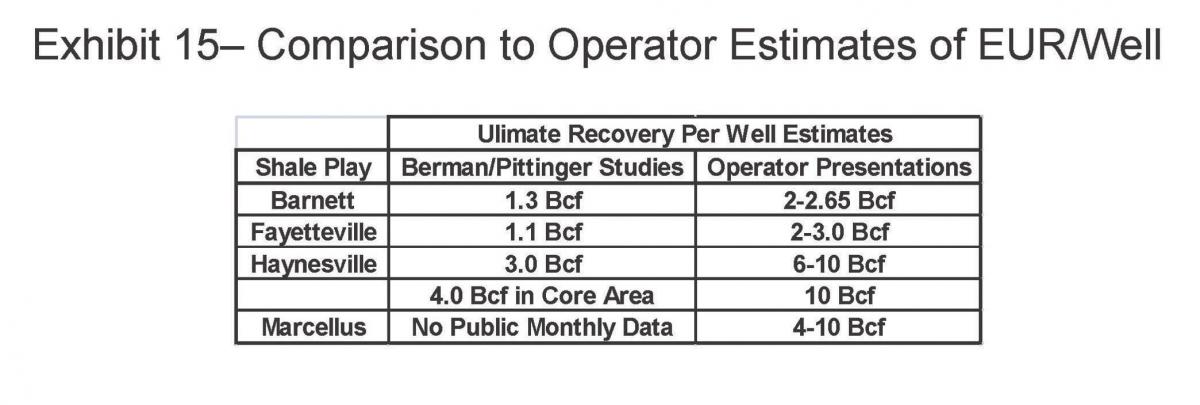

And what do the numbers say? That in fact production in the Barnett, Haynesville, and Fayetteville shales are indeed half of what the industry claims (and recall USGS reduced their estimate of available gas in the Marcellus by 80% last year). The following table shows the productions numbers for each, as calculated by the report “US Shale Gas: Less Abundance, Higher Cost”, put out by Arthur Berman and Lynn Pittinger:

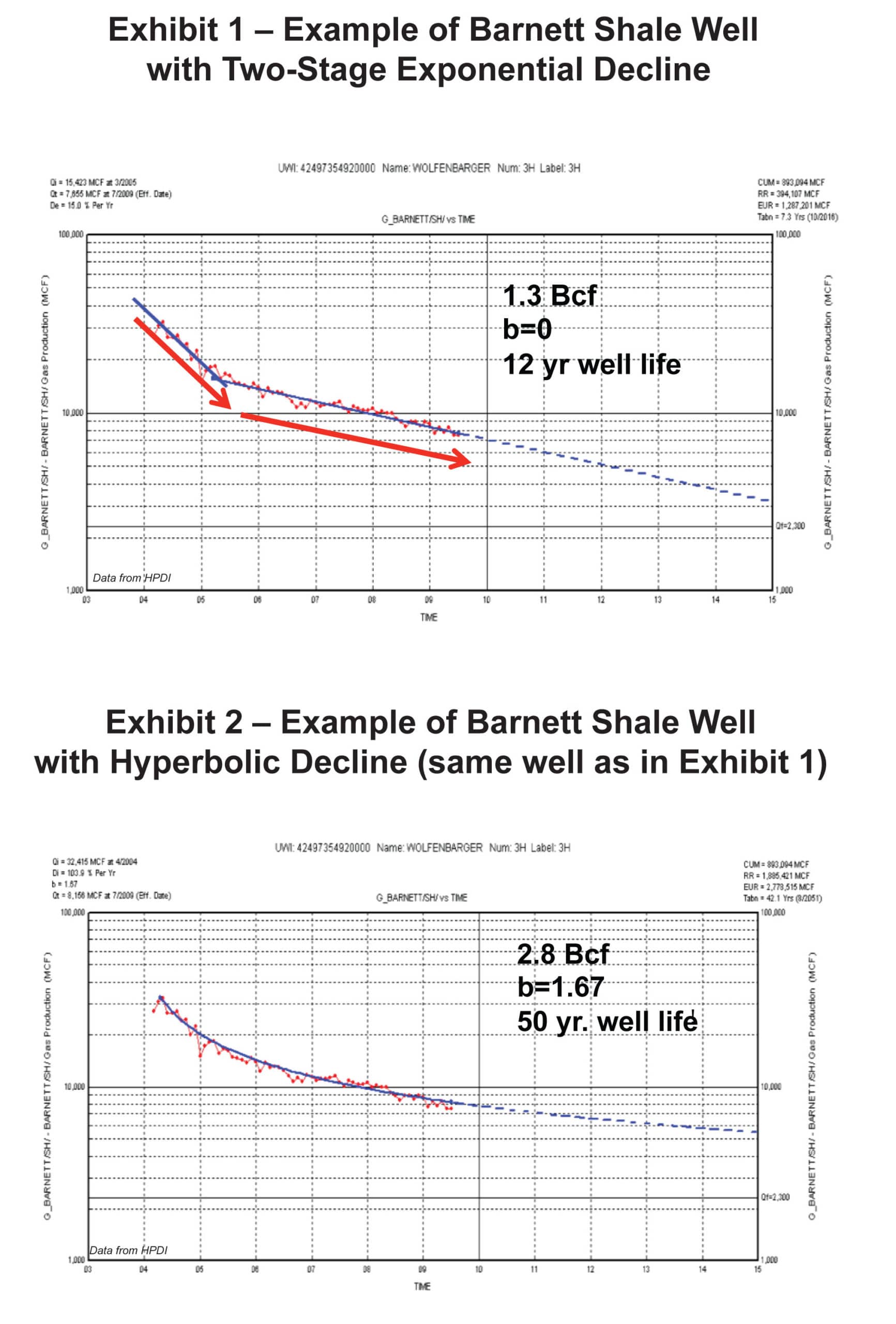

Output is declining in all the formations, and while it’s somewhat natural, the wells won’t last for the “100 years” the industry reports show. The 100-year long gas boom may turn out to be little more than a decade. According to how industry analysts calculate the longevity of a well, they use a curve that extends the life of a well atypical of how long the well usually lasts. When using a better fit model of calculation, call the “Two-Stage Decline”, a well that the industry claims will last 50 years actually may only last 12.

Furthermore, natural gas prices have taken a hit, while reaching a low this month at only $2.30/thousand cubic feet. At one point it was as high as $13, but with the current low selling price and the added costs of buying land, drilling, and completion costs, the economics don’t quite match up to the industry rhetoric.

Many companies are in fact losing money and not making much of a profit.

But so long as companies can keep moving from formation to formation – first Barnett, then Fayetteville, then Haynesville, then the Marcellus, and now Eagle Ford, Texas – they can artificially inflate the prosperity of gas fracking, despite the fact that they are all actually in decline.

But hey, are you going to believe what you see or what they tell you?

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts